JPMorgan Chase is a leading global financial services firm that offers a range of financial solutions to customers and clients worldwide. The company was formed in 2000 when J.P. Morgan & Co. merged with The Chase Manhattan Corporation, creating one of the largest banking institutions in the world.

As of 2021, JPMorgan Chase has over 250,000 employees and operates in over 100 countries. The company is headquartered in New York City and has assets of over $3 trillion, making it one of the largest financial institutions in the world.

JPMorgan Chase serves millions of customers, including individuals, small businesses, corporations, and governments. The company offers a range of financial services, including banking, investment management, asset management, and commercial banking.

In addition to its core financial services, JPMorgan Chase is also committed to corporate responsibility and sustainability. The company has pledged to invest $200 billion in clean energy and sustainable development projects by 2025, and has also set a goal to source 100% of its global energy needs from renewable sources by 2020.

JPMorgan Chase has received numerous awards and recognition for its financial services, including being named the World’s Most Admired Company in the banking industry by Fortune magazine in 2021.

History of JPMorgan & Chase – Margers of two financial powerhouses

The history of JPMorgan & Chase can be traced back to the 19th century, when two of the most prominent names in banking – J.P. Morgan and John D. Rockefeller – were making their mark on the financial industry.

J.P. Morgan, born in 1837, began his career in finance working for his father’s banking firm, J.S. Morgan & Co. After his father’s death, he joined the banking firm of Dabney, Morgan & Company, which later became J.P. Morgan & Co. Morgan quickly established himself as one of the most powerful bankers in the United States, and he played a major role in shaping the country’s economy during the late 19th and early 20th centuries.

John D. Rockefeller, born in 1839, made his fortune in the oil industry. He founded Standard Oil in 1870 and built it into one of the largest and most profitable companies in the world. Rockefeller’s wealth allowed him to become a major player in the financial industry, and he was a key investor in many of the companies that J.P. Morgan financed.

In 1877, J.P. Morgan formed a partnership with Anthony Drexel to create the banking firm Drexel, Morgan & Co. The firm quickly became one of the most successful and influential banks in the country, and it was involved in many of the major financial deals of the late 19th century.

Meanwhile, John D. Rockefeller had begun to focus more on philanthropy in the early 20th century, and he established the Rockefeller Foundation in 1913 to support scientific research, medical education, and public health initiatives.

In 1914, J.P. Morgan died, and his son, J.P. Morgan Jr., took over the family’s banking firm. The younger Morgan continued to expand the firm’s reach, and in 1930, it merged with the Guaranty Trust Company to become the largest bank in the world.

In 1955, the banking firm merged with the Chase National Bank to form the Chase Manhattan Bank. The new bank continued to grow, and it became known for its innovative financial products and services.

In 2000, the Chase Manhattan Bank merged with J.P. Morgan & Co. to form JPMorgan Chase. The new company became one of the largest and most powerful financial institutions in the world, offering a wide range of financial services to customers and clients worldwide.

Since its formation, JPMorgan Chase has continued to expand and innovate, and it has become a major player in the global financial industry. Today, the company is headquartered in New York City and has operations in over 100 countries, with assets of over $3 trillion.

The legend that JP Morgan was

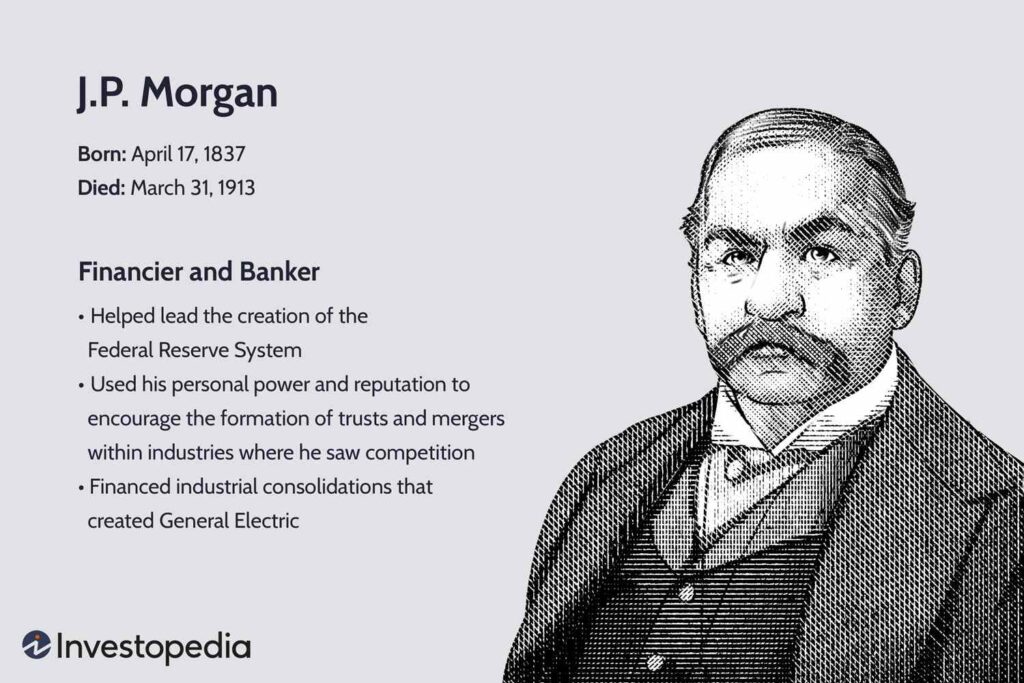

J.P. Morgan, also known as John Pierpont Morgan, was an American financier and banker who lived from 1837 to 1913. He was born into a wealthy family and went on to become one of the most influential figures in the financial industry.

J.P. Morgan began his career as a clerk at the banking firm of Duncan, Sherman & Company in New York City. He quickly rose through the ranks and became a partner in the firm, which was later renamed J.P. Morgan & Company.

Under Morgan’s leadership, the firm became one of the most powerful and respected banks in the world. Morgan was involved in many of the major financial deals of the late 19th and early 20th centuries, including the formation of U.S. Steel, the acquisition of the Northern Pacific Railroad, and the creation of General Electric.

In addition to his work in banking, J.P. Morgan was also known for his philanthropy and public service. He donated millions of dollars to charity and supported many educational and cultural institutions, including the Metropolitan Museum of Art and the American Museum of Natural History.

J.P. Morgan’s influence in the financial industry was such that he was able to intervene in several major financial crises and prevent them from turning into full-blown panics. In 1907, he led a group of bankers in a plan to provide liquidity to struggling banks, which helped to stabilize the financial system and prevent a widespread economic downturn.

J.P. Morgan died in 1913 at the age of 75, but his name has continued to be associated with excellence in banking and finance long after his death. The banking firm he founded, J.P. Morgan & Company, has gone through several mergers and acquisitions over the years and is now part of JPMorgan Chase, one of the largest banks in the world.

Overall, J.P. Morgan’s legacy as a financier, banker, philanthropist, and public servant has helped to shape the American economy and financial system in profound ways, and his influence is still felt today.

Business Segments of JP Morgan

JPMorgan Chase operates through several business segments, each focused on providing specific financial services to its clients. Here are the main business segments of JPMorgan Chase:

Consumer & Community Banking (CCB) – This segment provides financial services to consumers, including deposit accounts, loans, credit cards, and wealth management services. CCB also includes Chase Wealth Management, which offers investment advice and financial planning services to affluent clients.

Corporate & Investment Bank (CIB) – This segment provides a range of services to corporations, financial institutions, and governments worldwide, including investment banking, market making, treasury services, and securities services.

Commercial Banking (CB) – This segment provides banking services to mid-sized businesses, corporations, and municipalities in the United States. CB offers financing, treasury services, and cash management services to its clients.

Asset & Wealth Management (AWM) – This segment offers a range of investment management and wealth management services to individuals, families, and institutions. AWM provides services such as investment management, trust and estate planning, and retirement planning.

Corporate – This segment includes the company’s corporate functions and support services, such as finance, legal, human resources, and technology.

JPMorgan Chase’s business segments work together to provide a comprehensive range of financial services to its clients. The company’s diverse business mix and global reach enable it to serve a wide range of customers, from individuals to large corporations, and to adapt to changing market conditions.

Also Read: Too Big To Fail: Examining The Top 10 Companies With Systemic Importance

Why is JP Morgan so influential

JPMorgan Chase & Co. is one of the most influential financial institutions in the world, with a long history and a global reach. There are several reasons why JPMorgan Chase is so influential:

Size and scope – JPMorgan Chase is one of the largest banks in the world, with over $3 trillion in assets and operations in more than 100 countries. Its size and scope allow it to provide a wide range of financial services to individuals, businesses, and governments. JPMorgan Chase has a vast network of branches, ATMs, and online and mobile banking platforms that offer banking, lending, and investment services to customers across the globe. Its large customer base, extensive branch network, and diversified operations enable it to reach a broad range of customers and serve their needs effectively.

Diversified business model – JPMorgan Chase operates through several business segments, including consumer banking, commercial banking, investment banking, and asset management. Its diversified business model allows it to weather economic cycles and adapt to changing market conditions. Consumer banking provides services such as checking accounts, credit cards, mortgages, and personal loans.

Commercial banking provides services to businesses and corporations, such as lending, cash management, and treasury services. Investment banking provides services such as underwriting, mergers and acquisitions, and securities trading.

Asset management provides investment advice and portfolio management services to individuals, institutions, and governments. This diversified business model enables JPMorgan Chase to balance risks and opportunities across different market segments and provide a range of services to its customers.

Reputation for excellence – JPMorgan Chase has a reputation for excellence in banking and finance, built over more than a century of operation. Its expertise in areas such as investment banking, treasury services, and asset management is widely recognized. JPMorgan Chase has won numerous awards and accolades over the years, including being named the world’s best bank by Euromoney magazine in 2020. Its reputation for excellence helps it attract and retain top talent, build trust with customers, and maintain its position as a leading financial institution.

Political connections – JPMorgan Chase has long-standing connections to the political world, with many of its executives and board members holding high-level government positions. Its influence in Washington, D.C. and other global capitals is significant. JPMorgan Chase’s political connections have helped it shape regulatory policy, gain access to government contracts, and navigate complex legal and regulatory environments.

However, its close ties to government also make it vulnerable to criticism and scrutiny, especially in times of crisis.

Technology and innovation – JPMorgan Chase has invested heavily in technology and innovation, and is at the forefront of many emerging trends in finance, such as blockchain and digital payments. The bank has developed a number of proprietary technologies, such as its Athena trading platform and its blockchain-based payment system, JPM Coin.

JPMorgan Chase’s focus on technology and innovation enables it to offer cutting-edge services to its customers, reduce costs, and stay ahead of its competitors. However, it also exposes the bank to risks such as cybersecurity threats and technological disruption.

Overall, JPMorgan Chase’s size, scope, diversified business model, reputation for excellence, political connections, and focus on technology and innovation have all contributed to its influential position in the financial industry.

JPMorgan & Chase Investment Strategies

JPMorgan Chase & Co. is one of the largest and most prominent investment banks in the world. The bank has a long history of developing and implementing successful investment strategies across a wide range of asset classes, including equities, fixed income, currencies, and commodities.

Here are some of JPMorgan’s key investment strategies:

Active management: JPMorgan is known for its active management style, which involves actively selecting individual securities and making investment decisions based on market trends and macroeconomic conditions. This approach is intended to generate higher returns than passive management, which simply tracks an index.

Diversification: JPMorgan emphasizes diversification across a wide range of asset classes, sectors, and geographies. This strategy is intended to reduce risk by spreading investments across multiple areas, rather than relying on a single investment or sector.

Long-term focus: JPMorgan takes a long-term investment approach, with a focus on investing in companies and assets that it believes will generate sustainable returns over time. The bank also emphasizes the importance of conducting thorough due diligence on investments to ensure they meet its rigorous standards.

Quantitative analysis: JPMorgan uses sophisticated quantitative analysis tools to evaluate investment opportunities and make investment decisions. This approach involves analyzing large amounts of data and using statistical models to identify trends and patterns that may not be immediately apparent to human analysts.

ESG investing: JPMorgan has also recently placed a greater emphasis on environmental, social, and governance (ESG) investing. This approach involves taking into account factors such as a company’s environmental impact, labor practices, and corporate governance when making investment decisions.

Overall, JPMorgan’s investment strategies are designed to generate long-term value for its clients while managing risk and volatility in the markets. The bank’s combination of active management, diversification, long-term focus, quantitative analysis, and ESG investing has enabled it to develop a strong track record of success in the investment world.

JP Morgan & Chase Co role in 2008 Financial Crisis

JPMorgan Chase & Co. (JPM) is one of the largest and most influential financial institutions in the world. It played a significant role in the 2008 financial crisis, which was the most severe financial crisis since the Great Depression. The crisis resulted in a severe recession that affected the global economy, causing widespread job losses, bank failures, and widespread home foreclosures.

JPMorgan Chase & Co. was involved in the crisis in several ways, including:

Mortgage-backed securities: JPMorgan Chase & Co. was one of the largest issuers of mortgage-backed securities (MBS) during the housing bubble that preceded the financial crisis. These securities were created by bundling together large numbers of home loans, and then selling them to investors in the form of bonds. JPMorgan Chase & Co. sold billions of dollars worth of MBS, many of which were backed by risky subprime mortgages that were likely to default.

Derivatives: JPMorgan Chase & Co. was also a major player in the derivatives market, which is essentially a form of insurance on financial products. The bank sold credit default swaps (CDS), which are a type of derivative that provide insurance against the default of a financial product, such as a bond or a mortgage-backed security. JPMorgan Chase & Co. sold CDS on many of the same risky MBS that it had issued.

Bear Stearns: In March 2008, JPMorgan Chase & Co. acquired Bear Stearns, one of the largest investment banks on Wall Street. Bear Stearns had been heavily involved in the mortgage market and was struggling to stay afloat as the housing bubble burst. JPMorgan Chase & Co. agreed to buy Bear Stearns for a fraction of its previous value, effectively bailing out the firm.

WaMu: Later that year, in September 2008, JPMorgan Chase & Co. acquired Washington Mutual (WaMu), one of the largest savings and loans in the United States. WaMu had also been heavily involved in the mortgage market and was on the brink of collapse due to its exposure to subprime mortgages. JPMorgan Chase & Co. purchased WaMu’s assets and deposits for a fraction of their previous value, effectively bailing out the institution.

The role of JPMorgan Chase & Co. in the financial crisis was controversial. Some critics argued that the bank had engaged in risky behavior, such as issuing and selling large amounts of subprime MBS and CDS, which had contributed to the crisis. Others pointed out that JPMorgan Chase & Co. had actually been relatively conservative compared to other financial institutions, and that its acquisitions of Bear Stearns and WaMu had prevented even greater damage to the financial system.

In the aftermath of the crisis, JPMorgan Chase & Co. was one of several large financial institutions that received government bailouts in the form of loans and guarantees. The bank also faced significant legal and regulatory scrutiny, as regulators sought to prevent similar crises from occurring in the future.

To read more content like this, subscribe to our newsletter