Tipalti is a cutting-edge financial technology (fintech) startup that has revolutionized the way businesses handle their global payment operations. Established in 2010 by Chen Amit and Oren Zeev, Tipalti has emerged as a leader in providing comprehensive payment automation solutions that streamline and optimize the entire accounts payable process. With its innovative platform, Tipalti enables businesses to scale their payment operations, reduce manual workloads, enhance financial controls, and ensure regulatory compliance.

Chen Amit, the CEO of Tipalti, brings extensive experience in entrepreneurship and software development. Before co-founding Tipalti, Amit served as the CEO of Atrica, a telecommunications equipment manufacturer, and held leadership positions at other successful technology startups. His entrepreneurial vision and passion for transforming financial processes have been instrumental in guiding Tipalti’s growth and positioning the company as a market leader in the global payments space.

Oren Zeev, a renowned venture capitalist, serves as a co-founder and board member of Tipalti. With an impressive track record of successful investments in disruptive technology companies, Zeev brings invaluable expertise in strategic planning and scaling businesses. His guidance and strategic insights have played a vital role in shaping Tipalti’s trajectory and driving its expansion into new markets.

The founders recognized the inherent challenges faced by businesses when managing complex, time-consuming, and error-prone accounts payable processes, particularly on a global scale. Traditional manual payment methods were riddled with inefficiencies, leading to delays, errors, compliance issues, and strained vendor relationships. Motivated to solve these pain points, Amit and Zeev established Tipalti with a mission to modernize and automate the entire accounts payable workflow.

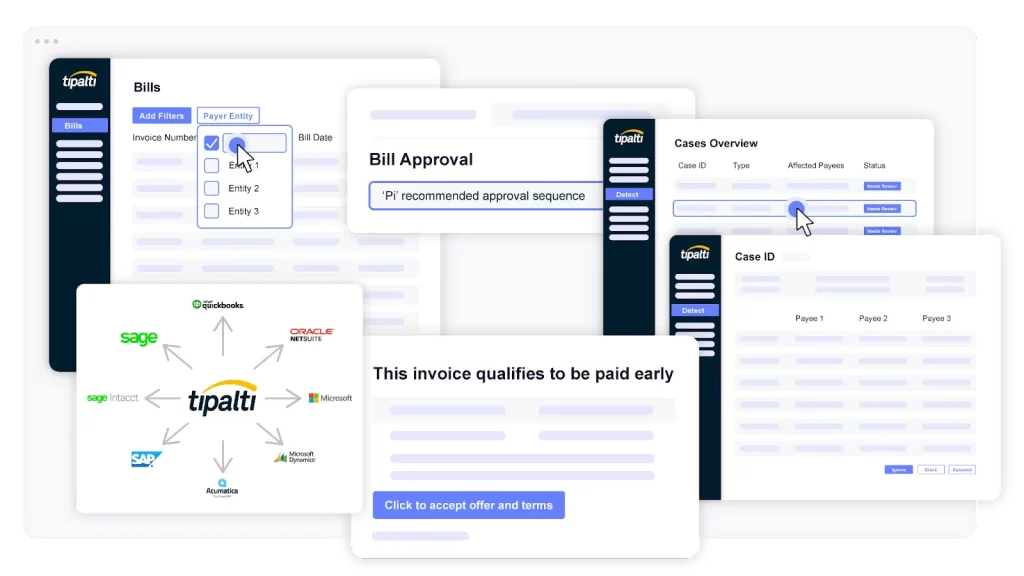

Tipalti’s platform integrates advanced technologies, such as artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA), to simplify and optimize payment operations. The platform offers a wide range of features, including supplier onboarding, invoice processing, tax compliance, payment reconciliation, and cross-border payment capabilities. By automating these critical functions, Tipalti empowers finance teams to focus on strategic initiatives, improve operational efficiency, and enhance the overall payment experience for both businesses and their global suppliers.

The success of Tipalti’s innovative approach is reflected in its rapidly growing customer base, which includes high-growth companies across various industries, including e-commerce, software-as-a-service (SaaS), digital marketplaces, and more. The platform has garnered praise for its ability to drive operational scalability, reduce costs, mitigate payment risks, and ensure regulatory compliance in a complex and ever-evolving global business environment.

Furthermore, Tipalti has received numerous industry accolades and recognition for its contributions to the fintech landscape. The company’s commitment to innovation, security, and customer-centricity has garnered it prestigious awards and accolades, solidifying its position as a trusted partner in the realm of global payments.

As Tipalti continues to innovate and expand its suite of payment automation solutions, the founders’ vision of simplifying and streamlining global payment operations remains at the forefront of the company’s mission. Through its advanced technology, strategic partnerships, and unwavering commitment to customer success, Tipalti is reshaping the way businesses manage their financial processes, empowering them to scale, grow, and thrive in an increasingly interconnected global economy.

Founding Story of Tipalti – History of Tipalti

Tipalti was founded in 2010 by Chen Amit and Oren Zeev. The founders recognized the significant challenges businesses faced when managing global payment operations and sought to revolutionize the accounts payable process through automation and innovative technology.

Chen Amit, the CEO of Tipalti, has a background in entrepreneurship and software development. Prior to co-founding Tipalti, he served as the CEO of Atrica, a telecommunications equipment manufacturer, where he gained valuable experience in building and scaling technology companies. Amit’s entrepreneurial spirit and expertise in software development became instrumental in shaping Tipalti’s technology and driving its growth.

Oren Zeev, a renowned venture capitalist, joined forces with Amit as a co-founder and board member of Tipalti. Zeev has an impressive track record of successful investments in transformative technology startups and brings extensive experience in strategic planning and scaling businesses. His expertise and guidance have been invaluable in shaping Tipalti’s business strategy and propelling the company’s growth trajectory.

The founding story of Tipalti dates back to Amit’s personal experience dealing with the complexities and inefficiencies of global payment operations. Recognizing the pain points and challenges faced by businesses in managing their accounts payable processes manually, Amit and Zeev were inspired to create a comprehensive payment automation solution that would address these issues and streamline financial operations.

With a vision to simplify and optimize the accounts payable workflow, the founders set out to develop an innovative platform that leveraged advanced technologies such as artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA). Their goal was to automate key functions of the payment process, enhance financial controls, improve operational efficiency, and ensure regulatory compliance.

Over the years, Tipalti has experienced significant growth and success. The company has secured substantial funding through various rounds of financing, attracting investments from prominent venture capital firms and strategic partners. This financial backing has allowed Tipalti to invest in research and development, expand its product offerings, and expand its customer base.

Today, Tipalti serves a diverse range of industries, including e-commerce, software-as-a-service (SaaS), digital marketplaces, and more. Its platform has gained widespread recognition for its ability to drive operational scalability, reduce costs, mitigate payment risks, and enhance the overall payment experience for businesses and their global suppliers.

Through strategic partnerships, continuous innovation, and a customer-centric approach, Tipalti has established itself as a leader in the fintech industry. The founders’ vision to transform the way businesses handle global payment operations has become a reality, as Tipalti continues to redefine the accounts payable landscape with its advanced payment automation solutions.

As the company looks toward the future, Tipalti remains committed to advancing its technology, expanding its market reach, and providing exceptional value to its customers. With its strong foundation and a team of dedicated professionals, Tipalti is poised to shape the future of payment automation and drive further innovation in the fintech industry.

Features of Tipalti Software

Tipalti offers a range of comprehensive products and features that collectively form its payment automation platform. These products are designed to streamline and optimize the accounts payable process, enhance financial controls, ensure compliance, and provide a seamless payment experience for businesses and their suppliers. Let’s explore the key products and features of Tipalti:

Supplier Management: Tipalti’s supplier management module enables businesses to efficiently onboard and manage their global supplier network. The platform offers self-service supplier portals where suppliers can submit their information, update payment preferences, and access relevant documents. Tipalti automates the supplier onboarding process, ensuring accurate and up-to-date supplier data and reducing the manual effort required for managing supplier records.

Invoice Processing: The invoice processing feature automates the extraction, validation, and routing of invoices. Tipalti’s platform leverages optical character recognition (OCR) technology to extract invoice data accurately. The system performs validations and automatically routes invoices to the appropriate approvers based on pre-configured workflows. This streamlines the invoice approval process, reduces errors, and improves overall efficiency.

Global Payment Processing: Tipalti offers robust payment processing capabilities that enable businesses to make payments to suppliers worldwide. The platform supports various payment methods, including ACH transfers, wire transfers, virtual cards, and global bank transfers, allowing businesses to choose the most suitable method for each transaction. Tipalti handles the complexity of cross-border payments, including currency conversion, compliance with local regulations, and tax calculations, ensuring smooth and secure international transactions.

Tax Compliance: With Tipalti’s tax compliance module, businesses can ensure compliance with tax regulations and streamline the tax reporting process. The platform collects tax-related information from suppliers, performs tax validations, calculates withholding tax, and generates tax forms such as 1099s for U.S. suppliers. Tipalti helps businesses stay compliant with tax requirements, reducing the risk of penalties and improving the accuracy of tax reporting.

Payment Reconciliation: Tipalti simplifies the payment reconciliation process by automating the matching of payments with corresponding invoices and supplier records. The platform provides detailed reports and reconciliation tools that enable businesses to identify discrepancies, track payment status, and resolve payment-related issues efficiently. This enhances financial visibility, reduces manual reconciliation efforts, and improves accuracy in financial reporting.

Regulatory Compliance and Risk Management: Tipalti incorporates compliance measures and risk management capabilities to help businesses maintain regulatory compliance and mitigate payment-related risks. The platform supports anti-money laundering (AML) and know-your-customer (KYC) procedures, performs sanctions screening, and implements fraud detection measures to identify and prevent fraudulent activities. By integrating compliance and risk management features, Tipalti helps businesses maintain a secure and trustworthy payment environment.

Reporting and Analytics: Tipalti provides comprehensive reporting and analytics tools that offer insights into payment operations, financial performance, and supplier behavior. The platform generates customized reports, including payment summaries, cash flow analysis, supplier payment history, and compliance reports. These analytics enable businesses to monitor key metrics, identify trends, and make data-driven decisions to optimize their payment operations.

Integrations and API: Tipalti offers integrations with various accounting systems, enterprise resource planning (ERP) software, and other business applications. These integrations allow for seamless data transfer and synchronization between Tipalti and other systems, improving operational efficiency and data accuracy. Additionally, Tipalti provides an API (Application Programming Interface) that enables businesses to integrate Tipalti’s functionality directly into their existing systems and workflows.

By offering these comprehensive products and features, Tipalti enables businesses to automate and optimize their accounts payable processes, enhance financial controls, ensure regulatory compliance, and provide a seamless payment experience. The platform’s robust capabilities cater to businesses of all sizes and industries, helping them achieve greater efficiency, accuracy, and scalability in their payment operations.

Business Model Overview : How does Tipalti make money?

The business model of Tipalti revolves around providing a comprehensive payment automation platform that streamlines and optimizes the accounts payable process for businesses. Let’s explore the various aspects of Tipalti’s business model:

Subscription-Based Model: Tipalti operates on a subscription-based pricing model, where customers pay a recurring fee to access and utilize its payment automation platform. The pricing structure is typically determined based on factors such as the size of the business, transaction volume, and the level of features and services required. This subscription model allows customers to align their investment with their specific payment automation needs and scale their usage as their business grows.

Payment Processing Fees: In addition to the subscription fees, Tipalti generates revenue through payment processing fees. These fees are charged for each payment transaction processed through the platform. The fees may vary depending on factors such as the payment method used, the currency involved, and any additional services required, such as tax compliance or regulatory reporting. The payment processing fees contribute to Tipalti’s revenue stream and are designed to cover the costs associated with facilitating secure and efficient payment transactions.

Value-Added Services: Tipalti offers value-added services that go beyond the core payment automation platform. These services may include supplier onboarding, tax compliance management, regulatory reporting, and fraud prevention measures. Customers can opt for these additional services to enhance their payment operations and ensure compliance with various financial regulations. The value-added services provide an additional revenue stream for Tipalti and cater to businesses with specific requirements or regulatory obligations.

Professional Services: Tipalti offers professional services to assist customers in implementing and optimizing the use of its payment automation platform. These services may include platform customization, integration with existing systems, training and onboarding, and ongoing consulting and support. The professional services generate revenue for Tipalti and help ensure successful customer onboarding, implementation, and adoption of the platform.

Strategic Partnerships: Tipalti forms strategic partnerships with complementary service providers, such as banks, payment processors, tax compliance firms, and other fintech companies. These partnerships help expand Tipalti’s ecosystem and enable it to offer integrated solutions that meet the diverse needs of its customers. Through these partnerships, Tipalti may receive referral fees, revenue-sharing agreements, or gain access to new customer segments, contributing to its overall revenue growth.

Data Analytics and Insights: Tipalti collects and analyzes data related to payment transactions, supplier information, and financial processes. The company can leverage this data to provide valuable insights to its customers, such as trends in payment behavior, risk analysis, and process efficiency improvements. Tipalti may offer advanced analytics and reporting capabilities as part of its platform or as additional services, creating opportunities for generating revenue based on data-driven insights.

Continuous Innovation and Product Development: Tipalti’s business model is underpinned by a commitment to continuous innovation and product development. The company invests in research and development to enhance its payment automation platform, incorporating new technologies, improving user experience, and staying ahead of evolving industry trends. By consistently introducing new features and capabilities, Tipalti aims to attract new customers, retain existing ones, and generate revenue through platform upgrades or expanded service offerings.

Overall, Tipalti’s business model combines subscription-based pricing, payment processing fees, value-added services, professional services, strategic partnerships, data analytics, and continuous innovation. This multi-faceted approach allows Tipalti to provide a comprehensive payment automation solution while generating revenue streams that align with customer needs and industry demands.

Growth of Tipalti over the years

In 2020, Tipalti had 1,000 customers and processed $12 billion in annual payments volume. By 2021, the company had grown to 2,000 customers and processed $30 billion in annual payments volume. And in 2022, the number of customers has surged to 3,000 and Tipalti processed $43 billion in annual payments volume, representing a 50% increase from the previous year.

Tipalti’s growth is being driven by a number of factors, including the increasing demand for AP automation solutions, the company’s strong customer base, and its continued product innovation.

The global AP automation market is expected to grow at a compound annual growth rate (CAGR) of 12.7% from 2022 to 2028. This growth is being driven by a number of factors, including the increasing complexity of AP processes, the growing number of global suppliers, and the need for businesses to improve their financial efficiency.

Tipalti has a strong customer base of more than 3,000 mid-market companies. These companies are drawn to Tipalti’s cloud-based platform, which offers a wide range of AP automation features, including:

- Automated invoice processing

- Payment approvals

- Tax compliance

- Currency conversion

- Supplier onboarding

Tipalti is also continuing to innovate its product offerings. In recent years, the company has launched a number of new features, including:

- A supplier portal that allows suppliers to self-onboard and manage their payments

- A fraud prevention solution that helps businesses protect themselves from fraudulent payments

- A global payments network that enables businesses to pay suppliers in over 196 countries

Tipalti’s growth is a testament to the company’s strong product offerings, its focus on customer satisfaction, and its commitment to innovation. The company is well-positioned to continue its growth in the years to come.

Also Read: Lacework – Founders, Business Model & Revenue Streams, Team

To read more content like this, subscribe to our newsletter