HSBC, a name synonymous with international banking, boasts a rich history and a presence that spans the globe. Founded in 1865 in Hong Kong, the company’s origins lie in facilitating trade between Europe and Asia. HSBC has since grown into one of the world’s largest banking and financial services organizations, serving millions of customers across over 60 countries and territories.

The story of HSBC begins with a simple yet powerful idea: a local bank catering to international needs. The Hongkong and Shanghai Banking Corporation Limited, as it was initially called, opened its doors in Hong Kong, strategically positioned to capitalize on the burgeoning trade routes of the era. This focus on international connections has remained a cornerstone of HSBC’s identity throughout its evolution.

The early years saw rapid expansion for the bank. By 1875, HSBC had established a foothold in seven countries across Asia, Europe, and North America. It played a crucial role in financing the flow of goods, from tea and silk from China to cotton and jute from India. This global reach not only solidified HSBC’s position as a key player in international trade but also fostered a deep understanding of diverse markets and economies.

The 20th century witnessed continued growth for HSBC. Under the leadership of visionary figures like Thomas Jackson, the bank expanded its footprint to 16 countries by 1900, financing trade on a global scale. Strategic acquisitions, such as the takeover of Midland Bank in 1992, further cemented HSBC’s position as a leading financial institution.

Today, HSBC offers a comprehensive suite of financial services, encompassing retail banking, wealth management, commercial banking, and investment banking. It caters to a wide range of clients, from individuals and small businesses to large corporations and multinational organizations. Its global network ensures seamless financial transactions across borders, while its in-depth understanding of local markets allows it to tailor solutions to specific needs.

HSBC’s commitment to innovation has also been a key driver of its success. The bank has continuously adapted to evolving technologies and market trends, ensuring it remains at the forefront of the financial services industry. From embracing digital banking solutions to developing sustainable financing initiatives, HSBC demonstrates a forward-thinking approach.

Looking ahead, HSBC faces a dynamic and ever-changing financial landscape. Yet, with its rich heritage, global reach, and commitment to innovation, the bank is well-positioned to navigate future challenges and continue serving its customers as a trusted financial partner on the world stage.

Business Segments of HSBC

HSBC’s vast network and global reach are underpinned by its three distinct business groups, each catering to specific customer segments with tailored financial solutions.

Commercial Banking (CMB)

Focused on empowering businesses to thrive, CMB acts as a one-stop shop for a comprehensive range of financial products and services. This segment is further divided into four key operating units:

- Credit and Lending: Provides businesses with essential financing solutions to support their growth aspirations. This may include loans for working capital, equipment acquisition, or expansion projects.

- Global Trade and Receivables Finance: Facilitates international trade by offering solutions for managing export and import transactions, ensuring smooth cross-border payments, and mitigating risks associated with foreign trade.

- Payments and Cash System: Streamlines business operations through efficient payment processing and cash management services. This includes solutions for domestic and international payments, collections, and account management.

- Insurance and Investments: Offers businesses a variety of insurance products to protect their assets and investments tailored to their specific risk profiles. Additionally, CMB provides access to investment solutions to help businesses grow their wealth.

Global Banking and Markets (GBM)

This segment is geared towards serving the complex financial needs of large corporations, governments, and institutional investors. GBM offers a sophisticated suite of services including:

- Transaction Banking: Provides solutions for managing day-to-day banking activities, such as account management, cash flow optimization, and payment processing for large-scale operations.

- Treasury Services: Offers tools and expertise for managing financial risks associated with foreign exchange fluctuations and interest rates.

- Investment Banking: Assists corporations with mergers and acquisitions, capital raising through initial public offerings (IPOs) or debt issuance, and other strategic financial transactions.

- Advisory: Provides expert guidance on a range of financial matters, including mergers and acquisitions, restructuring, and risk management.

- Capital Markets: Facilitates the buying and selling of securities such as stocks, bonds, and derivatives in the financial markets.

- Foreign Exchange: Offers expertise and solutions for managing the risks associated with currency fluctuations in international transactions.

- Fixed Income and Derivatives: Provides sophisticated financial instruments for managing interest rate risk and hedging against market volatility.

Wealth and Personal Banking (WPB)

This segment focuses on individual financial needs, offering a broad spectrum of products and services to help people manage their money and plan for the future. WPB’s core offerings include:

- Personal Banking: Provides everyday banking services such as current and savings accounts, debit cards, online banking, and bill payments.

- Mortgages: Offers home loan solutions to help individuals purchase or refinance their properties.

- Loans: Provides various loan options for personal needs such as car financing, education expenses, or debt consolidation.

- Credit Cards: Offers credit cards with reward programs, travel insurance, and other benefits.

- Savings and Investments: Provides a variety of savings accounts and investment products to help individuals achieve their financial goals.

- Insurance Services: Offers various insurance products to protect individuals and their families against life’s uncertainties.

It’s important to note that HSBC also has a Corporate Centre segment that manages central treasury functions, balance sheet optimization, and other legacy businesses. This segment plays a crucial role in ensuring the financial stability and overall health of the organization.

By catering to diverse financial needs through these distinct business groups, HSBC has established itself as a global leader in providing comprehensive financial solutions for individuals, businesses, and institutions alike.

What’s new with HSBC?

HSBC is making significant strides in sustainability and innovation, demonstrating its commitment to a greener future and a more technologically advanced financial landscape. Here’s a glimpse into some of their recent developments:

Financing the Future: Recognizing the urgency of climate action, HSBC pledged $1 billion in financing to early-stage climate tech companies. This critical investment aims to accelerate the development and adoption of innovative technologies that will pave the way for a net zero future by 2050. By supporting these companies, HSBC is playing a proactive role in driving the global transition towards a more sustainable economy.

Redefining Financial Services: In a move that highlights its commitment to innovation, HSBC partnered with B2B fintech company Tradeshift to establish a joint venture. This venture will focus on developing cutting-edge financial services apps and embedded finance solutions. These solutions are likely to streamline financial processes for businesses, making them more efficient and user-friendly.

Embracing Quantum Security: HSBC became the first bank to join a pioneering commercial quantum secure metro network. This network, developed by BT, Toshiba, and Amazon Web Services (AWS), utilizes quantum technology to provide enhanced security for data transmission. By taking the lead in adopting this groundbreaking technology, HSBC is demonstrating its commitment to safeguarding its customers’ financial information in the face of evolving cyber threats.

These developments showcase HSBC’s commitment to progress and its dedication to shaping a more sustainable and technologically advanced financial future.

Marketing Strategies of HSBC

HSBC, one of the world’s largest banking and financial services organizations, employs a range of marketing strategies to maintain its position in the market and attract and retain customers. Here’s an overview of some of their key marketing strategies:

1. Global Presence

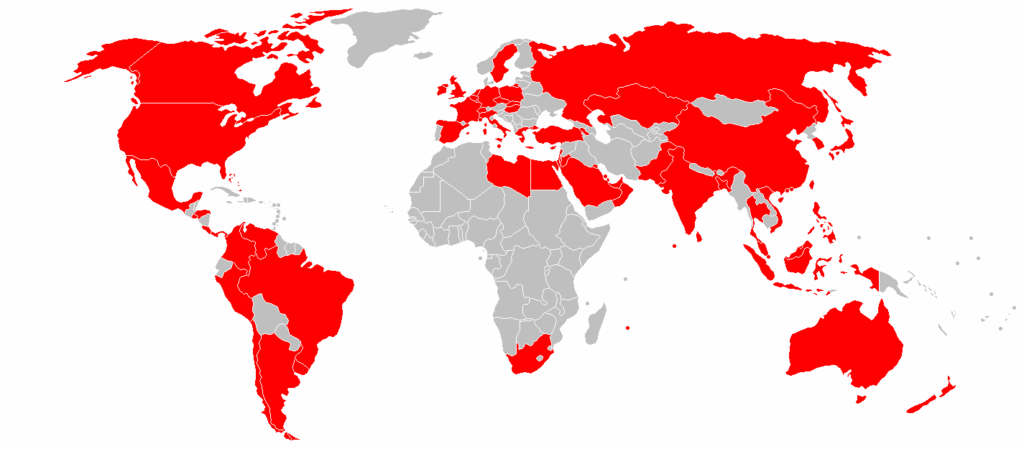

HSBC’s extensive global presence forms a cornerstone of its marketing strategy, and the details provided paint a clear picture of how they leverage this advantage. With a network spanning 62 countries and territories, boasting around 6,900 offices, HSBC positions itself as the “World’s Local Bank.” This powerful tagline underscores its ability to provide a familiar and trusted banking experience, regardless of location.

This vast network offers several advantages to HSBC’s customers. Individuals and businesses can access a wide range of financial products and services tailored to their specific needs, wherever they are in the world. For instance, an entrepreneur in Hong Kong expanding into the US market can leverage HSBC’s expertise and connections in both regions to navigate financial complexities. Similarly, an expat family relocating to Europe can maintain their existing banking relationship with HSBC, ensuring a seamless transition. Their global reach extends beyond physical presence; HSBC has a dual primary listing on the Hong Kong Stock Exchange and London Stock Exchange, with secondary listings on the New York Stock Exchange and the Bermuda Stock Exchange. This financial clout further reinforces their global standing and stability.

Furthermore, HSBC’s global reach empowers it to offer international trade and investment solutions with unparalleled ease. Companies can leverage HSBC’s network to facilitate cross-border transactions, manage foreign exchange risks, and access financing opportunities in new markets. This comprehensive support system, backed by dedicated departments like Group Risk & Compliance and Global Sustainability, makes HSBC a compelling partner for businesses with global ambitions.

By effectively communicating its global presence, the sheer number of customers served (over 60 million!), and the resulting benefits for customers, HSBC establishes itself as a reliable and convenient banking partner for individuals and businesses navigating an increasingly interconnected world. Their global reach is further amplified by their strong financial standing, evident in their stock exchange listings. This combination positions HSBC as a powerful and trusted partner for a truly globalized clientele.

2. Brand Identity and Reputation

HSBC’s brand identity and reputation are carefully crafted marketing tools that position the bank as a global partner for growth and progress.

Central to their brand identity is the concept of internationalism. Their core values highlight responsiveness to diverse cultures and a commitment to “Opening Up a World of Opportunity” for customers everywhere. This message resonates with individuals and businesses seeking a banking partner that understands their global aspirations. Further solidifying this image is their impressive reach, serving over 39 million customers across 62 countries and territories.

https://www.youtube.com/watch?v=zjrWwmYbXqo

HSBC also emphasizes its commitment to high standards and ethical practices. Their brand statements highlight operating with integrity and celebrating diverse cultures. This focus on responsible banking resonates with customers who value ethical business practices and a sustainable future. Further bolstering their reputation is their position as the most valuable bank brand in the UK (As of February 2024, HSBC had a brand value of over $20 billion), demonstrating strong brand recognition and customer trust.

However, it’s important to acknowledge that HSBC has also faced controversies related to money laundering and tax avoidance. These incidents have undoubtedly tarnished their reputation. Moving forward, HSBC will need to demonstrate a continued commitment to ethical practices and regaining public trust to fully leverage its strong brand identity and reputation as a marketing strategy.

3. Multichannel Marketing

In today’s digital age, customers expect a seamless and consistent experience across all touchpoints. HSBC recognizes this and has adopted a robust multichannel marketing strategy to connect with its diverse audience effectively.

HSBC leverages a strategic mix of traditional and digital channels to deliver targeted messages and personalized experiences. This includes a strong presence in physical branches, which remain crucial for building trust and offering personalized service, especially in regions where digital adoption is slower. Alongside physical branches, HSBC utilizes online banking platforms, mobile apps, and social media extensively. These digital channels allow for convenient access to account information, conducting transactions, and receiving personalized financial advice.

HSBC’s multichannel approach goes beyond simply providing access to services. They leverage various channels to deliver targeted marketing campaigns. For instance, social media platforms allow for geographically specific advertising and community building. Email marketing allows for personalized product recommendations and educational content based on individual customer needs. This coordinated approach ensures that customers receive relevant messages through their preferred channels, fostering brand awareness and engagement.

By strategically utilizing a multichannel approach, HSBC ensures it reaches its global audience effectively. This allows them to build stronger customer relationships, drive brand loyalty, and ultimately achieve their marketing goals.

4. Personalization

In today’s competitive financial landscape, a one-size-fits-all approach simply won’t do. HSBC understands this, and personalization is a core element of their marketing strategy. By tailoring their offerings and communications to individual needs, they aim to build stronger customer relationships and drive engagement.

HSBC’s personalization efforts begin with new customers. Over the first 90 days, they leverage automated messaging powered by data-driven insights and customer behaviors. These targeted messages educate new customers about account features, relevant offers, and valuable resources. This personalized approach ensures that new customers get the most out of their HSBC experience right from the start.

Personalization extends beyond initial onboarding. HSBC segments its customer base based on financial goals and behavior patterns. This allows them to develop targeted marketing campaigns that resonate with specific customer segments. For example, a young professional saving for a home will receive different marketing messages than a retiree focused on wealth management. Additionally, HSBC utilizes survey data to create customer personas, like “The Carefree Experientialist” or “The Budget-Minded Planner”. By understanding these personas, HSBC can tailor messaging and product offerings to meet the specific needs and aspirations of each customer segment.

HSBC’s commitment to personalization extends beyond marketing. They leverage data analytics, machine learning, and AI to personalize the overall customer experience. This could include recommending relevant financial products or services based on past transactions, or providing personalized financial advice through mobile apps. Ultimately, by personalizing the customer journey, HSBC fosters stronger relationships, builds brand loyalty, and positions itself as a trusted financial partner for all its customers.

5. Thought Leadership

HSBC has strategically positioned itself as a thought leader in the financial services industry, particularly in the realm of sustainable finance. This approach allows them to establish themselves as a trusted authority and influencer, ultimately attracting new business and fostering brand loyalty.

A key element of HSBC’s thought leadership strategy is their focus on Sustainable Financing. They have developed a unique blueprint centered on Transition Risk Management. This innovative approach goes beyond traditional credit assessments and incorporates potential risks associated with the transition to a low-carbon economy. By proactively managing these risks, HSBC demonstrates its commitment to sustainability and positions itself as a leader in this critical area.

HSBC further amplifies its thought leadership through various initiatives. They host webinars and conferences on pressing financial topics, such as the “Thought Leadership and Best Practice Sharing” event in 2019. These events bring together industry experts to discuss future trends and challenges in the financial services sector. By actively contributing to these conversations, HSBC establishes itself as a thought leader at the forefront of shaping the future of finance. This reputation for expertise and innovation attracts clients seeking a forward-thinking financial partner.

6. Community Engagement and Sponsorships

HSBC understands the importance of giving back to the communities it serves. Community engagement and sponsorships are key pillars of their marketing strategy, allowing them to connect with customers on a deeper level and establish themselves as a responsible corporate citizen.

HSBC sponsors a wide range of events and programs around the world. These sponsorships, like their involvement in the Hong Kong Sevens and the Sevens World Series, enhance brand recognition and position HSBC as a global leader. Similarly, sponsoring podcasts like “The News Agents” allows them to reach a targeted audience and showcase their expertise in international banking.

Beyond sponsorships, HSBC actively engages with communities on a global scale. Their commitment to sustainability is evident in their support for community projects focused on environmental awareness and water conservation. They further empower people and communities by investing in learning and mentorship programs. These initiatives provide valuable skills training and create opportunities for individuals to contribute their talents. Additionally, HSBC fosters future talent by investing in academic sponsorship programs. Their partnership with Stormzy to fund scholarships for disadvantaged students exemplifies this commitment. Through these global community programs, like the HSBC Youth Opportunities Programme and the Chevening Scholarship, HSBC fosters positive change and builds trust with a wider audience.

By strategically combining sponsorships with community engagement initiatives, HSBC creates a powerful marketing strategy. This approach positions them as a bank that not only offers financial services but is also deeply invested in the well-being of the communities it serves.

7. Digital Innovation

In today’s digital age, customer expectations are evolving rapidly. HSBC recognizes the importance of staying ahead of the curve, and digital innovation is a cornerstone of their marketing strategy. By embracing cutting-edge technologies, they aim to enhance customer experience, streamline operations, and ultimately position themselves as a leader in digital banking.

A key element of HSBC’s digital strategy is their investment in emerging technologies. They leverage artificial intelligence, machine learning, data analytics, and more to provide a more personalized and efficient banking experience. For instance, their mobile banking app allows customers to manage their finances conveniently, with features like biometric authentication for added security. Furthermore, platforms like HSBCnet offer secure access to a wide range of financial services, such as global cash management and trade finance solutions. These innovative tools cater to the needs of today’s tech-savvy customers.

HSBC’s commitment to digital innovation extends beyond internal systems. They actively seek collaborations to provide seamless financial experiences. Their partnership with Zoho Books exemplifies this approach. This collaboration allows customers to manage their finances and business operations on a single platform, promoting increased efficiency and convenience. Additionally, HSBC’s digital transformation initiatives, like moving HR systems to the cloud, demonstrate their commitment to internal optimization. These efforts ultimately translate into a more efficient and responsive banking experience for their customers.

By employing these marketing strategies, HSBC aims to maintain its position as a leading global bank and continue to attract and retain customers in a highly competitive financial services industry.

Marketing Mix of HSBC

HSBC, a global banking giant, leverages a robust marketing mix to maintain its competitive edge. Let’s delve into the 4Ps framework and see how HSBC uses each element strategically:

1. Product

Variety: HSBC offers a comprehensive suite of financial products catering to individuals, businesses, and corporations. This includes personal banking accounts, wealth management services, loans, credit cards, investment banking, and more.

Customization: HSBC recognizes that a one-size-fits-all approach doesn’t work. They tailor product offerings to specific customer segments, like high net-worth individuals or small businesses, ensuring a better fit.

Innovation: HSBC actively invests in developing new and innovative financial products. This could involve incorporating new technologies like mobile banking features or creating unique investment options.

2. Price

HSBC stays competitive by offering rates and fees that are in line with the market. They might also introduce introductory offers or bundled packages to attract new customers.

HSBC goes beyond just offering low prices. They emphasize the value proposition of their products, highlighting the benefits and features that justify the cost.

3. Place (Distribution)

Extensive Network: HSBC boasts a vast global network of branches, ATMs, and online platforms. This ensures easy access to their services for a wide customer base.

Convenience: HSBC prioritizes customer convenience. They offer multiple channels for accessing banking services, including mobile apps, internet banking, phone banking, and physical branches.

Strategic Partnerships: HSBC collaborates with other businesses to expand their reach. For example, they might partner with local retailers to offer their credit cards or financial services.

4. Promotion

Brand Awareness: HSBC invests heavily in building brand awareness through traditional advertising campaigns (TV, print) and digital marketing channels (social media, search engine marketing).

Targeted Marketing: HSBC uses targeted marketing strategies to reach specific customer segments with relevant messages. This could involve using social media advertising or email campaigns tailored to individual needs.

Sponsorships: HSBC sponsors high-profile sporting events and cultural activities to enhance brand image and connect with a broader audience.

By strategically using these marketing mix elements, HSBC positions itself as a global leader in financial services, catering to a diverse clientele and staying ahead of the curve in a dynamic financial landscape.

Also Read: Marketing Strategy and Marketing Mix of American Express

To read more content like this, subscribe to our newsletter