Flyhomes is an innovative real estate technology startup that has been making waves in the traditionally slow-to-change housing market. Founded in 2016 by Tushar Garg and Stephen Lane, Flyhomes set out to revolutionize the home-buying process by addressing key pain points for both buyers and sellers. The company’s mission is to empower people to buy and sell homes with confidence, speed, and ease, ultimately transforming the real estate industry.

At its core, Flyhomes operates as a tech-enabled real estate brokerage that offers a unique suite of services designed to streamline and simplify the home-buying and selling process. What sets Flyhomes apart from traditional brokerages is its innovative approach to solving common problems in real estate transactions, particularly in competitive housing markets.

One of Flyhomes’ most notable offerings is its Cash Offer program. In hot real estate markets where all-cash offers often win out over financed bids, Flyhomes enables buyers to make cash offers on homes, even if they don’t have the full amount in liquid assets. This is how it works: Flyhomes uses its own funds to purchase the home on behalf of the buyer, allowing the transaction to close quickly. The buyer then has time to secure traditional mortgage financing to purchase the home from Flyhomes. This innovative approach levels the playing field for buyers who might otherwise be shut out of competitive markets.

Another key service offered by Flyhomes is its Trade Up program.This program addresses a common dilemma faced by many homeowners: the need to sell their current home to fund the purchase of a new one. With Trade Up, Flyhomes buys the client’s new home with cash, allows them to move in, and then lists and sells their old home. This eliminates the stress and uncertainty of trying to time two transactions simultaneously and removes the need for contingent offers, which are often less competitive in hot markets.

Flyhomes also offers a Buy Before You Sell program, which is similar to Trade Up but designed for clients who find their new home before listing their current one. In this scenario, Flyhomes purchases the new home with cash, allowing the client to move in and then list their old home without the pressure of timing both transactions perfectly.

The company’s business model combines elements of traditional real estate brokerage with innovative financial services. Flyhomes generates revenue through standard real estate commissions, as well as fees for its cash offer and trade-up services. By offering these value-added services, Flyhomes is able to differentiate itself in a crowded market and attract clients who are looking for a more streamlined and less stressful home-buying or selling experience.

Flyhomes’ approach to real estate is heavily technology-driven. The company has developed proprietary software and algorithms to help price homes accurately, identify promising properties for buyers, and streamline the entire transaction process. This tech-forward approach allows Flyhomes to operate more efficiently than traditional brokerages and provide a more data-driven, transparent experience for its clients.

Since its founding, Flyhomes has experienced rapid growth and attracted significant investor interest. The company has raised over $200 million in funding as of 2021, with notable investors including Andressen Horowitz, Canvas Ventures, and Zigg Capital. This financial backing has allowed Flyhomes to expand its services and geographic reach, growing from its initial market in Seattle to operate in several major U.S. cities including San Francisco, Los Angeles, Boston, and Chicago.

Flyhomes’ success has not been without challenges. The company operates in a highly regulated industry and must navigate complex legal and financial landscapes. Additionally, its innovative services require significant capital, making efficient operations and risk management crucial to its success.

The COVID-19 pandemic presented both challenges and opportunities for Flyhomes. While the real estate market initially slowed in the early days of the pandemic, it quickly rebounded, with many markets seeing increased demand as people reassessed their housing needs in light of remote work and other lifestyle changes. Flyhomes’ tech-enabled, low-contact approach to real estate transactions positioned it well to serve clients during this time.

Looking to the future, Flyhomes continues to innovate and expand its services. The company is exploring ways to further streamline the home-buying and selling process, potentially incorporating emerging technologies like blockchain for more efficient and secure transactions. There’s also potential for Flyhomes to expand into adjacent services such as home insurance, renovation, and property management.

Flyhomes’ impact on the real estate industry extends beyond its direct services to buyers and sellers. By demonstrating the viability of tech-enabled, innovative approaches to real estate transactions, the company is helping to drive broader change in an industry that has long been resistant to disruption.

As the company continues to grow and evolve, it faces both opportunities and challenges. Expanding into new markets requires navigating different regulatory environments and real estate dynamics. Maintaining the quality of its services while scaling rapidly is another key challenge. Additionally, as a pioneer in its space, Flyhomes must continue to innovate to stay ahead of potential competitors who may seek to replicate its model.

Founders’ Story and Founders of Flyhomes

The story of Flyhomes’ founders is an inspiring tale of entrepreneurship, innovation, and problem-solving in the real estate industry. Let’s delve into the details of the founders and their journey:

Flyhomes was co-founded by Tushar Garg and Stephen Lane in 2016. Their backgrounds and experiences played a crucial role in shaping the vision and direction of the company.

Tushar Garg

Tushar Garg, who serves as the CEO of Flyhomes, is the primary visionary behind the company. Garg holds an MBA from Harvard Business School and a bachelor’s degree in Computer Science from the Indian Institute of Technology (IIT) Delhi. Prior to founding Flyhomes, Garg worked at Microsoft for several years, where he held various product management roles. His experience in technology and product development would prove invaluable in creating Flyhomes’ tech-driven approach to real estate.

The idea for Flyhomes came from Garg’s personal experience. While working at Microsoft in Seattle, he and his wife were looking to buy their first home. They found the process frustrating, time-consuming, and full of uncertainty, especially in a competitive market where all-cash offers often won out over traditional financing. Garg saw an opportunity to leverage technology and innovative financial products to solve the problems he experienced firsthand. He envisioned a company that could make the home-buying process more efficient, transparent, and accessible to a broader range of buyers.

Stephen Lane

Stephen Lane, the co-founder of Flyhomes, brought complementary skills and experience to the partnership. Lane holds an MBA from Harvard Business School, where he met Garg, and a bachelor’s degree from the University of Notre Dame. Before co-founding Flyhomes, Lane worked in management consulting at Bain & Company and in private equity at Altamont Capital Partners. His background in finance and strategy complemented Garg’s technology expertise.

Lane initially served as the company’s Chief Operating Officer, helping to shape the operational structure and strategy of Flyhomes as it grew from a startup to a significant player in the real estate tech space.

The Founding Story:

Garg and Lane met while pursuing their MBAs at Harvard Business School. They bonded over their shared interest in entrepreneurship and their frustrations with the traditional real estate market. The initial concept for Flyhomes was developed during their time at Harvard. They spent countless hours discussing the problems in the real estate industry and brainstorming potential solutions.

After graduation, Garg and Lane decided to turn their idea into reality. They launched Flyhomes in Seattle in 2016, choosing this market due to its competitive nature and tech-savvy population. In the beginning, the founders wore many hats, from developing the technology platform to acting as real estate agents themselves. They were hands-on in every aspect of the business, which gave them deep insights into the needs of both buyers and sellers.

The founders successfully raised seed funding to get the company off the ground. Their unique approach and early traction helped them secure additional rounds of funding in subsequent years. As the company grew, Garg and Lane continued to innovate, introducing new services like the Cash Offer program and Trade Up program in response to market needs and customer feedback.

The founders’ complementary skills and shared vision have been crucial to Flyhomes’ success:

- Garg’s technology background and product management experience drove the development of Flyhomes’ tech platform and user experience.

- Lane’s finance and strategy expertise helped shape the company’s innovative financial products and overall business strategy.

Their personal experiences as homebuyers informed their approach, ensuring that Flyhomes’ solutions addressed real pain points in the market.

In conclusion, the story of Flyhomes’ founders is one of identifying a significant problem in a traditional industry and leveraging their unique skills and experiences to create an innovative solution. Tushar Garg and Stephen Lane’s vision of transforming the real estate industry through technology and financial innovation has driven Flyhomes from a startup to a significant player in the prop-tech space, demonstrating the power of combining personal passion with professional expertise in entrepreneurship.

Business Model of Flyhomes

Flyhomes has a unique business model that sets it apart in the competitive real estate market. Here are the key elements of Flyhomes’ business model, enriched with real-life details:

Integrated Home Buying Experience: Flyhomes offers a seamless and integrated home buying experience by combining traditional real estate services with innovative solutions. They provide a one-stop shop for buyers, offering services such as brokerage, mortgage, closing, and even home renovation. This end-to-end approach simplifies the home buying process, reducing the complexity and stress typically associated with purchasing a home. For example, Flyhomes has facilitated over $6 billion+ in real estate transactions from 2015, showcasing their significant market impact.

Trade-Up Program: One of Flyhomes’ standout features is its Trade-Up Program, which allows homeowners to buy their next home before selling their current one. This program alleviates the common issue of needing to sell a home before purchasing a new one, offering a smoother transition for homeowners. Flyhomes makes competitive, non-contingent offers on behalf of clients, which strengthens their purchasing power in competitive markets. In Seattle, where the real estate market is highly competitive, Flyhomes’ Trade-Up Program has helped clients secure homes quickly and efficiently, with a success rate significantly higher than traditional methods.

Cash Offer Program: Flyhomes also provides a Cash Offer Program, wherein they purchase homes on behalf of clients using their own funds. This program is designed to make offers more attractive to sellers, as cash offers are typically preferred and can expedite the closing process. After securing the property, Flyhomes then sells it to the client. This program significantly enhances buyers’ chances of winning in competitive bidding situations. The company charges a service fee of 1% of the home’s purchase price for this service, which is highly competitive compared to industry standards.

Revenue Streams:

Brokerage Fees: Flyhomes earns revenue through traditional real estate brokerage fees when clients buy or sell homes through their platform. These fees typically range from 2.5% to 3% of the home’s sale price. For instance, on a $500,000 home, the brokerage fee would be approximately $12,500 to $15,000.

Mortgage Services: By offering in-house mortgage services, Flyhomes generates additional revenue through loan origination fees, which usually amount to around 1% of the loan amount. For a $400,000 mortgage, this fee would be about $4,000. They also earn from interest spread on mortgages they hold, which adds to their revenue stream.

Ancillary Services: Flyhomes also earns revenue from ancillary services such as title insurance, home insurance, and renovation services. For example, title insurance typically costs around 0.5% of the home’s purchase price, and home insurance can range from $500 to $2,000 annually, depending on the property value and location. By providing these additional services, they capture more value from each transaction.

Technological Innovation:

Flyhomes leverages technology to enhance the customer experience and streamline operations. Their platform offers features like virtual tours, digital document signing, and real-time market analysis, making the home buying process more efficient and transparent. This tech-driven approach allows Flyhomes to scale their operations and offer competitive advantages to their clients. Flyhomes’ technology infrastructure has supported over 3,000 successful transactions, reflecting its effectiveness and reliability.

In essence, Flyhomes’ business model revolves around providing a comprehensive, tech-enabled real estate service that simplifies the home buying and selling process, offers innovative solutions like cash offers and trade-up programs, and captures value from multiple revenue streams. Their competitive fees and charges, coupled with their extensive transaction data, highlight their significant role in the real estate industry.

Investments and Funding Rounds of Flyhomes

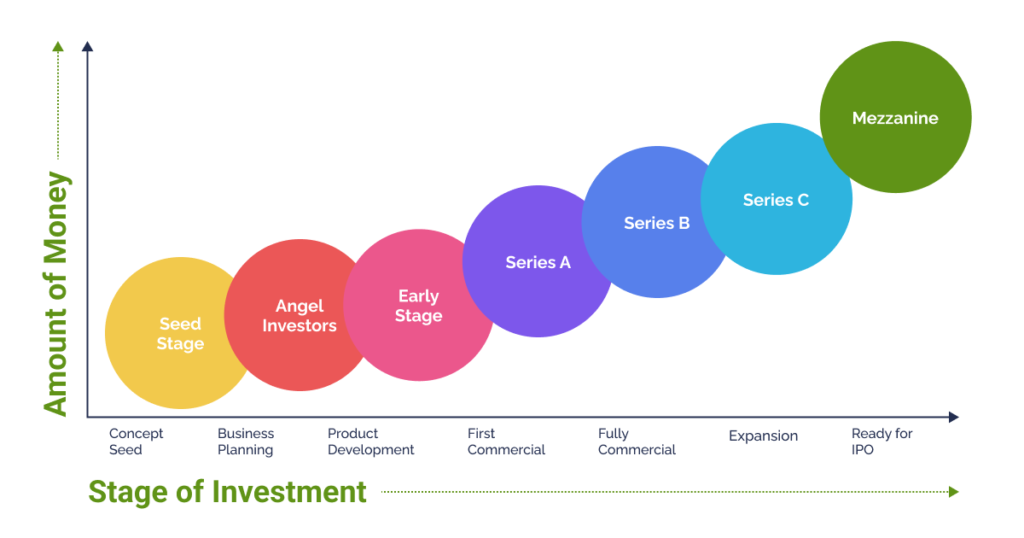

Flyhomes has raised significant capital through several funding rounds to support its growth and innovation.

Here are the details of Flyhomes’ funding rounds:

Seed Funding Round (2016)

Flyhomes raised $2 million in seed funding to kickstart its operations and develop its unique real estate platform. This initial funding helped the company establish its integrated home buying experience and launch its first services in the Seattle area. The seed round was led by Pritzker Group Venture Capital, with participation from other angel investors.

Series A (2018)

In 2018, Flyhomes raised $17 million in a Series A funding round. This round was led by Andreessen Horowitz (a16z), a prominent venture capital firm known for investing in disruptive technology companies. The funds from this round were used to expand Flyhomes’ services to new markets, enhance their technological infrastructure, and grow their team. The Series A funding also enabled the company to refine its Trade-Up and Cash Offer programs, which have become key differentiators in the real estate market.

Series B (2019)

Flyhomes secured $21 million in Series B funding in 2019, with Canvas Ventures leading the round. This funding was instrumental in accelerating Flyhomes’ national expansion and further developing its suite of services. The additional capital allowed Flyhomes to scale its operations, invest in marketing, and enhance its technology platform to provide better tools and insights for homebuyers and sellers. With this round, Flyhomes expanded into major markets like Boston, Portland, and the San Francisco Bay Area.

Series C (2021)

In 2021, Flyhomes raised $150 million in a Series C funding round led by Norwest Venture Partners, with participation from Battery Ventures, Fifth Wall, Camber Creek, Balyasny Asset Management, and Zillow co-founder Spencer Rascoff. This substantial infusion of capital was used to fuel Flyhomes’ aggressive growth strategy, including further geographic expansion and product innovation. The Series C round helped Flyhomes enhance its mortgage services, expand its Trade-Up and Cash Offer programs, and introduce new features to improve the customer experience. This round also supported the company in hiring key talent and strengthening its market presence.

Impact of Funding:

These funding rounds have collectively enabled Flyhomes to grow rapidly, innovate continuously, and disrupt the traditional real estate industry. With a total of approximately $200 million raised, Flyhomes has been able to expand its market presence, enhance its technology platform, and offer unique services that set it apart from competitors. The capital has also allowed Flyhomes to invest in marketing and customer acquisition, resulting in a substantial increase in their transaction volume and market share.

Flyhomes’ journey from a seed-funded startup to a well-capitalized industry disruptor highlights the importance of strategic funding and innovation in driving growth and success in the real estate sector.

Revenue of Flyhomes

In 2023, Flyhomes generated an estimated annual revenue of approximately $72.9 million. This revenue came primarily from its real estate brokerage services, mortgage offerings, and other related financial services. Flyhomes has managed to grow its revenue significantly by leveraging its unique business model, which includes facilitating cash offers for homebuyers and providing comprehensive end-to-end services in the real estate transaction process.

Competitors of Flyhomes

Flyhomes operates in a competitive landscape, with several notable competitors in the real estate technology sector. Here are detailed insights into some of their primary competitors:

1. Redfin

-

- Overview: Redfin is a full-service real estate brokerage that uses technology to enhance the home buying and selling experience. It offers lower commission rates than traditional brokers and features a user-friendly online platform for home searches.

- Revenue: In 2023, Redfin reported revenues of approximately $1.52 billion.

- Services: Besides brokerage services, Redfin offers mortgage, title, and home insurance services. They also provide a RedfinNow service, which buys homes directly from sellers.

- Competitive Advantage: Redfin’s extensive online platform and lower commission fees attract cost-conscious consumers.

2. Orchard

-

- Overview: Orchard is a tech-enabled real estate company that simplifies the buying and selling process. They offer a “Move First” service that allows customers to buy a new home before selling their current one.

- Revenue: Estimated revenue of $51.9 million in 2023.

- Services: Orchard provides end-to-end services including buying, selling, and financing homes. They leverage technology for home valuations and to streamline transactions.

- Competitive Advantage: Orchard’s ability to eliminate the need for sellers to move twice is a significant draw.

3. Knock

-

- Overview: Knock offers a “Home Swap” program that helps homeowners buy their new home before selling their old one. They provide bridge loans to cover the down payment and mortgage on the new home.

- Revenue: Estimated revenue of $42.2 million in 2023.

- Services: Knock’s services include home trade-in, home loans, and real estate brokerage.

- Competitive Advantage: The Home Swap program reduces the stress of buying and selling simultaneously, providing financial flexibility.

4. Homeward

-

-

- Overview: Homeward allows buyers to make all-cash offers by providing upfront cash to purchase a new home before selling their old one.

- Revenue: Estimated revenue of $43.1 million in 2023.

- Services: Their offerings include cash offer programs and buy-before-you-sell solutions.

- Competitive Advantage: Homeward’s cash offer program makes buyers more competitive in hot markets, increasing the likelihood of securing desired properties.

-

Flyhomes distinguishes itself through innovative financial solutions and a seamless, tech-enabled user experience, which enhances its competitive edge in the real estate market.

Also Read: Roadsync: Founders, Business Model, Funding, Competitors

To read more content like this, subscribe to our newsletter