2008 financial crisis in the USA brought almost every big economy of the world to its knees. People had lost faith in the investment options available to them. This happened in India as well as BSE SENSEX had plummeted by over 60% in one year. The recession had hit hard, and the markets were barely reviving themselves in 2009 when a man came up with an online business for stock broking called “Zerodha.”

The person was Nithin Kamath. He had been investing in stocks for some time. He was also managing portfolios of about 1000 people till that point. He was no rookie, but people still called him crazy to go against the giants in the business like ICICI, Sharekhan, and that too in a market that had not even revived itself up to that point. Today, he does not look as crazy as he did years ago.

Zerodha is an Indian fintech company offering retail and institutional broking, currencies and commodities trading, mutual funds, and bonds. The company is headquartered in Bangalore and has a physical presence in major Indian cities likes Delhi, Mumbai.

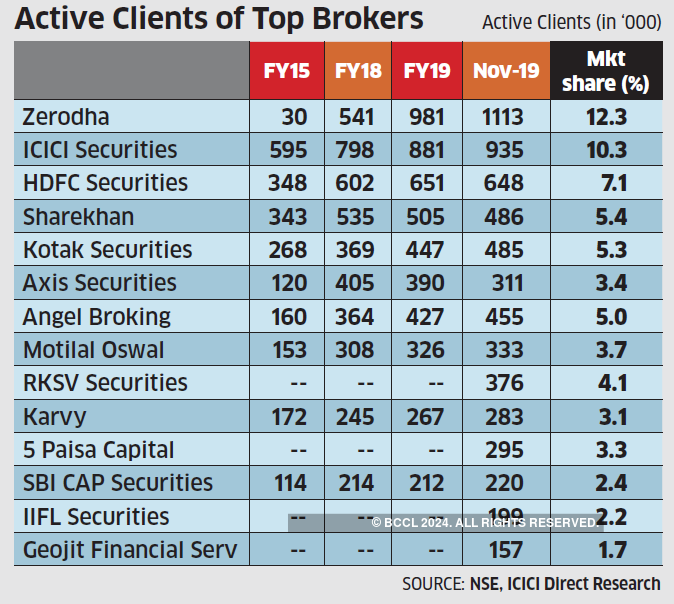

As of 2019, Zerodha is the largest retail stockbroker in India by an active client base and contributes upwards of 2% of daily retail volumes across Indian stock exchanges.

Inception to today

Nithin started Zerodha in 2010 with his brother Nikhil Kamath with a budget of around ₹ 10 lacs. Nine years later, the company has earned ₹850 crores in revenue, of which ₹350 crore was the net profit in FY19. Today, it has over 9 lakh clients all over the country through its multiple platforms, such as Kite and Pi. It is the largest stockbroker of the country today, leaving the likes of Motilal Oswal and HDFC behind. Interestingly, Zerodha has come this far and have no outside investment in the business till now. So the question is – how did they do it?

What goes behind the success of Zerodha

Zerodha is a word made by combining “Zero” and “Rodha.” Rodha is a Sanskrit word, which means obstruction. So it means no obstructions, and that was also the goal of the founders while starting the business.

The objective of the business is to make trading easier. For this, they introduced innovation, which included a mobile app, lower cost, superior website interface, and continuously improved platform that facilitated better experience for traders.

But making this platform attractive was still a challenge for Zerodha.

The solution to this challenge was in the business model. It adopted a “low margin and high volume” model. This meant starting a new kind of trading in the country, known as “Discount broking” today. The existing brokers in the country used to provide full broker services including advisory but Zerodha, as a discount broker, only offered a platform to trade which meant that it could control its costs and provide a better trading platform for the investors that do their research or invest as a hobby, instead of a saving plan.

With this, the company offered trading at a flat fee of ₹ 20 per trade irrespective of the trade value. Few deals were even made without any cost on the platform while the competitors were still working as a percentage broker, that is, charging a rate of commission on the value of the trade, which made them extremely expensive compared to Zerodha. This innovative approach allowed it to be unique and stand out from the crowd of existing full-service brokers.

Challenges faced by the company

Zerodha became a hot topic in the market by offering trades at much lower costs. Websites and news had articles about this new platform that was changing the way stocks were traded in the market. The low price was equally attractive to marginal investors as well as the big ones.

But there was still a problem, credibility, and trust.

Zerodha is in a business line that needed the customer to sign a bunch of documents and then give their savings to the platform to be able to trade. For this kind of commitment and faith by the customer, it needed to build trust with its customer. Although the first instinct in such a situation is generally to go for advertising, the company had other ideas for this, as well.

It decided to go for a word-of-mouth approach. The company claims that the first 1000 clients are the personal contacts of the founders. Then, it was through them that they brought in more business. In India, people trust the recommendations while making some risky purchases. Hence, this word-of-mouth approach also added the much-needed credibility for the prospects.

Also Read: Nestlé – The Global FMCG Brand Providing Good Food And Good Life

Success Factors

It started with no expenditure in marketing, and to this day, they have continued on the same path. The services include a brokerage calculator on the website for the users to know how much they will have to pay while using the services. The purpose of this feature is to bring transparency to its costing. This also leads to similar cost packages for all its customers, while the competitors offered different charges for different users as per the investment amount and other factors.

When the company started business in 2010, the market size they had acquired was quite small. They did not only had to learn business directly from the share of the leaders but also expand the market size in the long run. For this, they started to invest in new talent and businesses as well. They first bought a website created by a group of students at IIT Kharagpur. They continued to promote the business ecosystem by investing more in the future as well, for which they have come up with an initiative called Rainmatter, to fund and incubate innovative Indian fintech startups.

Not just that, Zerodha also saw an opportunity to expand business by educating more people about investments. For which, they started another initiative called Varsity, a platform to learn about finances and the latest happenings in the market. This platform gave confidence to the prospective clients and motivated them to join Zerodha and invest. As a result, we can see that about two-thirds of the total user base of Zerodha include is 37 years old or less.

Conclusion

In its ten years of existence, Zerodha has not only able to minimize the obstructions but also faced the competition courageously. Today, many other discount brokers have entered the market with cheap pricings. But utilizing its first-mover advantage and constant innovations, they have established itself as the market leader and a market developer in this sector. This is a perfect example of how a business needs an idea to grow apart from money and power.