Bank of America is one of the largest financial institutions in the world, with a history that dates back over a century. The company has grown into a global financial powerhouse, offering a wide range of financial products and services to individuals, businesses, and governments around the world.

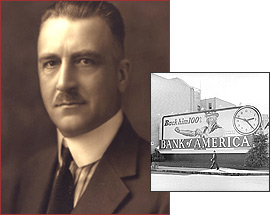

Bank of America was founded in 1904 in San Francisco, California, as the Bank of Italy by Amadeo Giannini. The bank’s original purpose was to serve immigrants and small businesses who were unable to obtain loans from traditional banks. The bank’s early success was due to its innovative approach to lending, which focused on evaluating borrowers based on their character and future earning potential, rather than just their credit history.

Over the years, the bank grew and expanded its operations, eventually changing its name to Bank of America in 1930. The bank played a key role in financing the growth of California’s economy, particularly in the aerospace, defense, and high-tech industries.

In the 1980s and 1990s, Bank of America underwent a period of rapid expansion and consolidation, acquiring a number of smaller banks and financial institutions. In 1998, the bank merged with NationsBank, creating the largest bank in the United States at the time, with assets of over $570 billion.

Today, Bank of America is a global financial institution with operations in over 35 countries and a market capitalization of over $230 billion. The bank’s business is divided into several key segments, including consumer banking, commercial banking, wealth management, and investment banking.

Some key facts about Bank of America include:

- Bank of America is the second-largest bank in the United States by assets, behind JPMorgan Chase.

- The bank has over 4,000 branches and 16,000 ATMs across the United States.

- Bank of America serves over 66 million consumer and small business clients.

- The bank has over 200,000 employees worldwide.

- In 2020, Bank of America generated over $85 billion in revenue.

- The bank is a leader in sustainable finance, having committed to a $1.5 trillion goal in sustainable finance by 2030.

Overall, Bank of America has a long and storied history as one of the world’s largest and most influential financial institutions. Its innovative approach to lending, focus on customer service, and commitment to sustainability have helped it maintain its position as a leader in the global financial industry.

Founding History of Bank of America

Bank of America has a rich history that dates back to the early 20th century. The bank was founded by a man named Amadeo Pietro Giannini, an Italian-American who had a vision of creating a bank that would serve the needs of the common people.

In 1904, Giannini founded the Bank of Italy in San Francisco, California. At the time, most banks were catering to the needs of the wealthy and well-connected, and few were willing to lend money to the working-class and immigrant communities. Giannini’s vision was to create a bank that would serve the needs of the average person, and he did so by offering small loans to individuals who didn’t have collateral or credit history.

Giannini was able to get his bank off the ground by soliciting deposits from the Italian-American community in San Francisco. He set up his bank in a converted saloon, which was a convenient location for many of his customers who were working in the nearby fishing and produce markets.

One of the key factors that set Giannini’s bank apart from others at the time was his approach to lending. Rather than relying solely on a borrower’s credit history or collateral, Giannini believed in evaluating a borrower based on their character and future earning potential. He was willing to take risks on borrowers who didn’t fit the traditional mold of a bank customer, and this approach proved to be successful.

In 1906, just two years after the Bank of Italy was founded, San Francisco was hit by a devastating earthquake and fire. Many banks were destroyed, and others were unable to operate due to the widespread damage. Giannini saw an opportunity to help the community, and he quickly set up a makeshift bank on the San Francisco docks. He used his own personal wealth to make loans to people who had lost everything in the disaster, and this act of generosity earned him the respect and admiration of many.

Over the years, the Bank of Italy grew and expanded its operations, opening branches in other parts of California and eventually changing its name to Bank of America in 1930. Giannini remained at the helm of the bank until 1945, and during his tenure, the bank played a key role in financing the growth of California’s economy, particularly in the aerospace, defense, and high-tech industries.

Today, Bank of America is one of the largest financial institutions in the world, with operations in over 35 countries and a market capitalization of over $200 billion. The bank’s success can be traced back to Giannini’s vision of creating a bank that would serve the needs of the common people and his innovative approach to lending, which focused on evaluating borrowers based on their character and future earning potential.

Mergers & Acquisitions of Bank of America

Bank of America has a long history of mergers and acquisitions that have helped to shape the bank into the global financial institution it is today. Here are some of the most significant mergers and acquisitions that Bank of America has undertaken over the years:

NationsBank merger: In 1998, Bank of America merged with NationsBank, a bank based in Charlotte, North Carolina. This merger created the largest bank in the United States at the time, with assets of over $570 billion.

FleetBoston Financial acquisition: In 2004, Bank of America acquired FleetBoston Financial, a bank based in Boston, Massachusetts, in a deal worth $47 billion. This acquisition gave Bank of America a strong presence in the Northeastern United States.

MBNA Corporation acquisition: In 2006, Bank of America acquired MBNA Corporation, a credit card company, in a deal worth $35 billion. This acquisition made Bank of America one of the largest credit card issuers in the world.

Countrywide Financial acquisition: In 2008, Bank of America acquired Countrywide Financial, a mortgage lender, in a deal worth $4 billion. This acquisition gave Bank of America a significant presence in the mortgage market.

- Merrill Lynch acquisition: In 2009, Bank of America acquired Merrill Lynch, a global investment bank, in a deal worth $50 billion. This acquisition made Bank of America one of the largest financial institutions in the world, with a broad range of capabilities across investment banking, wealth management, and retail banking.

U.S. Trust acquisition: In 2007, Bank of America acquired U.S. Trust, a private wealth management firm, in a deal worth $3.3 billion. This acquisition helped to expand Bank of America’s wealth management business and gave the bank a strong presence in the high net worth market.

First Republic Bank acquisition: In 2007, Bank of America acquired First Republic Bank, a private bank and wealth management firm, in a deal worth $1.8 billion. This acquisition helped to expand Bank of America’s wealth management business and gave the bank a strong presence in the West Coast market.

Overall, Bank of America’s mergers and acquisitions have helped to expand the bank’s geographic reach, diversify its business lines, and strengthen its position in key markets. However, some of these deals have also been controversial, with some analysts questioning whether the bank has overextended itself and taken on too much risk.

Financials of Bank of America

Bank of America has been one of the largest and most successful banks in the world for many years. The bank has a long history of strong financial performance, with consistently high levels of revenue, net income, and assets under management. Here are some key financial metrics for Bank of America over the past few years:

Revenue: In 2023, Bank of America generated revenue of $130.1 billion, up from $115.1 billion in 2022. This marked a 38.76% increase in revenue year-over-year.

Net income: In 2023, Bank of America reported net income of $7.04 billion, down from $26.01 billion in 2020. This marked a decrease in net income year-over-year.

Total assets: Bank of America had total assets of $2.9 trillion as of December 31, 2021. This marked a 10% increase in total assets year-over-year.

Return on equity (ROE): Bank of America’s ROE was 13.2% in 2021, up from 6.8% in 2020. This was a significant improvement in ROE year-over-year.

Overall, Bank of America has been performing well financially in recent years. The bank has benefited from a strong economy and favorable interest rate environment, as well as its diversified business lines and geographic reach. However, like all banks, Bank of America is subject to various risks, including economic, regulatory, and operational risks, that could impact its financial performance in the future.

Different Segments of Bank of America

Consumer Banking: Bank of America is one of the largest retail banks in the United States, serving more than 66 million consumer and small business clients. The Consumer Banking segment includes several key businesses, including Deposits, Consumer Lending, and Global Wealth & Investment Management. Deposits include checking and savings accounts, certificates of deposit, and other deposit products. Consumer Lending includes mortgages, home equity loans, and other consumer loans. Global Wealth & Investment Management includes Merrill Lynch Wealth Management, U.S. Trust, and other wealth management businesses that provide investment management, trust and estate planning, and other services to clients.

Global Wealth & Investment Management: Bank of America’s Global Wealth & Investment Management segment provides wealth management services to clients with investable assets of $250,000 or more. The segment includes Merrill Lynch Wealth Management, U.S. Trust, and other wealth management businesses. Merrill Lynch Wealth Management is one of the largest wealth management firms in the world, with more than 14,000 financial advisors and $2.9 trillion in client assets under management. U.S. Trust provides wealth management services to ultra-high net worth individuals, families, and institutions.

Global Banking: Bank of America’s Global Banking segment provides a wide range of banking and financial services to corporate and institutional clients. The segment includes several key businesses, including Investment Banking, Corporate Banking, Commercial Real Estate, and Treasury Services. Investment Banking provides advisory and underwriting services for mergers and acquisitions, debt and equity offerings, and other transactions. Corporate Banking provides lending, leasing, and other banking services to large corporations. Commercial Real Estate provides financing and other services to commercial real estate developers and investors. Treasury Services provides cash management, trade finance, and other treasury solutions to clients.

Global Markets: Bank of America’s Global Markets segment provides a wide range of trading and market-making services to institutional clients around the world. The segment includes several key businesses, including Equities, Fixed Income, Currencies, and Commodities. Equities provides trading and market-making services for equities and equity-related products. Fixed Income provides trading and market-making services for fixed income and credit products. Currencies provides trading and market-making services for foreign exchange products. Commodities provides trading and market-making services for commodities products.

All Other: Bank of America’s All Other segment includes all other businesses that are not included in the other four segments. This includes legacy businesses, discontinued operations, and other miscellaneous items. The All Other segment is relatively small compared to the other segments and does not contribute significantly to Bank of America’s overall financial performance.

By operating across these different segments, Bank of America is able to offer a wide range of financial services to clients around the world and generate strong financial results. The bank’s diversified business model also helps to reduce risk and provide stability during periods of economic volatility.

Also Read: Inside JPMorgan & Chase Co: Exploring the History and Future of Banking Giant

Why is Bank of America so influential?

Bank of America’s influence is reflected in several ways. One of the most significant is its impact on the global economy. As one of the largest banks in the world, Bank of America plays a critical role in providing capital to businesses and individuals, facilitating international trade, and supporting economic growth.

Bank of America’s size and reach give it significant influence over the global financial system. With over $2.8 trillion in assets as of 2021, the bank is one of the largest financial institutions in the world. Its extensive network of retail banking locations and ATMs in the United States, combined with its growing international presence, gives it significant market share in key regions around the world.

Bank of America’s diversified business model is another factor that contributes to its influence. The bank operates across a wide range of business segments, including consumer banking, wealth management, investment banking, corporate banking, and global markets. This diversity helps to reduce risk and provide stability during periods of economic volatility. It also allows the bank to generate revenue from multiple sources, which helps to support its financial performance.

Bank of America is also known for its innovative approach to banking and its use of technology to enhance the customer experience. The bank has invested heavily in digital banking solutions, including online and mobile banking platforms, which have helped to attract new customers and improve customer retention. Bank of America has also been a leader in developing new financial products and services, such as mobile payments and digital wallets, which have helped to transform the banking industry.

Finally, Bank of America’s commitment to social responsibility and sustainability has also contributed to its influence. The bank has set ambitious goals to reduce its environmental impact, support affordable housing initiatives, and promote diversity and inclusion within its workforce. Bank of America’s social responsibility initiatives have helped to establish it as a leader in corporate social responsibility and have earned it a positive reputation among customers and investors.

In summary, Bank of America’s influence is based on its size and reach, its diversified business model, its innovative approach to banking, and its commitment to social responsibility. These factors have all contributed to its significant impact on the global financial system, making it one of the most influential financial institutions in the world.

Role of Bank of America in 2008 financial crisis and its impact

Bank of America played a significant role in the 2008 financial crisis, both as a lender and as a recipient of government bailout funds.

During the run-up to the crisis, Bank of America, like many other financial institutions, engaged in risky lending practices, particularly in the area of mortgage lending. The bank acquired Countrywide Financial, a leading mortgage lender, in 2008, just as the housing market was starting to collapse. This acquisition would later prove to be a significant source of losses for Bank of America.

When the crisis hit in 2008, Bank of America was one of several major financial institutions that faced significant liquidity problems. The bank had significant exposure to troubled mortgage assets, including subprime mortgages, which were defaulting at an alarming rate. In addition, the bank faced significant legal and regulatory challenges related to its mortgage lending practices.

In response to these challenges, Bank of America received several rounds of government bailout funds, including a $20 billion investment from the Troubled Asset Relief Program (TARP). The bank also received support from the Federal Reserve in the form of emergency lending facilities.

Bank of America’s role in the crisis was not limited to its own financial troubles, however. As one of the largest banks in the world, the bank played a critical role in the broader financial system. Its struggles and its receipt of government funds were seen as emblematic of the larger problems facing the financial sector as a whole.

Following the crisis, Bank of America faced significant regulatory scrutiny and legal challenges related to its role in the mortgage market. The bank paid billions of dollars in fines and settlements related to mortgage-related claims and faced ongoing legal challenges for years.

In summary, Bank of America played a significant role in the 2008 financial crisis both as a lender and as a recipient of government bailout funds. Its struggles were emblematic of the larger problems facing the financial sector, and the bank faced significant regulatory and legal challenges in the aftermath of the crisis.

Controversies surrounding Bank of America

Bank of America has been involved in several controversies throughout its history, ranging from accusations of discriminatory lending practices to allegations of misleading investors. Here are some of the most notable controversies:

Mortgage Crisis: Bank of America was one of the banks at the center of the 2008 mortgage crisis, which led to a global financial crisis. The bank was accused of selling risky mortgage-backed securities to investors without adequately disclosing the risks involved. Bank of America paid a record $16.65 billion settlement to the US government in 2014 to resolve these allegations.

Foreclosure Abuses: In 2010, Bank of America was accused of fraudulent foreclosure practices, including robo-signing, a process in which foreclosure documents are signed without being reviewed by the signer. Bank of America agreed to pay $9.3 billion to settle these claims in 2013.

Discriminatory Lending Practices: In 2011, the US Department of Justice accused Bank of America of discriminatory lending practices, alleging that the bank charged higher interest rates and fees to African American and Hispanic borrowers. Bank of America agreed to pay $335 million to settle these claims.

Whistleblower Retaliation: In 2012, a former Bank of America employee accused the bank of retaliating against her for reporting fraud and misconduct within the bank. Bank of America settled the case for an undisclosed amount.

Overdraft Fees: Bank of America has been criticized for its overdraft fee policies, which charge customers fees for overdrawing their accounts, often resulting in significant financial burdens for low-income customers. In 2011, Bank of America settled a lawsuit for $410 million over allegations of unfair overdraft fee practices.

Sales Practices: In 2016, Bank of America was fined $12.5 million by the US Securities and Exchange Commission for engaging in illegal sales practices, including making unsuitable recommendations to customers and failing to disclose conflicts of interest.

These controversies have damaged Bank of America’s reputation and resulted in significant financial penalties for the bank. Despite these setbacks, Bank of America has taken steps to address these issues, including implementing new policies and procedures to prevent future misconduct.

To read more content like this, subscribe to our newsletter