SYSCO Corporation (an abbreviation for Systems and Services Company) is North America’s biggest marketer and distributor of foodservice products, with a 14 percent market share.

SYSCO serves about 390,000 restaurants, schools, hospitals, nursing homes, hotels, enterprises, and other foodservice clients through more than 160 distribution facilities situated across the continental United States and parts of Alaska, Hawaii, and Canada. Customers in restaurants contribute for over two-thirds of total income.

Fresh and frozen meats, fish, poultry, fully cooked dinners, fruit, canned and dry foods, desserts, imported specialities, paper and disposable goods, china and silverware, restaurant and kitchen equipment and supplies, and cleaning supplies comprise the company’s product line. Since its inception in 1969, SYSCO has developed gradually, mostly via dozens of acquisitions of smaller distributors, with double-digit gains in revenue and profitability practically every year.

History of Sysco Corporation

John Baugh was the driving factor behind the establishment of SYSCO. Baugh grew up on a ranch outside Waco, Texas, and got his start in the food industry while still in high school with a part-time work at a local A&P grocery store. He later created Zero Foods Company of Houston, a food distributor in Houston.

In 1969, Baugh persuaded the owners of eight other small food distributors to merge their businesses, producing what he anticipated would become a nationwide foodservice distribution company capable of distributing any product regardless of its geographical availability. Frost-Pack Distributing Company (Grand Rapids, Michigan); Global Frozen Foods, Inc. (New York); Houston’s Food Service Company (Houston); Louisville Grocery Company (Louisville, Kentucky); Plantation Foods (Miami, Florida); Texas Wholesale Grocery Corporation (Dallas); Thomas Foods, Inc. and its Justrite Food Service, Inc. subsidiary (Cincinnati); and Wicker, Inc. were the other eight original companies. The aggregate sales of the nine founding firms in 1969 was $115 million.

In 1970, SYSCO went public and made its first purchase, Arrow Food Distributor. Initially, the firm expanded by purchasing a series of modest foodservice distribution companies that were carefully selected for their geographic regions.

These acquisitions contributed to Baugh’s early objective of offering consistent service to consumers across the country. To deal with this fast development, SYSCO Corporation constructed several additional warehouses during the 1970s, subsequently inserting freezers into its warehouses and adding multi-temperature refrigerated vehicles to deliver produce and frozen items.

1980s: Rapid Growth Through Acquisitions

John E. Woodhouse, whom Baugh had appointed as chief financial officer in September 1969, took over as CEO of SYSCO in 1983, with Baugh remaining chairman. The next year, SYSCO resumed its acquisition strategy by purchasing three businesses of PYA Monarch, then a division of Sara Lee Corporation. One of SYSCO’s major acquisitions occurred in 1988, when the business paid $750 million for CFS Continental, the country’s third largest food distributor at the time, adding 4,500 people and expanding SYSCO’s service area to 148 of the top 150 areas.

Although most of the United States, particularly Texas, endured difficult economic circumstances throughout the 1980s, SYSCO Corporation remained unaffected as a national corporation in a largely recession-proof sector.

In the late 1980s, SYSCO also acquired several smaller foodservice distributors, including Olewine’s Inc. (Harrisburg, Pennsylvania), which was renamed Sysco Food Services of Central Pennsylvania, Inc.; Lipsey Fish Company, Inc. (Memphis, Tennessee); Hall One Chinese Imports, Inc. (Cleveland); and Fulton Prime Foods, Inc. (Albany, New York).

SYSCO reduced its acquisition pace in the late 1990s, although acquisitions were still considered as crucial for expansion in chosen new markets, particularly in far-flung places like as Alaska and Canada. Strano Foodservice of Peterborough, Ontario, was purchased in mid-1996, giving SYSCO a foothold in the Toronto market, and Alaska Fish and Farm, Inc. was purchased in early 1997.

SYSCO, on the other hand, implemented a “fold-out” expansion plan as a supplementary means of development beginning in 1995. This technique entailed establishing a sales base in markets far from an existing operation, then constructing a new distribution center, staffing it with transferred personnel, and thereby forming a stand-alone operational firm serving a new market. Through this initiative, SYSCO built its first distribution hub in Connecticut in 1995. Over the next four years, “fold-out” operating firms were established in Tampa and Riviera Beach, Florida, as well as Wisconsin, North Carolina, Birmingham, Alabama, and San Diego.

Also Read: Marketing Strategies Of Home Depot

Key Dates

- 1969:

- John Baugh, owner of Zero Foods Company of Houston, is the guiding force behind the creation of SYSCO Corporation from the combination of nine small food distributors.

- 1970:

- SYSCO goes public and makes its first acquisition, Arrow Food Distributor.

- 1979:

- Revenues surpass $1 billion.

- 1981:

- SYSCO becomes the largest U.S. foodservice distribution company.

- 1988:

- CFS Continental is acquired.

- 1991:

- SYSCO creates a subsidiary called the SYGMA Network, Inc. to consolidate its chain restaurant distribution systems.

- 1995:

- Company launches its “fold-out” expansion strategy as an additional method of growth.

- 2000:

- SYSCO acquires FreshPoint Holdings.

- 2002:

- Canadian operations are vastly enlarged through the purchase of Serca Foodservice.

- 2005:

- The first SYSCO regional redistribution centers open.

-

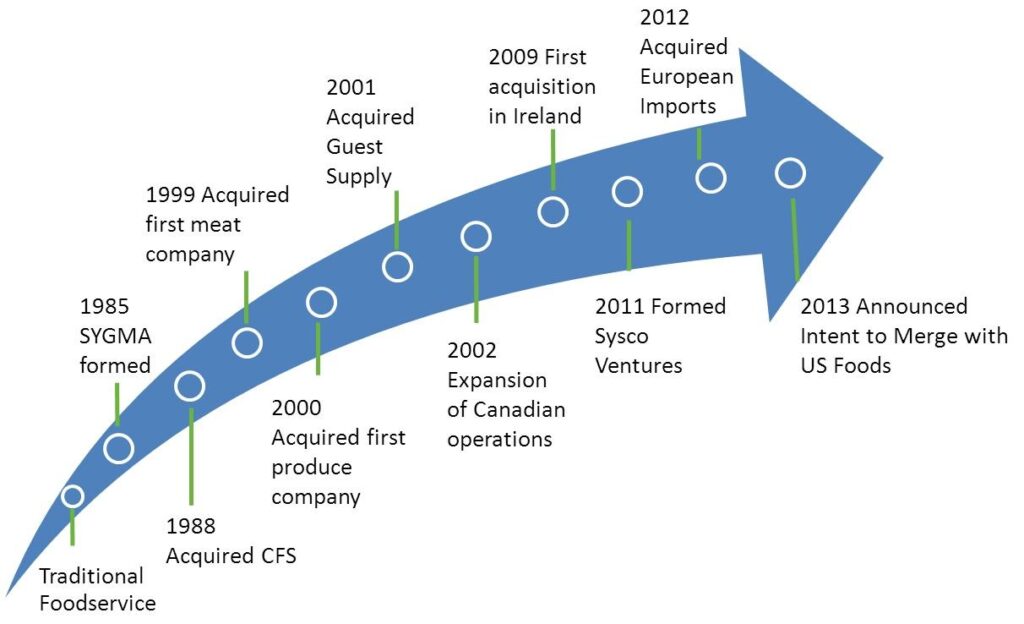

SYSCO Timeline

SYSCO’s constantly expanding revenues had reached $29.34 billion by fiscal 2004, a 12.2 percent increase over the previous year, while profitability had risen 16.6 percent to $907.2 million. However, fourth-quarter earnings fell short of Wall Street projections, owing in part to rising inflation on food purchased from suppliers. SYSCO removed 1,500 people from its workforce late in 2004 to decrease costs for the coming fiscal year.

SYSCO increased sales and profitability for the 29th consecutive year in fiscal 2005, although the increases were relatively minor, 6 percent for earnings, which totalled $961.5 million, and only 3.2 percent for revenues, which still surpassed $30 billion for the first time.

SYSCO was expected to maintain a careful check on spending while continuing to prioritize customer service and depending on its strong management team to keep the firm moving ahead, a team that had been enhanced over the years by a company strategy of keeping the managers of acquired enterprises. SYSCO was well-positioned to continue increasing its share of the foodservice distribution business, which had reached 14 percent by 2005.

To read more content like this, subscribe to our newsletter