Gopuff is a rapidly growing, on-demand delivery service that has revolutionized the way people access everyday essentials and convenience store items. Founded in 2013 by Rafael Ilishayev and Yakir Gola, then students at Drexel University in Philadelphia, Gopuff has quickly become a major player in the instant needs industry, offering fast delivery of a wide range of products directly to customers’ doors.

The company’s origin story is rooted in the founders’ personal experiences as college students. Ilishayev and Gola found themselves frequently making late-night runs to convenience stores for snacks and essentials, which inspired them to create a service that could deliver these items quickly and efficiently. They started by delivering to fellow students from the back of their Plymouth Voyager minivan, gradually building the business from the ground up.

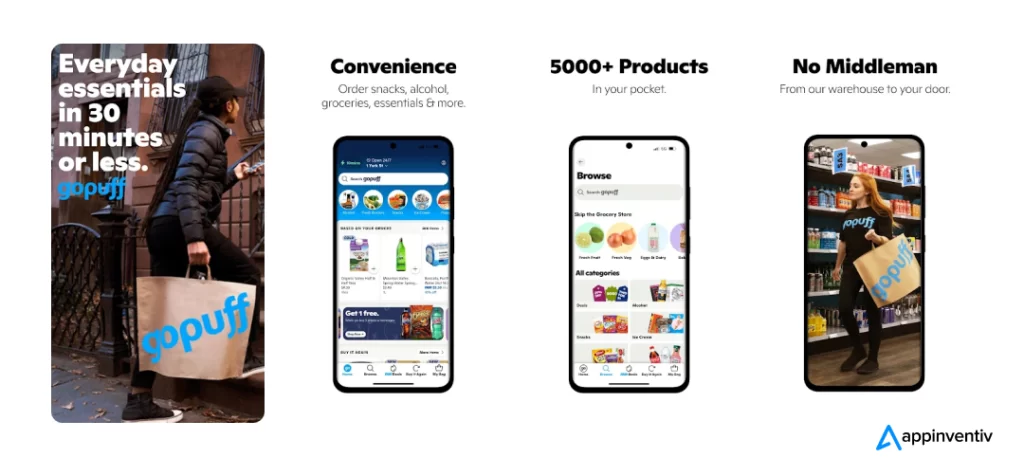

What sets Gopuff apart from other delivery services is its unique business model. Unlike many food delivery apps that act as intermediaries between customers and restaurants or stores, Gopuff operates its own network of micro-fulfillment centers, often referred to as “dark stores.” These facilities are strategically located in urban areas and stocked with thousands of products, ranging from snacks and drinks to household essentials, over-the-counter medications, and even alcohol in some markets.

This vertically integrated approach allows Gopuff to have greater control over inventory, pricing, and the overall customer experience. By owning the entire supply chain, from procurement to last-mile delivery, Gopuff can offer faster delivery times – often within 30 minutes – and more competitive pricing compared to traditional convenience stores or other delivery services.

The product range offered by Gopuff is extensive and continually expanding. Customers can order from a selection of over 4,000 items, including:

- Snacks and beverages

- Ice cream and frozen foods

- Household essentials like cleaning supplies and paper products

- Personal care items

- Over-the-counter medications

- Baby and pet supplies

- Alcohol (in select markets)

- Local specialties and fan-favorite brands

Gopuff’s technology platform is a crucial component of its success. The company has developed a sophisticated mobile app and website that allow customers to browse products, place orders, and track their deliveries in real-time. The backend logistics system optimizes routing and inventory management, ensuring efficient operations and fast delivery times.

Since its inception, Gopuff has experienced tremendous growth. The company expanded rapidly across the United States, and by 2023, it had established a presence in over 850 cities. This expansion has been fueled by significant venture capital investment, with the company raising billions of dollars in funding rounds from prominent investors.

Gopuff’s growth strategy has included both organic expansion and strategic acquisitions. Notable acquisitions include BevMo!, a leading alcoholic beverage specialty retailer on the West Coast, in 2020, and Fancy, a UK-based last-mile delivery platform, in 2021. These moves have helped Gopuff expand its product offerings and geographical reach.

The company’s success has not been without challenges. As with many rapidly growing startups, Gopuff has faced issues related to scaling its operations, managing labor costs, and navigating regulatory landscapes, particularly concerning the sale and delivery of age-restricted products like alcohol.

Gopuff’s impact on the retail and delivery landscape has been significant. The company has helped to create and define the “instant needs” category, challenging traditional convenience stores and pushing other delivery services to offer faster fulfillment times. This has led to increased competition in the space, with other companies launching similar services or partnering with existing retailers to offer rapid delivery.

The COVID-19 pandemic has played a crucial role in accelerating Gopuff’s growth. As stay-at-home orders and social distancing measures were implemented, demand for home delivery services surged, and Gopuff was well-positioned to meet this increased need. The company saw a substantial increase in order volume and customer acquisition during this period.

Looking to the future, Gopuff continues to innovate and expand its offerings. The company has been exploring new verticals, such as prepared food delivery through its Gopuff Kitchen initiative. This service allows customers to order fresh, made-to-order meals along with their other Gopuff items, further blurring the lines between convenience store delivery and traditional food delivery services.

As Gopuff continues to grow and evolve, it faces both opportunities and challenges. The instant needs market is becoming increasingly competitive, with established tech giants and retailers entering the space. Gopuff will need to continue innovating, optimizing its operations, and maintaining customer loyalty to stay ahead in this rapidly changing industry.

Features and Services of Gopuff

Gopuff offers a range of features and services that have contributed to its success in the instant needs delivery market. Here’s a detailed explanation of the key features and services:

1. Rapid Delivery

One of Gopuff’s core features is its promise of fast delivery, typically within 30 minutes. This is made possible by their network of micro-fulfillment centers strategically located in urban areas. The proximity of these centers to customers allows for quick dispatch and short delivery times, setting Gopuff apart from many traditional delivery services.

2. Wide Product Range

Gopuff offers a diverse inventory of over 4,000 products, including:

- Snacks and beverages

- Frozen foods and ice cream

- Household essentials (cleaning supplies, paper products)

- Personal care items

- Over-the-counter medications

- Baby and pet supplies

- Alcohol (in select markets)

- Local specialty items

This wide range allows customers to fulfill multiple needs with a single order, enhancing convenience.

3. Micro-Fulfillment Centers

Gopuff’s network of micro-fulfillment centers, or “dark stores,” is a key feature of its business model. These centers are not open to the public but serve as local inventory hubs. This model allows Gopuff to:

- Control inventory more effectively

- Offer competitive pricing

- Ensure product availability

- Reduce delivery times

4. User-Friendly Mobile App and Website

Gopuff’s digital platforms are designed for ease of use. Features include:

- Intuitive product browsing and search

- Easy reordering of favorite items

- Real-time order tracking

- Scheduled deliveries

- In-app customer support

5. Gopuff Kitchen

In select markets, Gopuff offers prepared food delivery through its Gopuff Kitchen initiative. This service allows customers to order fresh, made-to-order meals alongside their regular Gopuff items, expanding the company’s offerings beyond traditional convenience store items.

6. Alcohol Delivery

In markets where regulations allow, Gopuff offers alcohol delivery. This service includes:

- Age verification processes

- A wide selection of beer, wine, and spirits

- Integration with BevMo! in certain regions following Gopuff’s acquisition of the company

7. Gopuff Deals and Promotions

To attract and retain customers, Gopuff offers various deals and promotions, including:

- New customer discounts

- Seasonal promotions

- Loyalty programs in some markets

8. Fam Subscription Service

Gopuff offers a subscription service called Fam, which provides benefits such as:

- Free delivery on all orders

- Double Puff Points (rewards program)

- Exclusive deals and priority customer support

9. Corporate Partnerships

Gopuff has established partnerships with various companies to offer delivery services to their employees or customers. This includes collaborations with rideshare companies and other businesses.

10. Local Market Customization

Gopuff tailors its product offerings to local preferences in different markets. This includes stocking popular local brands and adjusting inventory based on regional tastes and needs.

11. 24/7 Availability

In many markets, Gopuff operates 24 hours a day, 7 days a week, catering to late-night needs and emergency purchases.

12. Contactless Delivery

In response to the COVID-19 pandemic, Gopuff implemented contactless delivery options, allowing customers to receive their orders with minimal physical interaction.

13. Gift Sending Feature

Gopuff allows users to send items as gifts to friends and family, expanding its use case beyond personal shopping.

These features and services collectively contribute to Gopuff’s value proposition of convenience, speed, and reliability in the instant needs delivery market. By continually expanding and refining these offerings, Gopuff aims to maintain its competitive edge in a rapidly evolving industry.

Business Model of Gopuff

Inventory-Based Model

GoPuff operates on an inventory-based business model. The company purchases products directly from manufacturers and stores them in its own warehouses and micro-fulfillment centers across the country. This allows GoPuff to have full control over its inventory and supply chain, enabling faster and more reliable delivery times compared to competitors that rely on third-party retailers and restaurants.

Delivery and Fulfillment

GoPuff has hundreds of micro-fulfillment centers and a large network of delivery drivers to facilitate fast delivery, typically within 30 minutes. Customers can order through the GoPuff mobile app or website and have the items delivered straight to their door. The company charges a delivery fee for non-subscription customers.

Revenue Streams:

GoPuff generates revenue through several key channels:

1. Markup Model

The core of GoPuff’s revenue model is its markup on the products it sells. GoPuff purchases products directly from manufacturers and brands, stores them in its own warehouses and micro-fulfillment centers, and then sells them to customers at a higher price. The difference between the wholesale cost and the retail price is GoPuff’s profit margin.

This inventory-based model gives GoPuff full control over its supply chain, allowing it to quickly update product assortments and avoid stockouts that plague competitors relying on third-party retailers.

2. Subscription Model

GoPuff charges a $3.95 delivery fee for non-subscription customers. An additional $3.95 fee is added for alcohol orders.

The delivery fee is waived for orders over $49, at which point GoPuff’s profit margins are high enough to cover the delivery costs.

3. Delivery Fees

GoPuff offers an optional $7.99 per month, or $79.99 per year subscription program called “GoPuff Fam” that provides free delivery and other discounts for members. This recurring revenue stream helps drive customer loyalty and repeat business.

4. Advertising Revenue

GoPuff generates revenue by selling preferential product placements and advertising opportunities to brands on its platform. Companies like PepsiCo, Mars Wrigley, and Unilever pay GoPuff to promote their products to the app’s customer base.

GoPuff’s advertising model is based on a cost-per-click (CPC) model, where advertisers only pay when a customer clicks on their ad.

In summary, GoPuff’s business model is centered around an inventory-based approach that allows the company to control its supply chain and deliver orders quickly. It monetizes through product markups, subscription fees, delivery charges, and advertising revenue – providing a diversified set of revenue streams.

Revenue of Gopuff

GoPuff’s revenue in 2023 was approximately $1.2 billion, marking a significant increase from the previous year. The company’s revenue growth was substantial, with a 194% increase in revenue from 2020 to 2021, reaching $1 billion, and a further increase to $1.2 billion in 2023.

GoPuff generates revenue through several key channels:

- Markup Model: GoPuff purchases products directly from manufacturers and sells them to customers at a higher price, marking up the wholesale cost to generate profit margins.

- Delivery Fees: For non-subscription customers, GoPuff charges a $1.95 delivery fee per order, with an additional $2 fee for alcohol orders. The delivery fee is waived for orders over $49.

- Subscription Revenue: GoPuff offers an optional subscription program called “GoPuff Fam” for $5.95 per month, which provides free delivery and other discounts for members. This recurring revenue stream helps drive customer loyalty and repeat business.

- Advertising Revenue: GoPuff generates revenue by selling advertising placements to brands on its platform. Advertisers pay for preferential product placements and post-checkout advertising opportunities, which are targeted to GoPuff’s customer base.

GoPuff’s customer base is primarily composed of young adults, with the largest age demographic between 24 and 34 years old. The company has expanded its offerings by acquiring several businesses, including BevMo and Liquor Barn, and has plans to launch its own-brand products and potentially go public through an IPO.

Competitors of Gopuff

Gopuff operates in the competitive on-demand delivery landscape, facing challenges from various players. Here’s a detailed analysis of its primary competitors:

1. DoorDash

DoorDash is a formidable competitor for Gopuff, primarily due to its extensive market presence and established brand recognition in the food delivery sector. With a vast network of restaurant partners and a growing number of convenience store offerings through DashMart, DoorDash has successfully expanded its service range to include groceries and everyday essentials. This expansion allows DoorDash to appeal to a broader customer base, making it a significant player in the on-demand delivery landscape. The company’s robust logistics infrastructure enables quick delivery times, although not always as rapid as Gopuff’s specialized micro-fulfillment model.

However, DoorDash faces challenges that Gopuff can leverage to maintain its competitive advantage. While DoorDash’s delivery fees can be higher, Gopuff often provides lower fees and faster delivery times for convenience items, positioning itself as the go-to choice for immediate needs. Additionally, Gopuff’s focus on a curated selection of products stocked in localized fulfillment centers allows for a more streamlined inventory tailored to consumer demands. As DoorDash continues to broaden its offerings, Gopuff’s unique positioning in the market may allow it to capitalize on the growing demand for instant delivery of essential items.

2. Instacart

Instacart presents a significant competitive challenge to Gopuff by leveraging its strong partnerships with major grocery retailers and extensive product offerings. With collaborations with chains like Costco, Kroger, and Safeway, Instacart provides a wide selection of grocery items, making it a popular choice for consumers looking to fulfill larger shopping needs. The platform’s ability to deliver a comprehensive grocery experience, combined with features like scheduled deliveries, positions it as a go-to option for families and regular shoppers, contrasting with Gopuff’s focus on rapid delivery of convenience items.

However, Instacart’s model often results in longer delivery times compared to Gopuff’s rapid service, which can be a disadvantage in the on-demand space. While Instacart excels in traditional grocery delivery, Gopuff’s micro-fulfillment centers enable quick access to everyday essentials in under 30 minutes. This speed, coupled with lower delivery fees through its subscription model, allows Gopuff to cater to consumers seeking immediate solutions for spontaneous purchases. As consumer preferences continue to shift toward instant gratification, Gopuff’s agility may give it an edge over Instacart in the convenience delivery sector.

3. Amazon Fresh and Prime Now

Amazon Fresh and Prime Now pose a strong competitive threat to Gopuff due to Amazon’s extensive logistics network and established customer loyalty. With the ability to deliver groceries and everyday essentials within hours, Amazon leverages its vast infrastructure to provide rapid service to Prime members. This integration within the Amazon ecosystem allows for a seamless shopping experience, encouraging users to consolidate their purchases through a trusted platform. The brand’s reputation for reliability and convenience positions it as a formidable player in the on-demand delivery market.

However, Gopuff differentiates itself by focusing specifically on instant delivery from localized micro-fulfillment centers, often achieving faster turnaround times than Amazon’s broader grocery service. While Amazon Fresh can handle larger grocery orders, Gopuff excels in delivering smaller convenience items quickly, catering to consumers’ immediate needs. Additionally, Gopuff’s competitive pricing structure and lower delivery fees through its subscription model attract users looking for cost-effective solutions for on-the-go purchases. This specialized focus allows Gopuff to carve out a niche that challenges Amazon’s dominance in the space.

4. 7-Eleven and Other Convenience Stores

7-Eleven and other convenience stores represent a significant competitive threat to Gopuff by leveraging their established brand recognition and widespread locations. These stores are well-known for their ability to provide quick access to everyday essentials, making them a popular choice for consumers seeking immediate solutions. Many convenience stores have partnered with delivery services to expand their reach, allowing customers to order items online and receive them swiftly, thus directly competing with Gopuff’s rapid delivery model.

However, while convenience stores offer a broad selection of everyday products, they often lack the specialized focus and speed that Gopuff provides through its micro-fulfillment centers. Gopuff’s business model is designed for rapid delivery of a curated selection of items, often within 30 minutes, which can outperform traditional convenience store delivery times. Additionally, Gopuff’s streamlined logistics and subscription model allow for lower delivery fees, attracting price-sensitive consumers. This targeted approach enables Gopuff to maintain a competitive edge in the convenience delivery market despite the presence of established retail players like 7-Eleven.

5. Postmates (Owned by Uber)

Postmates, now integrated into Uber Eats, poses a notable competitive challenge to Gopuff by offering a diverse range of delivery options that extend beyond just food. With its platform enabling users to order from local businesses, including convenience stores, Postmates provides flexibility and a broad selection of products. This variety allows Postmates to cater to a wide customer base, appealing to those looking for both meals and everyday essentials, thereby directly competing with Gopuff’s focus on convenience item delivery.

However, Gopuff differentiates itself through its dedicated model focused solely on rapid delivery from localized fulfillment centers, which enables quicker service times for essential items. While Postmates may offer a wider selection overall, its reliance on independent contractors can lead to inconsistent delivery experiences, impacting customer satisfaction. Gopuff’s streamlined operations ensure reliable and speedy delivery, often achieving fulfillment in under 30 minutes, which is a critical advantage for consumers seeking immediate needs. This specialization positions Gopuff as a compelling alternative for users prioritizing speed and efficiency in their convenience shopping experience.

6. FreshDirect

FreshDirect competes with Gopuff by focusing on high-quality grocery delivery, primarily serving urban markets with a strong emphasis on fresh produce and specialty items. Known for its commitment to sourcing local and organic products, FreshDirect appeals to health-conscious consumers looking for premium grocery options. This targeted approach positions FreshDirect as a reliable choice for customers interested in quality over speed, offering a more traditional grocery shopping experience compared to Gopuff’s rapid delivery model.

However, Gopuff’s unique selling proposition lies in its ability to deliver convenience items quickly, often within 30 minutes, catering to immediate needs that FreshDirect cannot match. While FreshDirect typically handles larger grocery orders with longer delivery windows, Gopuff specializes in small, everyday purchases that consumers might need on short notice. This focus on speed and accessibility allows Gopuff to capture a segment of the market that prioritizes instant gratification, making it a strong contender against FreshDirect’s grocery-centric offerings in the on-demand delivery landscape.

7. Snackdash

Snackdash is emerging as a notable competitor to Gopuff by focusing specifically on delivering snacks and convenience items quickly to urban consumers. By specializing in a curated selection of popular snacks and beverages, Snackdash appeals to a niche market that values speed and simplicity in their purchasing experience. This targeted approach allows Snackdash to directly challenge Gopuff’s core offering, attracting customers who prioritize rapid access to everyday indulgences.

However, while Snackdash’s emphasis on snacks creates a focused product range, Gopuff’s extensive inventory encompasses a broader array of items, including groceries and household essentials. Gopuff’s micro-fulfillment model enables it to deliver a wider selection of products in under 30 minutes, catering to a more diverse set of consumer needs beyond just snacks. This advantage positions Gopuff as a more comprehensive solution for on-demand delivery, allowing it to maintain a competitive edge in the convenience market despite Snackdash’s specialized focus.

In summary, GoPuff faces competition from grocery delivery services like Instacart, restaurant/convenience delivery from Uber Eats, and office-focused providers like Snackdash. Competitors have varying strengths in selection, delivery speed, and geographic coverage. But GoPuff’s owned inventory model and focus on rapid 30-minute delivery remain key differentiators.

Also Read: Airmeet: Founders, Business Model, Revenue, Competitors

To read more content like this, subscribe to our newsletter