How many other turbulences are ahead? Economic uncertainties, geopolitical tensions, wars. They can all affect companies across industries. However, some deals offer opportunities to adapt, innovate, and strengthen positions even during tough times.

In our post, we explain how your organization can benefit from the deal. For more value, we invite you to check virtual data rooms, which streamline the entire process and ensure you reap the benefits with minimal hassle.

So, let’s first learn what this software is and then explore how it improves the deal.

What is a virtual data room?

It is feature-rich business software used in mergers and acquisitions and due diligence. The platform allows users to store, manage, and share documents securely. Also, they can granularly control data access, collaborate in real time, and track the activities of all M&A parties, including investors and buyers.

Now that you know what this online solution is, let’s get closer to the point. For more information – https://dataroom-providers.org/

Top five advantages of mergers and acquisitions

Discover M&A’s advantages and potential pitfalls and learn how virtual data rooms can improve your chances of success.

1. A bigger market share

Increased market share comes from acquiring other organizations within the same industry. As a result, you get a more significant slice of the total market, which can bring more customers and revenue.

✖️Potential pitfall

Rival companies might resort to aggressive pricing strategies, product innovations, or marketing campaigns to retain customers and market share.

✔️ How can virtual data rooms help?

The software streamlines the collection and analysis of competitive intelligence, allowing organizations to monitor rival companies. By aggregating industry reports, competitor analyses, and market research within a data room, organizations can stay abreast of changes and adjust their strategies accordingly.

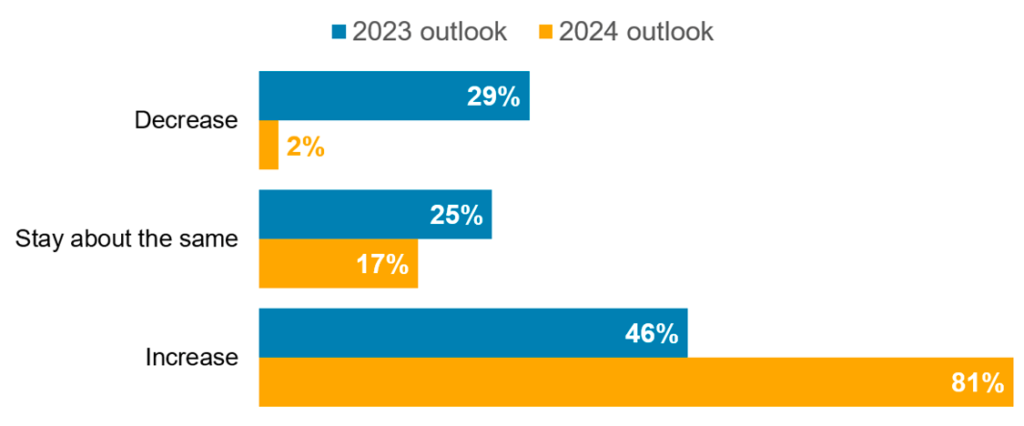

2024 outlook! With a global dry powder of 450 billion dollars at the end of December 2023, private credit funds are well-positioned to support increased dealmaking activity this year.

2. Access to industry-leading talent

By strategically expanding its talent pool through acquisition or merger, an organization can position itself to attract and retain the most skilled and innovative professionals, thereby enhancing its performance and profitability.

✖️Potential pitfall

Organizations often have unique organizational cultures, values, and operational methodologies, resulting in conflicts, opposition to change, and hurdles in integrating the newly joined workforce.

✔️ How can virtual data rooms help?

M&A data room providers offer a feature-rich protected platform for cross-functional collaboration. Thus, organizations can break down silos, foster teamwork, and build relationships among employees easier.

3. Support during tough periods

During challenging market conditions, pooling resources can effectively wait out the storm and emerge stronger.

✖️Potential pitfall

Different entities may have conflicting priorities or resource constraints, making it difficult to determine the optimal allocation strategy to address challenges.

✔️ How can virtual data rooms help?

The platform allows all decision-makers to use the same information and be transparent and honest with each other. Although documentation comes from different sources, it’s all kept in one place and automatically organized by data room providers. Thus, all parties can find and share data quickly.

4. Diversification

Having a diverse portfolio is good business practice, and acquiring other tools, products, and services can help organizations expand their offerings and become more competitive.

✖️Potential pitfall

Pursuing too many diversification opportunities simultaneously may lead to a lack of clarity and direction. That, in turn, results in missed opportunities and suboptimal performance in the organization’s core business areas.

✔️ How can virtual data rooms help?

Virtual data room providers give access to progress reports and performance metrics. Thus, organizations can track user engagement in projects, identify areas for improvement, and make data-driven decisions to succeed in diversification efforts.

5. Competitive edge

Acquiring or merging with another company can help establish an organization as a leader within their industry and prevent competitors from doing the same.

✖️Potential pitfall

Delays in integrating acquired companies or achieving synergies can erode the competitive edge, as rivals may capitalize on market opportunities or technological advancements during the integration period.

✔️ How can virtual data rooms help?

VDR due diligence platforms provide invaluable tools for streamlining post-M&A integration efforts, which allow businesses to facilitate document management, collaboration, integration planning, communication, security, compliance, and performance monitoring.

Now, if you are ready to maximize the benefits of M&A activities with the help of technologies, see how to choose the best tool.

What is the best M&A data room?

We’ve selected the three best providers based on their functionality and user feedback. Before choosing a specific due diligence data room, visit its official website and learn more about the product.

| Provider | Top dataroom features | Capterra rating |

| 1. iDeals | ● Drag-n-drop and bulk data upload

● Multi-format support ● Detailed user permissions ● Excel viewing permissions ● Built-in redaction ● Fence view ● Remote shred ● User activity tracking ● Group overview reports ● Colour-coded reports |

4.8 |

| 2. Ansarada | ● Access expiration

● Data backup ● Automatic numerical indexing ● Granular document permissions ● Scheduled activity reports ● Branded user interface |

4.6 |

| 3. Datasite | ● Two-factor authentications

● Access expiration ● View-only access ● Customizable watermarks ● Remote shred ● Graphic reports |

4.7 |

Final thoughts

Mergers and acquisitions provide big advantages to a company, but the process can be intricate. Fortunately, data rooms can enhance the likelihood of a successful outcome and further strengthen the benefits achieved.

Explore The Brand Hopper to read more such content

To read more content like this, subscribe to the newsletter

Go to the full page to view and submit the form.