HDFC Bank Limited is an Indian banking and financial services business located in Mumbai, Maharashtra. As of April 2021, HDFC Bank is India’s largest private sector bank in terms of assets and market capitalization. On the Indian stock markets, it is the third-largest corporation in terms of market capitalization. With approximately 120,000 workers, it is also the fifteenth largest employer in India.

HDFC Bank is one of India’s largest private banks, and it was one of the first to obtain approval from the Reserve Bank of India (RBI) to establish a private sector bank in 1994.

Today, HDFC Bank has a banking network of 5,653 branches. All branches are linked on an online real-time basis. Customers in over 2,900 locations are also serviced through Telephone Banking. The Bank also has a network of about over 16,291 networked ATMs across these cities.

History

The HDFC Bank was founded in August 1994 as ‘HDFC Bank Limited,’ with its headquarters in Mumbai, India. In January 1995, HDFC Bank began operations as a Scheduled Commercial Bank. As part of the Reserve Bank of India’s (RBI) deregulation of the Indian Banking Industry in 1994, the Housing Development Finance Corporation (HDFC) was among the first to gain ‘in principle’ clearance to establish a bank in the private sector.

The business’s promoter, HDFC, was founded in 1977 and is India’s top home financing company, with an immaculate track record in both domestic and foreign markets. HDFC has extensive competence in retail mortgage loans to various market segments, as well as a strong corporate client base for its housing-related credit facilities. With its financial market knowledge, strong market reputation, huge shareholder base, and distinctive consumer franchise, HDFC was well-positioned to promote a bank in the Indian market.

The shares are traded on the Bombay Stock Exchange and the National Stock Exchange of India. The bank’s American Depository Shares (ADS) are traded on the New York Stock Exchange (NYSE) under the symbol ‘HDB,’ while its Global Depository Receipts (GDRs) are traded on the Luxembourg Stock Exchange.

The merger of Centurion Bank of Punjab and HDFC Bank was legally authorised by the Reserve Bank of India on May 23, 2008, completing the legislative and regulatory clearance procedure. According to the scheme of merger, CBoP owners got one HDFC Bank share for every 29 CBoP shares.

The combined business now has a solid deposit base of about Rs. 1,22,000 crore and net advances of approximately Rs. 89,000 crore. The merged entity’s balance sheet will be more than Rs. 1,63,000 crore. The merger provided considerable benefit to HDFC Bank in terms of expanded branch network, geographic reach, and customer base, as well as a larger pool of trained labour.

Times Bank Limited (another new private sector bank sponsored by Bennett, Coleman & Co. / Times Group) merged with HDFC Bank Ltd. on February 26, 2000, in a landmark deal in the Indian banking market. In the New Generation Private Sector Banks, this was the first merger of two private banks. According to the merger arrangement approved by both banks’ shareholders and the Reserve Bank of India, shareholders of Times Bank received one share in HDFC Bank for every 5.75 shares of Times Bank.

What Products and Services does HDFC Bank provide?

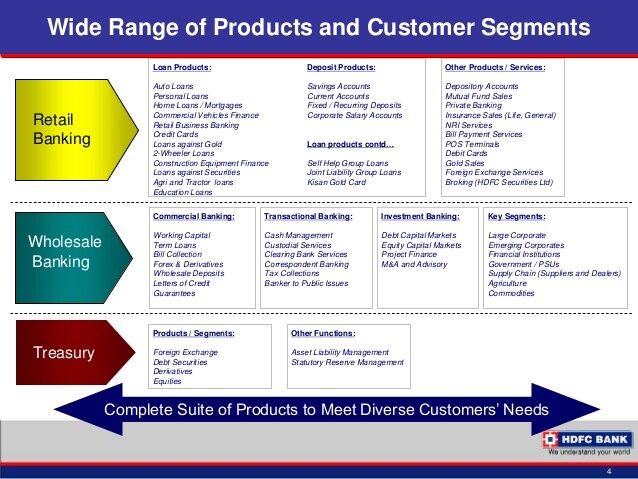

The goods and services offered by HDFC Bank include wholesale banking, retail banking, treasury, auto loans, two-wheeler loans, personal loans, loans against property, consumer durable loans, lifestyle loans, and credit cards. Payzapp and SmartBUY are two further digital goods.

HDFC Bank offers a diverse variety of banking services, including commercial and investment banking on the wholesale side, as well as transactional / branch banking on the retail side. The bank’s main business segments are as follows:

Wholesale Banking

The Bank’s target market consists largely of big, blue-chip manufacturing enterprises in the Indian corporate sector, as well as small and mid-sized corporates and agri-based businesses to a lesser extent. The Bank offers a comprehensive variety of commercial and transactional banking services to these customers, including working capital loans, trade services, transactional services, cash management, and so on.

The bank is also a prominent provider of structured solutions, which integrate cash management services with vendor and distributor finance to help its business customers achieve improved supply chain management.

The Bank has achieved major inroads into the banking consortia of a number of top Indian corporates, including multinationals, local business houses, and prime public sector enterprises, based on its outstanding product delivery/service standards and strong client focus. It is widely regarded as a major provider of cash management and transactional banking solutions to corporations, mutual funds, stock market members, and banks.

Treasury

The bank’s major product categories within this industry include Foreign Exchange and Derivatives, Local Currency Money Market & Debt Securities, and Equities. Corporates require increasingly sophisticated risk management information, guidance, and product structures as India’s financial markets liberalize.

The bank’s Treasury team provides these, as well as fine pricing on other treasury products. The Treasury Department is in charge of managing the investment portfolio’s returns and market risk.

Retail Banking

The Retail Bank’s goal is to offer its target market clients a comprehensive variety of financial products and banking services, offering the customer a one-stop-shop for all of his or her banking needs. The products are underpinned by world-class service and are available to clients through the expanding branch network as well as other delivery channels like ATMs, Phone Banking, NetBanking, and Mobile Banking.

HDFC Bank was the first Indian bank to offer an International Debit Card in collaboration with VISA (VISA Electron), and it also issues the MasterCard Maestro debit card. In late 2001, the bank began its credit card operation. By March 2015, the bank has a total card base of over 25 million (debit and credit cards). With approximately 235,000 Point-of-sale (POS) machines for debit/credit card acceptance at merchant establishments, the Bank is also one of the major participants in the “merchant acquiring” sector. The bank is well-positioned as a leader in a variety of net-based B2C prospects, including a broad range of internet banking services including Fixed Deposits, Loans, Bill Payments, and so on.

Also Read: LIC – Successful Strategies Of Insurance Giant

Marketing & Branding Strategies

Digital-only approach

HDFC Bank is focusing more on experience differentiation rather than only transactional interactions. This approach

provides bank competitive advantage over other banks.

Bank has tried to integrate newer technology platforms to attract more customers and to design more satisfying customer experience. Following are efforts taken by HDFC bank towards this direction through various tools i.e. EVA (Electronic Virtual Assistant), On Chat, DCC (Digital Command Care), Insta Alerts, Digital Loans, Virtual Insta Card, PayZapp, Smart Buy, Digital loans against securities and mutual fund, Smart Hub, Smart Hub Merchant App and BHIM App in digital marketing.

HDFC has achieved the target to install point of sale units, integrate the Bharat QR payment system and promote the Bhim mobile app based on the unified payment interface after demonetization. These are some of the tools which bank is providing to attract customers digitally.

HDFC bank is trying its best to provide an excellent digital banking experience with digital marketing to build trust among customers. HDFC bank’s proportion of investment in digital marketing has increased. The bank is spending more on technical staff which is handling digital media marketing. So, in every aspect bank is becoming ready to face future challenges, equipped with digital marketing.

Keeping it simple

HDFC Bank’s success comes from keeping its business simple by hewing to its founding principles: customer focus, risk management, technology-led innovation, and a “first among equals” culture.

One-stop solution to all financial needs

FROM doing cross-selling exercises to organizing school-level painting competitions, promotional activities are going to be the main focus of HDFC Bank’s marketing strategy this year. HDFC Bank is looking at positioning HDFC as a one-stop financial supermarket and the objective of the promos is not just the acquisition of new customers, but also looking at creating product awareness, enhancing usage, and also providing value-added services to the customers to reward them for their faith and loyalty.

Social Media Strategy

True to their success in the banking industry, their social media presence is a popular option among individuals, and for good reason. They make an effort to live up to their motto of “We Understand Your World” by thoroughly analyzing their target demographic and selecting their content properly. Their Instagram post is generally lighthearted and full of humorous asides. The canvas for their material is generally a shade of Yale blue, although they seldom mix it with any red or white to produce the colors of their emblem.

They rely heavily on topical material to remain in contact with their followers, and they’ve also mastered the art of quietly inserting their products into cultural allusions. The same zeal is channeled into their many campaigns.

Their marketing approach and posts fully support their tagline, ‘We Understand Your World,’ as seen by their meticulous planning and placement, using the appropriate platform at the appropriate time. Their precise targeting and funny advertisements might teach other businesses how to efficiently identify, understand, and serve their target audiences.

The goal is to create a stronger customer franchise across all businesses in order to become the chosen supplier of banking services for target wholesale and retail client groups, as well as to produce healthy profit growth that is commensurate with the bank’s risk tolerance.

HDFC Bank has effectively acquired a market share in its target client franchises throughout the years while maintaining healthy profitability and asset quality.

The bank has already witnessed improved resource utilization, faster turnaround times, uniformity of service levels, and the flexibility to deliver varied service levels based on the client profiles.

To read more content like this, subscribe to our newsletter.

Go to the full page to view and submit the form.