Solifi is a global fintech software platform that specializes in secured finance, offering end-to-end solutions for asset finance, automotive finance, floorplan (wholesale) finance, and working capital finance. Formerly known as International Decision Systems (IDS), the company has a 50-year legacy in providing mission-critical software to banks, equipment leasing companies, auto finance firms, and other financial institutions.

Solifi’s cloud-based Open Finance Platform integrates multiple proven products into a unified ecosystem, enabling customers to “connect capital to potential” by automating and managing their lending and leasing portfolios on a single platform.

With dual headquarters in Minneapolis (USA) and Milton Keynes (UK), 650+ employees worldwide, and customers including many of the world’s largest banks as well as independent and captive finance organizations, Solifi has a truly global footprint.

This article provides a comprehensive business analysis of Solifi, covering its founding story, key founders, business model and revenue streams, funding history, competitive landscape, product offerings, strategic partnerships, market presence, and future outlook.

Founding Story of Solifi

Solifi’s origins date back to 1974, when it was founded in Minnesota as Decision Systems, initially focusing on basic pricing software for equipment financing. The fledgling company met the needs of the equipment leasing industry by developing tools to evaluate lease/loan pricing scenarios and eventually created InfoLease, a flagship portfolio management system that became a mainstay in the sector.

Over the subsequent decades, IDS grew by partnering with major banks and finance companies, evolving from a startup into a global provider of leasing software. In 2000, the company rebranded as International Decision Systems (IDS) after a merger with a UK firm, and in 2003 its management bought the company back from public markets, setting the stage for private growth.

By the 2010s, IDS underwent significant transformations under new ownership. In 2012, SV Investment Partners took control of IDS and invested in modernizing its product suite – launching a next-generation cloud product and shifting toward recurring revenue models. This led to the introduction of IDScloud (a SaaS platform for equipment finance) and alternative consumption-based pricing that laid the groundwork for future growth.

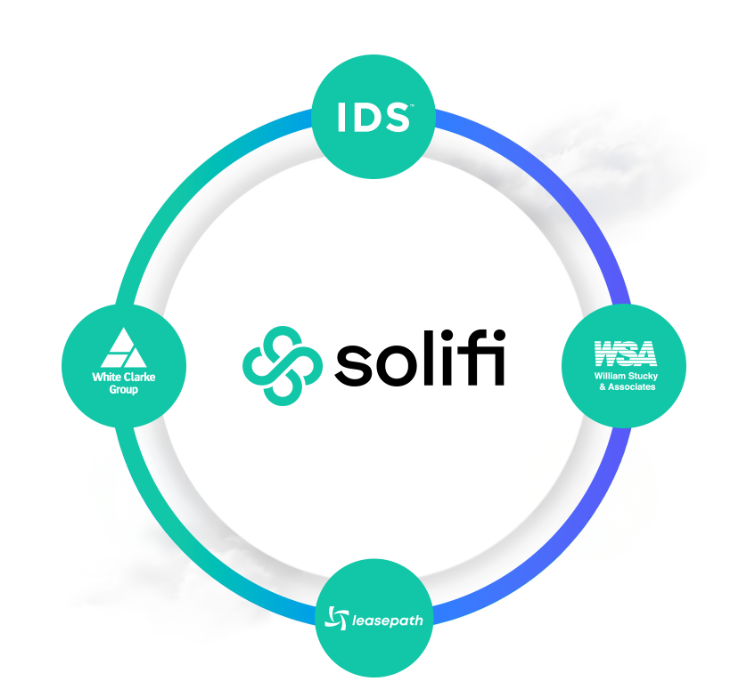

In 2019, private equity firm Thoma Bravo acquired IDS, bringing additional capital and strategic guidance. Under Thoma Bravo’s stewardship, IDS embarked on a “transformational year” in 2021, acquiring two other finance software leaders – William Stucky & Associates (WSA) and White Clarke Group (WCG) – and uniting all three under a new brand identity: Solifi.

This rebranding marked a critical milestone: the convergence of IDS’s 40+ years of equipment finance expertise with WSA’s strength in asset-based lending and factoring, and WCG’s leadership in automotive and floorplan finance. By bringing these market-leading solutions together, Solifi set out to “reshape the secured finance industry” with an integrated technology ecosystem.

The founding story of Solifi is thus not one of a single moment, but rather an evolution spanning five decades. It reflects a series of reinventions – from a niche software provider in the 1970s, to a modern cloud platform in the 2010s, to a multi-solution powerhouse in 2021. Today’s Solifi is built on the cumulative foundations of its predecessors.

The timeline below highlights key moments in this journey:

- 1974: Company founded as Decision Systems in Minnesota, focusing on equipment finance software.

- 1980s–90s: Growth through flagship products like InfoLease and partnerships with large banks.

- 2000: Renamed International Decision Systems (IDS) after going public via merger.

- 2003: Management buyout returns IDS to private ownership.

- 2012: SV Investment Partners investment; IDS begins cloud transition and recurring revenue model.

- 2019: Thoma Bravo acquires IDS, accelerating growth initiatives.

- 2021: IDS acquires WSA and White Clarke Group; rebrands as Solifi, launching a unified open finance platform.

- 2024: Solifi celebrates 50 years and secures a new majority investment (TA Associates) to fuel further expansion.

Founders of Solifi

Given Solifi’s complex heritage, there are multiple figures considered “founders” of its constituent parts:

-

International Decision Systems (IDS): While the original founders’ names from 1974 are not widely publicized, IDS’s early leadership established a culture of client-focused innovation. One key early contributor was the team that developed InfoLease, setting the competitive edge that propelled IDS’s growth. Over time, IDS’s leadership included executives like Katie Emmel – who joined in the late 1980s and rose to COO – reflecting continuity in vision and deep industry expertise.

-

William Stucky & Associates (WSA): This firm was founded by William Stucky in the 1970s and became the U.S. market leader in asset-based lending (ABL) and factoring software. Stucky, an entrepreneur and software pioneer in working-capital finance, led the company for decades. Upon the acquisition in 2021, William Stucky noted that IDS (Solifi) was “a perfect home for the Stucky ABL and factoring solutions,” highlighting how the combination would carry forward his company’s legacy of helping customers grow through technology.

-

White Clarke Group (WCG): Founded in 1992 by Ed White and Dara Clarke, WCG grew into a global leader in automotive and asset finance software. The co-founders built WCG’s flagship platform (CALMS) which serves eight of the world’s top 10 auto manufacturers. Dara Clarke’s untimely passing in 2014 did not halt the company’s momentum; under CEO Brendan Gleeson, WCG continued to thrive until joining Solifi. The founders’ vision of delivering full lifecycle auto finance solutions lives on as a core part of Solifi’s product suite.

In essence, Solifi stands on the shoulders of these industry pioneers. Its “founders” include the visionary teams behind IDS, WSA, and WCG. They shared a common thread: seeing technology as the key to modernizing secured finance. As Solifi’s CEO David Hamilton remarked during the rebrand, bringing these companies together created “an unmatched range of secured finance solutions” to support customers globally.

Today, although Solifi is led by a new executive team, the influence of its founders is evident in its culture of innovation, customer-centricity, and deep domain expertise.

Business Model of Solifi

Solifi operates a B2B enterprise software model centered on providing mission-critical software solutions via a cloud platform. Its business model has transitioned from traditional on-premise software licensing to a Software-as-a-Service (SaaS) subscription model, offering clients flexible, pay-as-you-go access to its platform.

This transition was deliberate – as early as the mid-2010s, IDS (now Solifi) introduced alternative licensing and consumption pricing to maximize recurring revenue and predictability.

Today, Solifi’s revenue model is predominantly recurring (subscription fees), complemented by services revenue for implementation, customization, and support.

Key aspects of Solifi’s business model include:

Open Finance Platform (SaaS)

Solifi’s software is delivered via its cloud-based Open Finance Platform. Customers subscribe to modules (e.g., loan origination, portfolio management, etc.) and “pay for only the features [they] need and use”. This usage-based pricing within SaaS allows clients to scale their usage up or down, aligning costs with business volume. The platform is multi-tenant and continuously updated, so clients always run the latest version without heavy upgrade projects.

Enterprise Software Sales

Solifi typically engages in direct sales to financial institutions and finance companies. Sales cycles are consultative, addressing complex requirements for integrating Solifi’s system with a client’s business processes. Given the mission-critical nature, clients often sign multi-year contracts. Solifi’s top 20 customers have an average relationship of 20 years, reflecting the long-term, sticky nature of its enterprise engagements.

Professional Services and Support

Implementing a secured finance platform is complex. Solifi provides consulting, project management, data migration, and training services to onboard new customers or extend functionality for existing ones. Guiding customers through implementation and ensuring a “quick time to value” is a critical part of the model. Additionally, Solifi offers ongoing customer support and account management to maintain high retention and satisfaction.

Modular Product Offerings

The platform’s modular design lets customers choose the solutions relevant to their business (e.g., equipment leasing, floorplan finance, factoring). Solifi encourages cross-selling across modules, so a bank that starts with equipment finance might later add working-capital solutions as their needs grow. This approach not only increases customer lifetime value but also differentiates Solifi as a one-stop-shop for multiple finance products.

Cloud Infrastructure and Security

Solifi partners with cloud providers (such as AWS) for infrastructure, embedding the cost of hosting into subscription fees. The platform meets high security standards (SOC 1/2 Type II) required by large banks. This emphasis on security and reliability is fundamental to the business model—clients trust Solifi with sensitive financial data, so robust infrastructure and compliance are essential value propositions.

Overall, Solifi’s business model focuses on recurring SaaS revenue, supported by value-added services, to deliver an integrated financial technology ecosystem. By aligning its success with its customers’ ongoing usage and growth, Solifi has built a stable and scalable model. In the words of Solifi’s COO, the company’s strategy is to remain customer-centric and future-focused – not just meeting current needs, but continuously evolving to support customers’ future demands and growth strategies.

Revenue Streams of Solifi

Solifi’s revenue comes from several streams, primarily tied to its software products and related services. The major revenue streams include:

SaaS Subscription Fees

This is the largest revenue component. Customers pay subscription fees (often annual or quarterly) for access to Solifi’s cloud software modules. These fees may scale based on metrics like number of users, number of contracts/leases managed, or asset volume on the platform. The “pay-for-what-you-use” model means a client’s cost aligns with their usage, making Solifi’s revenue a recurring flow that grows as clients expand. SaaS fees ensure a high proportion of Solifi’s revenue is recurring and predictable year-to-year.

Maintenance & Support (Legacy Licensing)

Some longtime customers still use on-premise or older versions of IDS software. They typically pay annual maintenance fees for support and updates. While Solifi is migrating most clients to SaaS, maintenance revenue from any remaining on-prem deployments continues to be a minor stream (likely declining over time as clients transition to the cloud).

Professional Services

Implementation projects, custom development, integration, and training services generate significant one-time and milestone-based revenues. For new customer onboarding or major upgrades, Solifi’s team provides consulting and technical services. These projects can be substantial in scope (especially for large banks rolling out a new system) and thus contribute meaningful revenue. Solifi’s emphasis on quick and successful go-lives (nearly 40 major go-lives in a recent year) underscores how services support its product adoption.

Partner Marketplace Revenue

Through the Solifi Marketplace, third-party fintech partners (providing complementary services like e-signature, insurance, data services, etc.) are integrated into the platform. Solifi may earn referral fees or revenue-sharing when customers adopt these partner solutions via the platform. For example, if a Solifi client uses an integrated service like DocuSign or Experian through the platform, Solifi might receive a portion of that transaction or a commission (this is a growing but relatively smaller revenue stream focused on enhancing platform stickiness).

License Fees for Additional Modules

In cases where clients opt for private cloud or specific module licensing, Solifi could earn license fees. For instance, adding a new module (like ESG Portfolio Strategist or a new country localization) might incur an extra license cost. However, in the SaaS model, this often translates to simply adjusting the subscription, so it overlaps with subscription revenue.

Consultative Advisory

As an industry expert, Solifi sometimes provides advisory services (outside of software implementation) for process optimization, compliance, or digital transformation strategy. While not a core revenue stream, these consulting engagements can strengthen customer relationships and occasionally provide incremental revenue.

The table below summarizes Solifi’s key revenue streams and their characteristics:

| Revenue Stream | Description | Revenue Model |

|---|---|---|

| SaaS Subscription | Cloud software access (modules for equipment finance, auto finance, ABL, etc.). Priced per usage or assets managed. | Recurring (annual/quarterly) subscription; usage-tiered (“pay for what you use”). |

| Maintenance & Support | Support for legacy on-premise installations and updates. | Recurring annual fees (declining as cloud adoption increases). |

| Professional Services | Implementation, integration, custom development, training for new and existing customers. | One-time or project-based fees (milestone payments). |

| Marketplace/Partner Fees | Integrated third-party services (e.g. credit data via Experian, e-sign via DocuSign) on Solifi platform. Solifi may take a referral fee or margin. | Transaction-based or revenue-share (recurring, but variable based on client usage of add-ons). |

| Additional License/Module | Fees for additional modules or private cloud licenses for certain clients. | One-time license fees or added subscription components (if not fully usage-based). |

| Advisory & Other | Consulting advice, industry reports (e.g., Global Leasing Report publication), and events. These reinforce the brand but are minor in revenue. | Mixed (some free value-add, some paid consulting engagements). |

Solifi’s shift toward SaaS has increased the weight of recurring revenue. According to its investors, this strategy of “as-a-service business models” and subscription pricing unlocks more value and predictability. It aligns Solifi’s success with its customers’ usage and growth. The company’s recurring revenue focus, combined with high customer retention, provides a stable financial base to invest in innovation and expansion.

Funding and Funding Rounds of Solifi

Solifi (and its predecessor IDS) has a history of strategic investments, private equity backing, and transformative M&A rather than traditional venture capital rounds. Below is a timeline of key funding events and ownership changes that have shaped the company’s capital structure:

| Date/Year | Funding Event | Investors / Parties | Details / Outcome |

|---|---|---|---|

| 2000 | Merger & Public Listing (IDS) | – (Merger with CFS, UK firm) | IDS went public via a merger, expanding its reach. Renamed International Decision Systems. |

| 2003 | Management Buyout of IDS | IDS Management | IDS’s managers bought the company back for ~$25 million. Company returned to private ownership. |

| 2012 | Private Equity Investment (Control) | SV Investment Partners (SVIP) | SVIP acquired a controlling stake. Funded product development (IDScloud) and new leadership hires. |

| 2019 | Acquisition by Thoma Bravo (Leveraged Buyout) | Thoma Bravo | Thoma Bravo, a software-focused PE firm, purchased IDS. Provided growth capital and M&A support. |

| Feb 2021 | Acquisition of William Stucky & Assoc. (WSA) | Thoma Bravo-backed IDS & WSA founders | IDS acquired WSA (leading ABL & factoring software provider) to broaden its portfolio. Funded by IDS (likely via Thoma Bravo support). WSA founder William Stucky took an exit role while supporting integration. |

| Apr 2021 | Acquisition of White Clarke Group (WCG) | IDS (Thoma Bravo) & Five Arrows (seller) | IDS acquired WCG (auto & asset finance software). Five Arrows (WCG’s PE owner) sold majority stake but remained a shareholder in the combined entity. This deal roughly doubled the company’s customer base and added a UK co-headquarters. |

| Oct 2021 | Rebrand to Solifi (Post-M&A) | – | IDS, WSA, and WCG formally merged identities into Solifi. Not a funding round, but marked the integration of acquired assets and a unified market presence. |

| Oct 2024 | Majority Investment by TA Associates | TA Associates (lead), Thoma Bravo (partial exit) | TA Associates, a global growth private equity firm, made a majority investment in Solifi. Thoma Bravo retained a meaningful minority stake. This infusion is aimed at accelerating product innovation and expansion into new markets via organic growth and strategic M&A. Financial terms were not disclosed, but the partnership with TA positions Solifi for its “next chapter” of growth. |

Table: Key Funding and Ownership Milestones for Solifi (IDS).

Throughout these events, Solifi has been private equity-backed, indicating a focus on long-term strategic growth over short-term public market pressures. The investments by firms like Thoma Bravo and TA Associates validate the company’s strong position in a niche market: Thoma Bravo saw potential to unlock value in the secured finance software space, and TA Associates noted Solifi’s leadership in mission-critical fintech and the opportunity to drive digital transformation in secured finance.

It’s worth noting that Solifi has financed multiple acquisitions as part of its growth strategy (WSA, White Clarke Group, and more recently Leasepath in 2025). These were likely funded by a combination of equity from its PE sponsors and debt. For example, in 2021 the combination of IDS and WCG created a company serving over 300 customers globally and targeting a $7 trillion secured finance market, indicating substantial scale achieved through those acquisitions.

The latest funding round (TA Associates in 2024) suggests continued support for M&A: Solifi explicitly states that the growth investment will help drive “expansion into adjacent financing markets and new geographies through strategic M&A”. This implies future funding may be deployed to acquire complementary technologies or enter new segments in fintech, bolstering Solifi’s platform.

In summary, Solifi’s funding history reflects strategic capital and ownership changes rather than serial venture rounds. Each funding milestone was tied to a transformation: SVIP’s investment drove cloud innovation, Thoma Bravo’s ownership enabled major acquisitions, and TA’s investment is fueling global expansion and product breadth.

Competitors of Solifi

Solifi operates in a competitive landscape of software providers serving the lending, leasing, and secured finance industry. Its competitors range from specialized independent software vendors to divisions of larger fintech companies. Below is a comparison of some key competitors:

| Competitor | Overview & Focus | Notable Strengths / Clients |

|---|---|---|

| Alfa Financial Software | UK-based provider of Alfa Systems, a leading asset finance platform for auto and equipment finance. Focuses on high-volume leasing operations for banks and captives. | Strong in automotive and equipment leasing; serves some of the world’s largest auto captives and banks. Known for deep industry functionality and large-scale deployments. |

| Odessa (Odessa Technologies) | US-based provider of the Odessa Platform (formerly LeaseWave), an end-to-end asset finance solution. Serves equipment leasing and finance companies globally. | Highly configurable, no-code approach to automation; Odessa is recognized for its scalable platform and a large development team (1000+ professionals). Clients include global lessors and independents. (Odessa and Solifi were reported to pursue a merger in 2022, but Solifi continues to operate independently under its brand). |

| LTi Technology Solutions | US-based company offering ASPIRE, a finance leasing software primarily for equipment finance and specialty lending. Targets mid-market lessors, independent finance companies, and some banks. | Deep experience in North American equipment finance. Flexible deployment (on-prem or cloud). Often praised for customer service. Competitors and industry directories frequently list LTi alongside Solifi in the equipment finance software category. |

| NETSOL Technologies | Global software company with NFS Ascent platform, catering to auto finance and leasing, especially in Asia-Pacific and emerging markets. | Strong presence in captive auto finance (especially in China, APAC). Offers a full suite from origination to collections. Competitive in markets requiring localized compliance and multilingual support. |

| Finastra (Asset Finance Division) | Part of a large fintech firm, Finastra provides asset finance modules (originations and portfolio management) often integrated with core banking systems. | Leverages Finastra’s core banking relationships; strong in syndicated lending and corporate lending software. However, its asset finance solution is less specialized than Solifi’s, making Finastra a competitor mainly for bank customers seeking an all-in-one vendor. |

| Others (Niche Competitors) | Examples: DataScan (USA) for floorplan/wholesale finance systems, Lendscape (HPD) (UK) for factoring and ABL software, IFS Leaseworks for small/mid leasing companies, and newer fintechs like QuickFi (digital lending platform) or LeaseAccelerator (lease management for lessees). | These competitors focus on specific niches. DataScan is a direct competitor for dealer floorplan finance software (serving major wholesale lenders). Lendscape competes in invoice finance and ABL, especially in Europe. Such niche players have strong domain-specific features but may lack the breadth of Solifi’s multi-solution platform. |

Table: Solifi and Selected Competitors in the Secured Finance Software Market.

Solifi’s competitive environment is characterized by a few large players and several specialized firms:

-

Breadth vs. Depth: Solifi’s unique value is the breadth of its platform – spanning equipment finance, auto finance, floorplan, and working capital – whereas some competitors specialize in one or two areas. For instance, Alfa and Odessa strongly compete in equipment and auto finance (and were traditionally rivals of IDS in leasing software), while a competitor like Lendscape focuses purely on factoring/ABL. Solifi’s multi-asset coverage on one platform is a key differentiator and competitive advantage.

-

Cloud Leadership: Many legacy competitors started as on-premise solutions. Solifi (through IDScloud and now Open Finance Platform) was an early mover in true SaaS for this industry. This gives it an edge with customers prioritizing cloud deployments and frequent upgrades. Competitors like Odessa and Alfa have also launched cloud offerings, so the race continues in terms of who can deliver more seamless SaaS experiences.

-

Scale and Stability: Solifi, bolstered by 50 years of experience and backing from large investors, can tout financial stability and a large support network (global offices, 650+ staff). This matters to conservative clients (banks) who view vendor longevity as crucial. Some smaller competitors can be perceived as riskier or lacking global support presence.

-

Innovative New Entrants: In recent years, fintech startups have introduced point solutions (for example, QuickFi for automated equipment loan origination, or Syndifi for loan syndication marketplace). These aren’t full competitors to Solifi’s platform, but they increase competition in certain functions. Solifi’s strategy of partnering (or even acquiring, as in the case of Leasepath in 2025) is a response to this – ensuring it can offer modern capabilities either in-house or through integration.

Industry sources like the Equipment Leasing and Finance Association (ELFA) software guide and Monitor magazine’s listings routinely cite Solifi (IDS) alongside Alfa, Odessa, LTi, Netsol, DataScan, etc. as the leading providers in this sector. This competitive group is relatively specialized – it’s a smaller pond than general fintech – and competition often centers on domain expertise, functionality, and relationships rather than pure price wars.

In summary, while Solifi faces strong competitors in each segment of its business, it has carved a position as a comprehensive, one-stop platform. Its competitive advantage, as detailed next, stems from leveraging this broad scope and decades of know-how to win and retain clients.

Competitive Advantage of Solifi

Solifi’s competitive advantage lies in a combination of its integrated product suite, deep industry experience, and strategic vision. Several factors give Solifi an edge in the secured finance software market:

1. Unified Platform with Multi-Asset Coverage

Solifi offers end-to-end solutions for multiple secured lending verticals on one platform. A customer can manage an equipment loan portfolio, a floorplan line of credit, and a factoring facility all with Solifi’s software. This is unique in the industry, stemming from the merger of three market leaders. Thoma Bravo highlighted that bringing IDS, WSA, and White Clarke together created a combination that “is not only unique, but also allows Solifi to accelerate growth of digital transformation and ‘as-a-service’ models across the industry”. Competitors often cover one domain deeply (e.g., only auto finance or only factoring), whereas Solifi’s breadth appeals to large financial institutions looking to consolidate systems.

2. Proven Track Record & Customer Loyalty

With 50 years in business, Solifi (IDS) has built a strong reputation. Its top 20 clients have been with the company for an average of 20 years, evidencing exceptional client trust and retention. Such longevity is rare in fintech and speaks to Solifi’s ability to adapt to clients’ evolving needs. The company’s legacy products like InfoLease became industry standards, and that goodwill has carried into the Solifi era. Customers know that Solifi’s solutions have been tested through decades of economic cycles and regulatory changes.

3. Cloud-First Innovation

Solifi is viewed as a leader in moving secured finance to the cloud. It launched a comprehensive SaaS offering in 2018 – earlier than some competitors – and by 2021 had over 110 customers on its Open Finance Platform SaaS solution, managing $150+ billion in assets. Its cloud platform delivers continuous automated upgrades, high scalability, and integrated data streaming, which help clients stay nimble and current. As more institutions modernize legacy systems, Solifi’s head start in cloud tech and its SOC 1/SOC 2 compliant security give it an upper hand with risk-conscious customers.

4. Comprehensive Product Functionality

Through acquisitions, Solifi now has “best-of-breed” components in each area: e.g., InfoLease for lease accounting, Rapport/Originations for front-end, WSA’s Stucky system for ABL and factoring, WCG’s CALMS for auto finance, etc. Each of these was a market-leading solution in its niche. Now under Solifi, they are being integrated into a cohesive platform. This means Solifi can match or exceed competitors in functionality across the board. The WSA acquisition gave Solifi “best-in-class ABL and factoring solutions”, allowing customers to offer holistic working capital finance alongside equipment loans. Similarly, White Clarke’s auto finance software brought cutting-edge features for vehicle leasing, subscription models, and mobility trends that Solifi’s rivals in equipment finance alone might not have.

5. Global Reach and Support

Solifi’s global presence (offices in North America, Europe, Asia-Pacific) means it can support customers in multiple regions with local expertise. Notably, after the WCG acquisition, Solifi established dual HQs in the US and UK and has offices in Australia, Germany, Austria, Canada, India, etc. This global footprint is a competitive advantage when serving multinational clients or entering emerging markets where on-the-ground support matters. Few pure-play competitors have equally distributed global teams.

6. Strong Partnerships Ecosystem

Solifi has cultivated a network of partnerships that extend its capabilities beyond what competitors offer out-of-the-box. For example, Solifi’s integration with Tamarack Technology (via partnership) helps clients accelerate digital transformation and cloud migrations, enhancing the overall value of IDScloud (Solifi’s SaaS) for equipment finance firms. Solifi also integrates with data providers and fintechs (e.g., Experian for credit data, DocuSign for e-signatures, Codat for accounting data sync). These partnerships mean Solifi customers can have a more complete solution without needing to custom-build every integration – a differentiator versus more closed systems.

7. Customer-Centric Approach & Domain Expertise

Solifi’s leadership and team include individuals with decades of experience in secured finance. COO Katie Emmel’s 37-year tenure and involvement on industry boards (e.g., ELFA) is one example. Such expertise translates to a consultative, partnership approach with clients. Solifi places emphasis on guiding customers through change (e.g., implementing new tech, adapting to new regulations) rather than just selling software. In a relationship-driven industry, this yields competitive advantage in client satisfaction and references.

8. Financial Backing and Stability

With backing from TA Associates and Thoma Bravo, Solifi has significant capital available for R&D and acquisitions. This financial strength assures customers that Solifi will continue investing in innovation (for example, developing new features like ESG Portfolio Strategist) and won’t be outpaced by market changes. It also allows Solifi to acquire emerging competitors or complementary tech, as it did with Leasepath in 2025 to enhance mid-market offerings. Smaller competitors may lack such resources to expand or adjust rapidly.

In summary, Solifi’s competitive advantage stems from being a trusted, one-stop solution provider with modern technology and a heritage of success. By continuously evolving (technologically and through M&A) while maintaining strong customer relationships, Solifi guards its market leadership. This combination of innovation + integration + experience positions it strongly against both longstanding competitors and new fintech entrants.

Product and Services Breakdown of Solifi

Solifi provides a broad suite of products and services, addressing the needs of various segments in the secured finance industry. These offerings are all built on the Solifi Open Finance Platform, ensuring a unified user experience and data model. Below is a breakdown of Solifi’s key product areas:

Equipment Finance Solutions

These cater to equipment leasing and lending (for assets like machinery, technology, vehicles, etc.). Solifi’s Originations module handles deal originations – from application through credit underwriting and documentation – while Portfolio Management (largely derived from the legacy InfoLease system) handles contract management, billing, accounting, and end-of-lease processes. Together, they provide a full lifecycle system for equipment finance companies and banks. Solifi’s equipment finance solution remains one of its core offerings, reflecting the company’s roots. It supports features like complex lease accounting, tax handling, and asset management that are crucial for lessors.

Automotive Finance & Fleet Finance

Solifi offers specialized solutions for auto lending and leasing – covering consumer auto loans/leases, dealer floorplan (wholesale) financing, and fleet management. These were strengthened significantly by the White Clarke Group acquisition. The Wholesale Finance module is tailored for floorplan (inventory) finance, enabling lenders to manage credit lines for dealerships and track underlying vehicle collateral. Solifi’s auto finance software (previously White Clarke’s CALMS) supports point-of-sale credit approval, loan/lease originations for vehicle finance, and servicing. It’s used by captives and banks to manage large volumes of auto contracts, and notably “serves 8 of the top 10 car manufacturers” through captive finance programs. Additionally, fleet finance capabilities help manage vehicle fleets under finance or lease, addressing needs of fleet lessors.

Working Capital & Commercial Lending

Solifi covers the spectrum of working capital finance through its Asset-Based Lending (ABL) and Factoring modules. These were incorporated via the acquisition of William Stucky & Associates. The ABL solution allows lenders to manage revolving lines of credit secured by assets like accounts receivable and inventory – it includes loan monitoring, borrowing base calculations, collateral tracking, and borrower portals. The factoring solution supports invoice factoring and receivables financing (both recourse and non-recourse), purchase order financing, and other forms of working capital lending. Combined, these solutions enable banks and factors to provide working capital to businesses, and they integrate with the platform’s general ledger and risk tools. By adding WSA’s products, Solifi can serve commercial finance companies looking for software in these areas, which was “a range of working capital solutions” many customers were seeking.

Lease & Loan Pricing and Analytics

Solifi provides a Lease & Loan Pricing tool (sometimes historically known as Rapport or InfoAnalysis) which helps financiers model deals and price them appropriately. This tool allows sales and credit teams to calculate payment schedules, yields, and perform scenario analysis on leases/loans. It ensures deals are structured profitably and comply with accounting standards. The pricing tool is often integrated with originations for a seamless process from quote to contract. Additionally, Solifi introduced an ESG Portfolio Strategist module, which presumably helps lenders analyze the environmental, social, and governance metrics of their portfolios (a response to the growing focus on sustainable finance).

Data and Integrations Services

Alongside its core modules, Solifi emphasizes data-centric services. Its Data Streaming capability allows near real-time sharing of data with other enterprise systems via APIs. This is crucial for clients who want to integrate Solifi with CRM systems, general ledgers, or data warehouses. Solifi’s Open Finance Platform is API-driven, with an API Developer Portal that customers and partners can use to build custom integrations. Solifi also offers a Marketplace of pre-built integrations: for example, connections to credit bureaus (Experian), electronic signature (DocuSign), insurance (Assurant, Great American), and others, which extend the functionality of its modules.

Professional Services & Support

On the services side, Solifi provides comprehensive support to implement and maximize the use of its software. This includes project management, configuration, data migration from legacy systems, custom report development, and user training. Post-implementation, Solifi’s customer support and cloud operations teams ensure the platform is running smoothly (24/7 monitoring, regular backups, etc.), and they assist with any issues. Solifi also periodically shares industry insights – for example, it publishes the annual Global Leasing Report (as of 2025) which provides market data to clients. These services reinforce the product offering by ensuring clients can fully leverage Solifi’s technology.

The integrated nature of these products is a major selling point. Solifi often highlights that “secured finance firms can access any of our market-leading solutions in a pay-for-what-you-use model” on one platform. This means a finance company could start with one module (say, equipment finance) and later adopt another (like ABL) without implementing a separate system. Everything from originations to servicing to analytics can be handled within the same ecosystem, with consistent data and user interface.

To illustrate Solifi’s product lineup and target segments, consider the following table of Solifi’s offerings:

| Product/Module | Purpose & Features | Origin / Notable Facts |

|---|---|---|

| Originations | Front-end system for loan/lease origination: application intake, credit scoring, workflow, documentation. Allows automated decisioning and dealer/customer portals for finance applications. | Evolved from IDS’s Rapport and White Clarke’s POS systems. Enables faster deal processing and integration with pricing tools. |

| Portfolio Management | Back-end contract management for leases and loans: billing, amortization, collections, asset tracking, end-of-term options, accounting outputs. | Based on IDS’s InfoLease (a long-established lease accounting system). Renowned for robust accounting accuracy and compliance (e.g., ASC 842 lease accounting). |

| Wholesale Finance | Floorplan finance management: manages inventory financing for dealers (e.g., car dealerships). Handles credit line monitoring, curtailments, audits of inventory, and repayment as units are sold. | Acquired via White Clarke Group. The CALMS wholesale module, now part of Solifi, is used by major auto captives and floorplan lenders. |

| Asset-Based Lending (ABL) | Manages revolving credit facilities secured by business assets. Functions include borrowing base calculation, collateral reporting (A/R, inventory), covenant tracking, and client web portal. | Acquired via WSA (Stucky system). Widely used by ABL lenders in the US; known for compliance with ABL field exams and audits. |

| Factoring | Supports factoring of invoices and receivables financing. Tracks purchased invoices, advances, collections, and debtor credit limits. Can handle both recourse and non-recourse factoring. | Also from WSA acquisition. WSA’s factoring software was a market leader with 120+ customers pre-acquisition. |

| Lease & Loan Pricing | Analytical tool for modeling leases/loans: compute payments, yields, PV, IRR, residuals. Helps sales teams structure competitive yet profitable deals. Integrates with Originations to seamlessly create contracts from approved quotes. | Originally an IDS tool (sometimes called InfoAnalysis). Vital for complex deals and syndicated loans. It supports multi-currency and tax calculations for global deals. |

| ESG Portfolio Strategist | Newer analytics tool focusing on ESG metrics. Allows lenders to assess and report on the environmental and social impact of their finance portfolios. Can be used to strategize portfolio shifts or meet regulatory reporting on sustainability. | Developed in response to market demand for sustainable finance insights. Leverages Solifi’s data across all lending activities to compute ESG scores or carbon footprint of financed assets (e.g., percentage of EVs in an auto portfolio). |

| Data Streaming & APIs | Platform capabilities for real-time data sharing and integrations. Enables event-driven updates to downstream systems (e.g., update general ledger when a payment is made) and open APIs for extending functionality. | Built on modern cloud architecture (e.g., using Confluent Kafka for streaming). Ensures Solifi can fit into clients’ IT ecosystems easily – a key selling point in digital transformation projects. |

| Marketplace Integrations | Catalog of plug-and-play integrations with third-party services: e.g., credit bureaus (Experian), e-signature (DocuSign), insurance (Assurant), accounting data sync (Codat), risk analytics (EQ Riskfactor). | Launched as part of the Open Finance Platform to provide an ecosystem. Reduces time and cost for clients to add common functionalities. This ecosystem approach is aligned with Solifi’s vision of an “integrated technology ecosystem” in secured finance. |

| Professional Services | Project-based services including implementation, configuration, data migration, testing, training, and go-live support. Also business consulting for best practices in lease/loan management. | Provided by Solifi’s in-house experts, many of whom have decades of domain experience. Ensures client success and faster ROI from the software – a point emphasized by Solifi for customer satisfaction. |

Table: Solifi’s Key Product Modules and Services. (Note: All modules are delivered via the unified Solifi Open Finance Platform, leveraging common data models and infrastructure.)

Through this comprehensive portfolio, Solifi is able to support a wide range of secured finance products “out-of-the-box”. Clients can tailor which modules they use, and the platform’s flexibility means it serves both large global banks (with complex, multi-product portfolios) and smaller independent finance companies (who might start with just one module like factoring). The availability of professional services and a partner network further means Solifi can meet specialized needs without the customer leaving the platform.

Conclusion

Challenges do exist – competition will respond, and large banks have lengthy procurement cycles – but Solifi’s forward-looking strategy and backing position it to navigate these. The emphasis on anticipating future demands (like usage-based financing models for specialized equipment) shows Solifi’s mindset of looking ahead. If Solifi executes on its vision, the company can realize its goal of being the “world’s leading provider of secured finance software technology” into the next decade.

In the long run, Solifi aims to reach its centennial (100-year) milestone by staying nimble, innovative, and customer-focused. The secured finance industry’s future – increasingly digital, data-driven, and global – will have Solifi as a key enabler, connecting capital with opportunity and unleashing potential for businesses worldwide.

Also Read: VAST Data – Founders, Business Model, Funding & Competitors

To read more content like this, subscribe to our newsletter

Go to the full page to view and submit the form.