Chime is an American neobank that provides a variety of financial products and services. Chime operates no physical customer branches as a digitally enabled bank. Customers instead use Chime’s mobile app to keep track of their finances.

Account authentication and registration occur during video identification. Chime claims that accounts can be created in under two minutes.

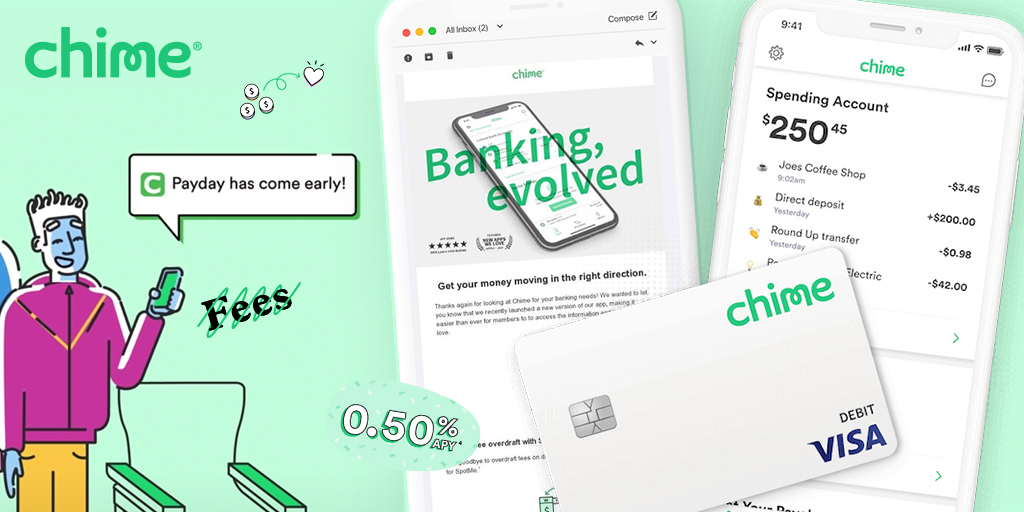

In addition to the digital account, members will receive a free Visa debit card to spend their hard-earned money.

Other app features include a detailed overview of account balances and spending history, automatically setting money aside into a savings account, getting paid early with direct deposits, no overdraft fees, fee-free withdrawal at over 60,000 ATMs across the US, the ability to pay other Chime users instantly, and many more. The attractiveness of the organisation stems from its ability to streamline the whole banking process, from opening an account to eliminating hidden expenses.

Chime can be used by any American citizen over the age of 18. Accounts can only be provided to members who have a valid SSN and live in the United States or the District of Columbia.

Aside from a debit account, customers may create a savings account as well as a credit card account (dubbed Credit Builder). Its Credit Builder programme is geared at millennials and Generation Z consumers who want to be more financially responsible and improve their credit ratings.

Credit Builder was born from Chime’s 2018 acquisition of Pinch, a service dedicated to assisting young adults in building better credit. Its founders assisted Chime in the development of the product.

Chime, unlike its European FinTech peers, does not have a banking licence. Instead, it collaborated with The Bancorp Bank to safeguard accounts against any form of default.

Chime accounts are thus FDIC-insured up to $250,000. Chime presently serves over 13 million customers.

Chime History / Startup Story

Chris Britt (CEO) and Ryan King established Chime in 2013. (CTO). Britt formerly worked as an executive in the financial sector, overseeing product development for businesses such as Visa and the Green Dot Corporation.

Britt worked at Green Dot to assist the unbanked in receiving and opening their first bank account.

Chime started out as a sort of extension of someone’s current bank account. Customers may use the free debit card to make payments or withdraw funds.

Users would receive real-time notifications on their expenditure and account balance as a result. Even in today’s banking industry, these functionalities are not available in every banking application – less alone in 2014, when Chime was eventually made available to the public.

Chime has continued to offer new capabilities to its service while concurrently increasing its user base over the years.

Chime, unlike many of its European competitors, does not yet have a banking licence, despite rumours that it has attempted to obtain one in the past.

Currently, the company is focusing on attracting new customers and expanding beyond its predominantly low- and middle-income consumer base to larger accounts.

The business has also demonstrated concern for its customers. It began handing out stimulus cheques two days before April 2020. Chime effectively funded the programme with its own money. The original trial had 1,000 users and is now available to all clients.

The startup announced its most recent round of fundraising in September 2020. Chime became the most valued FinTech consumer company in the United States as a result of the investment, surpassing Robinhood along the way.

Chime is investing much on marketing and branding activities in order to boost its prominence. It secured a multi-year brand relationship with the Dallas Mavericks earlier in 2020. Chime became the team’s official shirt sponsor as a result of the agreement.

Chime, furthermore, continues to expand its product line to increase user retention and create future opportunities for cross-selling. In March 2021, it launched a P2P payment service to compete against the likes of Square Cash and Zelle.

However, not everything always went as planned. Following an examination by the California Department of Financial Protection and Innovation, Chime agreed to cease using the term “bank” (Chime itself does not possess a banking licence and offers most of its banking service through a cooperation with Green Dot Bank).

Months later, in July, the startup made headlines after hundreds of clients claimed being unable to access their money for months at a time owing to suspicions of fraudulent activity (dubbed “forced account closures”).

Chime Business Model

Chime earns money via interchange fees, cash interest, and ATM fees. Let’s take a closer look at each of these revenue streams below.

Chime makes money by charging merchants interchange fees (fees paid to financial institutions) everytime their debit card is used.

In the instance of Chime, businesses pay Visa around 1.5 percent of the sale value. Chime receives a piece of that 1.5 percent.

According to CEO Britt, Chime customers make 40 transactions each month on average. And, given that the average adult in the United States has the same primary checking account for roughly 16 years, this can result in a massive quantity of transactions and fees over time.

Chime’s attractiveness arises in part from the fact that traditional banks sometimes levy costs on a variety of circumstances, such as ATM fees, overdraft fees, account maintenance fees, transfer fees, overseas fees, and non-sufficient fund (NSF) penalties. Meanwhile, Chime customers are not charged any “penalty” costs.

So far, this technique appears to be working. Chime just announced that it had over eight million customers. This marks an 800% growth from the company’s 1 million users in 2018.

Furthermore, CEO Britt stated that the majority of the newly recruited clients are from large banks such as Wells Fargo or JPMorgan Chase.

Interest On Cash

Users who wish to save money can do so by creating a high interest savings account with Chime.

The account is available alongside the FinTech’s Automatic Savings tool. Furthermore, there are no fees associated with the account.

Chime presently provides a 0.5 percent Annual Percentage Yield (APY) on the balance of the account. According to the firm, the national average is 0.06 %.

Chime definitely does not provide money to its consumers for altruistic motives. Like any other bank, utilises the funds in customer accounts to lend to other institutions, such as other banks.

They then get interest from these institutions (also known as the Net Interest Margin).

ATM Fees

Finally, Chime earns money anytime a user withdraws cash from an ATM that is not part of the MoneyPass or VPA networks.

Chime costs $2.50 each withdrawal in this circumstance. At their option, the ATM provider may levy an extra fee.

Axios reported in January 2021 that ATM fees account for 21 percent of Chime’s income.

Also Read: PhonePe: Enabling Digital Payment Ecosystem

Chime Funding, Valuation & Revenue

According to Crunchbase, Chime has raised $2.3 billion in venture capital financing in 11 rounds.

Chime was valued at $25 billion in its most recent Series G round (August 2021), when it received $750 million. This is a $10 billion boost over the last fundraising round (in September 2020).

DST Global, Menlo Ventures, General Atlantic, Dragoneer Investment Group, and others are among the company’s investors.

Chime, like any other fast-growing business, does not publicly publish its sales or profit figures. However, according to Forbes, Chime’s revenue for 2021 will be close to $1 billion, up from $600 million in 2020.

Who Owns Chime?

Chime, like its sales data, is not obliged to divulge its ownership structure to the public.

Because of the company’s several investment rounds, it is safe to conclude that Chime’s founders have given up a considerable amount of their stock.

DST Global, which led two of Chime’s fundraising rounds, is one of its major institutional shareholders (Series D and E). Other major owners include Sequoia Capital, Crosslink Capital, and Aspect Ventures.

To read more content like this, subscribe to our newsletter

Go to the full page to view and submit the form.