Bank of America stands as a titan in the world of finance, boasting a rich history dating back over 240 years. Its roots can be traced back to the founding of the Bank of Italy in 1904 by Amadeo Giannini, an Italian immigrant who envisioned a bank that catered to the needs of immigrants and working-class families. From its humble beginnings in San Francisco, the bank expanded rapidly throughout California, eventually merging with Bank of America in 1998 to create the financial behemoth we know today.

Through further strategic acquisitions and mergers, including Countrywide Financial in 2008 and Merrill Lynch in 2009, Bank of America solidified its position as the second-largest banking institution in the United States, serving over 66 million individual and household clients, and leading the nation in small business banking.

Beyond its sheer size, Bank of America is a diversified financial powerhouse, offering a comprehensive suite of services that cater to a wide range of clientele. For individuals and families, Bank of America provides traditional banking products like checking and savings accounts, debit and credit cards, and various loan options, including mortgages, auto loans, and personal loans. Its wealth management division, Merrill Lynch, offers investment solutions and financial planning services to help individuals achieve their long-term financial goals. For businesses of all sizes, Bank of America caters to their specific needs through dedicated business banking units, offering cash management solutions, commercial loans, international trade finance, and investment banking services.

Bank of America’s reach extends beyond physical borders, with a global presence in over 35 countries. This international network allows the bank to facilitate cross-border trade and investment, catering to the needs of multinational corporations and individuals with global financial needs. Furthermore, its robust digital banking platform, consistently ranked among the best in the industry, provides convenient and secure access to financial accounts and services 24/7.

Bank of America’s commitment extends beyond its core business, actively engaging in community development initiatives and environmental sustainability efforts. The bank invests in programs that promote financial inclusion, affordable housing, and small business development, particularly in underserved communities. Additionally, it has made significant strides in reducing its environmental footprint, focusing on renewable energy sources, energy efficiency in its operations, and sustainable financing solutions for clients. This dedication to social responsibility strengthens Bank of America’s reputation as a trusted financial partner, not just for individuals and businesses, but also for the communities it serves.

Marketing Strategies of Bank of America

Bank of America leverages a robust marketing strategy to maintain its position as a leader in a competitive landscape. Here’s a breakdown of their key approaches:

1. Brand Positioning

At the heart of Bank of America’s marketing strategy lies a powerful brand positioning statement: “What would you like the power to do?” This question isn’t just a tagline; it’s a core philosophy that shapes how Bank of America interacts with its customers. It positions the bank not just as a provider of financial products, but as an enabler.

By asking “What would you like the power to do?”, Bank of America acknowledges that its customers have unique goals and aspirations. They understand that financial security and freedom are key ingredients in achieving those dreams. Whether it’s buying a home, starting a business, or simply planning for retirement, Bank of America positions itself as a partner, offering the tools and resources to help customers unlock their financial potential.

This brand positioning resonates with a broad audience. It speaks to both individual and business needs, highlighting Bank of America’s ability to empower financial success across various life stages. It also fosters a sense of trust and collaboration, positioning Bank of America as a financial partner invested in its customers’ journeys.

In essence, Bank of America’s brand positioning goes beyond traditional banking. It taps into a deeper human desire for control and achievement, framing financial services as a means to an end – the end of achieving one’s goals and living a fulfilling life. This emotional connection is a powerful marketing tool that sets Bank of America apart in a crowded financial landscape.

2. Multi-Channel Marketing

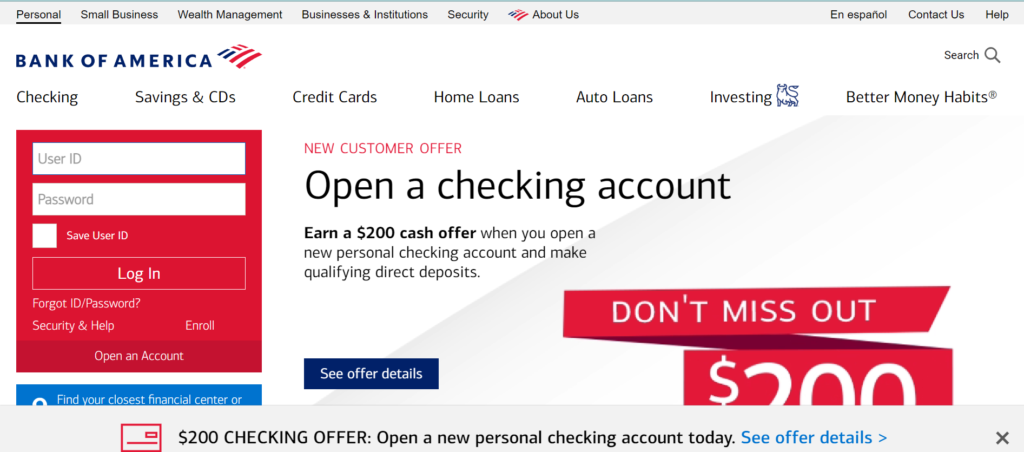

In today’s digital age, consumers expect to interact with their bank on their terms, across various platforms. Bank of America understands this, and their multi-channel marketing strategy is a testament to their commitment to customer convenience and accessibility.

This strategy goes beyond simply having a website and a social media presence. Bank of America seamlessly integrates various channels to create a cohesive customer experience. Their user-friendly website serves as a central hub, offering account information, educational resources, and the ability to initiate transactions. Their robust mobile app mirrors this functionality, allowing customers to manage their finances on the go.

Beyond digital channels, Bank of America maintains a network of physical branches. These branches offer a human touch, with financial advisors available to provide personalized guidance and assistance for complex financial needs. Additionally, Bank of America utilizes traditional media like television and print advertising to reach a broader audience, particularly those who may not be active online.

This multi-channel approach ensures Bank of America can connect with customers wherever they are, through their preferred method. It fosters a sense of familiarity and trust, as customers can access information and support through the channels they find most comfortable. Ultimately, Bank of America’s multi-channel marketing strategy creates a convenient and comprehensive financial experience for its diverse customer base.

3. Digital Presence

In the age of online connectivity, Bank of America (BoA) has established itself as a leader in utilizing its digital presence as a powerful marketing strategy. By prioritizing digital innovation, offering a wide range of online services, and focusing on robust security, BoA cultivates a user-centric experience that keeps customers engaged and satisfied.

One of the key indicators of BoA’s digital success lies in its massive user base. With over 10.5 billion logins recorded in 2021, representing a 15% year-over-year increase, BoA demonstrates its ability to attract and retain customers in the digital sphere. This strong digital presence translates to brand value, with BoA’s brand being valued at $36.7 billion in 2022.

Beyond user numbers, BoA actively embraces digital payment technologies to enhance its offerings. They understand the convenience and efficiency that digital options provide, allowing customers to manage their finances seamlessly through online channels. This commitment to digital transformation ensures BoA remains relevant and competitive in a rapidly evolving technological landscape.

Furthermore, BoA leverages artificial intelligence (AI) to personalize the customer experience. By utilizing machine learning and business intelligence, BoA can analyze financial preferences and behaviors to offer tailored financial advice and solutions. This personalized approach strengthens customer relationships, fostering trust and loyalty in the digital environment.

4. Community Engagement

Going beyond traditional marketing tactics, Bank of America embraces community engagement as a strategic tool to connect with customers and build lasting relationships. This strategy focuses on several key areas that contribute to the well-being and prosperity of the communities they serve.

Firstly, Bank of America actively supports local non-profit organizations. By investing in these organizations, they contribute to addressing critical needs and fostering positive change in their communities. This support can range from financial grants to volunteer opportunities for employees, demonstrating a commitment to the social fabric of the communities they operate within.

Secondly, Bank of America recognizes the vital role small businesses play in the local economy. They offer various lending programs and resources specifically tailored to meet the needs of small businesses. By supporting their growth and success, Bank of America contributes to job creation and overall economic vitality in their communities.

Thirdly, Bank of America is dedicated to hiring local talent. This not only strengthens the local workforce but also demonstrates a commitment to investing in the communities they serve. Hiring individuals who are familiar with the local landscape fosters a deeper understanding of customer needs and allows Bank of America to better serve its local clientele.

5. Educational Campaigns

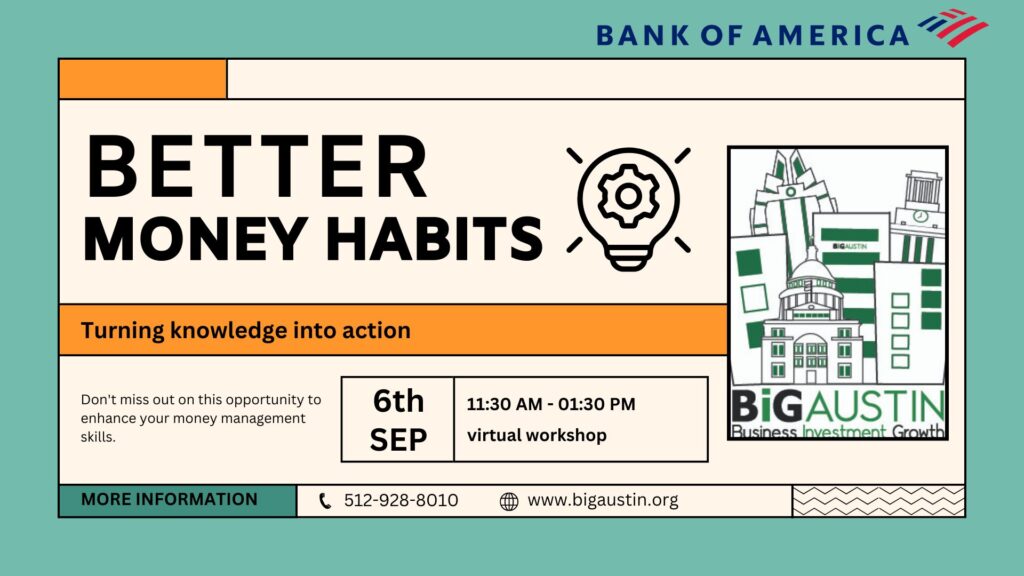

In today’s complex financial landscape, access to information and education is crucial for individuals to make informed financial decisions. Recognizing this, Bank of America leverages educational campaigns as a key marketing strategy, empowering their customers and fostering responsible financial behavior.

One of their flagship programs is “Better Money Habits,” a free online platform offering comprehensive financial education resources in both English and Spanish. This platform covers various topics, including budgeting, saving for different goals, planning for retirement, and even navigating the complexities of homeownership. By providing easy-to-understand resources in multiple languages, Bank of America ensures accessibility and inclusivity, empowering individuals from diverse backgrounds to gain financial knowledge.

Beyond core financial literacy, Bank of America’s “The Academy” program takes a comprehensive approach. It offers a range of live and on-demand educational resources designed to cater to various needs. Whether individuals are seeking to enhance professional skills, boost their confidence, or navigate the job market, “The Academy” offers relevant content and tools. This commitment to lifelong learning empowers customers not just as individuals, but also as professionals, fostering a sense of personal and professional growth.

Furthermore, Bank of America extends its educational reach through targeted campaigns and strategic utilization of social media. Their financial awareness campaign aims to educate students about managing their finances and introduces them to the convenience and security of mobile banking. Additionally, their consistent presence on various social media platforms allows them to share bite-sized financial knowledge and engage with their audience in a more interactive way.

Bank of America’s educational campaigns go beyond marketing; they represent a genuine commitment to financial empowerment. By offering accessible and informative resources across various platforms, Bank of America equips their customers with the tools and knowledge necessary to navigate their financial lives confidently and responsibly.

In conclusion, Bank of America’s multifaceted marketing strategy reflects a deep understanding of its diverse customer base and the ever-evolving financial landscape. By leveraging a combination of targeted messaging, trust-building initiatives, omnichannel marketing, social responsibility, data-driven decision making, and a commitment to innovation, Bank of America positions itself as a trusted partner for individuals, businesses, and communities alike, securing its position as a leader in the competitive world of finance.

Also Read: Marketing Strategy and Marketing Mix of American Express

To read more content like this, subscribe to our newsletter