Fintech startups are gaining momentum around the globe, changing the traditional ways consumers manage and control their financial assets. From investment apps to peer-to-peer lending platforms, the sector boasts exciting new ideas and concepts designed to empower customers and change old paradigms. Amidst this rapidly evolving industry landscape, Toss, a young Korean startup founded in 2016, quickly made waves in the mobile banking sphere with its intuitive and engaging approach to personal finance management.

At first glance, Toss seems similar to other digital wallets offering quick person-to-person (P2P) payments, split bills, and remittances. What sets it apart from the competition is its laser-sharp focus on user convenience and delightful UX/UI elements, making financial interactions effortless and even enjoyable. With a simple signup process requiring just a phone number instead of a complex KYC verification, Toss swiftly gained popularity amongst tech-savvy millennials looking for an alternative to clunky and expensive traditional banks. Soon enough, word spread, and Toss surpassed eight million downloads in mid-2021, representing nearly 25% of the entire smartphone population in South Korea!

Now let’s dive deeper into the main characteristics that define Toss’s success:

Wide range of supported financial institutions and partnerships – Toss boasts connections with multiple credit card providers and banks, enabling seamless account linking and funds transfers. Additionally, integration with various merchant point-of-sale systems allows easy bill settlements without having to swipe plastic cards.

High-level security measures through biometric authentication – Users can employ fingerprint scanning, facial recognition, or iris scan technologies to secure accounts, ensuring maximum protection against unauthorized access or fraudulent activities.

Another significant aspect worth mentioning is Toss’s constant development of new features. Since day one, Toss has not settled for mediocrity but rather strived to offer cutting-edge functionalities to meet evolving customer needs. For instance, its recent addition of cashback deals and discount programs through strategic partnerships creates a win-win scenario for both merchants and users. By providing value beyond basic transaction processing, Toss fosters stronger loyalty and retention rates amidst strong competitive pressure.

However, no company operates in isolation; it must navigate regulatory frameworks and collaborate with ecosystem players. In this regard, Toss has demonstrated impressive adaptability and collaboration skills, working closely with authorities like the Financial Supervisory Service to ensure compliance while maintaining flexibility and agility during unforeseen circumstances. During the COVID-19 pandemic, for example, Toss introduced a temporary limit on third-party beneficiaries to prevent any potential misuse of the platform. Such proactive actions showcase Toss’s responsible attitude towards protecting consumers, which ultimately benefits the overall trustworthiness of the fledgling fintech industry.

Although Toss primarily serves the Korean market currently, its influence extends far beyond national borders. As highlighted earlier, Viva Republica, the parent firm behind Toss, acquired Singapore-based PINTEC Group last year, giving rise to plans to expand into Southeast Asia. This move could potentially open doors to captivate non-Korean speakers who appreciate straightforward mobile banking experiences tailored to local preferences. Moreover, Toss recently announced a tie-up with Standard Chartered in Bangladesh to enable cross-border remittances, signalling its willingness to go global. Therefore, it would not come as a surprise if we see further expansions outside East Asia or continued acquisitions throughout the world as the battle among fintech giants intensifies globally. With large players exploring new markets and forming alliances, emerging stars such as Toss will likely have ample opportunities to thrive within a dynamic environment shaped by innovative business models, ever-increasing regulations, and rising consumer expectations.

Founding History and Founders of Toss

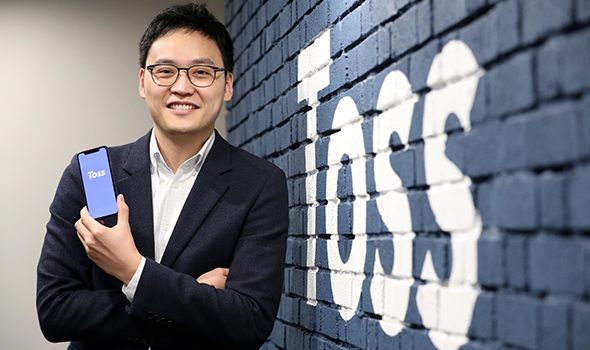

Toss is a South Korean startup that provides a mobile financial services platform. The company was founded in 2015 by former dentist Lee Seung-gun, who recognized the need for easier and more convenient financial services in South Korea. Toss quickly gained popularity and became one of the leading fintech startups in the country.

Lee Seung-gun, commonly known as SG Lee, is the primary founder of Toss. After graduating from Yonsei University’s School of Dentistry, Lee decided to pursue a career in entrepreneurship rather than dentistry. He initially started his career at Samsung Electronics, where he worked as a product manager. However, he soon realized his passion for entrepreneurship and left Samsung to start his own company.

The idea for Toss came to Lee when he experienced the complexity and inconvenience of financial services in South Korea firsthand. He identified the need for a mobile platform that would streamline and simplify banking, payments, and other financial transactions. With this vision in mind, he founded Toss with the goal of revolutionizing the financial industry in South Korea.

Lee assembled a team of talented individuals who shared his vision for a user-friendly financial services platform. Together, they worked tirelessly to develop and launch the Toss app. The team’s dedication and innovative approach quickly gained attention, and Toss began to attract significant investments from various venture capital firms.

Toss initially focused on providing a peer-to-peer money transfer service that allowed users to send and receive money easily through their mobile phones. Over time, the company expanded its offerings to include features such as bill payment, investment options, loans, and insurance services. Toss became known for its user-friendly interface, simplified processes, and emphasis on customer experience.

The success of Toss can be attributed to its ability to disrupt the traditional banking sector in South Korea. The startup’s platform offered a convenient alternative to traditional banking methods, attracting a large user base. Toss gained popularity among young people and tech-savvy individuals who sought a more accessible and modern financial experience.

Since its founding, Toss has continued to grow rapidly and has become one of the most valuable startups in South Korea. It has secured significant funding from both domestic and international investors, further fueling its expansion and innovation.

Products and Services of Toss

Toss offers a range of financial products and functions through its mobile app. Let’s delve into the details of Toss’s offerings:

Money Transfers: Toss provides a convenient and user-friendly platform for peer-to-peer money transfers. Users can easily send and receive money from their mobile devices using the Toss app. This feature eliminates the need for traditional bank transfers and allows users to transfer funds quickly and securely to friends, family, or businesses.

Bill Payments: Toss simplifies the process of bill payments by allowing users to settle their utility bills, credit card bills, and other payments directly through the app. Users can access and manage their bills from various service providers within the app, making it easier to track and pay their bills on time.

Investments: Toss offers investment options to its users, enabling them to access and manage investment products through the app. Users can explore and invest in various financial instruments such as mutual funds or stocks. Toss provides a user-friendly interface to view investment portfolios, track performance, and make informed investment decisions based on personal financial goals and risk preferences.

Loans: Toss provides users with access to personal loans through its platform. Users can apply for loans directly through the app, and Toss offers quick approval and disbursement processes. By leveraging user data and advanced algorithms, Toss tailors loan options to individual users, providing personalized loan terms and amounts based on their financial situation and creditworthiness.

Insurance Services: Toss integrates insurance services into its platform, allowing users to explore and purchase insurance products through the app. Users can access a range of insurance offerings, such as health insurance, automobile insurance, or property insurance. Toss simplifies the insurance process by providing a convenient interface to compare different policies, obtain quotes, and manage insurance coverage.

Budgeting and Expense Tracking: Toss offers tools and features to help users manage their finances effectively. Users can set budgets, track expenses, and receive insights on their spending habits. Toss categorizes transactions and provides visual representations of spending patterns, allowing users to gain a better understanding of their financial habits and make informed decisions.

Credit Score Monitoring: Toss provides users with access to their credit scores and credit histories. Users can monitor their credit scores, receive alerts for any changes, and access insights to improve their creditworthiness. This feature helps users understand their credit health and take necessary steps to manage and improve their credit profiles.

Financial Insights and Recommendations: Leveraging user data and advanced analytics, Toss offers personalized financial recommendations and insights. Users receive tailored suggestions for investment opportunities, loan options, or savings goals based on their financial behaviors and goals. These insights aim to help users make informed financial decisions and optimize their financial well-being.

It’s important to note that the specific features and functions offered by Toss may evolve over time as the company continues to innovate and expand its services. By providing a comprehensive suite of financial products and functions, Toss aims to simplify and enhance the financial experience for its users in South Korea.

Business Model of Toss

Toss has adopted a unique business model that combines various financial services into a comprehensive mobile platform. Let’s delve into the details of Toss’s business model.

Mobile Financial Services: At its core, Toss operates as a mobile financial services platform. The company offers a range of financial services that were traditionally provided by banks, but with a greater focus on convenience and accessibility. Users can perform various transactions, such as money transfers, bill payments, loans, investments, and insurance, all through the Toss mobile app.

Peer-to-Peer Money Transfers: Toss initially gained popularity for its peer-to-peer money transfer service. Users can easily send and receive money from their mobile devices using Toss. The platform simplified the process by eliminating the need for traditional bank transfers, making it more convenient and efficient for users to send money to friends, family, or businesses.

Bill Payments: Toss expanded its services to include bill payments. Users can conveniently settle their utility bills, credit card bills, and other payments directly through the app. Toss aggregates bill information and provides a unified platform for users to manage and pay their bills, eliminating the need to navigate multiple websites or visit physical payment locations.

Investments: Toss also offers investment options to its users. Through the app, users can access investment products, such as mutual funds or stocks, and make investment decisions based on their financial goals and risk preferences. This feature allows individuals who may not have been traditional investors to easily enter the investment market.

Loans: Toss provides users with access to personal loans through its platform. Users can apply for loans directly through the app and receive quick approval and disbursement. By leveraging user data and advanced algorithms, Toss offers personalized loan options tailored to each user’s financial situation and creditworthiness.

Insurance Services: Toss has also integrated insurance services into its platform. Users can explore and purchase insurance products, such as health insurance or automobile insurance, through the app. This simplifies the insurance process and allows users to manage their policies and claims conveniently from a single platform.

Data-driven Personalization: Toss leverages user data and advanced analytics to provide personalized financial recommendations and services. By analyzing user behavior, spending patterns, and financial goals, Toss can offer tailored suggestions for investments, loans, and other financial products. This data-driven approach enhances the user experience and helps users make more informed financial decisions.

In summary, Toss operates as a mobile financial services platform, providing users with convenient access to a range of financial services through a single app. By combining services like money transfers, bill payments, investments, loans, and insurance, Toss simplifies the financial experience for its users. Leveraging data-driven personalization and generating revenue through transaction fees and partnerships, Toss has created a successful business model in the South Korean fintech industry.

Revenue Streams of Toss

Toss generates revenue through several key streams. These revenue streams contribute to the company’s financial sustainability and growth. Let’s explore the details of Toss’s revenue generation model:

Transaction Fees: Toss earns revenue through transaction fees charged for various financial services offered on its platform. For example, when users make money transfers through Toss, a fee is levied on each transaction. Similarly, when users pay bills through the app, Toss may charge a small fee for facilitating the transaction. These transaction fees contribute to the company’s revenue and are a primary source of income.

Loan Interest and Fees: Toss provides users with access to personal loans through its platform. When users avail themselves of these loans, Toss earns revenue through the interest charged on the loans. The interest rate is typically determined based on the user’s creditworthiness and the terms of the loan. Additionally, Toss may charge certain fees associated with loan processing or administration, further contributing to its revenue stream.

Investment Commissions: Toss offers investment options to its users, such as mutual funds or stocks. When users engage in investment activities through the Toss platform, the company may earn commissions or referral fees from financial partners. For instance, Toss may collaborate with asset management companies or brokerage firms and earn a percentage of the fees or commissions generated from users’ investments. This allows Toss to generate revenue by facilitating investment transactions and providing access to investment products.

Partnerships and Advertising: Toss may enter into partnerships and collaborations with other businesses to offer value-added services and generate additional revenue streams. For instance, Toss could partner with insurance companies and earn a referral fee or commission when users purchase insurance products through the platform. Additionally, Toss may explore opportunities for targeted advertising or promotional partnerships, where businesses pay for advertising or promotional space within the app, further diversifying its revenue streams.

Data Monetization: As a mobile financial services platform, Toss collects and analyzes vast amounts of user data. While user privacy and data security are of utmost importance, Toss may explore opportunities to leverage anonymized and aggregated data to generate insights or analytics for partner organizations or financial institutions. By providing valuable data-driven insights, Toss can potentially earn revenue through data monetization strategies while ensuring user privacy and compliance with applicable regulations.

In conclusion, Toss generates revenue through transaction fees, loan interest and fees, investment commissions, partnerships and advertising, and potentially data monetization. These revenue streams enable Toss to maintain its financial viability, invest in further innovation, and continue providing convenient and accessible financial services to its users in South Korea.

Growth of Toss over the years

Toss was founded in 2014 by Lee Seung-gun, a dentist who had previously founded and failed eight other businesses. The company’s first product was a peer-to-peer payments app that allowed users to send and receive money quickly and easily. The app was an instant success, and Toss quickly gained a large user base in South Korea.

In 2016, Toss expanded its product offerings to include investment, insurance, and credit scoring services. The company also began to invest heavily in marketing campaigns to promote its services. These efforts helped Toss to further grow its user base and become one of the most popular financial apps in South Korea.

In 2018, Toss raised $80 million in Series D funding, which valued the company at over $1 billion. This made Toss the first unicorn startup in South Korea. The company’s valuation has continued to grow in the years since, and as of 2023, Toss is valued at over $9 billion.

Toss’s growth has been driven by a number of factors, including its user-friendly interface, its wide range of financial services, and its aggressive marketing campaigns. The company has also benefited from the growing popularity of fintech in South Korea. The country’s financial services industry is highly regulated, but Toss has been able to succeed by offering innovative financial products and services that meet the needs of a young and tech-savvy population.

In recent years, Toss has expanded its operations beyond South Korea. In 2020, it launched a service in Vietnam, and it has plans to enter other Southeast Asian markets in the future. The company has also begun to offer services in the United States and Europe.

Toss’s growth is indicative of the growing importance of fintech in the global economy. The company is well-positioned for continued growth in the years to come. With its strong user base, wide range of financial services, and growing international presence, Toss is likely to become a major player in the global fintech industry.

Here are some of the key milestones in Toss’s growth story:

- 2014: Toss is founded by Lee Seung-gun.

- 2015: Toss raises $3 million in Series A funding.

- 2017: Toss raises $10 million in Series B funding.

- 2018: Toss raises $30 million in Series C funding.

- 2019: Toss raises $80 million in Series D funding and becomes a unicorn startup with a valuation of over $1 billion.

- 2020: Toss raises $261.5 million in Series E funding and its valuation reaches $2.2 billion.

- 2021: Toss raises $410 million in pre-Series G funding and its valuation reaches $7.4 billion.

- 2022: Toss raises $405 million in Series G funding and its valuation reaches $9.1 billion.

- 2022: Toss’s monthly active users (MAUs) reach 14 million.

- 2023: Toss’s registered users reach 30 million.

Toss is a success story for South Korea’s fintech industry. The company has shown that it is possible to build a successful fintech company in a highly regulated market. Toss is also a success story for Lee Seung-gun, who has shown that he can overcome failure and achieve success.

Also Read: Ramp – History, Features, Business & Revenue Model, Growth

To read more content like this, subscribe to our newsletter

Go to the full page to view and submit the form.