India is quickly developing as a hotspot of unicorns, or firms with valuations more than $1 billion. The country’s unicorn total has already surpassed 50, including household brands like Flipkart, Paytm, Zomato, and Ola, with as many as 16 start-ups achieving unicorn status in 2021 alone.However, it is only now that digital economy firms are going public, with the forthcoming Zomato IPO heralding the age of big Indian startup IPOs.

About Zomato IPO

Zomato’s growth represents the coming-of-age of not just the New India, but also its young startups. It began as a firm that aimed to solve a ‘hungry’ problem and has since become the first Indian unicorn to enter the public markets.

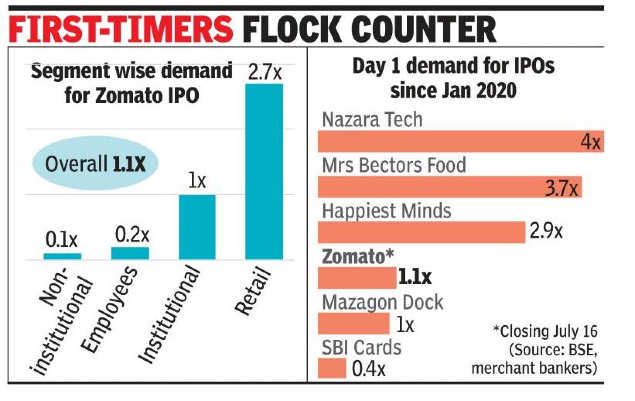

According to subscription statistics on the markets, Zomato’s Rs. 9,375 crore initial public offering (IPO) has been subscribed 38.25 times as of the third and final day of the sale. The top online meal delivery service provider’s initial public offering (IPO) started for investors on Wednesday, July 14 for a three-day period.

Zomato, which is backed by China’s Ant Group, is one of the most notable startups in the nation today, with a presence in 24 countries.

The IPO of Zomato is anticipated to open the door for other prominent digital businesses to go public, such as Paytm, Flipkart, and Ola. According to market regulator SEBI, Paytm submitted draft documents for an initial public offering of up to 16,600 crore on Friday.

Will 2021 be the year of unicorns?

The IPO of Paytm is likely to be the next in line. According to rumours, the mobile payments and commerce network is contemplating an IPO for about 166 billion ($2.23 billion). Flipkart and Ola are two more Indian unicorns that are likely to seek funding in the major markets this year.

Mobikwik is also planning an IPO, despite the fact that the digital payment firm is not a unicorn in the traditional meaning of the term, with a valuation of $70 million. On Monday, the digital payments startup backed by Sequoia Capital and Bajaj Finance filed for an initial public offering (IPO) valued up to Rs. 1,900 crore with market regulator Sebi.

Many other non-unicorn firms have also expressed interest in going public. A total of 30 businesses have filed IPO papers in an attempt to raise 55,000 crore, and at least 10-15 companies have begun the process of going public.

According to media reports and insiders, at least a half-dozen online businesses are now in talks to go public via an Initial Public Offering (IPO). Food-delivery company Zomato, cosmetics brand and store Nykaa, ecommerce logistics company Delhivery, and insurance marketplace Policybazaar are among them.

Other names that have surfaced include software firm Freshworks and online retailer Flipkart. However, according to sources, the top four are intending to list in India (on the Bombay Stock Exchange or the National Stock Exchange), which adds to the enthusiasm among investors. Others, like PepperFry, Mobikwik, Oyo, Paytm, and Byju’s, have expressed an interest at some time.

Why the rush?

India is in the midst of a stock market bull run, with indexes reaching new highs and a slew of exceptionally successful initial public offerings (IPOs) ranging from Burger King to Indigo Paints. While current mood is particularly positive, the previous several years have witnessed at least a few successful postings on a continuous basis.

These startup IPOs have the potential to catapult things to new heights. If you exclude the huge IPO of SBI Cards, their total value of Rs 134000 crore is 67 percent more than the top five IPOs of the previous two calendar years combined. Aside from the SBI Cards IPO last year, the top five IPOs in the previous two years each had a post-IPO market valuation of around Rs 80,195 crore, according to Prime Database statistics. These still include big winners like Burger King, Gland Pharma, Sterling, and Wilson Solar.

But it’s not quite that simple. For starters, internet firms are not the same as any of the major pharma, financial services, or consumer corporations that have gone public. Their size is undeniably huge, and they are still rapidly developing, but with the exception of Nykaa, none of these local IPO prospects is profitable, unlike their listed predecessors.

Also Read: Featured Startup | Swiggy – The Ultimate Food Delivery App

The impending IPOs may provide the first financial indicator of whether India’s new economy has succeeded or not. Investors will receive their first taste of a completely new sector of India’s economy, one that is hailed as the future and has had a massive influence in other nations. In the US and Chinese stock markets, technology demands the highest valuations and generates huge profits, despite the fact that these lucrative firms are decades old (Amazon, Facebook, Alibaba, Tencent, et al).

Startup unicorns – companies valued at a billion dollars or more — have been able to command high values based on future predictions, market domination with significant losses, and the distant vision of a profitable colossus. However, those gains may have to materialise fast in order to justify the stock market’s high valuation.

To read more content like this, subscribe to our newsletter.

Go to the full page to view and submit the form.