Visa Inc. is one of the world’s leading digital payment companies, serving individual customers, retailers, financial institutions, and governments in over 200 countries and territories. The organization offers a wide range of services to financial institutions and merchants, including authorisation, clearing, and settlement.

Furthermore, while Visa does not issue credit or debit cards, it does provide consumers and companies with credit, debit, and prepaid card services. The real cards are issued by Visa’s clients.

Visa earns money by acting as a middleman between financial institutions and retailers. The corporation does not earn from the interest levied on Visa-branded card payments, which instead goes to the financial institution that issued the card. Visa has such a monopoly on the market that it has just a few major competitors, including Mastercard and American Express, as well as digital payment providers like PayPal.

Visa Business Model

The objective of Visa is to “connect the world with the most creative, dependable, and secure payment network, allowing individuals, organizations, and economies to prosper.”

Visa works with a variety of payment methods to fulfill this aim, including:

- Contactless transactions

- Digital wallets

- E-commerce

Visa is the quintessential “multi-sided platform.” Visa’s platform generates cross-side network effects by encouraging Visa cardholders to use their cards more, which encourages retailers to accept them more, and so on. On the money side, we may consider the merchants, and on the subsidies side, we can consider the customer. Visa devotes the majority of its efforts to encouraging consumer usage, which promotes merchant adoption.

VisaNet, a breakthrough payment technology, was created in 1973. The objective was to give a better way to make payments internationally, and they achieved more than fifty years later.

Banks build and construct credit card and debit card programs for their consumers using VisaNet’s payment processing technology. As previously stated, Visa does not issue credit cards or provide credit on its own; this is handled by banks.

Instead, Visa runs an open-loop payments network to aid in the management of payment information flow between businesses and financial institutions such as JP Morgan.

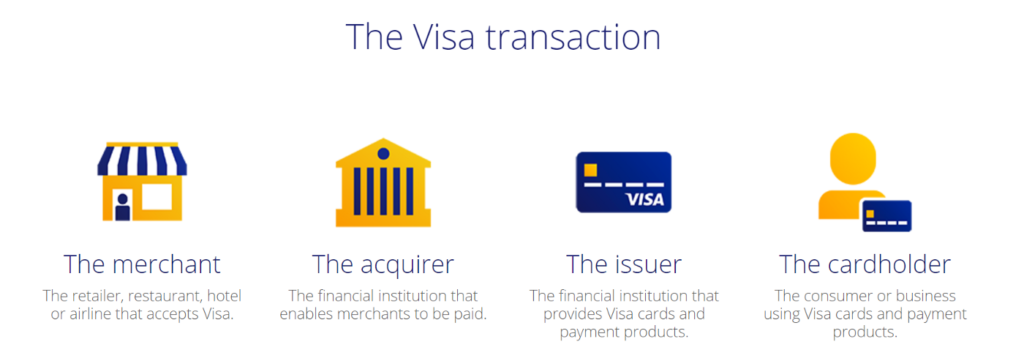

Visa’s ecosystem operates in this manner:

- Cardholders are customers who have a Visa debit or credit card.

- Issuers are financial firms that provide Visa cards to their account customers, such as JP Morgan. Credit card providers also establish interest rates and any other fees that may be charged to account holders.

- Payment processors, often known as payfacs, are third-party organizations that provide merchants with payment processing software and technology. These are sometimes independent firms, and other times they are the merchant acquirer or issuer acquirer. Square and JP Morgan, for example, can manage all three business sides: issuer, client, and merchant.

- Merchants are businesses that accept Visa cards as payment from customers.

- Acquirers are banks or payment processors that entice retailers like Starbucks to accept Visa cards.

- Merchant acquirers, such as Fiserv, provide merchants with access to Visa’s network connection and payment acceptance, as well as the ability to negotiate any discounts for taking Visa cards in their companies.

When a cardholder gives their Visa card to pay for their double coffee, the payment sequence is as follows:

- Starbucks sends the money to the acquirer when a consumer presents a Visa card for payment.

- The acquirer communicates with the issuer via the Visa Net network.

- The issuer sends sufficient money to complete the transaction, and this information is relayed back to the merchant.

- If the balance is sufficient, the merchant accepts the payment; otherwise, it is rejected.

The issuer invoices the credit card holder on a monthly basis, and the customer pays the balance due.

If all goes well, Starbucks will bring you your double latte, keeping in mind that the aforementioned process takes only seconds to complete.

Visa offers many different products and services to its customers, including:

- Products – Visa-branded debit cards, credit cards, commercial cards, prepaid cards, and mobile and money transfers are among the products available.

- Services – include authorization, clearing, and settlement services, as well as mobile financial services such as mobile payments and money transfers.

Visa, which operates one of the world’s largest payment systems, is also one of the most straightforward companies. It can practically turn out the lights in the office and still earn money. The protocol and network they developed over fifty years ago are still operational.

It is easy to grasp the business once you realize they are the intermediary in the payment processing order flow and operate as the toll booth for all payments.

Also Read: HDFC Bank – Profile, History, Share Price, Marketing Strategies

How Visa Makes Money?

Visa generates money through four distinct segments:

Service Revenue

The revenue from services offered to support client usage of Visa’s payment services makes up Visa’s service subsegment. This is distinct from the authorisation, clearing, and settlement processes associated with the company’s payment services, which are covered above. Visa’s service revenue was $3.2 billion in Q1 FY 2022, accounting for about 34% of the company’s overall gross revenue. This is up 19.3% over the previous quarter.

Data Processing Revenue

Visa’s data processing revenue comprises revenue from clearing, settlement, authorization, value-added services, network access, and other comparable services. In the first quarter of fiscal year 2022, data processing revenue accounted for the majority of the company’s total revenue: $3.6 billion, or around 38%. This statistic is up 19.2% from the first quarter of fiscal year 2021.

International Transaction Revenue

Visa is significantly involved in cross-border transaction processing and currency conversion, which create income in the international transaction revenue subsegment. International transaction revenue was $2.2 billion in Q1 FY 2022, accounting for about 23% of total revenue. When compared to the same quarter last year, revenue for this component increased by 49.8%.

Other Revenue

Visa also generates money through license fees, value-added services, account holder services, certification, and other means. These sources are categorized as Other. The Other component accounts for the smallest share of revenue at $449 million, or 5% of Visa’s Q1 FY 2022 total revenue. Other revenue increased 16.9% over the previous quarter.

Explore Visa’s financials here

Visa established global processing centers with connected infrastructure consisting of many synchronized processing centers, all of which are interconnected and constructed for redundancy in order to capture value for its clients. Visa’s processing facilities are as follows:

- Ashburn, Virginia

- Highlands Ranch, Colorado

- London, England

- Singapore

Visa’s guarantee includes ensuring the secure, efficient, and consistent processing of payments for its banks, cardholders, and merchants. In this day and age of hacking, it’s incredible that Visa’s network has never gone down.

To read more content like this, subscribe to our newsletter