Wells Fargo is a renowned American multinational financial services company headquartered in San Francisco, California. The company was founded in 1852 by Henry Wells and William Fargo and has since grown to become one of the largest and most respected financial institutions in the world.

With over 70 million customers and 7,000 branches across the United States, Wells Fargo provides a wide range of financial services, including banking, insurance, investments, mortgages, and consumer and commercial finance. The company has a strong presence in the US financial market, with over $1.89 trillion in assets as of March 2023.

Wells Fargo has a rich history of innovation and has been at the forefront of developing new technologies and financial products. The company was the first to introduce online banking and was also a pioneer in mobile banking, making it easy for customers to access their accounts and perform transactions on the go.

Wells Fargo is also known for its strong commitment to corporate social responsibility. The company is involved in various community initiatives and philanthropic programs aimed at supporting education, affordable housing, environmental sustainability, and other important causes.

Overall, Wells Fargo is a trusted and reliable financial partner for individuals, businesses, and communities across the United States. Its strong focus on innovation, customer service, and social responsibility has made it a leader in the financial industry and a highly respected institution worldwide.

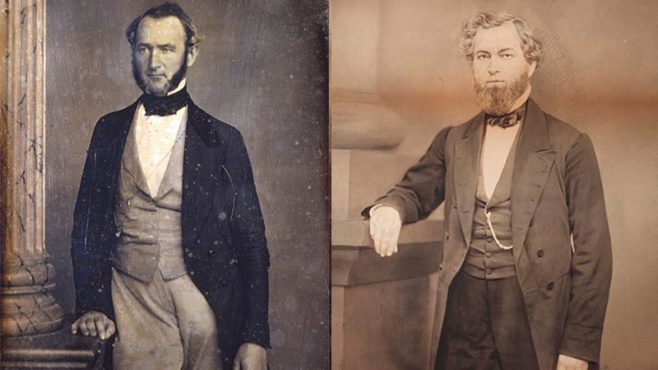

Founding History of Wells Fargo

Wells Fargo was founded in 1852 by Henry Wells and William Fargo, two successful businessmen with a history of entrepreneurship and innovation. Wells had previously founded American Express in 1850, while Fargo was a prominent banker and co-founder of the American Express competitor, Wells & Company.

The two men saw an opportunity to capitalize on the booming gold rush in California and the West by establishing a new delivery service that would transport valuable goods and packages across the country. They began by forming a joint venture called “Wells, Fargo & Co.” and launched their first stagecoach service from San Francisco to New York City in July of 1852.

The company’s initial focus was on transporting mail and other small parcels, but they soon expanded into banking services, as many gold miners needed a secure place to store their wealth. Wells Fargo became the first bank to offer “free banking,” meaning that customers could deposit their gold without paying fees. The company also introduced express and telegraph services, making it easier for customers to communicate and do business across the country.

Throughout the 1850s and 1860s, Wells Fargo played a critical role in the development of the American West. The company’s stagecoaches, known for their iconic red and gold colors, became a symbol of reliable transportation and safe passage through the frontier. Wells Fargo also invested heavily in technology, becoming one of the first companies to use steamships and railroads to transport goods and packages.

By the end of the 19th century, Wells Fargo had become one of the most prominent and successful financial institutions in the United States. The company weathered several economic crises, including the Panic of 1873 and the Great Depression, and continued to innovate and expand its services. Today, Wells Fargo is a global financial services company with a rich history of entrepreneurship, innovation, and service to its customers and communities.

Read history in more detail – Wells Fargo – The History Of Leading Financial Company

Mergers and Acquisitions involving Wells Fargo

Wells Fargo has a long history of mergers and acquisitions, which have helped the company expand its services, grow its customer base, and increase its market share. Here are some of the most significant mergers and acquisitions involving Wells Fargo:

Wachovia Corporation: In 2008, Wells Fargo acquired Wachovia Corporation, a Charlotte-based financial services company. The deal was worth $15.1 billion and helped Wells Fargo expand its operations in the Southeast and Mid-Atlantic regions of the United States.

The acquisition of Wachovia Corporation was one of the largest in banking history. Wachovia was struggling due to the subprime mortgage crisis and was on the verge of collapse. Wells Fargo was able to acquire Wachovia at a discounted price, gaining access to its extensive branch network and customer base. The acquisition was not without its challenges, as Wells Fargo had to deal with significant integration issues and legal disputes related to Wachovia’s past practices. However, in the long run, the acquisition proved to be a smart move, as it helped Wells Fargo become one of the largest and most successful financial institutions in the world.

Norwest Corporation: In 1998, Wells Fargo merged with Norwest Corporation, a Minneapolis-based bank. The deal was worth $34 billion and created one of the largest financial services companies in the world.

The merger with Norwest Corporation was a strategic move for Wells Fargo. Norwest was a well-respected bank with a strong presence in the Midwest, while Wells Fargo was a leading financial institution on the West Coast. The merger allowed the two banks to combine their strengths and expand their services to customers across the country. The merger also gave Wells Fargo access to Norwest’s mortgage banking and insurance businesses, which helped the company diversify its revenue streams.

First Interstate Bancorp: In 1996, Wells Fargo acquired First Interstate Bancorp, a Los Angeles-based bank. The deal was worth $11.6 billion and made Wells Fargo the largest bank on the West Coast.

The acquisition of First Interstate Bancorp was a contentious one. First Interstate had initially rejected Wells Fargo’s offer, prompting a hostile takeover bid. The acquisition was also subject to intense regulatory scrutiny, as it would have created a monopoly in several Western states. In the end, Wells Fargo was able to overcome these challenges and acquire First Interstate. The acquisition gave Wells Fargo a dominant presence in the Western United States and helped the company become one of the largest banks in the country.

Crocker National Corporation: In 1986, Wells Fargo acquired Crocker National Corporation, a San Francisco-based bank. The deal was worth $1.1 billion and helped Wells Fargo expand its operations in California.

The acquisition of Crocker National Corporation was a pivotal moment in Wells Fargo’s history. Crocker was a respected financial institution with a strong reputation in California. The acquisition helped Wells Fargo become the largest bank in California and gave the company a significant presence in the Bay Area. The acquisition also helped Wells Fargo strengthen its corporate banking and international operations.

First National Bank of Chicago: In 1960, Wells Fargo acquired the First National Bank of Chicago, a leading financial institution in the Midwest. The acquisition helped Wells Fargo expand its services in the Midwest and gave the company a foothold in the highly competitive Chicago market.

Overall, these mergers and acquisitions have helped Wells Fargo grow into one of the largest and most successful financial services companies in the world. By acquiring other financial institutions, Wells Fargo has been able to expand its services, increase its market share, and serve more customers across the United States and beyond.

Which Business Segments does Wells Fargo operates in?

Wells Fargo is a diversified financial services company that operates in a variety of business segments. Here are some of the primary business segments of Wells Fargo:

Community Banking: The Community Banking segment includes Wells Fargo’s retail and small business banking operations. This segment includes deposits, loans, and other financial services for individuals and small businesses. The segment also includes mortgage lending and servicing, credit card services, and other consumer lending products.

Wholesale Banking: The Wholesale Banking segment includes Wells Fargo’s commercial banking, corporate banking, and treasury management operations. This segment serves medium-sized and large businesses, as well as institutional clients. The Wholesale Banking segment provides a range of financial products and services, including lending, cash management, international trade services, and capital markets services.

Wealth & Investment Management: The Wealth & Investment Management segment includes Wells Fargo’s wealth management, private banking, and retirement services operations. This segment provides investment management, trust and estate planning, and other financial services to high-net-worth individuals, families, and institutional clients.

Mortgage Banking: The Mortgage Banking segment includes Wells Fargo’s mortgage origination, sales, and servicing operations. This segment provides a range of mortgage products and services to customers across the United States. The Mortgage Banking segment also includes the servicing of mortgage loans, which generates fee income for the company.

Consumer Lending: The Consumer Lending segment includes Wells Fargo’s auto lending, student lending, and other consumer lending operations. This segment provides loans and other financial products to customers across the United States. The Consumer Lending segment also includes the purchase of retail installment sales contracts from auto dealers, which generates fee income for the company.

Commercial Real Estate: The Commercial Real Estate segment includes Wells Fargo’s commercial real estate lending, servicing, and investment operations. This segment provides financing for a wide range of commercial real estate projects, including office buildings, shopping centers, hotels, and other properties. The Commercial Real Estate segment also includes the acquisition and management of real estate assets, which generates income for the company.

Overall, Wells Fargo operates in a variety of business segments, including community banking, wholesale banking, wealth and investment management, mortgage banking, consumer lending, and commercial real estate. By diversifying its operations across these different segments, Wells Fargo is able to manage risk and generate consistent earnings over time.

Revenue Streams of Wells Fargo – How does Wells Fargo make money?

Wells Fargo is a diversified financial services company that generates revenue through a variety of sources. Here are some of the primary ways that Wells Fargo makes money:

Interest income: One of the primary ways that Wells Fargo generates revenue is by earning interest income on its loans and investments. Wells Fargo is a leading provider of consumer and commercial loans, including mortgages, credit cards, auto loans, and business loans. The interest charged on these loans generates a significant amount of revenue for the company. In addition, Wells Fargo invests its own funds in a variety of securities, including government bonds, corporate bonds, and mortgage-backed securities, which also generate interest income.

Fees and commissions: Wells Fargo also earns revenue from various fees and commissions charged for its services. For example, the company charges fees for checking accounts, ATM usage, wire transfers, and other services. Wells Fargo also earns commissions on the sale of insurance products, investment products, and other financial services.

Investment banking: Wells Fargo also generates revenue through its investment banking operations. The company provides a range of investment banking services, including underwriting of equity and debt securities, mergers and acquisitions advice, and other advisory services. These services generate fees for the company, which can be significant for large transactions.

Wealth management: Wells Fargo also generates revenue through its wealth management division. The company provides a range of services to high-net-worth individuals and families, including investment management, trust and estate planning, and private banking services. These services generate fees for the company based on the amount of assets under management.

Trading and market-making: Finally, Wells Fargo also generates revenue through its trading and market-making operations. The company engages in a variety of trading activities, including market-making in equity and fixed-income securities, foreign exchange trading, and commodity trading. These activities generate revenue for the company based on the spreads between bid and ask prices and other market factors.

Overall, Wells Fargo’s revenue is generated from a variety of sources, including interest income, fees and commissions, investment banking, wealth management, and trading and market-making. By diversifying its revenue streams across these different areas, Wells Fargo is able to manage risk and generate consistent earnings over time.

2008 Financial Crisis impact on Wells Fargo and its role in the crisis

The 2008 financial crisis had a significant impact on Wells Fargo, as it did on many other banks and financial institutions. Here’s a more detailed look at the role and impact of the crisis on Wells Fargo:

Role in the Crisis:

Wells Fargo was one of the largest banks in the United States at the time of the financial crisis, and it was heavily involved in the mortgage market. Like many other banks, Wells Fargo had originated and securitized a large number of subprime mortgages, which were loans made to borrowers with poor credit histories. The bank’s involvement in the subprime mortgage market was largely through its acquisition of Wachovia Corporation, which it purchased in 2008.

Impact of the Crisis:

The financial crisis had a significant impact on Wells Fargo’s financial performance. Here are some of the key impacts:

Loan losses: As the housing market declined and the number of foreclosures increased, Wells Fargo experienced significant losses on its mortgage loans. In 2008, the bank reported $3.3 billion in credit losses, which was up from $1.6 billion the previous year. The bank’s losses continued in the following years, with credit losses of $21.3 billion in 2009 and $9.9 billion in 2010.

Government intervention: In 2008, Wells Fargo received $25 billion in government bailout funds as part of the Troubled Asset Relief Program (TARP). The funds helped stabilize the bank’s finances and restore confidence in the banking system. In addition to the TARP funds, the bank also received guarantees from the Federal Deposit Insurance Corporation (FDIC) on certain debt issuances.

Business consolidation: Following the crisis, Wells Fargo consolidated its operations and closed some of its branches in order to reduce costs and improve efficiency. The bank also reduced its workforce by around 7% in 2009 and 2010.

Regulatory scrutiny: Like many other banks, Wells Fargo faced increased regulatory scrutiny in the wake of the crisis. The bank was subject to a number of regulatory actions, including fines and enforcement actions related to its mortgage practices. In 2011, the bank entered into a $85 million settlement with the Federal Reserve related to its mortgage practices.

Despite the challenges posed by the financial crisis, Wells Fargo emerged from the crisis as one of the stronger banks in the United States. The bank was able to repay its TARP funds ahead of schedule and continued to grow its business in the years that followed. However, the crisis had a lasting impact on the bank’s reputation and led to increased regulatory scrutiny, which would later contribute to the bank’s later scandals.

Competitors of Wells Fargo

Wells Fargo is one of the largest banks in the United States and competes with several other major banks in the industry. Here’s a closer look at some of Wells Fargo’s key competitors:

JPMorgan Chase: JPMorgan Chase is one of the largest banks in the world, with operations in over 100 countries. Like Wells Fargo, JPMorgan Chase is involved in a range of banking services, including consumer banking, commercial banking, and investment banking. The bank has a large retail banking network and is also a major player in credit cards and mortgage lending.

Bank of America: Bank of America is another major U.S. bank that competes with Wells Fargo. The bank is involved in a range of banking services, including consumer banking, commercial banking, and investment banking. Bank of America has a large retail banking network and is also a major player in credit cards and mortgage lending.

Citigroup: Citigroup is a global bank with operations in over 100 countries. The bank is involved in a range of banking services, including consumer banking, commercial banking, and investment banking. Citigroup has a large retail banking network and is also a major player in credit cards and mortgage lending.

US Bancorp: US Bancorp is a regional bank that operates in 26 states. The bank is involved in a range of banking services, including consumer banking, commercial banking, and investment banking. US Bancorp has a large retail banking network and is also a major player in credit cards and mortgage lending.

PNC Financial Services: PNC Financial Services is a regional bank that operates in 21 states. The bank is involved in a range of banking services, including consumer banking, commercial banking, and investment banking. PNC Financial Services has a large retail banking network and is also a major player in credit cards and mortgage lending.

Each of these banks competes with Wells Fargo across a range of banking services, including consumer banking, commercial banking, and investment banking. They also compete for market share in credit cards and mortgage lending. However, each bank has its own strengths and weaknesses, and their competitive positioning can vary depending on the market and the specific banking services being offered.

Is Wells Fargo too big to fail?

Wells Fargo is one of the largest banks in the United States, with over $1.9 trillion in assets as of 2021. The concept of “too big to fail” refers to the idea that some financial institutions are so large and interconnected that their failure could have significant negative impacts on the wider economy.

Wells Fargo’s size and interconnectedness mean that if it were to fail, it could potentially cause widespread disruption in the financial system. For example, if Wells Fargo were to experience significant financial losses or become insolvent, it could lead to a loss of confidence in the banking system as a whole, which could cause a run on other banks and lead to a wider economic crisis.

In the wake of the 2008 financial crisis, the U.S. government implemented a number of regulations and safeguards to prevent “too big to fail” institutions from causing economic instability. These included the Dodd-Frank Wall Street Reform and Consumer Protection Act, which created a regulatory framework for monitoring and managing systemic risk in the financial system.

As part of these reforms, the Federal Reserve implemented a series of stress tests to evaluate the resilience of large financial institutions, including Wells Fargo. These tests assess how well banks could withstand a severe economic shock, such as a recession or financial market crash. The results of these tests are used to determine whether banks are required to take additional steps to improve their financial health, such as increasing their capital reserves or limiting their risk exposure.

While Wells Fargo has passed these stress tests in recent years, some critics argue that the bank is still too big to fail and that more needs to be done to reduce its systemic risk. This includes calls for stricter regulation and a possible breakup of the bank into smaller, more manageable entities. However, others argue that such a move could have unintended consequences and that Wells Fargo’s size and scale are necessary for it to compete effectively in the global financial system.

Overall, whether or not Wells Fargo is truly “too big to fail” remains a matter of debate among policymakers, regulators, and financial experts. However, it is clear that the bank’s size and significance in the financial system mean that its stability and financial health are closely monitored and closely tied to the wider economic health of the country.

To read more content like this, subscribe to our newsletter

Go to the full page to view and submit the form.