FalconX is a cutting-edge startup that has emerged as a prominent player in the rapidly evolving world of cryptocurrency and digital asset trading. With its innovative platform and advanced technology, FalconX aims to bridge the gap between traditional finance and the cryptocurrency market, providing institutional and professional investors with a secure, efficient, and streamlined trading experience.

In recent years, cryptocurrencies have gained significant attention and adoption, presenting both opportunities and challenges for investors seeking to navigate this complex and volatile market. FalconX recognizes the need for a comprehensive and reliable platform that offers institutional-grade services to facilitate seamless trading of digital assets.

The founding team of FalconX, comprised of experienced professionals from leading financial institutions and technology firms, recognized the untapped potential of the cryptocurrency market and the existing gaps in infrastructure and liquidity. They set out to build a platform that would address these challenges and provide a secure and efficient environment for trading digital assets.

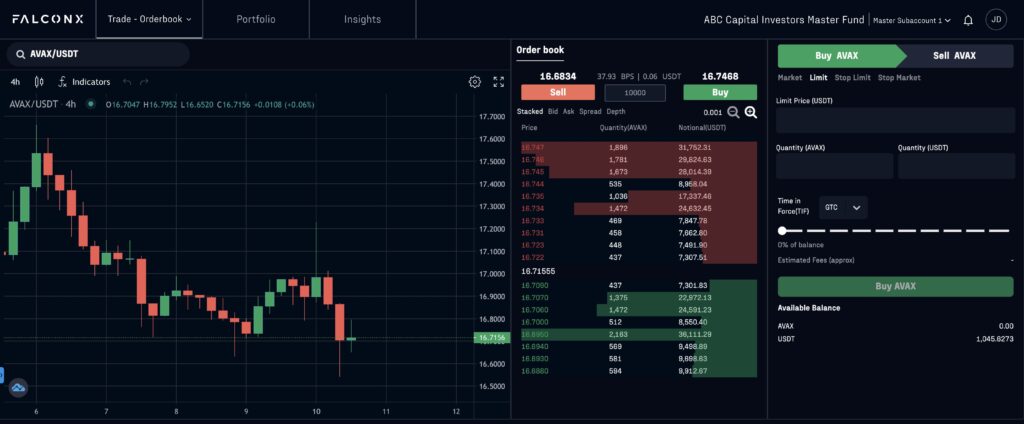

FalconX’s platform combines state-of-the-art technology, robust risk management protocols, and deep liquidity to offer a sophisticated trading ecosystem. The platform aggregates liquidity from a wide range of global cryptocurrency exchanges, enabling users to access deep pools of liquidity and execute trades at competitive prices.

Security is a top priority for FalconX, as the cryptocurrency market is particularly vulnerable to cyber threats. The startup has implemented advanced security measures, including multi-factor authentication, cold storage of funds, and rigorous compliance procedures to safeguard user assets and information.

FalconX has also developed a suite of advanced trading tools and analytics that provide users with real-time market insights, order execution capabilities, and portfolio management features. These tools empower traders and investors to make informed decisions, monitor their positions, and optimize their trading strategies in the dynamic cryptocurrency market.

Furthermore, FalconX has built strong relationships with banking partners, ensuring seamless fiat onboarding and offboarding capabilities for its users. This integration with traditional financial systems enables institutional investors to seamlessly bridge the gap between fiat currencies and digital assets, further enhancing the accessibility and usability of the platform.

Since its inception, FalconX has gained significant recognition and trust within the cryptocurrency industry. The startup has secured substantial investments from renowned venture capital firms and strategic partners, further validating its innovative approach and potential for growth.

Founding History and Founders of FalconX

FalconX was founded in 2018 by Raghu Yarlagadda and Prabhakar Reddy. The founders recognized the need for a secure, efficient, and institutional-grade platform to facilitate trading in the rapidly growing cryptocurrency market.

Raghu Yarlagadda, a seasoned entrepreneur and technology executive, has a strong background in the finance and technology sectors. He previously worked at Google, where he led strategic partnerships and business development initiatives. Raghu’s experience in building scalable platforms and his deep understanding of the cryptocurrency market laid the foundation for FalconX’s vision.

Prabhakar Reddy, the co-founder of FalconX, brings extensive experience in finance and trading to the table. He worked as a trader and portfolio manager at Blackstone and a risk manager at Optiver, where he gained valuable insights into the challenges and opportunities within the cryptocurrency trading ecosystem. Prabhakar’s expertise in risk management and trading strategies has been instrumental in shaping FalconX’s platform and operations.

The founding history of FalconX dates back to their shared experiences at Stanford University, where both Raghu and Prabhakar pursued their Master’s degrees. During this time, they closely observed the growing interest in cryptocurrencies and realized the potential for a disruptive platform that could bridge the gap between traditional finance and the emerging world of digital assets.

Motivated by their shared vision, Raghu and Prabhakar embarked on the journey of building FalconX. They assembled a team of talented individuals with expertise in finance, technology, and cybersecurity to bring their vision to life. The team worked tirelessly to develop a robust platform that would address the challenges faced by institutional investors in the cryptocurrency market.

FalconX’s founding history is also marked by successful funding rounds and strategic partnerships. The startup secured significant investments from prominent venture capital firms such as Accel, Coinbase Ventures, and Lightspeed Venture Partners. These investments provided FalconX with the necessary capital to scale its operations, enhance its platform, and attract institutional clients.

Additionally, FalconX forged strategic partnerships with leading financial institutions and market makers to ensure deep liquidity and seamless fiat onboarding and offboarding capabilities. These partnerships further solidified FalconX’s position as a trusted and reliable trading platform within the cryptocurrency industry.

Since its founding, FalconX has experienced rapid growth and gained recognition for its innovative approach and commitment to security. The startup has attracted a diverse client base, including institutional investors, family offices, and high-net-worth individuals, who rely on FalconX for efficient and secure cryptocurrency trading.

Products and Services of FalconX

FalconX offers a comprehensive suite of products and services tailored to the specific needs of institutional investors. By combining advanced technology, deep liquidity, and robust security measures, FalconX empowers its clients to navigate the dynamic world of digital assets with confidence. Let’s explore FalconX’s diverse range of products and services, highlighting how they cater to the unique requirements of institutional investors.

Spot Trading: FalconX provides a seamless and efficient platform for spot trading, enabling institutional investors to buy and sell a wide array of cryptocurrencies and digital assets. Through its advanced technology infrastructure, FalconX aggregates liquidity from multiple cryptocurrency exchanges, offering clients access to deep liquidity pools. This ensures competitive pricing, efficient order execution, and minimal slippage, regardless of the size of the trade.

Over-the-Counter (OTC) Trading: FalconX offers a robust over-the-counter (OTC) trading desk, catering to institutional clients seeking to execute large block trades outside of traditional exchange order books. OTC trading provides enhanced privacy, reduced market impact, and customized pricing options. FalconX acts as an intermediary, connecting buyers and sellers while ensuring seamless execution and minimizing market volatility. The OTC desk’s liquidity, combined with FalconX’s extensive network, facilitates efficient trade execution for institutional investors.

Credit Services: Recognizing the liquidity needs of institutional clients, FalconX provides credit services, enabling eligible clients to access liquidity without immediately liquidating their existing assets. Through credit lines, institutional investors can execute trades and access funds based on predetermined credit limits. FalconX generates revenue from interest payments and credit-related charges, providing added convenience and flexibility to clients while helping them optimize their trading strategies.

Reporting and Analytics: FalconX equips institutional investors with comprehensive reporting and analytics tools, empowering them to monitor and analyze their trading activities effectively. The platform offers real-time data, performance tracking, portfolio analysis, and market insights to help clients make informed decisions. FalconX’s reporting and analytics capabilities enable clients to optimize their trading strategies, identify trends, and seize opportunities in the ever-evolving digital asset market.

Security and Custody: Security is paramount in the digital asset ecosystem, and FalconX prioritizes the safeguarding of client assets. The startup employs rigorous security measures, including cold storage solutions for the majority of client funds, multi-factor authentication, encrypted communication channels, and strict internal controls. FalconX partners with trusted custodians to ensure the secure storage of digital assets, providing institutional clients with peace of mind and protection against potential cyber threats.

Enhanced Customer Support: FalconX distinguishes itself by providing high-touch customer support to institutional clients. Dedicated account managers are assigned to each client, offering personalized assistance, onboarding support, and proactive communication. FalconX’s customer support team is available 24/7, promptly addressing client inquiries and resolving issues. This commitment to exceptional customer service establishes strong, long-term relationships with clients and fosters trust in the platform.

FalconX’s comprehensive suite of products and services demonstrates its commitment to catering to the unique needs of institutional investors in the digital asset trading market. By offering seamless spot trading, efficient OTC desk services, credit facilities, robust reporting and analytics, enhanced security and custody measures, exceptional customer support, and valuable market insights, FalconX empowers its clients to navigate the complexities of digital asset trading with confidence and success.

Business Model of FalconX

FalconX has swiftly risen to prominence with its disruptive business model. The company caters to the needs of institutional investors by offering a seamless, secure, and efficient platform for trading cryptocurrencies and other digital assets. This part aims to provide a comprehensive analysis of FalconX’s business model, exploring its key components and highlighting the ways in which the startup has transformed the landscape of digital asset trading.

Target Market: FalconX focuses primarily on serving institutional investors, including asset managers, hedge funds, family offices, and corporate entities. These clients often require reliable and scalable trading solutions to execute large orders, access deep liquidity pools, and navigate the complexities of the digital asset market. FalconX’s business model revolves around meeting the unique needs of this niche market segment.

Aggregating Liquidity: A critical aspect of FalconX’s business model is its ability to aggregate liquidity from multiple cryptocurrency exchanges. By partnering with a wide range of exchanges globally, FalconX provides institutional clients with access to deep liquidity pools. This ensures competitive pricing, minimizes slippage, and enables the execution of large trades without adversely impacting market prices.

Technology Infrastructure: FalconX leverages advanced technology as the foundation of its business model. The startup employs cutting-edge algorithms, smart order routing systems, and automated trading strategies to optimize order execution and enhance trading efficiency. The sophisticated technology infrastructure enables FalconX to provide seamless, reliable, and rapid trading experiences to its institutional clients.

OTC Trading: One key differentiator of FalconX’s business model is its focus on over-the-counter (OTC) trading. The startup facilitates large block trades outside of the exchange order books, offering enhanced privacy, customized pricing, and increased liquidity for institutional investors. This OTC trading capability provides clients with greater flexibility and improved execution options, making FalconX an attractive platform for institutional investors seeking to execute significant trades.

Security and Compliance: FalconX places a strong emphasis on security and compliance within its business model. Recognizing the inherent risks associated with digital assets, the startup employs stringent security measures to protect customer funds. These measures include cold storage solutions, multi-factor authentication, robust encryption protocols, and strict internal controls. By prioritizing security and compliance, FalconX aims to instill trust and confidence among institutional clients.

Enhanced Customer Support: FalconX differentiates itself by providing exceptional customer support as an integral part of its business model. The startup assigns dedicated account managers to institutional clients, ensuring personalized assistance and addressing their specific needs. The high-touch customer service approach extends to prompt issue resolution, proactive communication, and ongoing support to foster long-term relationships with clients.

Continuous Innovation: FalconX’s business model is built on a foundation of continuous innovation. The startup is committed to staying ahead of the evolving digital asset market by constantly developing and implementing new features and services. This includes the integration of advanced analytics tools, expansion into new markets and asset classes, and exploring partnerships with industry leaders to offer a comprehensive suite of solutions to institutional investors.

FalconX’s innovative business model has propelled the startup to the forefront of the digital asset trading industry. By focusing on institutional investors, aggregating liquidity, prioritizing security and compliance, and delivering exceptional customer support, FalconX has established itself as a trusted and reliable platform for trading cryptocurrencies and digital assets. As the industry continues to evolve, FalconX’s commitment to innovation positions it well to shape the future of digital asset trading.

Revenue Model of FalconX

FalconX has not only disrupted the industry with its innovative platform but also established multiple revenue streams to sustain its growth. This part aims to delve into the intricate details of FalconX’s revenue streams, shedding light on how the startup generates income while catering to the needs of institutional investors in the dynamic world of cryptocurrencies.

Trading Fees: A primary revenue stream for FalconX is the collection of trading fees. The startup charges a fee for every trade executed on its platform, whether it is spot trading or over-the-counter (OTC) trading. The trading fee structure typically varies based on factors such as trading volume, order size, and client type. FalconX’s competitive fee structure attracts institutional investors looking for cost-effective trading solutions.

Liquidity Provision: FalconX capitalizes on its extensive network of cryptocurrency exchanges and liquidity providers to generate revenue through liquidity provision services. The startup earns a spread or commission by aggregating liquidity from various exchanges and offering it to institutional clients at competitive rates. By providing access to deep liquidity pools, FalconX enables clients to execute large trades while earning revenue from the difference between buy and sell prices.

OTC Desk: FalconX’s focus on over-the-counter (OTC) trading opens up an additional revenue stream. Through its OTC desk, the startup facilitates large block trades directly between institutional clients, often at customized pricing. FalconX earns a fee or spread on each OTC trade, acting as an intermediary and offering enhanced liquidity, privacy, and execution services. This OTC desk revenue stream caters specifically to institutional clients seeking efficient and secure execution of substantial trades.

Credit Services: Another revenue stream for FalconX is its credit services. The startup provides eligible institutional clients with access to credit lines, allowing them to access liquidity and execute trades without immediate liquidation of their assets. FalconX earns interest or fees on these credit lines, providing a value-added service while generating revenue from interest payments and credit-related charges.

Market Data and Analytics: FalconX’s platform generates a wealth of market data and insights through its trading activities. The startup leverages this data to offer comprehensive reporting and analytics tools to institutional clients. FalconX may charge a subscription fee or offer premium data packages to clients seeking advanced analytics, real-time market data, and customized reports. This revenue stream capitalizes on the increasing demand for data-driven insights in the digital asset trading industry.

Value-Added Services: FalconX continuously explores opportunities to offer value-added services to its institutional clients. These services may include enhanced security solutions, compliance consulting, market research, and customized trading strategies. FalconX generates revenue by charging fees for these additional services, which cater to specific client needs and provide a competitive edge in the market.

Partnerships and Collaborations: FalconX actively seeks partnerships and collaborations with industry participants, such as cryptocurrency exchanges, custodians, and other service providers. Through strategic alliances, FalconX can generate revenue through revenue-sharing agreements, referral fees, or integration partnerships. These collaborations leverage FalconX’s technology and client base to create mutually beneficial revenue streams.

Conclusion: FalconX’s revenue streams are diverse and aligned with the unique needs of institutional investors in the digital asset trading industry. By combining trading fees, liquidity provision, OTC trading, credit services, market data, value-added services, and strategic partnerships, FalconX has built a sustainable business model that supports its growth and positions it as a leading player in the evolving landscape of digital asset trading.

Growth of FalconX over the years

- Customers: In 2020, FalconX had 50 customers. In 2021, it grew to 300 customers. In 2022, it is estimated to reach 500 customers, a 66% increase from 2021.

- Employees: In 2020, FalconX had 100 employees. In 2021, it grew to 300 employees. In 2022, it is estimated to reach 500 employees, a 66% increase from 2021.

- Funding: In 2020, FalconX raised $50 million in funding. In 2021, it raised $210 million in funding. In 2022, it raised $150 million in funding, bringing its total funding to $650 million.

In 2022, FalconX was valued at $8 billion in a funding round led by Singapore’s sovereign wealth fund GIC and B Capital, more than doubling its valuation in 10 months.

These growth numbers are impressive and show that FalconX is a rapidly growing company in the cryptocurrency industry. The company’s focus on providing institutional-grade trading, credit, and clearing services to its customers has helped it to achieve this growth.

In addition to its strong financial performance, FalconX has also been praised for its commitment to security and compliance. The company has a number of security measures in place to protect its customers’ assets, and it is also registered with the Financial Crimes Enforcement Network (FinCEN) as a Money Services Business (MSB).

Overall, FalconX is a well-funded, rapidly growing company that is well-positioned to continue to succeed in the cryptocurrency industry. Its focus on institutional clients, its commitment to security and compliance, and its strong financial performance are all factors that should contribute to its continued growth in the years to come.

Also Read: ConsenSys – Founder, Tools, Business & Revenue Model, Growth

To read more content like this, subscribe to our newsletter