Hopper is a travel app that uses predictive analytics to help travelers find the best deals on flights, hotels, and car rentals. The company was founded in 2007 by Frederic Lalonde and Joost Ouwerkerk in Montreal, Canada. Hopper spent its first six years in stealth mode, building what it claimed was the “world’s largest structured database of travel information.” In 2014, the company launched its public beta and quickly gained popularity among travelers. In this article, we’ll explore the startup story, history, founders, business model, revenue streams, valuation and funding of Hopper App.

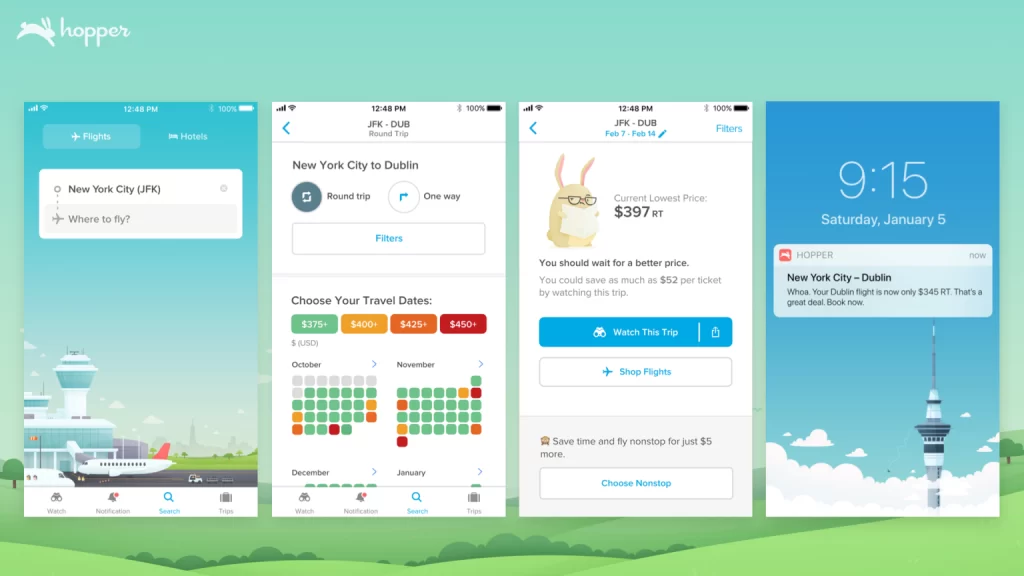

Hopper’s core product is its flight prediction tool. The tool uses machine learning to analyze historical flight prices and predict future prices. Hopper users can set up price alerts for specific flights, and they will be notified when the price of their desired flight drops to its predicted lowest point. Hopper also offers a “Flexible Dates” feature that allows users to search for flights over a wider range of dates, which can often lead to lower prices.

In addition to flights, Hopper also offers deals on hotels, car rentals, and vacation packages. The company’s hotel search tool allows users to compare prices from different booking websites, and its car rental tool offers discounts on rentals from major car rental companies. Hopper also offers a “Price Guarantee” on all of its products, which means that users will get a full refund if the price of their travel booking drops after they purchase it.

Hopper has raised over $740 million in funding from investors such as Capital One Ventures, Citi Ventures, and Accel Partners. The company is currently valued at over $5 billion. Hopper is one of the fastest-growing travel startups in the world, and it is poised to become a major player in the travel industry.

Founding History of Hopper App

The inception of the Hopper app in 2007 was the collaborative brainchild of two visionary entrepreneurs, Frederic Lalonde and Joost Ouwerkerk. Their shared passion for leveraging technology to reshape the travel industry culminated in the creation of a groundbreaking platform that would forever alter the way people approach travel planning and booking.

Both Frederic Lalonde and Joost Ouwerkerk brought unique experiences and expertise to the founding of Hopper. Lalonde’s background in technology and travel, combined with Ouwerkerk’s expertise in data science and algorithms, formed the perfect synergy for the ambitious venture they were about to embark upon.

Recognizing the challenges travelers faced when navigating the complexities of fluctuating travel prices, the founders conceived the idea of a platform that harnessed data analytics and predictive algorithms to provide travelers with insights that could empower their decisions. Their shared vision was to create a tool that not only displayed real-time prices but also offered predictions on potential price changes.

The journey from concept to reality was marked by intensive research, development, and algorithmic refinement. Lalonde and Ouwerkerk worked tirelessly to aggregate vast amounts of historical pricing data and combine it with advanced machine learning techniques. The result was an algorithm capable of predicting when flight and hotel prices were likely to be at their lowest, a feature that would become the cornerstone of the Hopper app.

In 2015, after years of dedication and innovation, Hopper was officially launched to the public. The app’s user-friendly interface and its groundbreaking predictive capabilities immediately captured the attention of travelers and the industry alike. Travelers were now equipped with a tool that not only simplified the booking process but also gave them the upper hand in securing the best deals.

As Hopper gained momentum, the startup secured investments to fuel its growth and further enhance its technology. The app’s accuracy in predicting price fluctuations continued to improve, solidifying its reputation as a reliable resource for travelers seeking cost-effective solutions. The platform expanded its features, introducing push notifications and other enhancements that streamlined the planning experience even further.

In summary, the founding history of the Hopper app is a testament to the collaborative spirit of two visionary entrepreneurs who recognized the potential of technology to revolutionize the travel industry. Frederic Lalonde and Joost Ouwerkerk’s joint efforts have paved the way for a platform that empowers travelers with information, enabling them to navigate the complexities of travel pricing with confidence and convenience.

Business Model of Hopper App – How Hopper App Makes Money?

The Hopper app has revolutionized the way people plan and book travel. With its intuitive interface and powerful algorithms, Hopper makes finding the cheapest flights and vacation packages easier than ever before. But what exactly is the business model behind this popular travel app? Let’s take a closer look at how Hopper works and how it generates revenue.

At its core, Hopper operates as a travel agency, connecting users with airlines, hotels, car rentals, and other travel providers. However, unlike traditional travel agents who rely solely on human expertise, Hopper uses artificial intelligence and machine learning algorithms to analyze massive amounts of data and predict the best times to book flights. This combination of high-tech analysis and human touch sets Hopper apart from competitors and appeals to modern travelers seeking efficiency and affordability.

The primary source of revenue for Hopper comes from commissions charged on bookings made through the app. For each ticket sold, Hopper receives a small percentage of the total cost, usually around 5-10%. While this may not seem like much, considering the large volume of transactions processed daily, these commissions quickly add up to substantial revenue streams. Additionally, Hopper offers premium features that require a one-time payment or subscription, further boosting its bottom line.

Another important aspect of Hopper’s business model involves partnering with major brands to serve targeted advertisements directly to users. These ads appear within the app and often feature special promotions or discounts related to travel destinations or services. In exchange for displaying these ads, Hopper receives compensation from participating companies eager to reach a captivated audience already interested in travel plans.

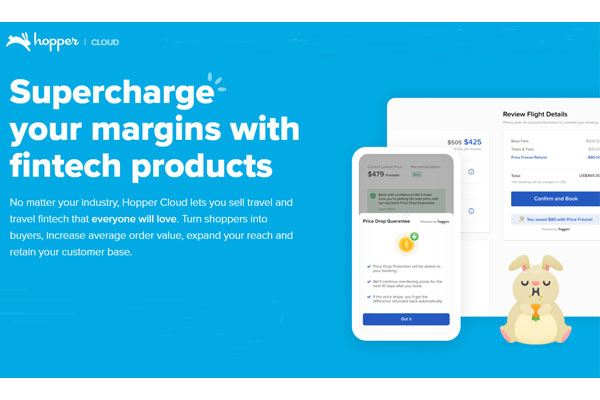

Hopper Cloud

Hopper Cloud is a travel fintech platform that helps businesses sell travel products and services. The platform provides businesses with access to Hopper’s predictive analytics, dynamic pricing, and other technologies to help them sell travel more effectively.

Hopper Cloud offers a variety of features that can help businesses sell travel, including:

- Predictive analytics: Hopper Cloud uses machine learning to predict future travel prices. This allows businesses to set up price alerts for specific travel products and services, and to be notified when the price is at its lowest point.

- Dynamic pricing: Hopper Cloud uses data-driven insights to dynamically price travel products and services. This allows businesses to set prices that are competitive and profitable.

- Fintech products: Hopper Cloud offers a variety of fintech products that can help businesses sell travel, such as payment processing, financing, and insurance.

Hopper Cloud is a white-label platform, which means that businesses can use it to create their own travel booking websites or apps. This gives businesses the flexibility to customize the platform to their own brand and needs.

New Customer Acquisitions of Hopper App

To drive growth and expand its user base, Hopper employs several tactics aimed at acquiring new customers.

A robust content marketing strategy featuring blog posts, videos, and social media updates educates readers about the benefits of using Hopper.

Paid search engines and social media platforms help increase visibility and draw visitors to the website where they can learn more about the app’s capabilities. Email newsletters and push notifications keep subscribers informed of current deals and upcoming sales events, encouraging them to return to the site frequently. Finally, referral programs reward existing users for sharing Hopper with friends and family members, helping spread word-of-mouth awareness and attract new users organically.

Overall, Hopper’s business model successfully balances innovative technological solutions with proven marketing techniques to create a winning formula for both customers and investors alike. Its commitment to transparency and fairness ensures continued trust among users while its ability to adapt to emerging trends positions the brand well for sustained success in the years ahead. Whether you’re planning your next trip or simply curious about the inner workings of successful startups, Hopper provides valuable insights into what it takes to build a thriving business in today’s fast-paced world.

Funding, Valuation and Investors of Hopper App

Hopper has raised over $740 million in funding over 12 rounds. Its latest funding round was a Series G round on November 7, 2022, for $96 million. The round was led by Capital One Ventures, with participation from Citi Ventures, Accel Partners, and OMERS Ventures.

Funding and valuation

Hopper App has raised over $740 million in venture capital funding to date. Here is a breakdown of the company’s funding rounds:

Series B: In Dec 2012, Hopper App raised US$12 million Series B investment round.

Series C: In Dec 2016, Hopper App raised $82 million Series C investment round led by Caisse de dépôt et placement du Québec (CDPQ), one of North America’s largest pension fund managers. Existing investors Brightspark Ventures, Accomplice, OMERS Ventures, Investissement Québec and BDC Capital IT Venture Fund also participated in the round.

Series D: In Oct 2018, Hopper App raised $100 million Series D investment round led by OMERS Ventures. Existing investors Caisse de dépôt et placement du Québec (CDPQ), Accomplice, Brightspark Ventures, Investissement Québec, BDC Capital IT Venture Fund, and new investor Citi Ventures participated in the round

Series E: In May 2020, Hopper App raised $70 million Series E investment round led by WestCap, a strategic operating and investing firm that focuses on tech-enabled, asset-light marketplaces.

Series F: In March 2021, Hopper App raised a $170 million Series F round, led by Capital One. Participation in the Series F round also included new and existing investors GS Growth, Inovia Capital, WestCap Group, and Citi Ventures.

Series G: In Aug 2021, Hopper App raised a $175 million Series G investment round led by GPI Capital that values it at an impressive $3.5 billion. The all-equity round also saw participation from new investor Glade Brook Capital, and return investors WestCap, Goldman Sachs Growth, and Accomplice.

Hopper’s valuation has increased significantly in recent years. In 2019, the company was valued at $1.5 billion. In 2022, it was valued at $5 billion. The company’s rapid growth and its strong financial performance have contributed to its high valuation.

Growth of Hopper App

Hopper’s valuation is now $5B. The company’s valuation has more than tripled since early 2020. The company grew its revenue by more than 300% YoY in 2021. Hopper’s revenue run rate is now 30X higher than its pre-pandemic high point, and Hopper Cloud, Hopper’s new B2B initiative, is already 15% of its revenues and growing.

According to Apptopia, Hopper was the #1 most downloaded OTA in the US in 2021. The app has over 70 million downloads. Hopper’s recovery is faster than the market, and its share of the air travel market in North America is now 300% higher than before the pandemic, according to MIDT.

The company sells over $2B in travel and travel-related financial services annually. Hopper’s fintech offerings, such as Price Freeze and Rebooking Guarantee, now represent over 70% of its air revenue. The industry opportunity for Hopper Cloud is enormous as projections estimate that if all travel distribution channels offered travel fintech, it could increase the total consumer spend for the sector by $200 billion annually.

Also Read: Flink – History, Founders, Features, Business Model & Valuation

To read more content like this, subscribe to our newsletter