Unlike other consumer forums or call centers, where centers receive calls from customers for the purpose of support or inquiries, insurance centers’ primary aim is to deal with consumer claims and insurance regarding several services that they have purchased. Support teams are usually enlisted to monitor these calls since they go out to pools of existing customers with whom the company may want to follow up or update for new developments.

Recently, a lot of companies have been trying to implement AI into their insurance call services. But what do the people actually using this technology think? More specifically, can call centers benefit from Call Center insurance-virtual-assistant using generative machine learning?

How can AI be implemented in insurance call centers?

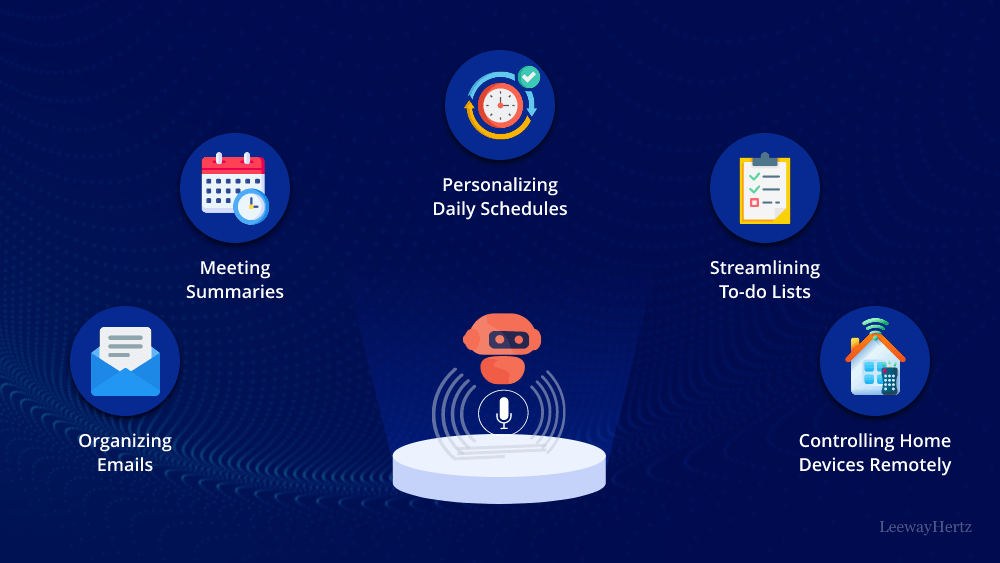

Now that generative machine learning has found its way into virtually everything, insurance services have also been impacted. This can be for quick follow-ups, consumer verifications of claims, etc. The idea is that using artificial intelligence as your virtual assistant is an effectively faster and more precise method of dealing with technical issues and verifications on call. Further, this mostly sees its potential in terms of delivering messages, fixing appointments, and verifying reasons. After all, a virtually associated, AI-enhanced chatroom is live 24×7.

Another place where fintech professionals find the use of this tool is in the process of insurance verifications, setting appointments, and sorting through claims and remunerations. This is where companies can find out what the customer is owed when they make certain claims. However, the accuracy and the safety of this are still quite suspect.

Lastly, as mentioned earlier, AI insurance call center assistance and the constant presence of virtual assistants could provide constant support and extend hours beyond that of traditional and physical operations.

What other ways can insurance call centers be enhanced?

Another way to harness the power of artificial intelligence in the field of insurance call centers is to have product information ready to go on call. This can further be enhanced by translation tools for more effective communication. This is especially relevant if the country has several different languages spoken. Not only can they bridge the communication gap, but they also provide enhanced and more informed customer support.

Wrapping Up

That brings us to the end of some of the ways in which AI can be used in insurance call centers. The mechanism of insurance call centers is fundamentally more detailed and needs more accuracy. While there certainly is great potential for change and improvement as it is right now. The aim here is to bridge the gap between the company and the customer in a meaningful way and build a better and more organic client relationship that can last and be beneficial for both parties.

To read more content like this, explore The Brand Hopper

Subscribe to our newsletter

Go to the full page to view and submit the form.