Berkshire Hathaway is an American multinational conglomerate holding company that is headquartered in Omaha, Nebraska. It was founded in 1839 by Oliver Chace as a cotton manufacturing company in Rhode Island. However, the company’s fortunes turned around after it was taken over by Warren Buffett, who transformed it into an investment holding company.

Today, Berkshire Hathaway is one of the largest and most successful companies in the world. It is known for its vast and diverse portfolio of subsidiaries and investments, which includes companies operating in a range of industries such as insurance, energy, manufacturing, retail, and transportation. Some of its most well-known subsidiaries include GEICO, Duracell, Dairy Queen, and Fruit of the Loom.

Berkshire Hathaway’s success can be attributed to the investment philosophy of Warren Buffett, who is widely regarded as one of the greatest investors of all time. Buffett believes in investing in companies with a long-term outlook and a strong competitive advantage, and he prefers to buy companies that are undervalued and have a strong track record of earnings growth. He is also known for his focus on value investing and his reluctance to invest in companies that he does not fully understand.

Under Buffett’s leadership, Berkshire Hathaway has generated consistent and impressive returns for its shareholders, with the company’s stock price increasing by more than 2,800% since Buffett took over in 1965. In addition, Berkshire Hathaway’s annual meeting, which is held in Omaha, has become a major event in the financial world, attracting thousands of investors and journalists from around the globe.

In summary, Berkshire Hathaway is a highly successful multinational conglomerate holding company that has grown and diversified under the leadership of Warren Buffett. Its investment philosophy, which focuses on long-term investments in undervalued companies with strong competitive advantages, has been key to its success.

Founding History of Berkshire Hathaway

The history of Berkshire Hathaway dates back to 1839 when Oliver Chace founded the Valley Falls Company, a textile manufacturer based in Rhode Island. The company expanded over the years and merged with Berkshire Fine Spinning Associates in 1929 to form Berkshire Hathaway Inc.

The textile industry faced tough times in the 1960s, and Berkshire Hathaway was no exception. In 1962, a young investor named Warren Buffett began buying shares in the company, which he saw as undervalued. By 1965, Buffett had amassed a controlling stake in the company and took over as chairman of the board.

Buffett’s investment philosophy and business acumen soon transformed Berkshire Hathaway into a holding company. He used the company’s cash flow to invest in other businesses and stocks that he believed were undervalued. He also took a hands-on approach to managing the companies in which Berkshire Hathaway had acquired stakes.

One of Berkshire Hathaway’s earliest investments was in the insurance industry. In 1967, the company acquired National Indemnity Company, a struggling insurance firm. Buffett saw potential in the company’s business model, which involved underwriting insurance policies that were perceived as high-risk. He also believed that the company’s reserves could be invested in the stock market to generate additional returns.

Over the years, Berkshire Hathaway continued to expand its portfolio of companies and investments. It acquired a number of well-known brands, such as GEICO, See’s Candies, and Dairy Queen. It also invested in other companies, such as American Express, Coca-Cola, and IBM.

In 2010, Berkshire Hathaway made headlines when it acquired Burlington Northern Santa Fe Corporation, a major U.S. railroad company, for $26.5 billion. The acquisition was seen as a major bet on the future of the U.S. economy and transportation infrastructure.

Today, Berkshire Hathaway is one of the largest and most successful companies in the world, with a market capitalization of over $700 billion. The company’s success is largely attributed to Warren Buffett’s investment philosophy and his ability to identify undervalued companies with strong long-term potential. The company’s annual meeting in Omaha, Nebraska, has become a major event in the financial world, attracting thousands of investors and journalists from around the globe.

Also Read: Berkshire Hathaway – History of Waren Buffet Led Investment Holding Company

Investment Portfolio of Berkshire Hathaway

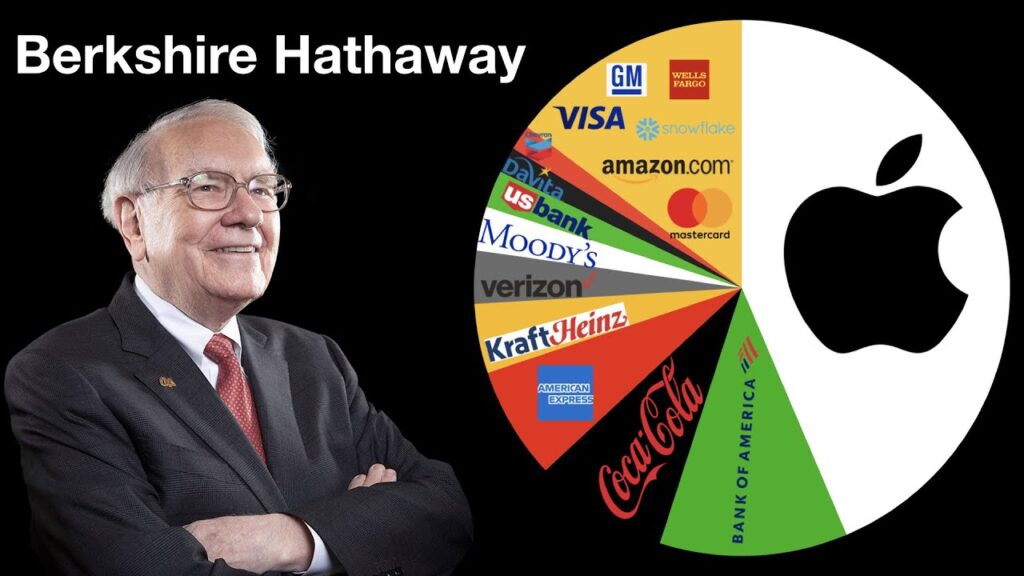

Berkshire Hathaway’s investment portfolio is one of the most closely watched and successful portfolios in the world. The company’s chairman, Warren Buffett, is known for his value investing approach and his ability to identify undervalued companies with strong long-term potential. The following is a breakdown of Berkshire Hathaway’s investment portfolio as of the end of 2021:

Apple: Berkshire Hathaway’s largest holding is in Apple, the tech giant. As of the end of 2021, Berkshire Hathaway held approximately $132 billion worth of Apple shares, representing approximately 42% of the company’s investment portfolio.

Bank of America: Berkshire Hathaway holds a significant stake in Bank of America, the second-largest bank in the United States. As of the end of 2021, the company held approximately $46 billion worth of Bank of America shares, representing approximately 15% of its investment portfolio.

Coca-Cola: Berkshire Hathaway has a long-standing investment in Coca-Cola, the world’s largest soft drink maker. As of the end of 2021, the company held approximately $21 billion worth of Coca-Cola shares, representing approximately 7% of its investment portfolio.

American Express: Berkshire Hathaway has a significant stake in American Express, the global financial services company. As of the end of 2021, the company held approximately $15 billion worth of American Express shares, representing approximately 5% of its investment portfolio.

Moody’s: Berkshire Hathaway has a stake in Moody’s, the credit rating agency. As of the end of 2021, the company held approximately $8 billion worth of Moody’s shares, representing approximately 3% of its investment portfolio.

Verizon: Berkshire Hathaway has a stake in Verizon, the telecommunications giant. As of the end of 2021, the company held approximately $8 billion worth of Verizon shares, representing approximately 3% of its investment portfolio.

Chevron: Berkshire Hathaway has a stake in Chevron, the multinational energy corporation. As of the end of 2021, the company held approximately $4 billion worth of Chevron shares, representing approximately 1% of its investment portfolio.

In addition to these holdings, Berkshire Hathaway also has significant investments in a number of other companies, including JPMorgan Chase, General Motors, and Berkshire Hathaway Energy. The company’s investment portfolio is carefully managed by Warren Buffett and his team of investment managers, who are known for their disciplined and patient approach to investing.

Berkshire Hathaway’s approach to investing

Berkshire Hathaway’s approach to investing is grounded in Warren Buffett’s philosophy of value investing, which emphasizes buying stocks of companies that are undervalued relative to their intrinsic value. The company seeks out companies with strong competitive advantages, stable earnings, and good management teams. Berkshire Hathaway invests in both publicly traded stocks and privately held companies.

One of the key tenets of Berkshire Hathaway’s approach is to invest for the long-term. The company prefers to hold onto its investments for years, if not decades, rather than engaging in short-term trading. This approach is based on the belief that a company’s value will ultimately be reflected in its stock price over the long-term, despite short-term fluctuations in the market.

Another important aspect of Berkshire Hathaway’s approach is its focus on investing in businesses that have a “moat” around them, meaning a competitive advantage that makes it difficult for other companies to enter the market. This can come in the form of a strong brand, high barriers to entry, or a unique product or service. Berkshire Hathaway believes that companies with strong competitive advantages are more likely to have sustainable profits and generate value over the long-term.

Berkshire Hathaway’s approach to investing also involves a significant amount of research and due diligence. The company’s investment managers carefully analyze a company’s financial statements, industry trends, and management team before deciding to invest. They also closely monitor the companies in which they have invested to ensure they continue to meet their investment criteria.

Finally, Berkshire Hathaway’s approach to investing involves a significant amount of patience. The company is known for its willingness to wait for the right investment opportunities, even if it means sitting on cash reserves for extended periods of time. This approach reflects Warren Buffett’s belief that it is better to wait for a good investment opportunity than to invest in a mediocre one.

Overall, Berkshire Hathaway’s approach to investing is characterized by a disciplined and patient approach to identifying undervalued companies with strong long-term potential. This approach has been highly successful, and has helped the company to become one of the most successful and respected investors in the world.

Growth and Revenue of Berkshire Hathaway

Berkshire Hathaway’s growth and revenue growth have been significant over the years, driven by its successful investments and its ability to generate cash flow from its diverse range of businesses.

In terms of growth, Berkshire Hathaway’s net worth has grown from around $22 million in 1965, when Warren Buffett took control of the company, to over $700 billion as of 2021. This represents a compound annual growth rate (CAGR) of around 20%. This growth has been driven primarily by the company’s successful investments in a range of companies, including Apple, Bank of America, Coca-Cola, and American Express, as well as its ownership of a number of well-known subsidiaries, such as GEICO, Duracell, and BNSF Railway.

In addition to net worth growth, Berkshire Hathaway has also seen strong revenue growth over the years. In 2020, the company reported total revenues of $245 billion, up from $247 billion in 2019. This revenue growth has been driven primarily by the company’s diverse range of subsidiaries, which operate in a variety of industries, including insurance, transportation, energy, and manufacturing.

Berkshire Hathaway’s revenue growth has also been driven by its ability to generate strong cash flows from its operations. The company has a number of businesses that generate consistent cash flows, such as its insurance subsidiaries and BNSF Railway. This cash flow has allowed the company to make significant investments in a range of companies, while also providing it with the financial flexibility to weather economic downturns.

Overall, Berkshire Hathaway’s growth and revenue growth have been significant over the years, driven by its successful investments, diverse range of businesses, and ability to generate strong cash flows.

Future of Berkshire Hathaway

Berkshire Hathaway has a solid track record of long-term success and a proven investment philosophy. It is likely to continue to pursue its value investing approach and seek out undervalued companies with strong competitive advantages. The company has also been expanding its holdings in the technology sector in recent years, including investments in Apple, Amazon, and Microsoft, which may indicate a shift in its investment strategy towards the tech industry.

In addition to its investments, Berkshire Hathaway’s diverse range of subsidiaries, including insurance, transportation, and manufacturing businesses, provide a stable foundation for the company. These subsidiaries generate consistent cash flows and provide a buffer against economic downturns.

However, Berkshire Hathaway is also facing challenges. The COVID-19 pandemic has impacted the company’s operations, particularly its insurance subsidiaries, and there are concerns about the impact of rising inflation on the company’s investments. In addition, Berkshire Hathaway’s reliance on a small number of key investments, such as Apple, means that the company’s performance is vulnerable to changes in the performance of these companies.

Overall, the future of Berkshire Hathaway will depend on its ability to navigate these challenges while continuing to pursue its successful investment strategy. The company has a strong foundation and a proven track record, but it will need to adapt to changing market conditions and invest in new opportunities to continue to grow and succeed over the long term.

To read more content like this, subscribe to our newsletter

Go to the full page to view and submit the form.