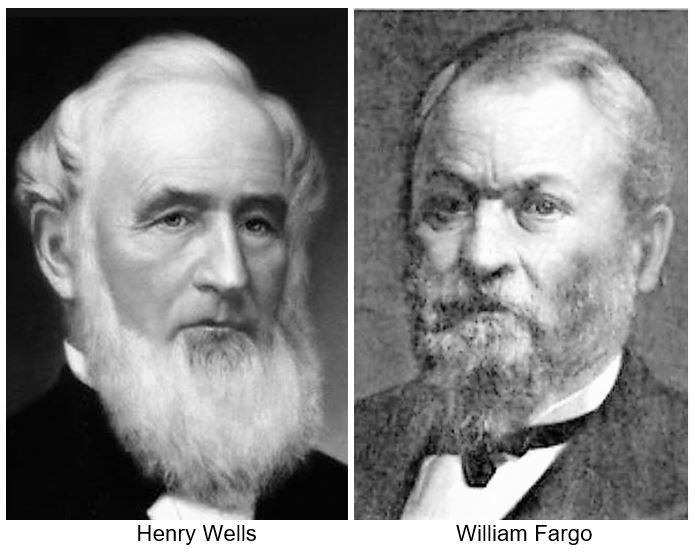

Wells Fargo & Company is one of the largest and oldest financial institutions in the United States, with a rich history dating back to the mid-19th century. Founded on March 18, 1852, by Henry Wells and William G. Fargo, the company was originally established to provide express and banking services to California during the Gold Rush. Its iconic stagecoach logo harkens back to this era, symbolizing its long-standing tradition of reliable and secure financial services.

Headquartered in San Francisco, California, Wells Fargo has grown into a global financial services company with operations in over 35 countries and territories. It serves millions of customers through a comprehensive range of banking, investment, mortgage, and consumer and commercial finance services. As of recent data, the company operates approximately 7,200 locations and has over 13,000 ATMs, making it one of the most accessible banks in the United States.

Wells Fargo’s core businesses are divided into four primary segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management. Each segment is designed to cater to the diverse financial needs of its customers, from individual consumers to large corporations.

- Consumer Banking and Lending: This segment offers a variety of services, including checking and savings accounts, credit and debit cards, personal loans, auto loans, and home mortgages. Wells Fargo is renowned for its extensive branch network and customer-centric approach, aiming to provide convenient and personalized banking experiences.

- Commercial Banking: Focused on serving small, mid-sized, and large businesses, this segment provides commercial loans, lines of credit, commercial real estate financing, treasury management, and merchant services. Wells Fargo’s strong relationships with businesses help them achieve their financial goals and navigate complex economic landscapes.

- Corporate and Investment Banking: This division delivers a broad range of services, including capital raising, advisory, mergers and acquisitions, risk management, and trading. Wells Fargo’s expertise in capital markets and its robust financial infrastructure support the strategic needs of corporations, institutions, and governments.

- Wealth and Investment Management: Catering to affluent individuals and families, this segment offers comprehensive wealth management, investment, and retirement planning services. Wells Fargo Advisors, one of the nation’s largest full-service retail brokerage firms, is a key component of this segment, providing clients with tailored financial strategies and solutions.

Wells Fargo has faced significant challenges and controversies in recent years, notably the 2016 account fraud scandal where millions of unauthorized accounts were created. This led to a series of regulatory actions, leadership changes, and efforts to rebuild trust and strengthen governance. Under new leadership, Wells Fargo has committed to improving its corporate culture, risk management practices, and customer relationships.

Despite these challenges, Wells Fargo remains a cornerstone of the American banking industry. Its commitment to innovation is evident in its investment in digital banking solutions, aiming to enhance customer experience and operational efficiency. The company’s mobile app and online banking platform are widely recognized for their user-friendly design and robust features..

In conclusion, Wells Fargo’s long history, extensive service offerings, and commitment to innovation and community engagement make it a significant player in the financial services industry. While it continues to navigate challenges, its foundational principles and strategic initiatives position it for future growth and stability.

Top Wells Fargo’s Competitors and Alternatives

Wells Fargo is a major player in the global banking and financial services industry, but it faces stiff competition from several key competitors. Here’s an in-depth look at Wells Fargo’s top competitors, detailing how they compare in various aspects:

1. JPMorgan Chase

Website – https://www.jpmorganchase.com/

JPMorgan Chase is often regarded as the largest bank in the United States by assets, presenting a formidable competition to Wells Fargo in terms of market presence and financial products. JPMorgan offers a wide range of services including commercial banking, investment banking, and asset management, areas where Wells Fargo also operates but with less emphasis on investment banking. JPMorgan’s global reach and significant investment capabilities give it a competitive edge in serving large corporations and international clients, which is an area where Wells Fargo has been more conservative, particularly after its various scandals and regulatory issues.

JPMorgan Chase also leads in technology investment, spending billions annually to enhance its digital banking services and cybersecurity. This has allowed it to stay ahead of digital transformation trends, attracting tech-savvy consumers and young customers. Wells Fargo, on the other hand, has been playing catch-up in digital innovations following its reputational damage in recent years, focusing on rebuilding trust and enhancing customer experience through technology.

2. Bank of America

Website – https://www.bankofamerica.com/

Bank of America is a direct competitor to Wells Fargo, with a similar breadth of services including consumer banking, wealth management, and investment services. Both banks have a strong retail banking presence in the United States, but Bank of America has a more pronounced global presence, providing it with diversified risks and revenues. This global footprint helps Bank of America attract multinational corporations and affluent clients who require a broad range of international banking services.

In terms of consumer banking, Bank of America has been a leader in integrating artificial intelligence and machine learning into its operations, particularly through its virtual assistant, Erica, which enhances customer service and operational efficiency. Wells Fargo also invests in technology to improve customer service and has been enhancing its digital platforms, but Bank of America’s early investments in AI have set a high industry standard that Wells Fargo is striving to meet.

3. Citigroup

Website – https://www.citigroup.com/global

Citigroup offers a more international scope compared to Wells Fargo, which is predominantly focused on the United States. Citigroup’s vast network across more than 160 countries allows it to serve multinational corporations and high-net-worth individuals in ways that Wells Fargo cannot, given its more domestically focused operations. Citigroup’s strength in global banking and capital market services contrasts with Wells Fargo’s traditionally stronger presence in community banking and mortgage services.

Furthermore, Citigroup has positioned itself as a leader in sustainable finance, committing billions to environmental and sustainable business practices and financing. This commitment to sustainability appeals to a growing demographic of environmentally and socially conscious consumers and investors, offering a competitive edge over Wells Fargo, which has also been making strides in this area but with less overall market impact to date.

4. Goldman Sachs

Website – https://www.goldmansachs.com/

Goldman Sachs, traditionally known for its prowess in investment banking and asset management, represents a different kind of competitor to Wells Fargo. While Wells Fargo does offer wealth management and investment services, its capabilities are not as extensive or as globally recognized as those of Goldman Sachs. Goldman’s dominance in advising large corporate mergers, acquisitions, and initial public offerings sets it apart from Wells Fargo’s more traditional banking and retail investment services.

Goldman Sachs has also been expanding into consumer banking under its Marcus brand, directly competing with Wells Fargo’s personal banking products. The Marcus platform offers high-yield savings accounts and personal loans with competitive rates, appealing to a segment of consumers looking for straightforward, high-value banking products. This move has prompted Wells Fargo to enhance its offerings and customer benefits to retain competitiveness.

5. Morgan Stanley

Website – https://www.morganstanley.com/

Morgan Stanley, traditionally a leader in investment banking, competes with Wells Fargo particularly in the wealth management and advisory services sectors. While Wells Fargo has a significant presence in wealth management through its Wells Fargo Advisors division, Morgan Stanley’s acquisition of E*TRADE has bolstered its capabilities and client base in the retail brokerage and wealth management areas, enhancing its competitive edge. Morgan Stanley’s focus on providing comprehensive financial advice and services to high-net-worth individuals and institutions offers a depth of expertise that is highly regarded in the industry.

Moreover, Morgan Stanley has made strategic investments in technology to support its wealth management services, providing integrated and personalized financial planning tools that help attract and retain clients. This emphasis on leveraging technology for enhanced client services is an area where Wells Fargo has also been focusing, especially to recover and rebuild customer trust after past regulatory challenges. However, Morgan Stanley’s strong brand reputation and advanced technological offerings in wealth management set it apart as a leading choice for affluent clients.

6. U.S. Bank

Website – https://www.usbank.com/index.html

U.S. Bank is another major competitor, known for its strong retail banking operations which go head-to-head with Wells Fargo’s extensive branch network. U.S. Bank offers a comprehensive suite of banking products including consumer and business banking, wealth management, and payment services. While Wells Fargo has a larger national footprint, U.S. Bank’s reputation for customer service and reliability often ranks it higher in customer satisfaction surveys, presenting a formidable challenge in terms of consumer preference.

U.S. Bank has also been proactive in its approach to digital banking innovations, particularly in mobile banking services, where it has introduced features that simplify customer interactions like bill payments, loan applications, and account management. Wells Fargo has similarly invested in digital banking technologies to enhance its customer service capabilities, making it essential for Wells Fargo to continue innovating and improving its digital offerings to stay competitive in a market where customers increasingly value convenience and efficiency.

7. PNC Financial Services

Website – https://www.pnc.com/en/

PNC stands out with its strategic focus on middle-market customers and its integrated financial services model that combines retail banking with asset management and corporate banking. This strategic positioning allows PNC to serve a wide range of customers, from individuals to large corporations, effectively competing with Wells Fargo’s diversified financial services. PNC’s acquisition of BBVA USA also marks its territorial expansion, especially in the southern U.S., directly challenging Wells Fargo’s market share in these regions.

PNC has been a pioneer in virtual banking with its Virtual Wallet product, which has been well-received for combining spending, saving, and budgeting tools into one comprehensive service. This innovation sets a benchmark in the industry, pushing Wells Fargo to continuously improve its own digital banking solutions to meet evolving customer expectations and retain its competitiveness in the banking sector.

8. Capital One

Website – https://www.capitalone.com/

Capital One is primarily recognized for its credit card services, but it has also made significant strides in retail banking and commercial lending, areas where Wells Fargo is traditionally strong. Capital One’s strategy focuses on harnessing technology to enhance customer experiences, evident from its investments in data analytics and machine learning to personalize customer interactions and improve financial products.

Furthermore, Capital One’s commitment to digital transformation is exemplified by its status as the first major bank to go all-in on the cloud, enhancing its agility and innovation capabilities. This move challenges traditional banks like Wells Fargo to accelerate their digital transformation strategies to remain competitive in a landscape increasingly dominated by tech-savvy players.

These competitors illustrate the breadth of challenges Wells Fargo faces across various dimensions of the financial services spectrum. From investment banking to innovative digital banking, Wells Fargo must navigate a complex environment, adapting to technological advancements and evolving customer needs while maintaining a strong focus on rebuilding trust and ensuring regulatory compliance.

Also Read: The Business of Banking: Analysis of US Major Bank Wells Fargo

To read more content like this, subscribe to our newsletter

Go to the full page to view and submit the form.