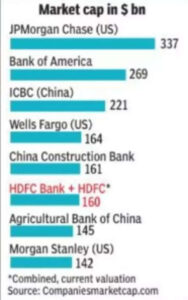

Bank of America Corporation is a prominent multinational investment bank and financial services holding company, with its headquarters located in Charlotte, North Carolina. It holds the distinction of being the second-largest banking establishment in the United States, coming after JPMorgan Chase. Furthermore, on a global scale, it ranks as the second-largest bank by market capitalization. As a significant player in the financial sector, Bank of America is recognized as one of the leading members of the “Big Four” banking institutions within the United States.

About Bank of America

The bank was founded in San Francisco, California, in 1904. It was originally known as the Bank of Italy, and it was founded by Amadeo Peter Giannini. Giannini was a self-made man who came from a poor family. He was passionate about helping people, and he wanted to create a bank that would be accessible to everyone, regardless of their financial status.

The Bank of Italy grew rapidly, and it eventually became the largest bank in California. In 1928, it merged with the Bank of America, Los Angeles, to form the Bank of America. The new bank quickly became one of the largest banks in the United States.

Bank of America continued to grow and expand throughout the 20th century. It acquired several other banks, including the Security Pacific Corporation in 1991 and the FleetBoston Financial Corporation in 2004.

In the early 2000s, Bank of America was one of the banks that was involved in the subprime mortgage crisis. The crisis led to the collapse of several banks, but Bank of America was able to survive. However, the crisis had a significant impact on the bank, and it took several years for it to recover.

Today, Bank of America is a major player in the global financial system. It offers a wide range of financial services, including:

- Commercial banking

- Consumer banking

- Investment banking

- Asset management

- Securities underwriting

- Financial advisory services

Bank of America has over 4,000 branches and 15,000 ATMs in the United States. It also has operations in more than 35 countries around the world.

Bank of America’s Success Story: A Journey of Innovation, Expansion, and Customer-Centricity

In the world of finance and banking, Bank of America stands as an enduring symbol of innovation, adaptability, and resounding success. Let’s embarks on a captivating journey through the extraordinary trajectory of Bank of America, a story that reverberates with visionary leadership, strategic evolution, and a commitment to excellence. With an unwavering focus on customer-centricity, technological advancement, and a global perspective, Bank of America’s success story offers profound insights into how a financial institution can not only weather challenges but also thrive in the face of adversity. Join us as we uncover the strategic nuances, pivotal decisions, and defining moments that have etched Bank of America’s triumph in the annals of corporate history.

Inception and Early Years:

The inception of Bank of America traces back to the year 1904 when Amadeo Peter Giannini, an Italian-American visionary, laid the foundation for what would become a financial giant. Giannini’s mission was to establish a bank that catered to individuals who had little to no experience with traditional banking services. He held a philosophy of “serving the little fellows,” a concept that later earned him the moniker “America’s banker,” a testament to his enduring impact on the American financial landscape.

From Vision to Formation: Bank of Italy Opens Its Doors:

Operating out of California, Giannini noticed the exclusion of many individuals, particularly immigrants, from established banks. With the rising number of Italian immigrants in the state, Giannini recognized an opportunity to provide banking services to the masses. He initiated a unique approach by selling 3,000 shares of stock, mainly to small investors, raising capital to establish the Bank of Italy in San Francisco. The bank’s philosophy was grounded in inclusivity, aiming to offer financial services to a diverse clientele.

The Growth of the Unorthodox Bank:

Bank of Italy’s unconventional practices marked a turning point. Giannini pioneered a grassroots approach by going door-to-door to promote the bank and educate potential customers about financial security and basic banking principles. This novel strategy, combined with his focus on the value of financial literacy, set Bank of Italy apart. The bank’s revolutionary policy allowed anyone to open an account and request loans, even extending loans as low as $25 to workers, thereby democratizing access to credit.

Bouncing Back from the 1906 San Francisco Earthquake:

Bank of Italy faced a severe test of its resilience during the 1906 San Francisco earthquake, which devastated over 80% of the city. The bank’s strategic location outside the city spared it from the worst of the destruction. Giannini quickly set up a makeshift bank to provide loans and support to locals and vendors for reconstructing their damaged homes and businesses. This proactive approach not only facilitated the city’s recovery but also solidified the bank’s reputation for trustworthiness and service.

Fluctuations and Progressions in the Early 20th Century Shape Bank of America’s Trajectory

From the conclusion of the American Civil War until approximately 1900, the presence of branch banking was nearly absent in the United States, a result of the constraints outlined in the National Bank Act of 1853. This legislation limited banking corporations to operating from a single office, aligning with the public policy that championed the unit banking system.

However, a positive shift began in 1909 with the enactment of modified banking regulations by the State of Washington Legislature. These new regulations granted banks the opportunity to expand into smaller branches across California, heralding a transformative phase.

Expansion and Excellence Through Client Services

With the intention of broadening its customer base and fostering greater stability within the financial system, the Bank of Italy embarked on a journey to acquire a local bank in San Jose as its inaugural branch. This endeavor marked just the beginning of their strategic expansion efforts.

Over time, these acquisitions persisted, resulting in the establishment of 24 Bank of Italy branches by 1918. This feat granted the bank the distinction of being the first institution to provide statewide coverage. Moreover, recognizing the value of linguistic diversity, the Bank of Italy introduced new departments where personnel could communicate fluently in multiple languages, enhancing customer convenience and inclusivity.

Furthermore, ahead of its time, the bank introduced a dedicated office catering exclusively to female clients. This pioneering step was in response to the increasing number of women embarking on entrepreneurial ventures. Demonstrating a commitment to inclusivity long before it became a prevailing theme, Bank of America exhibited a forward-thinking approach to facilitating its diverse clientele.

The Merger of Bank of Italy and Bank of America

In a bid to expedite growth in Southern California, the Bank of Italy initiated discussions with Orra E. Monnette, the president of Bank of America, a Los Angeles-based institution established just six years prior. The appeal of Bank of America to Bank of Italy’s visionary Giannini stemmed from its streamlined accounting methods and efficient cash distribution network. Unlike other banks that retained substantial reserves away from investment objectives, Bank of America upheld a practice of maintaining limited amounts at its branches, utilizing a secure fleet of armored cars.

Ultimately, both institutions’ founders arrived at a decision to christen the newly merged entity as “The Bank of America.” This choice reflected their shared vision of nationwide expansion and marked the official merger in November of 1929.

Navigating Through the Great Depression of 1929

Following its establishment, Bank of America faced a profound challenge—the onset of the Great Depression in 1929.

In the latter part of October 1929, the stock market witnessed a catastrophic crash, resulting in a staggering 40% erosion of the common stock’s paper value. This initial crash set in motion a sequence of events that plunged the nation into one of the most devastating periods in American history.

The repercussions of this market crash reverberated throughout the entire US financial system, leading to the collapse of numerous banks. In the face of this economic turmoil, the Bank of America stood resolute, demonstrating its resilience and stability.

Remarkably, despite the overwhelming impact of the Depression, Bank of America managed not only to weather the storm but also to thrive throughout the 1930s. Its growth was so significant that it necessitated the addition of another headquarters to complement its existing four locations in San Francisco.

Bank of America’s Innovation Strategy:

Bank of America’s innovative streak remained strong. By 1936, the bank had become the second-largest savings bank and the fourth-largest banking institution in the US. It introduced a pioneering line of loans known as Timeplan installment loans. These encompassed various financial products such as real estate loans, car financing, personal credit loans, and home remodeling loans, showcasing the bank’s commitment to diversifying its offerings.

Facing Challenges in the 1980s and Making a Comeback:

Bank of America’s journey was not without challenges, notably in the 1980s. The departure of key leadership led to turmoil, exacerbated by loan defaults and financial crises. However, the bank’s resilience came to the forefront. A change in leadership and strategic restructuring led to a remarkable turnaround, with a renewed focus on operational efficiency and customer-centric services.

Bank of America’s Growth Via Strategic Acquisitions and Digital Transformation:

After the merger with NationsBank in 1998, Bank of America continued its growth trajectory through strategic acquisitions. Acquiring LaSalle Bank Corporation in 2007 and Countrywide Financial in 2008 significantly expanded the bank’s reach in terms of branches and mortgage services. Additionally, the bank embarked on a journey of digital transformation, emphasizing the expansion of its mobile banking platform.

Bank of America’s Ongoing Success:

Bank of America’s success is underpinned by its commitment to client-focused services, operational excellence, and sustainable growth. With an extensive network of retail financial centers, ATMs, and a strong digital presence, the bank continues to serve millions of consumers and small businesses. It stands as a world leader in wealth management, corporate, and investment banking, all while fostering an inclusive and diverse workforce.

Bank of America’s Growth by Numbers:

| Year | 2021 | 2010 |

|---|---|---|

| Revenue | $89.1 billion | $111.4 billion |

| Net Income | $32.0 billion | $2.2 billion |

| Stock Price | $44.5 | $13.3 |

| Employees | 208,000 | 288,000 |

Conclusion:

Bank of America’s journey, from its humble beginnings as Bank of Italy to its current status as a global financial powerhouse, is a testament to innovation, resilience, and a customer-centric approach. Its continuous evolution, strategic acquisitions, and embrace of digital transformation have solidified its position as a leader in the banking industry. With a mission to improve financial lives and a commitment to inclusive practices, Bank of America’s legacy continues to shape the financial landscape for generations to come.

Also Read: Success Factors: What Makes Foot Locker Inc. So Successful?

To read more content like this, subscribe to our newsletter

Go to the full page to view and submit the form.