HSBC, which stands for The Hongkong and Shanghai Banking Corporation, is one of the world’s largest banking and financial services organizations. Founded in 1865, HSBC has grown from its origins in Hong Kong and Shanghai to become a global institution with a presence in 64 countries and territories across Europe, Asia, North America, Latin America, and the Middle East and North Africa.

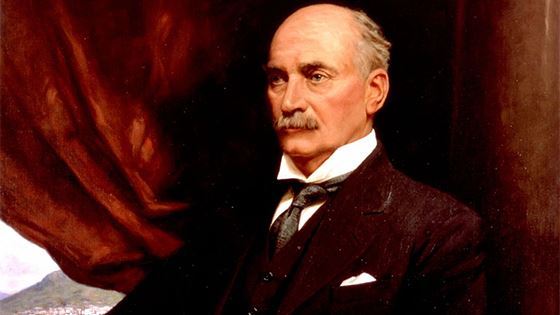

The bank was established by Thomas Sutherland, a Scotsman working for the Peninsular and Oriental Steam Navigation Company, to finance the growing trade between China and Europe. Sutherland recognized the need for local banking facilities in Hong Kong and along China’s coast. The bank’s first branch opened in Hong Kong on March 3, 1865, and a second branch in Shanghai followed a month later. This dual-city origin is reflected in the bank’s name and remains an important part of its identity to this day.

Throughout its history, HSBC has played a significant role in the economic development of its home markets and in facilitating international trade. The bank’s early success was built on financing trade between Europe and Asia, particularly the tea and silk trades. As trade routes expanded and new markets emerged, HSBC grew alongside them, establishing branches in key trading centers across the world.

HSBC’s modern global structure began to take shape in the late 20th century through a series of strategic acquisitions and expansions. In 1992, HSBC Holdings plc was established in London as the parent company of the HSBC Group. This move shifted the bank’s center of gravity westward and positioned it for further international growth. Notable acquisitions include Midland Bank in the UK (1992), which significantly expanded HSBC’s presence in Europe, and Marine Midland Bank in the US (fully acquired in 1987), which provided a foothold in the North American market.

Today, HSBC operates across three main business lines: Wealth and Personal Banking, Commercial Banking, and Global Banking and Markets. These divisions serve a diverse client base ranging from individual consumers to large multinational corporations and institutions. The bank’s network spans both established and emerging markets, allowing it to connect customers to opportunities around the world.

HSBC’s global reach is one of its key strengths. The bank’s extensive international network allows it to facilitate cross-border trade and investment, positioning it as a leader in global transaction banking. This is particularly important in the context of increasing economic interconnectedness and the rise of emerging markets, especially in Asia.

In recent years, HSBC has been at the forefront of digital banking innovation. The bank has invested heavily in technology to improve customer experience, enhance operational efficiency, and stay competitive in an increasingly digital financial landscape. This includes the development of mobile banking apps, online investment platforms, and the use of artificial intelligence and machine learning in areas such as fraud detection and customer service.

However, HSBC’s journey has not been without challenges. The bank has faced regulatory scrutiny and fines related to issues such as money laundering controls and tax evasion. In response, HSBC has significantly strengthened its compliance and risk management functions, implementing more robust systems and controls across its global operations.

HSBC’s brand is symbolized by its distinctive hexagon logo, often referred to as “the Hexagon.” The current version of this logo, introduced in 2018, is a simplified and more dynamic interpretation of the original design from 1983. The red and white color scheme is instantly recognizable and reflects the bank’s heritage, with red being a color of prosperity in many Asian cultures.

In terms of financial performance, HSBC consistently ranks among the world’s largest banks by total assets. As of 2023, the bank reported total assets of over $3 trillion, making it one of the few trillion-dollar banks globally. HSBC’s financial strength and global presence have made it one of the few truly global systemically important banks, as designated by the Financial Stability Board.

Top Competitors and Alternatives of HSBC

HSBC faces competition from several global banking giants as well as regional powerhouses across its various markets. Here’s a detailed exploration of HSBC’s top competitors and alternatives:

1. Citigroup

Website – https://www.citigroup.com/global

Citigroup and HSBC are two of the largest multinational financial institutions, competing across various segments of banking and financial services globally.

Citigroup, headquartered in New York City, operates in over 160 countries and provides a broad range of financial products and services, including consumer banking, corporate banking, investment banking, and wealth management. Citigroup’s strengths lie in its extensive global presence, diversified product offerings, and strong capabilities in investment banking and corporate finance. It is known for its innovation in digital banking services and robust risk management practices. However, Citigroup faces challenges such as regulatory scrutiny due to its global footprint and complexities in managing diverse operations across different markets.

HSBC, based in London, also operates globally with a significant presence in Europe, Asia-Pacific, and the Americas. It offers similar services to Citigroup, including retail banking, commercial banking, investment banking, and wealth management. HSBC’s strengths include a strong focus on international banking and trade finance, particularly in emerging markets, and a reputation for stability and longevity. It is known for its extensive network of branches and customer-centric approach. However, HSBC has been navigating challenges related to regulatory compliance, operational efficiency, and strategic restructuring.

Comparative Summary

| Feature | Citigroup | HSBC |

|---|---|---|

| Primary Strengths | Global Presence, Diversified Product Offerings | International Banking, Trade Finance, Stability |

| Core Offerings | Consumer Banking, Corporate Banking, Investment Banking | Retail Banking, Commercial Banking, Investment Banking |

| Geographic Presence | Operates in over 160 countries | Significant presence in Europe, Asia-Pacific, Americas |

| Challenges | Regulatory scrutiny, Complexity in global operations | Regulatory compliance, Operational efficiency |

| Market Focus | Innovation in digital banking, Risk management | Customer-centric approach, Strategic restructuring |

2. JPMorgan Chase

Website – https://www.jpmorganchase.com/

JPMorgan Chase and HSBC are prominent global financial institutions, competing across various segments of banking and financial services.

JPMorgan Chase, headquartered in New York City, is one of the largest banks in the United States and operates globally. It offers a wide range of financial services, including consumer banking, commercial banking, investment banking, asset management, and wealth management. JPMorgan Chase’s strengths lie in its robust investment banking division, strong presence in capital markets, and extensive network of branches across the United States. It is known for its leadership in financial advisory services and innovation in digital banking solutions. However, JPMorgan Chase faces challenges such as regulatory scrutiny, particularly in its investment banking and trading operations, and complexities in managing a vast and diverse portfolio of financial services.

HSBC, headquartered in London, operates across Europe, Asia-Pacific, and the Americas. Like JPMorgan Chase, it provides a broad spectrum of services including retail banking, commercial banking, investment banking, and wealth management. HSBC’s strengths include its international banking capabilities, particularly in trade finance and emerging markets, and a strong reputation for stability and global connectivity. It is recognized for its extensive network of branches and digital transformation initiatives. However, HSBC encounters challenges related to regulatory compliance, operational efficiency, and strategic alignment amidst global economic shifts.

Comparative Summary

| Feature | JPMorgan Chase | HSBC |

|---|---|---|

| Primary Strengths | Investment Banking, Capital Markets, Branch Network | International Banking, Trade Finance, Stability |

| Core Offerings | Consumer Banking, Commercial Banking, Investment Banking | Retail Banking, Commercial Banking, Investment Banking |

| Geographic Presence | Strong presence in the United States and globally | Significant presence in Europe, Asia-Pacific, Americas |

| Challenges | Regulatory scrutiny, Complexity in financial operations | Regulatory compliance, Operational efficiency |

| Market Focus | Leadership in financial advisory, Digital innovation | Global connectivity, Customer-centric approach |

3. Standard Chartered

Website – https://www.sc.com/en/

Standard Chartered and HSBC are two major global banks with overlapping but distinct strengths in the financial services industry.

Standard Chartered, headquartered in London, operates primarily in Asia, Africa, and the Middle East, with a focus on emerging markets. It offers a wide range of services including retail banking, corporate banking, commercial banking, and wealth management. Standard Chartered’s strengths lie in its extensive presence in high-growth markets, particularly in Asia, and its expertise in trade finance and international banking. It is known for its strong relationships with corporate clients and government entities across its operating regions. However, Standard Chartered faces challenges such as economic volatility in emerging markets, regulatory scrutiny across multiple jurisdictions, and operational risks associated with its geographic footprint.

HSBC, also headquartered in London, operates globally with a significant presence in Europe, Asia-Pacific, and the Americas. It offers similar services to Standard Chartered, including retail banking, commercial banking, investment banking, and wealth management. HSBC’s strengths include its global network, stability, and expertise in international banking and trade finance. It is recognized for its strong customer base and digital banking initiatives aimed at enhancing customer experience and operational efficiency. However, HSBC encounters challenges related to regulatory compliance, operational scale, and strategic alignment amidst changing global economic conditions.

Comparative Summary

| Feature | Standard Chartered | HSBC |

|---|---|---|

| Primary Strengths | Presence in Emerging Markets, Trade Finance, International Banking | Global Network, Stability, International Banking |

| Core Offerings | Retail Banking, Corporate Banking, Wealth Management | Retail Banking, Commercial Banking, Investment Banking |

| Geographic Presence | Strong in Asia, Africa, Middle East | Significant presence in Europe, Asia-Pacific, Americas |

| Challenges | Economic volatility in emerging markets, Regulatory scrutiny | Regulatory compliance, Operational scale |

| Market Focus | Expertise in trade finance, Corporate relationships | Global connectivity, Digital banking initiatives |

4. Bank of China

Website – https://www.boc.cn/en/

Bank of China (BOC) and HSBC are significant players in the global banking industry, each with distinct strengths and strategies.

Bank of China, headquartered in Beijing, is one of China’s largest state-owned commercial banks, operating domestically and internationally. It provides a wide range of financial services including retail banking, corporate banking, investment banking, and asset management. BOC’s strengths lie in its strong government backing, extensive network across China, and deep expertise in financing large-scale infrastructure projects and international trade. It is known for its leading role in renminbi (RMB) internationalization and its pivotal position in China’s banking sector. However, BOC faces challenges such as navigating regulatory environments in multiple jurisdictions, managing risks associated with its expansive operations, and maintaining profitability amidst global economic fluctuations.

HSBC, headquartered in London, operates globally with a significant presence in Europe, Asia-Pacific, and the Americas. It offers similar services to Bank of China, including retail banking, commercial banking, investment banking, and wealth management. HSBC’s strengths include its global network, stability, and expertise in international banking and trade finance. It is recognized for its strong customer base and digital banking initiatives aimed at enhancing customer experience and operational efficiency. However, HSBC encounters challenges related to regulatory compliance, operational scale, and strategic alignment amidst changing global economic conditions.

Comparative Summary

| Feature | Bank of China | HSBC |

|---|---|---|

| Primary Strengths | Government Backing, Leading Role in RMB Internationalization, Infrastructure Financing | Global Network, Stability, International Banking |

| Core Offerings | Retail Banking, Corporate Banking, Investment Banking | Retail Banking, Commercial Banking, Investment Banking |

| Geographic Presence | Strong in China, International Operations | Significant presence in Europe, Asia-Pacific, Americas |

| Challenges | Regulatory complexities, Operational risks, Economic fluctuations | Regulatory compliance, Operational scale |

| Market Focus | Large-scale infrastructure projects, International trade | Global connectivity, Digital banking initiatives |

5. DBS Bank

Website – https://www.dbs.com/in/index/default.page

DBS Bank and HSBC are prominent banks operating across Asia-Pacific and globally, each bringing unique strengths and strategies to the financial services industry.

DBS Bank, headquartered in Singapore, is known for its strong presence in Southeast Asia and its innovative approach to digital banking. DBS’s strengths lie in its digital transformation initiatives, customer-centric approach, and strong foothold in key markets like Singapore, Hong Kong, and India. It offers a comprehensive range of services including consumer banking, institutional banking, asset management, and treasury and markets. However, DBS faces challenges such as competition from local and global banks, regulatory complexities across different jurisdictions, and managing risks associated with its regional focus.

HSBC, headquartered in London, operates globally with a significant presence in Asia-Pacific, Europe, and the Americas. It provides a broad spectrum of financial services including retail banking, commercial banking, investment banking, and wealth management. HSBC’s strengths include its extensive global network, stability, and expertise in international banking and trade finance. It is recognized for its strong customer base and digital banking initiatives aimed at enhancing customer experience and operational efficiency. However, HSBC encounters challenges related to regulatory compliance, operational scale, and strategic alignment amidst changing global economic conditions.

Comparative Summary

| Feature | DBS Bank | HSBC |

|---|---|---|

| Primary Strengths | Digital Transformation, Customer-Centric Approach, Strong Asia-Pacific Presence | Global Network, Stability, International Banking |

| Core Offerings | Consumer Banking, Institutional Banking, Asset Management, Treasury and Markets | Retail Banking, Commercial Banking, Investment Banking |

| Geographic Presence | Strong in Southeast Asia, Presence in key markets like Singapore, Hong Kong | Significant presence in Europe, Asia-Pacific, Americas |

| Challenges | Competition from local and global banks, Regulatory complexities, Regional risks | Regulatory compliance, Operational scale |

| Market Focus | Innovation in digital banking, Regional leadership | Global connectivity, Digital banking initiatives |

6. Barclays

Website – https://home.barclays/

Barclays, headquartered in London, operates globally with a focus on retail banking, corporate banking, investment banking, and wealth management. Barclays’ strengths lie in its strong presence in Europe and the United States, robust investment banking division, and innovative digital banking solutions. It is known for its leadership in areas such as mergers and acquisitions, debt capital markets, and electronic trading platforms. However, Barclays faces challenges such as regulatory scrutiny, particularly in its investment banking operations, and managing risks associated with its global footprint and diverse business lines.

HSBC, also headquartered in London, operates globally with a significant presence in Europe, Asia-Pacific, and the Americas. It offers a broad spectrum of financial services including retail banking, commercial banking, investment banking, and wealth management. HSBC’s strengths include its extensive global network, stability, and expertise in international banking and trade finance. It is recognized for its strong customer base and digital banking initiatives aimed at enhancing customer experience and operational efficiency. However, HSBC encounters challenges related to regulatory compliance, operational scale, and strategic alignment amidst changing global economic conditions.

Comparative Summary

| Feature | Barclays | HSBC |

|---|---|---|

| Primary Strengths | Strong Presence in Europe and the United States, Investment Banking Leadership, Digital Banking Innovation | Global Network, Stability, International Banking |

| Core Offerings | Retail Banking, Corporate Banking, Investment Banking, Wealth Management | Retail Banking, Commercial Banking, Investment Banking |

| Geographic Presence | Significant presence in Europe and the United States | Significant presence in Europe, Asia-Pacific, Americas |

| Challenges | Regulatory scrutiny, Global operational risks | Regulatory compliance, Operational scale |

| Market Focus | Leadership in investment banking, Digital innovation | Global connectivity, Digital banking initiatives |

7. BNP Paribas

Website – https://group.bnpparibas/en/

BNP Paribas and HSBC are major global banks with extensive operations and a broad range of financial services.

BNP Paribas, headquartered in Paris, operates across Europe, the Americas, Asia-Pacific, and the Middle East. It offers a comprehensive array of services including retail banking, corporate and institutional banking, investment solutions, and asset management. BNP Paribas’ strengths lie in its strong presence in Europe, particularly in investment banking and asset management, and its leadership in sustainable finance and corporate social responsibility. It is known for its robust risk management practices and innovative digital banking initiatives. However, BNP Paribas faces challenges such as regulatory complexities across multiple jurisdictions, economic fluctuations impacting global markets, and operational risks associated with its expansive footprint.

HSBC, headquartered in London, operates globally with a significant presence in Europe, Asia-Pacific, and the Americas. It provides a broad spectrum of financial services including retail banking, commercial banking, investment banking, and wealth management. HSBC’s strengths include its extensive global network, stability, and expertise in international banking and trade finance. It is recognized for its strong customer base and digital banking initiatives aimed at enhancing customer experience and operational efficiency. However, HSBC encounters challenges related to regulatory compliance, operational scale, and strategic alignment amidst changing global economic conditions.

Comparative Summary

| Feature | BNP Paribas | HSBC |

|---|---|---|

| Primary Strengths | Strong Presence in Europe, Leadership in Sustainable Finance, Robust Investment Banking | Global Network, Stability, International Banking |

| Core Offerings | Retail Banking, Corporate & Institutional Banking, Investment Solutions, Asset Management | Retail Banking, Commercial Banking, Investment Banking |

| Geographic Presence | Extensive in Europe, Americas, Asia-Pacific, Middle East | Significant presence in Europe, Asia-Pacific, Americas |

| Challenges | Regulatory complexities, Economic fluctuations, Operational risks | Regulatory compliance, Operational scale |

| Market Focus | Sustainable finance, Innovation in digital banking | Global connectivity, Digital banking initiatives |

8. Deutsche Bank

Website – https://www.db.com/

Deutsche Bank and HSBC are prominent global banks, each with a wide range of financial services and a significant international presence.

Deutsche Bank, headquartered in Frankfurt, Germany, operates globally with a focus on investment banking, corporate banking, asset management, and retail banking. Deutsche Bank’s strengths lie in its robust investment banking division, strong presence in capital markets, and extensive client base across Europe and the United States. It is known for its expertise in mergers and acquisitions, securities trading, and structured finance solutions. However, Deutsche Bank faces challenges such as regulatory scrutiny, operational efficiency, and strategic restructuring amidst economic volatility.

HSBC, headquartered in London, operates globally with a significant presence in Europe, Asia-Pacific, and the Americas. It offers a broad spectrum of financial services including retail banking, commercial banking, investment banking, and wealth management. HSBC’s strengths include its extensive global network, stability, and expertise in international banking and trade finance. It is recognized for its strong customer base and digital banking initiatives aimed at enhancing customer experience and operational efficiency. However, HSBC encounters challenges related to regulatory compliance, operational scale, and strategic alignment amidst changing global economic conditions.

Comparative Summary

| Feature | Deutsche Bank | HSBC |

|---|---|---|

| Primary Strengths | Investment Banking, Capital Markets, Extensive European and US Presence | Global Network, Stability, International Banking |

| Core Offerings | Investment Banking, Corporate Banking, Asset Management, Retail Banking | Retail Banking, Commercial Banking, Investment Banking |

| Geographic Presence | Strong in Europe and the United States, Global Operations | Significant presence in Europe, Asia-Pacific, Americas |

| Challenges | Regulatory scrutiny, Operational efficiency, Economic volatility | Regulatory compliance, Operational scale |

| Market Focus | Leadership in investment banking, Capital markets expertise | Global connectivity, Digital banking initiatives |

HSBC’s response to this competition has been multifaceted. The bank has been investing heavily in digital transformation, enhancing its mobile and online banking capabilities. It has also been focusing on its strengths, particularly its extensive international network and its strong position in Asia. HSBC has been streamlining its operations, exiting from less profitable markets to focus on areas where it has a competitive advantage.

Additionally, HSBC has been emphasizing its expertise in areas such as trade finance, cross-border banking, and sustainable finance. The bank’s ability to serve clients across multiple geographies remains a key differentiator in the face of both global and local competition.

Also Read: Top JPMorgan Chase Competitors and Alternatives in 2024

To read more content like this, subscribe to our newsletter