The global banking landscape has witnessed unprecedented transformation in recent years, with UBS’s landmark acquisition of Credit Suisse in 2023 marking a pivotal moment in financial history. The $3.25 billion deal not only reshaped the competitive dynamics of the banking sector but also created a financial powerhouse managing over $5 trillion in assets. This comprehensive analysis delves deep into UBS’s primary competitors, examining their strengths, market positions, and strategic initiatives that define today’s banking industry.

The banking sector’s competitive landscape has become increasingly complex, driven by technological innovation, changing customer preferences, and evolving regulatory requirements. UBS, with its enhanced position following the Credit Suisse acquisition, now faces competition from diverse institutions, each with unique strengths and market focuses. From American giants to European powerhouses, these competitors shape the future of global finance through their strategic initiatives and market presence.

Top Competitors of UBS

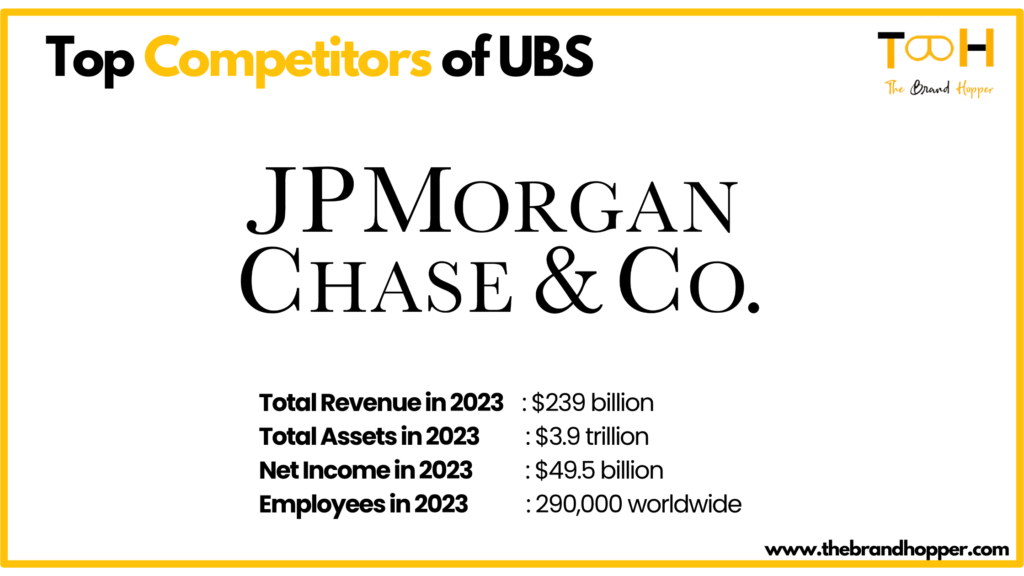

1. JPMorgan Chase

Website – https://www.jpmorganchase.com/

JPMorgan Chase stands as a testament to American financial dominance, with its remarkable presence across multiple banking segments making it a formidable competitor to UBS. Under the leadership of Jamie Dimon, the bank has consistently demonstrated its ability to navigate complex market conditions while maintaining strong financial performance. With $3.9 trillion in assets and a market capitalization exceeding $492 billion in 2024, JPMorgan Chase has established itself as the largest bank in the United States.

The bank’s investment banking division has been particularly successful, capturing a 9.2% global market share in 2023. This success stems from its comprehensive service offering, including M&A advisory, equity underwriting, and debt capital markets. JPMorgan’s technological infrastructure, supported by an annual technology budget of $12 billion, has enabled the bank to stay ahead of digital transformation trends. Their proprietary trading algorithms and risk management systems have set industry standards.

In wealth management, JPMorgan’s Private Bank serves ultra-high-net-worth individuals with personalized investment strategies and comprehensive financial planning services. The bank’s acquisition of nuBank and partnerships with fintech companies have strengthened its digital capabilities, allowing it to compete effectively with UBS in the evolving digital wealth management space.

2. Goldman Sachs

Website – https://www.goldmansachs.com/

Goldman Sachs, often referred to as the preeminent investment banking institution, has maintained its position as a global financial powerhouse through strategic innovation and adaptation. Managing $2.8 trillion in assets under supervision, Goldman Sachs has successfully diversified its business model while maintaining its core strengths in investment banking and trading.

The firm’s investment banking division continues to dominate the M&A advisory space, commanding a 25.4% market share in global mergers and acquisitions. Goldman’s trading operations, particularly in Fixed Income, Currencies, and Commodities (FICC), generated revenues of $14.9 billion in 2023, demonstrating the firm’s trading prowess. Their proprietary trading platforms and market-making capabilities have set industry standards for execution and liquidity provision.

Goldman’s expansion into consumer banking through its Marcus platform represents a strategic pivot towards retail banking. With over $100 billion in deposits and a growing loan portfolio, Marcus has enabled Goldman to diversify its revenue streams and compete in new market segments. The firm’s commitment to technological innovation is evident in its $1 billion annual fintech investment budget, funding developments in artificial intelligence, blockchain technology, and digital banking solutions.

3. Morgan Stanley

Website – https://www.morganstanley.com/

Morgan Stanley has undergone a remarkable transformation under James Gorman’s leadership, evolving from a traditional investment bank into a wealth management powerhouse. Managing $1.46 trillion in client assets, the firm has successfully integrated E*TRADE’s digital platform with its traditional wealth management services, creating a comprehensive offering that caters to both mass-affluent and ultra-high-net-worth clients.

The acquisition of E*TRADE for $13 billion in 2020 has proven transformative, adding over 5.2 million retail client relationships and $360 billion in retail client assets. Morgan Stanley’s wealth management platform now combines sophisticated financial planning tools with access to professional research and investment products. The firm’s research division, consistently ranked among the top globally, provides clients with actionable insights across markets and sectors.

Morgan Stanley’s investment in sustainable investing has been particularly noteworthy. The firm committed to mobilizing $1 trillion for sustainable solutions by 2030, developing innovative products and services that align with growing client demand for environmental, social, and governance (ESG) investments. Their Institute for Sustainable Investing has become a thought leader in the space, influencing industry standards and practices.

4. Bank of America Merrill Lynch

Website – https://business.bofa.com/

Bank of America Merrill Lynch exemplifies the successful integration of traditional banking services with modern investment capabilities. With $1.6 trillion in assets, the institution leverages its vast network of 4,100 financial advisors and comprehensive digital platform to serve diverse client needs. Their Merrill Lynch Wealth Management division manages $3.1 trillion in client balances, offering sophisticated investment solutions and personalized financial advice.

The bank’s digital transformation has been particularly impressive, with 55 million verified digital users accessing services through their advanced platform. Bank of America’s Erica, their AI-powered virtual assistant, has handled over 1 billion client interactions since its launch, demonstrating the institution’s commitment to technological innovation. Their CashPro platform for corporate clients processes over $4.5 trillion in payments annually, showcasing their strength in transaction banking.

Corporate and investment banking services represent another key competitive advantage. The division generated revenues of $9.8 billion in 2023, supported by strong relationships with 95% of the U.S. Fortune 1000 companies. Their global research platform, covering over 3,000 companies across 25 countries, provides clients with comprehensive market insights and investment recommendations.

5. Deutsche Bank

Website – https://www.db.com/

Deutsche Bank, with $1.4 trillion in assets, represents Germany’s largest financial institution and a significant European competitor to UBS. Following a comprehensive restructuring program initiated in 2019, Deutsche Bank has emerged as a more focused and profitable institution, concentrating on its core strengths in corporate banking, investment banking, and private banking.

The bank’s corporate banking division serves as the cornerstone of its operations, maintaining relationships with 70% of German corporations and providing essential services to multinational companies. Their transaction banking platform processes over €500 billion in daily payments, demonstrating their crucial role in global trade finance and cash management services.

Deutsche Bank’s investment banking operations have shown remarkable resilience, particularly in fixed income trading and debt capital markets. The division generated revenues of €7.6 billion in 2023, supported by strong performance in rates trading and foreign exchange. Their private bank serves over 28 million clients globally, with a particular focus on European high-net-worth individuals and family offices.

6. BNP Paribas

Website – https://group.bnpparibas/en/

BNP Paribas has established itself as a European banking champion, with $41 billion in assets and a presence across 65 countries. The bank’s universal banking model combines retail banking strength in Europe with significant global corporate and institutional banking capabilities. Their commitment to sustainable finance has positioned them as an industry leader, with €220 billion dedicated to sustainable investments and green financing.

The bank’s corporate and institutional banking division has shown particular strength in derivatives trading and structured products. Their equity derivatives platform ranks among the global leaders, while their fixed income trading operations consistently generate strong returns. BNP Paribas has also made significant investments in digital transformation, allocating €3 billion annually to technology initiatives.

In wealth management, BNP Paribas has successfully expanded its Asian presence, growing assets under management in the region by 45% since 2020. Their private banking division serves over 500,000 clients globally, with a particular focus on entrepreneurial wealth and next-generation services. The bank’s commitment to innovation is evident in their digital private banking platform, which provides clients with sophisticated portfolio management tools and investment insights.

7. HSBC

Website – https://www.hsbc.com/

HSBC’s unique position as a bridge between Eastern and Western markets sets it apart in the global banking landscape. Managing $3 trillion in assets, HSBC leverages its extensive international network to facilitate global trade and investment flows. The bank’s particular strength in Asia-Pacific markets, where it generates over 60% of its profits, provides a competitive advantage in one of the world’s fastest-growing regions.

The bank’s global banking and markets division serves over 90% of Fortune 500 companies, providing comprehensive corporate banking services and sophisticated financial solutions. HSBC’s transaction banking platform processes over $500 trillion in payments annually, demonstrating its crucial role in international trade finance and global money movements.

HSBC’s wealth management services have shown significant growth, particularly in Asia, where the bank has invested heavily in digital capabilities and relationship managers. Their private banking division manages over $400 billion in client assets, offering bespoke investment solutions and strategic advice to ultra-high-net-worth individuals.

8. Barclays

Website – https://home.barclays/

Barclays maintains its position as a leading global financial institution with £1.4 trillion in assets, combining strong investment banking capabilities with retail and corporate banking services. The bank’s investment banking division has shown particular strength in debt capital markets and advisory services, generating revenues of £6.8 billion in 2023.

Their corporate banking operations serve over 1 million business clients globally, providing essential services ranging from transaction banking to complex financing solutions. Barclays’ investment in financial technology has been substantial, with their mobile banking platform serving over 9 million active users and their corporate banking platform processing over £350 billion in annual payments.

The bank’s trading operations have demonstrated consistent profitability, particularly in fixed income and foreign exchange markets. Their research division provides comprehensive coverage of global markets, supporting both institutional clients and wealth management services.

9. Citigroup

Website – https://www.citigroup.com/global

Citigroup’s presence in over 160 countries makes it one of the most geographically diverse financial institutions globally. Managing $2.4 trillion in assets, Citigroup combines extensive retail banking operations with sophisticated institutional services. Their transaction services platform processes over $4 trillion in daily transactions, demonstrating their crucial role in global financial infrastructure.

The bank’s institutional clients group has shown particular strength in treasury and trade solutions, generating consistent fee income and maintaining relationships with 90% of global Fortune 500 companies. Citigroup’s investment banking operations have maintained strong positions in debt capital markets and syndicated lending, while their markets division has demonstrated resilience across trading cycles.

Citigroup’s wealth management division has undergone significant transformation, focusing on high-net-worth and ultra-high-net-worth clients globally. Their investment in digital capabilities has enhanced client service delivery, while their research platform provides comprehensive market insights and investment recommendations.

Credit Suisse Integration Impact and Future Implications

The integration of Credit Suisse into UBS represents the most significant banking sector consolidation in recent history. The combined entity, managing over $5 trillion in invested assets, has created a global wealth management powerhouse with enhanced capabilities across investment banking and asset management. This merger has particularly strengthened UBS’s position in key Asian markets, where Credit Suisse maintained strong client relationships and investment banking capabilities.

The integration process, expected to continue through 2024-2025, presents both opportunities and challenges. Cost synergies are estimated at $8 billion annually, while revenue synergies could exceed $3 billion per year once the integration is complete. The combined entity’s market position in ultra-high-net-worth wealth management is particularly strong, with an estimated 27% market share in this segment globally.

Conclusion

The global banking landscape continues to evolve rapidly, driven by technological innovation, changing client preferences, and regulatory requirements. UBS’s acquisition of Credit Suisse has created a new competitive dynamic, particularly in wealth management and investment banking. Each competitor maintains unique strengths and market positions, from JPMorgan Chase’s comprehensive financial services to HSBC’s Asian expertise.

Looking ahead, several key trends will shape competition in the banking sector. Digital transformation remains crucial, with banks investing heavily in artificial intelligence, blockchain technology, and digital platforms. Sustainable finance has emerged as a key battleground, with institutions competing to develop innovative ESG products and services. The continued growth of Asian markets presents both opportunities and challenges, requiring banks to adapt their strategies and service offerings.

For investors and industry observers, understanding these competitive dynamics is crucial. The success of financial institutions will increasingly depend on their ability to combine traditional banking strengths with technological innovation while maintaining strong client relationships and risk management practices. As the sector continues to evolve, monitoring these developments through reliable financial news sources and institutional research remains essential for making informed decisions in this dynamic environment.

Also Read: Top 10 Competitors and Alternatives of Citigroup

Also Read: List of Top Goldman Sachs Competitors: Wall Street’s Rivals

To read more content like this, subscribe to our newsletter

Go to the full page to view and submit the form.