For those who haven’t shopped on the site or seen the “Shein hauls” on TikTok, Shein is a powerhouse in the world of fast fashion. It sells trendy clothing, beauty and home items for absurdly low prices.

About Shein

SHEIN (pronounced “She In”) is an online fast-fashion business that collaborates with hundreds of manufacturers to produce new apparel designs quickly. It sells products for men, women, children, and also for the household. Customers may purchase hundreds of different products such as dresses, shirts, shoes, and other accessories.

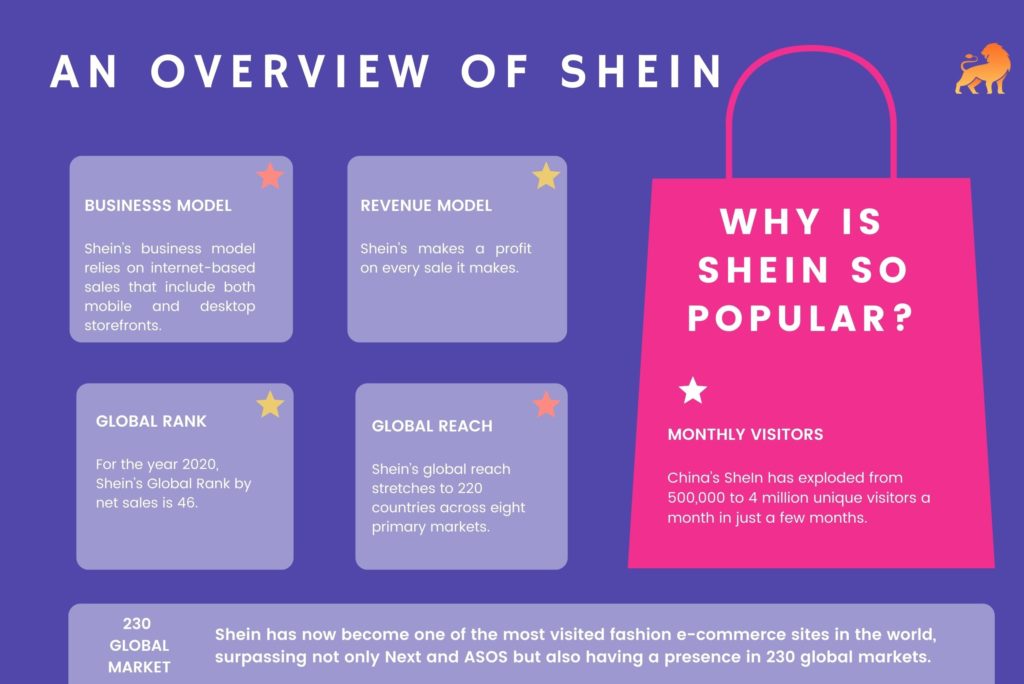

SHEIN ships to over 220 countries and has specialised websites for the United States, Spain, France, the Middle East, and a variety of other places. Nonetheless, the vast majority of manufacturers and warehouses with whom SHEIN collaborates are based in China.

Customers may add products to their “Shopping Bag” as they choose, much like on most other fashion websites. When a consumer is ready, they may inspect their shopping bags and go to the secure checkout gateway. Customers may then pay using a number of ways such as debit and credit cards, PayPal, Apple or Google Pay, Buy Now, Pay Later services like Klarna, and others.

SHEIN essentially controls the whole manufacturing chain by collaborating with thousands of manufacturers that produce the apparel it sells. When its system detects a new trend, it quickly sends an order to the companies responsible for producing a sample of that product, which is then evaluated on its website. Furthermore, SHEIN collaborates with hundreds of influencers who market its goods across various social networks.

History of Shein – Early Days and Founding Story

The founder, Chris Xu, had the concept for Shein after learning about the commercial value of Chinese items on worldwide marketplaces. Xu was working for Nanjing Aodao Information Technology Co. at the time, but he quickly resigned to launch an online retail site for affordable fashion apparel.

Further investigation revealed that women’s wedding gowns are among the most sought-after garments in the entire world. Furthermore, he learned that the only thing standing between worldwide consumers and Chinese items was the difference in their currencies and all the complications that entailed. After establishing ZZKKO, he began selling bridal gowns.

The company eventually expanded into women’s clothing and changed its name to “SheInside.” In the early 2010s, the corporation expanded its product line to include cosmetics, jewellery, shoes, handbags, and other accessories. By 2013, Sheinside had approximately 100 staff. It improved its marketing methods even more, and it eventually became a fully integrated retailer. In 2015, the firm renamed itself “Shein” to make it easier for everyone to remember. In 2016, the Shein team grew to 800 members.

Shein Business Model

SHEIN’s business model is based on producing new designs at a significantly faster rate than traditional shops like as H&M or Zara.

To determine what’s presently trending, SHEIN uses data from a number of sources, including Google Trends, social media hashtags, and scraping its competitor’s website. The data is then translated into trendy items by an in-house design team made of hundreds of fashion designers.

By ensuring that the factories with whom it collaborates utilise SHEIN’s in-house software, it is able to deliver those digested insights to its manufacturing partners in real-time. Each of SHEIN’s suppliers has their own account on the company’s internal platform, where they can monitor current sales, stock levels, and even bid on creating a new set of apparel.

SHEIN is typically able to produce new designs within three days since it works directly with manufacturers. Even competitors that are more technologically savvy, like as ASOS, will take a few weeks to do the same. Furthermore, it may make considerably lower bids.

SHEIN typically makes roughly 100 products, but even ultra-fast fashion shops such as Boohoo must purchase between 300 and 500 items.

SHEIN then evaluates how well those designs perform in its online shop. Traditional businesses do not have the option to test with their physical shops. When the test is judged successful, the product is subsequently rolled out to a broader group of clients. As a result of its short lead times, SHEIN is able to test over a thousand new goods every day.

SHEIN may avoid local import taxes since it uses dropshipping, which means it ships straight from the producer to the consumer. As a result, clients must wait significantly longer for their products to arrive.

Its consumer-to-manufacturer strategy, which is similar to Pinduoduo’s, is driven by aggressive client acquisition and in-app advertising strategies. For the first time, SHEIN collaborates with hundreds of influencers and even sponsors TV shows like The Voice by outfitting contestants in its clothing.

Furthermore, SHEIN employs different gamification strategies to tempt users to make impulsive purchases, such as countdown clocks, subscription discounts, trending stickers, and more. As a result of these practises, Rouge Media called SHEIN the “most manipulative” fashion website.

SHEIN may also add other monetization channels in the future. For example, it may enable manufacturers to buy advertising space on the site or simply transition to a marketplace model in which it takes a commission on each sale (similar to platforms like Poshmark).

Thanks for its entirely digital sales model, Shein saw its popularity soar during the pandemic as more people turned to online shopping. In 2020, Shein’s global sales doubled to $10 billion, about half that of Inditex Group. In May 2021, Shein overtook Amazon as the most downloaded shopping app in the U.S. Analysts believe Shein’s revenue is on track to surpass that of Inditex this year.

SHIEN Competitors

The top SheIn competitors are –

SHEIN Funding, Revenue & Valuation

SHEIN, according to Crunchbase, has raised a total of $2.1 billion across six rounds of venture funding.

Notable investors include Sequoia Capital China, Tiger Global Management, IDG Capital, Greenwoods Asset Management, and more.

SHEIN is currently being valued at $100 billion by those very same investors after raising $1.5 billion in Series F funding in April 2022. For reference, SHEIN’s valuation is higher than the one of H&M and Zara – combined.

Moreover, the company has generated about $15.7 billion in revenue for 2021 based on reporting from Reuters. In 2020, it allegedly made $5 billion.

Also Read: H&M – A Brand Delivering Affordable Fashion For Everyone

Who Owns SHEIN?

SHEIN’s ownership structure is not publicly disclosed. However, it is safe to infer that founder and CEO Chris Xu remains one of the company’s top stockholders.

He had bootstrapped the firm for five years before getting equity capital. He was probably able to negotiate more favourable conditions because he had a proven concept and existing income.

From an institutional standpoint, Sequoia Capital, which participated in two investment rounds, as well as Tiger Global Management, are anticipated to possess major stakes in SHEIN.

Company’s website – https://www.shein.com

To read more content like this, subscribe to our newsletter