The term “too big to fail” refers to companies that are considered so large and important that their failure could have significant negative consequences for the overall economy. These companies are often seen as having a special status or protection from government intervention due to their systemic importance. Here are the top 10 companies that are widely considered to be too big to fail:

- JPMorgan Chase & Co.

JPMorgan Chase & Co., commonly known as JPMorgan, is an American multinational investment bank and financial services company. It is one of the largest banks in the world and operates in over 100 countries. JPMorgan offers a wide range of financial services to individuals, corporations, governments, and institutions, including commercial banking, investment banking, asset management, and wealth management.

JPMorgan was founded in 1799 and has grown through a series of mergers and acquisitions over the years. In 2000, JPMorgan merged with Chase Manhattan Corporation, creating JPMorgan Chase & Co. The bank weathered the 2008 financial crisis relatively well compared to some of its competitors, in part due to its size and diversification.

JPMorgan is headquartered in New York City and has a significant presence in other major financial centers around the world, including London, Tokyo, and Hong Kong. The bank is led by Chairman and CEO Jamie Dimon, who has been with the company since 2004. In recent years, JPMorgan has faced scrutiny over various issues, including allegations of market manipulation and compliance failures. Nonetheless, JPMorgan remains a key player in the global financial system and continues to be one of the most profitable banks in the world.

The company is considered too big to fail due to its size, complexity, and interconnectedness with other parts of the financial system.

2. Goldman Sachs Group Inc.

Goldman Sachs Group Inc. is an American multinational investment bank and financial services company that was founded in 1869. The company provides a wide range of financial services, including investment banking, securities underwriting, asset management, and securities trading. Goldman Sachs is headquartered in New York City and has a presence in major financial centers around the world.

Goldman Sachs is known for its expertise in mergers and acquisitions, as well as its significant investment in technology and innovation. The company is one of the largest investment banks in the world and is consistently ranked among the most profitable banks.

Goldman Sachs remains a major player in the global financial system and continues to be highly regarded for its expertise and influence in the world of finance. Its importance to the global financial system has earned it a place on the list of companies that are too big to fail.

3. Citigroup Inc.

Citibank, officially known as Citigroup Inc., is a multinational investment bank and financial services corporation. Founded in 1812 as the City Bank of New York, Citibank has grown into one of the largest banks in the world, operating in over 160 countries and territories.

Citibank offers a range of financial services, including retail banking, commercial banking, credit cards, wealth management, and investment banking. The bank is known for its focus on innovation and technology, as well as its ability to serve clients around the world.

Over the years, Citibank has faced a number of challenges, including legal and regulatory issues, as well as financial crises. In the 2008 financial crisis, Citibank was among the banks that received a bailout from the US government. Despite these challenges, Citibank remains one of the most influential banks in the world and continues to be a key player in the global financial system.

The company’s size and global reach make it a critical player in the financial markets, and its failure could have far-reaching consequences.

4. Wells Fargo & Co.

Wells Fargo & Company is a multinational financial services company based in San Francisco, California. The company was founded in 1852 and has since grown to become one of the largest banks in the United States.

Wells Fargo offers a wide range of financial services, including banking, investment, and insurance products. The bank serves individuals, small businesses, and large corporations across the United States and has a significant presence in other countries around the world.

Its importance to the U.S. economy and financial system make it a company that is too big to fail.

5. Bank of America Corp.

Bank of America Corporation, commonly known as Bank of America, is a multinational investment bank and financial services company based in Charlotte, North Carolina. The company was founded in 1904 and has since grown to become one of the largest banks in the United States and in the world.

Bank of America provides a wide range of financial services to individuals, small businesses, and large corporations, including banking, investment, and insurance products. The bank has a significant presence in the United States and operates in other countries around the world.

Bank of America has faced a number of challenges over the years, including legal and regulatory issues, as well as financial crises. In the 2008 financial crisis, the bank received a bailout from the US government. Despite these challenges, Bank of America remains a major player in the global financial system and continues to be highly regarded for its expertise and influence in the world of finance. Its size and importance to the global financial system make it a critical player that is too big to fail.

6. American International Group Inc.

American International Group, Inc. (AIG) is an American multinational insurance company that provides a wide range of insurance and financial services to customers around the world. The company was founded in 1919 and is headquartered in New York City.

AIG offers a variety of insurance products, including life insurance, property and casualty insurance, and retirement products. The company also provides investment management services and other financial services.

AIG has faced a number of challenges over the years, including significant financial losses during the 2008 financial crisis, which led to a government bailout of the company. The company has also been involved in a number of controversies, including a scandal involving accounting irregularities and allegations of fraud.

Despite these challenges, AIG remains a major player in the insurance industry and continues to be highly regarded for its expertise and influence in the world of finance.

Its importance to the global financial system has earned it a place on the list of companies that are too big to fail.

7. General Electric Co.

General Electric (GE) is a multinational conglomerate company that operates in a variety of industries, including aviation, healthcare, renewable energy, and finance. The company was founded in 1892 and is headquartered in Boston, Massachusetts.

GE is best known for its innovations in the field of electrical engineering and its long history of producing consumer and industrial products, such as light bulbs, appliances, and power generation equipment. The company has also played a significant role in the development of the aviation industry, producing aircraft engines and other aerospace technologies.

Over the years, GE has faced a number of challenges, including financial losses, legal and regulatory issues, and a decline in its core businesses. In recent years, the company has undergone significant restructuring and has focused on divesting non-core businesses and investing in high-growth areas, such as renewable energy and digital technologies.

Despite these challenges, GE remains a major player in the global business landscape and continues to be highly regarded for its innovations and expertise in a variety of industries.

Its size and importance to the global economy make it a company that is too big to fail.

8. Boeing Co.

The Boeing Company is an American multinational corporation that designs, manufactures, and sells airplanes, rotorcraft, rockets, satellites, telecommunications equipment, and missiles worldwide. The company was founded in 1916 and is headquartered in Chicago, Illinois.

Boeing is one of the largest aerospace companies in the world, and its commercial airplanes division is one of the leading manufacturers of passenger aircraft. The company also produces military aircraft, including fighter jets and helicopters, and provides defense and space-related products and services.

Over the years, Boeing has faced a number of challenges, including safety issues with its airplanes, production delays, and financial losses. In recent years, the company has been impacted by the grounding of its 737 Max airplanes due to safety concerns and the ongoing COVID-19 pandemic, which has led to a decline in demand for air travel.

Despite these challenges, Boeing remains a major player in the aerospace industry and continues to be highly regarded for its technical expertise and innovation.

Its importance to the U.S. economy and national security make it a company that is too big to fail.

9. ExxonMobil Corp.

ExxonMobil is an American multinational oil and gas corporation that is headquartered in Irving, Texas. The company was formed in 1999 through the merger of Exxon and Mobil, two of the largest oil companies in the world.

ExxonMobil is one of the largest oil and gas companies in the world, with operations in more than 50 countries. The company is involved in all aspects of the oil and gas industry, from exploration and production to refining and marketing.

Over the years, ExxonMobil has faced a number of challenges, including concerns about its impact on the environment, regulatory issues, and declining demand for fossil fuels. In recent years, the company has been investing in alternative energy sources, such as wind and solar power, and has been working to reduce its carbon footprint.

Despite these challenges, ExxonMobil remains a major player in the global energy industry and continues to be highly regarded for its technical expertise and financial performance.

Its importance to the global energy market and the broader economy make it a company that is too big to fail.

Also Read: Inside ExxonMobil: Exploring World’s Largest Energy Corporation

10. Amazon.com Inc.

mazon is an American multinational technology company that is headquartered in Seattle, Washington. The company was founded in 1994 by Jeff Bezos and began as an online bookstore. Since then, Amazon has expanded its product offerings to include a wide range of goods and services, including electronics, apparel, groceries, streaming media, and cloud computing.

Amazon is the largest online retailer in the world and has revolutionized the way people shop and consume goods. The company’s business model is based on offering low prices, a vast selection of products, and fast and reliable delivery.

Over the years, Amazon has faced a number of challenges, including concerns about its impact on small businesses, issues with employee working conditions, and antitrust investigations. Despite these challenges, the company continues to grow and expand its reach, with a market capitalization of over $1.5 trillion as of early 2023.

Its size and importance to the global economy make it a company that is too big to fail.

Also Read: Amazon – Delivering A To Z Of Business And Success

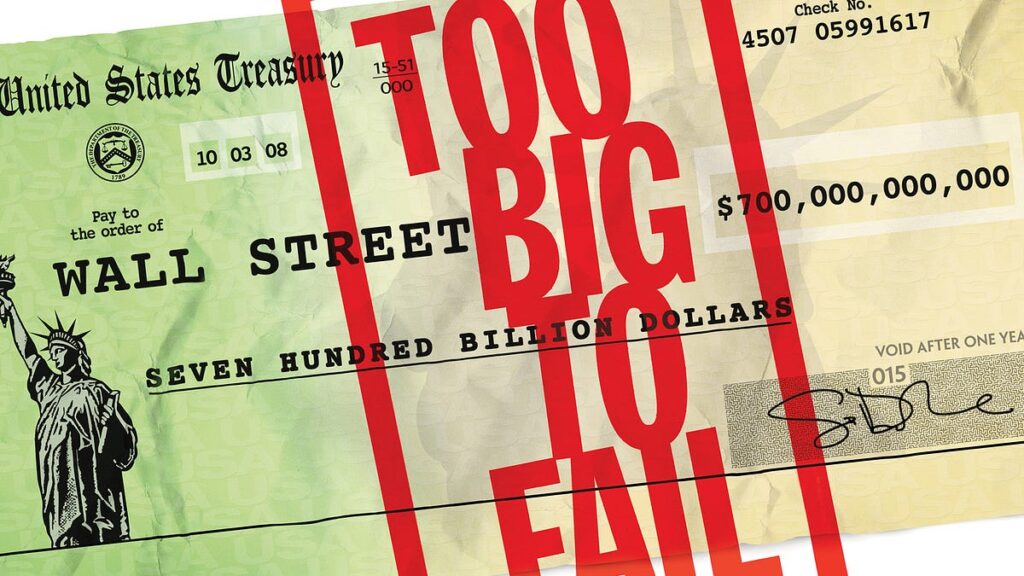

The concept of “too big to fail” emerged in the aftermath of the 2008 financial crisis, which was caused in part by the collapse of several large financial institutions. The failure of these companies had significant negative consequences for the broader economy, including the loss of jobs, the collapse of housing markets, and the near-collapse of the global financial system. As a result, policymakers and regulators began to focus on identifying and managing the risks posed by companies that were deemed too big to fail.

One of the primary reasons that these companies are considered too big to fail is their size and complexity. Many of the companies on the list have operations in multiple countries and are involved in a wide range of activities, including banking, insurance, and energy. This complexity makes it difficult for regulators to monitor and manage the risks posed by these companies.

Another factor that contributes to the too big to fail status of these companies is their interconnectedness with other parts of the economy. Many of these companies are critical players in the financial system, providing essential services such as lending, insurance, and investment banking. The failure of one of these companies could lead to a chain reaction of defaults and losses that could have catastrophic consequences for the broader economy.

In addition to their size and complexity, many of these companies are also considered too big to fail because of their importance to national security and the broader economy. For example, Boeing is a major supplier of military aircraft and is critical to the U.S. defense industry. ExxonMobil is one of the largest energy companies in the world and is critical to the functioning of the global energy market. The failure of these companies could have far-reaching consequences for national security and the global economy.

While the too big to fail status of these companies provides some level of protection, it also creates a moral hazard. This occurs when companies take on excessive risks because they believe that they will be bailed out if they fail. This can lead to even greater systemic risk and the potential for even more catastrophic consequences if one of these companies were to fail.

To manage the risks posed by too big to fail companies, regulators have implemented a range of measures aimed at reducing their systemic importance and increasing their resilience to shocks. These measures include stricter capital and liquidity requirements, stress testing, and the designation of systemically important financial institutions. However, there is ongoing debate over whether these measures are sufficient to manage the risks posed by these companies and prevent another financial crisis.

To read more content like this, subscribe to our newsletter

Go to the full page to view and submit the form.