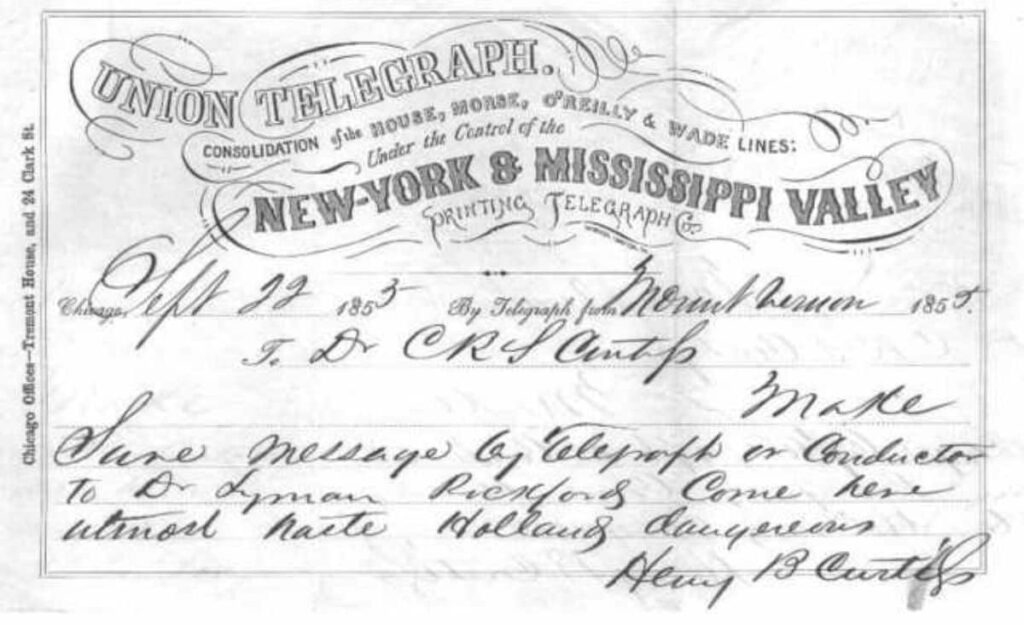

The Western Union Company, headquartered in Denver, Colorado, stands as an American multinational financial services titan with a rich history dating back to 1851. Originally founded as the New York and Mississippi Valley Printing Telegraph Company in Rochester, New York, the company underwent transformative changes, eventually adopting the name the Western Union Telegraph Company in 1856 through mergers with other telegraph firms.

For over a century, from the 1860s to the 1980s, Western Union reigned supreme in the American telegraphy industry. During this time, it not only pioneered groundbreaking technologies like telex but also diversified its services, encompassing wire money transfer alongside its core mission of transmitting and delivering telegram messages.

As the company navigated financial challenges in the 1980s, it made a strategic shift away from communications and refocused on its burgeoning money-transfer services. By 2006, Western Union had entirely phased out its communications operations. This shift led The New York Times to herald it as “the world’s largest money-transfer business” at the time, a title it retained thanks to its pivotal role in facilitating money transfers for a global community of immigrants sending funds back to their homelands.

In this introduction, we embark on a journey through the remarkable success story and evolution of The Western Union Company, a financial services giant that has played a pivotal role in shaping the way money moves across borders.

The Success Story of Western Union: A Journey through Time

From Telegraphy to Global Money Transfers: The Evolution of Western Union

The Western Union Company, headquartered in Denver, Colorado, is a name that resonates with the history of communication and finance. Its journey from the early days of telegraphy to becoming a global leader in money transfers is a testament to its resilience and adaptability.

Founding & Expansion

The roots of Western Union can be traced back to 1851 when it was founded as the New York and Mississippi Valley Printing Telegraph Company in Rochester, New York. Its founders, including Samuel L. Selden and Hiram Sibley, embarked on a mission to revolutionize communication. By 1856, through mergers with competitors like the Erie and Michigan Telegraph Company, Western Union emerged and adopted its enduring name.

The company’s ambitious pursuits led to participation in the ‘Treaty of Six Nations’ in 1857, an effort to establish regional telegraphy monopolies with shared main lines. Western Union, however, continued to expand through acquisitions, eventually transforming from a regional monopoly into a national oligopolist by 1864

In 1861, Western Union achieved a significant milestone by completing the first transcontinental telegraph. Additionally, it embarked on a visionary project to connect America to Europe via Alaska and Siberia. Although this endeavor was abandoned in 1867 following the successful laying of a transatlantic cable in 1866, it showcased Western Union’s spirit of innovation.

Dominance & New Challengers

In 1866, Western Union made a groundbreaking move by acquiring its main competitors, the American Telegraph Company and the United States Telegraph Company, effectively gaining a virtual monopoly over the American telegraphy industry. This period also witnessed the company diversifying its services beyond telegrams, introducing the first stock ticker in 1866 and pioneering wire money transfer in 1871.

The late 1870s brought new challenges as the telegraphy conglomerate Atlantic and Pacific Telegraph Company and the emerging Bell Telephone Company posed competition. While Western Union briefly ventured into the telephone business, it ultimately settled a patent lawsuit with Bell and exited the telephone industry in 1879.

Monopoly & Decline of Telegraphy

By 1884, Western Union’s stature was evident when it became one of the original eleven companies included in the Dow Jones Railroad Average stock market index for the New York Stock Exchange. The company’s telegraph lines extended over a million miles, and it operated two international undersea cables by 1900.

In 1909, AT&T acquired a 30% stake in Western Union. However, in 1913, due to antitrust concerns, AT&T was compelled to sell its shares, once again rendering Western Union independent.

Western Union’s dominance in the American telegraphy sector reached its zenith when it acquired Postal Telegraph, Inc. in 1945, essentially granting the company a monopoly. Yet, by 1960, the telegraphy industry faced a significant decline, with total telegraph messages nearly halving from 1945 to 1960.

The late 1950s marked a transition as Western Union ventured into telex services in New York City in 1958. This new service laid the foundation for international telex services, starting with limited service to London and Paris in 1960.

Western Union International Spin-off

In 1963, Western Union organized its international cable system and right-of-way into a separate entity, Western Union International (WUI). This company was eventually sold to American Securities in 1967, listed on the New York Stock Exchange, and subsequently acquired by Xerox in 1979. The Western Union branding was replaced with MCI International.

Consolidation

Western Union acquired AT&T’s TWX system in 1969, eliminating a major competitor to its telex network. The company also became a pioneer in maintaining its fleet of geosynchronous communications satellites in 1974, enabling nationwide communication.

In 1981, Western Union invested in Airfone but later sold it to GTE in 1986. It was during this period, in 1982, that Western Union began offering wire money transfer services globally, taking advantage of financial services deregulation.

Financial Difficulties, Bankruptcies & Restructuring

The 1980s brought financial challenges for Western Union, leading to debt restructuring in 1987 under the leadership of Bennett S. LeBow and Robert J. Amman. The company’s transformation strategy focused on consumer-based money transfer financial services, marking a shift away from being an asset-based communications provider.

Amman’s strategic divestitures of non-strategic telecommunications assets further streamlined the company. Amid these changes, the corporation’s name was changed to New Valley Corporation in 1991 as it sought bankruptcy protection to eliminate debt while expanding its money transfer business.

The years under Chapter 11 bankruptcy witnessed significant value growth for the company, supported by Robert A. Schriesheim’s divestiture of non-strategic assets. Following various restructurings and ownership changes, including First Data Corporation’s acquisition in 1994 for $1.2 billion, Western Union reemerged.

Public Listing & International Expansion

In 2006, Western Union embarked on a new chapter when it became an independent publicly traded financial services company, focusing on money transfers. This transition coincided with the decision to cease offering telegram transmission and delivery.

In 2009, Western Union expanded its global footprint by acquiring Canada-based Custom House for $371 million, rebranding it as Western Union Business Solutions. Subsequently, it acquired Travelex’s Global Business Payments division for £606 million in 2011.

Rumors of a merger with competitor MoneyGram circulated in 2015, but Western Union denied these claims. In 2017, Ant Financial’s attempted acquisition of MoneyGram for $880 million was blocked by the U.S. government.

Today, Western Union continues to be a global leader in money transfer services, offering wire transfers, mobile money transfer, and innovative services like Western Union Connect. Its evolution from a telegraph company to a modern financial services provider demonstrates its ability to adapt and thrive in an ever-changing world of communication and finance.

As Western Union looks to the future, its legacy of connecting people and facilitating financial transactions remains a testament to its enduring success and global impact.

Current Services

Western Union offers a range of services to meet the diverse needs of its customers:

Wire Transfer: You can send money either online or in-person at Western Union agent locations. To receive cash, you simply visit any Western Union agent location worldwide and provide the 10-digit MTCN (Money Transfer Control Number) along with identification. In some cases, instead of identification, you can use a secret question and answer for added security.

Western Union Mobile: In 2007, Western Union unveiled plans to introduce a mobile money-transfer service in partnership with the GSM Association, a global organization representing over 700 mobile operators across 218 countries, serving a staggering 2.5 billion mobile subscribers. This service leverages the widespread availability of mobile phones in both developed and developing economies, turning these devices into convenient tools for delivering various financial services. This includes features like text notifications for Western Union cash deliveries and phone-based remittance options. Western Union’s mobile money transfer service seamlessly connects with mobile banking (m-bank) and mobile wallet (m-wallet) platforms provided by mobile operators and locally regulated financial institutions.

Western Union Connect: Launched in October 2015, Western Union Connect has resulted from collaborative efforts with major instant messaging apps like WeChat and Viber. This partnership empowers users of WeChat to send funds, up to $100, to destinations including China, the United States, and 200 other countries. For Viber users, this service allows money transfers of up to $100 for a fixed fee of $3.99, along with exchange rate fees. As you send more money, the fixed fee gradually increases, reaching a limit of $499.

These services reflect Western Union’s commitment to providing accessible and efficient financial solutions for its customers, catering to both local and international needs.

Also Read: Achieving Excellence: The Delta Airlines Success Story

To read more content like this, subscribe to our newsletter