The state-owned company Oil and Natural Gas Corporation Limited (ONGC) is India’s largest company devoted to exploration and production (E&P) and refining activities. Founded in 1956, ONGC has seen remarkable growth in the last six decades.

In 2020, ONGC group’s total production of oil and oil – equivalent gas (o+oeg) is about 2.8 million barrels per day, thus accounting for nearly 57% of India’s oil and gas (O&G) production. It is the only public sector Indian company to feature in Fortune’s ‘Most Admired Energy Companies’ list. ONGC ranks 18th in ‘Oil and Gas operations’ and 220 overall in Forbes Global 2000. Acclaimed for its Corporate Governance practices, Transparency International has ranked ONGC 26th among the biggest publicly traded global giants. It is the most valued and largest E&P Company in the world, and one of the highest profit-making and dividend-paying enterprises.

ONGC’s evolution is a remarkable story of how state-owned firms respond and adapt to shift in owner (government) priorities, which in turn are strongly influenced by microeconomic and political conditions.

Historically, ONGC has been the Government of India’s (GoI’s) trusted custodian of India’s oil and gas reserves. As such, it enjoyed a near-monopoly in this sector for nearly four decades (1955-1995), during which good luck and easy oil elevated the company to stardom. During those years it also functioned as the de facto regulator of the oil and gas sector. The Oil Ministry depended heavily on the company for coordinating activities in the sector. But changing economic priorities and soaring domestic demand for oil and gas in India have significantly changed the dynamics of its relationship with the government in many ways. Through a series of reforms since the mid-1990s, the Government of India has increasingly tried to maintain an arm’s length relationship with ONGC.

It is exposed to more competition in the sector than ever before and it has also lost its regulator status, which is now a separate arm within the government.

History

ONGC was set up under the visionary leadership of Pt. Jawahar Lal Nehru, going against the wisdom of the then multinational oil companies operating in the country, has almost written India off as a “Hydrocarbon Barren” country. Nehru reposed faith in Shri Keshav Dev Malviya who laid the foundation of ONGC in the form of the Oil and Gas division, under Geological Survey of India, in 1955.

Over 64 years of its existence ONGC has crossed many a milestone to realize the energy dreams of India. The journey of India’s Maharatna, over these years, has been a tale of conviction, courage, and commitment. Its superlative efforts have resulted in converting earlier frontier areas into new hydrocarbon provinces. From a modest beginning, ONGC has grown to be one of the largest E&P companies in the world in terms of revenue and production.

Today, ONGC is the leader in Exploration & Production (E&P) activities in India having a 72% contribution to India’s total production of crude oil and 48% of natural gas. ONGC was the first to achieve Rs. 100 billion net profit in the corporate history of India.

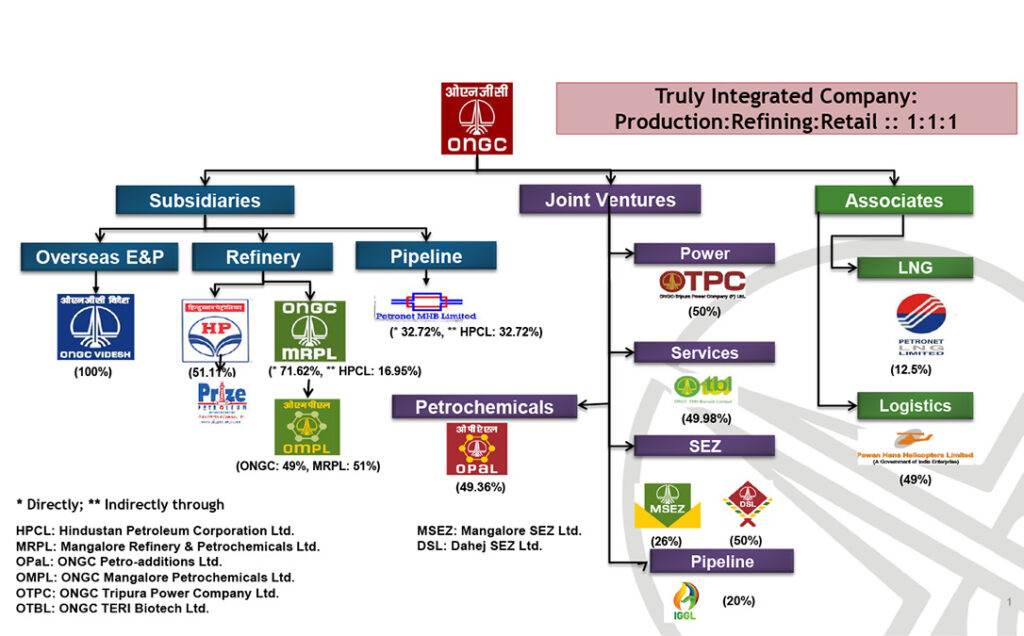

ONGC faced a decline in crude oil and gas production in the mid-1990s which it tried to cover up by acquiring foreign oil equity through its subsidiary ONGC Videsh Limited (OVL). The acquisition of Mangalore Refinery and Petrochemicals Limited (MRPL) made ONGC the first integrated oil company in India.

To avoid stagnation of core business, ONGC planned related diversification and unrelated diversification which was vanished by the Government of India.

Growth Phase

Phase – I (Till the 1990s)

Before independence, there were two companies that are Assam Oil Company and Attock Oil Company, which were doing oil exploration in the northwest and northeast in India. After independence, the Government of India felt the importance of the oil industry for industrialization, and in the 1950s, private companies entered into the industry but they haven’t explored the offshore region.

In the mid-1950s government decided to explore oil and natural gas and at the end of 1955, Oil and Natural Gas Directorate was formed under the Ministry of Natural Resources and Scientific Research. Soon the body provided new status and power to handle exploration but it was under GoI.

ONGC began work and established a new oil province in Cambay of Gujarat. In the 1970s, ONGC discovered a rich oil source in Bombay High, over five billion metric tons.

Also Read: BSNL – The Crumbling Of ‘Once’ Mighty Teleco

Phase II – (1990-2000)

The government of India adopted a policy of economic liberalization in the early 1990s, with the core sector and petroleum sector also gets deregulated. As a result, ONGC reorganized as a company under the Companies Act, 1956 in 1994, and businesses transferred to ONGC.

In the year 2000, ONGC’s oil production reduced substantially and it realized that it is relying on its core business heavily, to overcome this they have to diversify into other new businesses. In the year 2000, production of ONGC was noted as 25.05 million metric tons.

ONGC found that reason for their failure in the 1990s is their dependency on outdated and obsolete technology. It also weighed down by corporate tax and interest on them using 1990s. At that time they are having huge cash reserves and they pay a substantial amount as interest on foreign loans.

Phase III – (2001 onwards)

From the year 2001 onwards significant developments start in ONGC, in the year 2002 ONGC was granted to market transportation fuel on the condition and to do this, ONGC acquired 37.39% equity share in Mangalore Refineries and Petrochemicals Limited (MRPL) from the AV Birla Group. It also diversified in refining and retaining business. In this phase, they focused on vertical integration and future growth plan as well as human resource development and financing restructuring.

On 1 November 2017, the Union Cabinet approved ONGC for acquiring a majority 51.11% stake in HPCL (Hindustan Petroleum Corporation Limited). On Jan 30th, 2018, Oil & Natural Gas Corporation acquired the entire 51.11% stake of Hindustan Petroleum Corporation.

ONGC Videsh

ONGC Videsh Limited, Miniratna Schedule “A” Central Public Sector Enterprise (CPSE) of the Government of India, under the administrative control of the Ministry of Petroleum & Natural Gas, is a wholly-owned subsidiary and overseas branch of Oil and Natural Gas Corporation Limited (ONGC), India’s flagship national oil company (NOC).

The primary business of NGOC Videsh is the prospect of oil and gas acreage outside India, including oil and gas discovery, growth, and production.ONGC Videsh holds 37 oil and gas reserves in 17 countries and developed about 30.3 percent of oil and 23.7 percent of India’s domestic oil and gas output in 2019-20. In terms of reserves and development, NGOC Videsh is India’s second-largest oil company, alongside its parent ONGC.

Strategies that make it successful

New technologies: ONGC realized during the late 1990s that outdated and obsolete technologies were not only leading to high operation and maintenance costs but also was acting as an impediment to its high growth plans. To enhance the recovering quantities from basins that were near their maturity phase, they employed technology-enabled measures namely Increased Oil Recovery (IOR), Enhanced Oil Recovery (EOR), and SCADA (Supervisory Control and Data Acquisition).

It also implemented an Enterprise Resource Planning (ERP) system which covered all aspects of the Management Information System.

Human Resource Development: As a part of ONGC’s vision and mission statement, the HR policy was aimed to “Foster a culture of trust, openness and mutual concern to make working a stimulating and challenging experience for our people”. To overcome the problem of overstaffing and procedural delays, ONGC revamped all internal processes to facilitate faster file processing. It also redesigned its appraisal system by introducing a new result-oriented incentive and reward scheme like the Productivity Honorarium Scheme, Quarterly Incentive Scheme, Group incentive for Cohesive team working, and reward and recognition scheme.

ONGC also established the Institute of Management Development (IMD), later named ONGC academy.

Financial Restructuring: ONGC strived to improve its operational efficiencies and reduce costs. ONGC had huge cash reserves on the one hand and huge interest outgo due to foreign debt on the other hand. ONGC thus took steps to make itself a zero-debt company. The excess cash was then employed to acquire better technology that would support its growth momentum.

ONGC was also entitled to huge tax-concessions after its takeover of loss-making MRPL.

Related functions such as Treasury Management, Budget Control, Expenditure Monitoring, and Reporting were also streamlined.

To read more content like this, subscribe to our newsletter.

Go to the full page to view and submit the form.