In the fast-paced world of startups, success often depends on the ability to scale quickly, innovate, and build trust with partners, investors, and customers. One key aspect of establishing this trust, especially for businesses operating in the digital economy, is ensuring compliance with regulations and maintaining transparency. Know Your Business (KYB) procedures play a critical role in helping startups meet these requirements.

KYB, like its counterpart Know Your Customer (KYC), is a process designed to verify the legitimacy of a business by assessing its background, ownership structure, and compliance with relevant laws. For startups, implementing KYB is not just about compliance—it’s about fostering trust and mitigating risk as they grow.

What is Know Your Business (KYB)?

KYB is a due diligence process that involves verifying a company’s identity, ownership, and financial information to ensure that it is operating lawfully and ethically. This process helps businesses assess potential partners or customers and avoid engaging with companies involved in fraudulent or illegal activities.

KYB typically involves:

- Business identity verification: Confirming the legitimacy of a company through documentation, such as registration details, company certificates, and tax records.

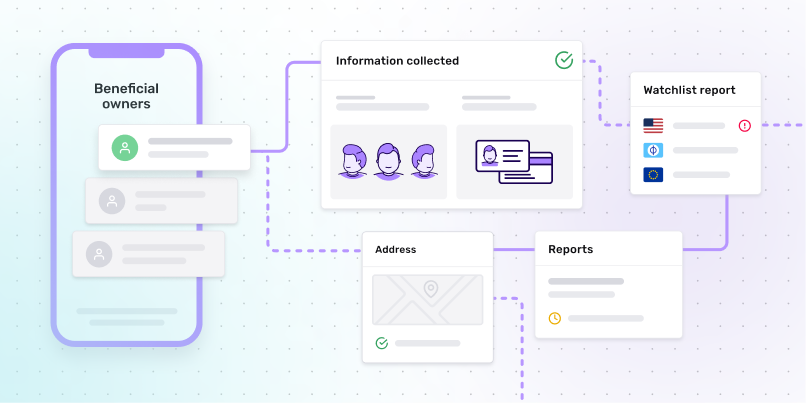

- Ultimate beneficial owner (UBO) verification: Identifying and verifying individuals who have significant control or ownership in the company.

- Financial background checks: Examining a company’s financial history to ensure it has no ties to illegal activities like money laundering or tax evasion.

- Compliance checks: Ensuring the company complies with local and international regulations, particularly in industries that are heavily regulated (such as finance, legal, and real estate).

Why KYB is Essential for Startups

For startups, KYB can be a crucial factor in establishing credibility and fostering growth. Here’s why it matters:

- Building Trust with Investors and Partners Startups rely heavily on securing funding and forming partnerships to grow. Investors and partners want to know that the businesses they’re engaging with are legitimate, transparent, and in compliance with legal regulations. By having KYB procedures in place, startups can demonstrate that they’ve taken steps to verify their legitimacy, giving stakeholders more confidence in the business.

- Compliance with Regulations Many industries, especially finance and fintech, are subject to stringent regulations that require businesses to verify the identities of their clients and partners. Failing to comply with these regulations can result in hefty fines, reputational damage, or even the shutdown of the business. Implementing KYB procedures helps startups stay compliant and avoid these costly consequences.

- Mitigating Risks In the early stages of a startup, every relationship—whether it’s with clients, partners, or suppliers—matters. A startup that unknowingly partners with a fraudulent or high-risk company could face serious repercussions, including financial losses and reputational harm. KYB helps mitigate these risks by thoroughly vetting companies before entering into any agreements.

- Improving Operational Efficiency While KYB processes can be complex, especially for startups with limited resources, they can also streamline business operations. By automating parts of the KYB process, startups can improve efficiency, ensuring that due diligence is completed quickly and accurately. This allows startups to focus on growth rather than getting bogged down by manual verification tasks.

How Startups Can Implement KYB Processes

Implementing KYB for startups doesn’t have to be a daunting task. With advancements in technology, startups can leverage digital solutions to automate and simplify the process. Here are a few steps to consider:

- Use Digital Verification Tools: Several platforms offer KYB solutions that can verify a business’s identity, ownership structure, and compliance in real time. This can save startups significant time and effort while ensuring that due diligence is thorough.

- Create Clear Policies and Procedures: Startups should develop internal policies that outline their KYB processes. This includes specifying what documents are required, how often checks should be conducted, and what actions to take if a business fails to meet compliance standards.

- Work with Experienced Partners: For startups that are new to KYB, partnering with legal or compliance experts can provide valuable guidance. These experts can help navigate the complexities of business verification and ensure that startups meet all regulatory requirements.

KYB and the Role of ID Verification in Startups

In addition to KYB, ID verification plays a key role for startups that need to onboard both businesses and individual clients. For startups in sectors like fintech, legal tech, or even e-commerce, ensuring that the individuals behind each business are legitimate is crucial. This often means incorporating ID verification alongside KYB to create a more robust security and compliance framework.

By verifying both the business and the individuals who own or control it, startups can reduce the risk of fraud and improve trust with customers, investors, and partners. Integrating KYB and ID verification solutions into the onboarding process will not only safeguard the startup but also ensure smoother scaling and compliance as the business grows.

Conclusion: KYB as a Growth Enabler for Startups

Know Your Business (KYB) processes are essential for startups looking to scale responsibly. By implementing KYB, startups can foster trust with investors, partners, and clients, ensuring they remain compliant with regulations and protected from potential risks. In today’s fast-evolving business landscape, startups that prioritize transparency, security, and regulatory compliance through KYB are more likely to succeed and grow sustainably.

To read more content like this, explore The Brand Hopper

Subscribe to the newsletter

Go to the full page to view and submit the form.