What is Brex?

Brex is a fintech company that provides corporate credit cards and financial services to startups and businesses. It was founded in 2017 by two Brazilian entrepreneurs, Henrique Dubugras and Pedro Franceschi, with the goal of making financial services more accessible and tailored to the needs of startups.

Brex offers a unique approach to corporate credit cards, with no personal guarantee required, no fees or interest charges, and a rewards program that is specifically designed for startup companies. The company also offers cash management accounts, expense management tools, and other financial services tailored to the needs of startups.

Since its founding, Brex has experienced significant growth and has become one of the most valuable fintech startups in the world. As of its last funding round in May 2022, the company was valued at $12.4 billion. In addition, Brex has raised over $1.5 billion in venture capital funding from investors such as Ribbit Capital, Kleiner Perkins, and Y Combinator.

Brex has also attracted a significant customer base, with over 10,000 businesses and startups using its services as of 2021. This includes a number of high-profile companies such as Airbnb, Y Combinator, and Carta.

Overall, Brex has emerged as a major player in the fintech industry, offering innovative financial services and credit solutions to startups and businesses. Its growth and success reflect a growing trend towards the use of fintech services and digital solutions for financial management, particularly among younger and more tech-savvy entrepreneurs.

What does Brex do?

Brex offers a range of financial services and products, primarily focused on serving the needs of startups and businesses. The core offerings of Brex include corporate credit cards, cash management accounts, and expense management tools.

Brex’s corporate credit card is designed specifically for startups and businesses, with features such as no personal guarantee, no fees or interest charges, and a rewards program that is tailored to the needs of the startup ecosystem. This means that startups can use the Brex card to make purchases and manage their expenses without having to worry about high fees or interest charges.

In addition to its credit card, Brex also offers a cash management account that provides businesses with a place to store and manage their cash balances. This account offers higher interest rates than traditional bank accounts and comes with a range of features designed to help businesses manage their cash flow more effectively.

Finally, Brex offers a range of expense management tools that allow businesses to track and categorize their expenses, automate their accounting processes, and generate reports to help with budgeting and financial planning.

Overall, Brex’s products and services are designed to help startups and businesses manage their finances more effectively, with a particular focus on providing solutions that are tailored to the unique needs of the startup ecosystem.

What is Business Model of Brex?

Brex’s business model is focused on providing financial services and products to startups and businesses, with a particular emphasis on leveraging technology to offer innovative solutions that are tailored to the needs of this market segment. Below are some of the key elements of Brex’s business model:

Revenue streams: Brex generates revenue primarily through interchange fees charged on transactions made with its corporate credit card. The company also earns interest income on cash held in its cash management accounts.

Target market: Brex’s target market is primarily startups and businesses, with a focus on serving the unique financial needs of this market segment. This includes offering credit solutions without requiring a personal guarantee, providing higher interest rates on cash management accounts, and offering expense management tools that are tailored to the needs of businesses.

Technology focus: Brex’s business model is heavily focused on leveraging technology to offer innovative financial solutions. This includes using machine learning and data analytics to identify creditworthy customers, automating expense tracking and accounting processes, and offering real-time spending controls and fraud protection.

Partner ecosystem: Brex has built a partner ecosystem that includes a range of companies that serve startups and businesses, such as venture capital firms, co-working spaces, and software providers. By partnering with these companies, Brex is able to reach a wider audience and offer its products and services to customers through a range of channels.

Growth strategy: Brex’s growth strategy is focused on expanding its customer base, both within its existing market segment and into new markets. The company has also expanded its product offerings to include cash management accounts and other financial services, and has plans to continue to expand its product suite in the future.

Overall, Brex’s business model is built on leveraging technology to offer innovative financial solutions that meet the unique needs of startups and businesses. By focusing on this market segment and offering tailored solutions, Brex has been able to carve out a niche in the fintech industry and achieve significant growth and success.

Funding and Investors of Brex

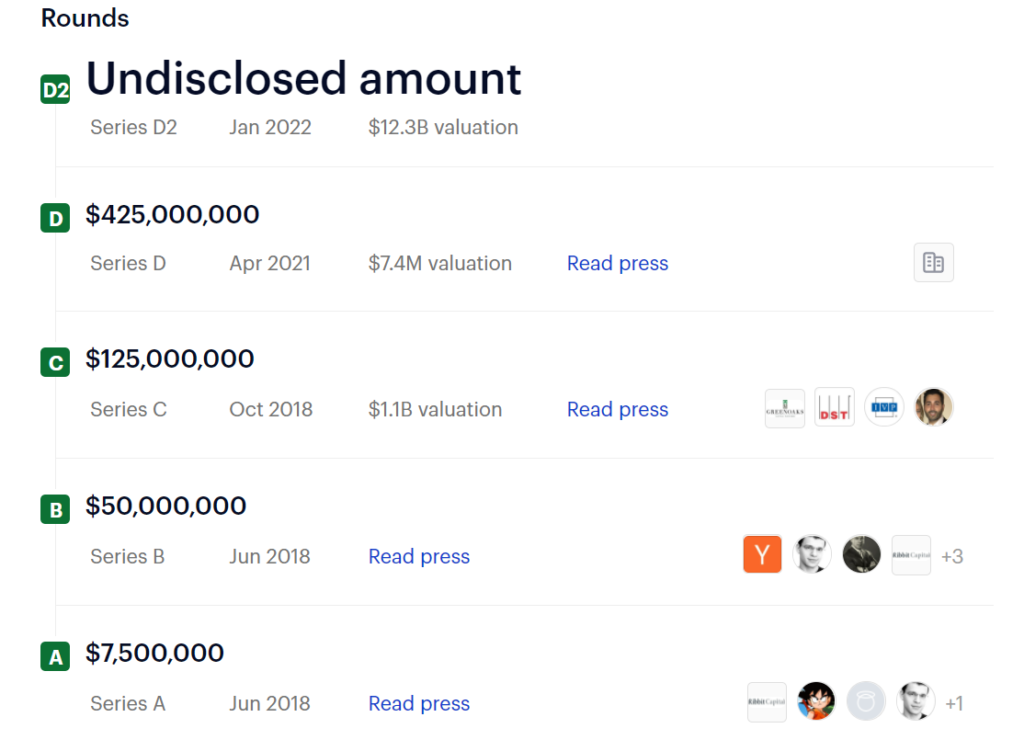

Brex has raised a significant amount of funding since its founding in 2017. Below is an overview of the company’s funding history:

Overall, Brex has raised over $1.5 billion in venture capital funding and debt financing since its founding. The company has attracted support from a range of high-profile investors, including Peter Thiel, Kleiner Perkins, and Tiger Global, and has used its funding to expand its product offerings, grow its customer base, and invest in technology and infrastructure to support its business.

What are some of Brex Competitors?

Brex competes with a range of companies in the fintech industry, including other providers of corporate credit cards, cash management accounts, and expense management tools. Below is an overview of how Brex compares to some of its main competitors:

American Express: American Express is one of the largest providers of corporate credit cards in the world and has a long history in the financial services industry. Compared to Brex, American Express offers a wider range of card options, including both charge cards and credit cards, as well as more robust rewards programs. However, American Express charges fees and interest on its cards, whereas Brex does not, and Brex’s card is designed specifically for startups and businesses.

Silicon Valley Bank: Silicon Valley Bank is a bank that specializes in serving the needs of startups and technology companies. Like Brex, Silicon Valley Bank offers cash management accounts and other financial services tailored to the needs of startups. However, Silicon Valley Bank does not offer a corporate credit card, and its cash management accounts may have higher fees and lower interest rates than Brex’s.

Also Read: SVB Crisis Explained: The Rise And Fall of Silicon Valley Bank

Divvy: Divvy is another provider of corporate credit cards and expense management tools, similar to Brex. However, Divvy’s card requires a personal guarantee, unlike Brex’s, and its rewards program may not be as tailored to the needs of the startup ecosystem. On the other hand, Divvy offers more robust budgeting and spending controls than Brex.

Ramp: Ramp is a newer entrant in the corporate credit card space, and like Brex, it offers a card with no fees or interest charges. However, Ramp’s card does require a personal guarantee, unlike Brex’s, and its rewards program may not be as robust as Brex’s. On the other hand, Ramp offers more advanced expense management tools than Brex, including automated receipt matching and real-time transaction categorization.

Overall, Brex differentiates itself from its competitors by offering a corporate credit card with no fees or interest charges, cash management accounts with higher interest rates, and expense management tools tailored to the needs of startups and businesses. While some of its competitors may offer more robust features in certain areas, Brex’s focus on serving the unique needs of the startup ecosystem has helped it carve out a niche in the fintech industry.

Growth and Revenue of Brex

The company has reported significant growth in terms of its customer base, product offerings, and funding rounds since its founding in 2017.

Here are some key milestones and growth figures for Brex:

Valuation: In just two years after its founding, Brex reached a $2.6 billion valuation in 2019. In 2021, the company announced a $7.4 billion valuation after raising $425 million in a Series D funding round.

Customer Base: As of 2021, Brex has more than 10,000 customers, including startups, small businesses, and larger enterprises. The company has reported that its customer base has grown by 10 times over the past year.

Product Offerings: While Brex initially launched as a corporate credit card provider, the company has expanded its offerings to include cash management accounts, expense management tools, and other financial services tailored to the needs of startups and businesses. In 2020, Brex launched Brex Cash, a cash management account with a higher interest rate than traditional banks. The company has also launched Brex Rewards, a rewards program that offers cash back on purchases in categories such as software, advertising, and travel.

Funding Rounds: Since its founding in 2017, Brex has raised more than $1.2 billion in funding across multiple funding rounds. The company’s investors include major venture capital firms such as Ribbit Capital, DST Global, and Kleiner Perkins.

Employee Growth: Brex has grown its employee base rapidly since its founding, with more than 1,000 employees as of 2021. The company has also expanded its presence globally, with offices in San Francisco, New York, Vancouver, and São Paulo.

Overall, these growth figures suggest that Brex has experienced significant success since its founding and is well-positioned for future growth in the fintech industry. The company’s focus on serving the unique needs of startups and businesses has likely contributed to its rapid growth and high valuations in recent years.

Future of Brex

The future of Brex looks promising as the company continues to expand its product offerings and customer base. Here are some factors that could contribute to the company’s future success:

Continued Expansion: Brex has already expanded beyond its original focus on corporate credit cards to include cash management accounts, expense management tools, and other financial services tailored to the needs of startups and businesses. The company has also expanded globally, with offices in San Francisco, New York, Vancouver, and São Paulo. As Brex continues to expand its offerings and presence, it may be able to capture even more of the growing fintech market.

Innovation: Brex has already demonstrated its ability to innovate with the launch of new products such as Brex Cash and Brex Rewards. The company may continue to innovate in the future with new products or services that meet the evolving needs of its customers.

Strategic Partnerships: Brex has already formed partnerships with other companies such as BigCommerce and Shopify to offer its products and services to their customers. As the company continues to grow, it may form additional strategic partnerships that could help it expand its reach and customer base even further.

Competitive Landscape: The fintech industry is highly competitive, with many other companies offering similar products and services to Brex. However, Brex has already demonstrated its ability to differentiate itself from its competitors with its focus on serving the unique needs of startups and businesses. If the company can continue to differentiate itself and provide superior products and services, it may be able to maintain its competitive advantage in the future.

Overall, while there are no guarantees for any company’s future success, Brex has already achieved significant growth and success in a relatively short period of time. If the company can continue to expand its offerings, innovate, form strategic partnerships, and differentiate itself from its competitors, it may be able to achieve even greater success in the future.

To read more content like this, subscribe to our newsletter