Formula 1 stands as the pinnacle of motorsport, captivating millions of fans worldwide with high-speed racing and cutting-edge technology. Behind the glamour of champagne-soaked podiums and fierce on-track battles lies a sophisticated financial ecosystem that powers the sport’s ten elite teams. In 2024, Formula 1 achieved record-breaking revenue of $3.65 billion, an impressive 11% increase from the previous year. This article delves into the complex web of revenue streams that sustain F1 teams, from prize money and sponsorships to merchandise sales and beyond, offering insights into one of sport’s most lucrative business models.

1. Revenue from Formula 1 Prize Money and the Concorde Agreement

At the core of F1 teams’ income is the Formula 1 prize money, distributed based on the Concorde Agreement—a confidential contract between Formula 1, the FIA (Fédération Internationale de l’Automobile), and all participating teams.

Breakdown of Prize Money:

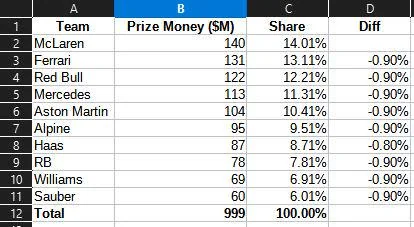

Formula 1 typically distributes about 50% of its annual revenues (which were $3.2 billion in 2023) to teams. The prize pool is divided into several categories:

- Column 1 Payments: A fixed payment to teams who finished in the top 10 in two of the past three seasons. Each team gets an equal share.

- Column 2 Payments: Based on a team’s final position in the Constructors’ Championship. The higher a team finishes, the more it earns.

- Bonus Payments and Historical Payments: Ferrari receives a special Long Standing Team (LST) bonus, reportedly worth over $35 million, for its continuous participation since the first F1 season in 1950. Other top teams like Mercedes and Red Bull also receive performance-based bonuses.

In 2022:

- Mercedes earned over $90 million in prize money.

- Ferrari took home around $80 million.

- Smaller teams like Haas or Williams earned between $50–60 million.

These payments are crucial for mid-to-lower-tier teams, often comprising 30–50% of their total revenue.

2. Sponsorships and Branding

Perhaps the most visible source of income comes from sponsorships. Team uniforms, cars, helmets, garages—even drivers’ social media—are all prime real estate for brands.

Tiered Sponsorship Model:

- Title Sponsors: Often have naming rights to the team (e.g., Oracle Red Bull Racing or Mercedes-AMG Petronas). These deals can be worth $40–60 million annually.

- Principal Partners: Brands like Petronas (Mercedes), Shell (Ferrari), and Aramco (Aston Martin) are involved in technical and fuel partnerships, worth $20–40 million+ per year.

- Official Suppliers/Supporters: Companies like Pirelli, Snap-On, or Richard Mille that supply products and contribute $1–10 million annually.

Sponsorship makes up 60–80% of a team’s revenue, especially for private teams like Williams or Haas. A prime example is Red Bull Racing, whose title sponsor, Oracle, signed a 5-year deal worth $300 million in 2022.

The appeal for sponsors? Global exposure, association with cutting-edge technology, and brand prestige.

3. Manufacturer Funding and Parent Companies

Many teams are backed by automotive giants or private conglomerates:

- Mercedes F1 is part-owned by Mercedes-Benz Group AG, which views the team as a marketing arm for its luxury cars.

- Ferrari, a public company, leverages its F1 participation as a core brand pillar—F1 success is directly linked to car sales and investor confidence.

- Alpine is funded by Renault, which uses the team to boost its performance image.

- Aston Martin Aramco Cognizant F1 Team is heavily funded by Lawrence Stroll and Saudi oil giant Aramco.

Manufacturer teams benefit from massive R&D investments, often channeling learnings back into their road cars. In return, F1 visibility helps sell high-end cars, justify luxury branding, and enhance technical credibility.

These investments range from $100–300 million per year, depending on ambition and budget caps.

4. Merchandising and Licensing

From replica team shirts and jackets to branded water bottles, F1 merchandising is a growing revenue stream.

Revenue Streams from Merchandising:

- Official Team Stores: Both online and at race circuits.

- Collaborations: Red Bull’s fashion collabs, Ferrari’s designer clothing lines, or McLaren’s retro collections attract lifestyle buyers.

- Die-cast Models and Collectibles: Highly profitable niche, especially with teams like Ferrari or McLaren.

Teams typically keep 50–70% of the profit from licensed merchandise, and for some, especially Ferrari, this can run into tens of millions annually. For smaller teams, it’s supplemental but still valuable.

5. Driver-Linked Revenue and Sponsorship

Some drivers bring sponsorship money with them—especially in lower-ranked teams.

- Lance Stroll, for instance, is the son of billionaire Lawrence Stroll, whose investments secure his seat at Aston Martin.

- Nikita Mazepin brought Russian sponsor Uralkali to Haas in 2021 (worth over $20 million), although the deal ended due to political tensions.

- Sergio Pérez has long enjoyed backing from Mexican brands like Telmex and Claro.

This model helps smaller teams like Haas or Williams offset costs and attract sponsors who wouldn’t otherwise invest in F1.

6. Technology and Engineering Services

F1 teams are tech powerhouses, and some monetize their innovations via applied technologies divisions.

Notable Examples:

- Mercedes Applied Science has worked on America’s Cup yachts, medical devices, and advanced cycling.

- McLaren Applied has been involved in motorsport electronics, data analytics, and e-sports.

- Red Bull Advanced Technologies collaborated on hypercar projects, including the Aston Martin Valkyrie.

By offering consulting, data science, aerodynamics, and simulation services, teams generate millions in B2B contracts.

7. Hospitality and VIP Experiences

Formula 1 is a high-glamour sport, and teams capitalize on this by offering luxury experiences to VIPs, clients, and sponsors.

Offerings Include:

- Paddock Club Access: Behind-the-scenes passes sold for $5,000–$10,000 per weekend.

- Driver Meet-and-Greets

- Team Garage Tours

- Corporate Hospitality: Includes fine dining, entertainment, and networking.

Teams like Red Bull and Mercedes monetize this through corporate deals, while others offer fan club memberships, exclusive content, and VIP subscriptions. The income isn’t massive compared to other streams but enhances brand loyalty and sponsorship value.

8. Media Rights and Digital Content

Teams don’t directly earn from global TV broadcasting rights—those are retained by Formula One Management (FOM). However, indirect benefits are significant:

- Brand Exposure: On-screen time translates into advertising value equivalency (AVE) for sponsors.

- Team YouTube Channels and Podcasts: McLaren, Red Bull, and Ferrari generate ad revenue and fan engagement.

- Streaming Collaborations: F1’s collaboration with Netflix on Drive to Survive has boosted fanbases, especially in the U.S.

Some teams even create original digital content, monetizing via ads, exclusive access, or fan subscriptions. While small in absolute value, it’s a growing area of brand building and monetization.

9. Strategic Investments and Equity Sales

Several teams have raised funds or cashed out through equity sales:

- McLaren sold a minority stake to MSP Sports Capital in 2020.

- Williams was bought by Dorilton Capital, which injected fresh investment in return for ownership.

- Alpine sold a 24% stake in 2023 to investors like Ryan Reynolds, worth $218 million, valuing the team at nearly $900 million.

These strategic investments not only bring money but marketing muscle and media visibility, especially in North America.

10. Cost Cap and Profitability Goals

Since 2021, F1 has imposed a cost cap (set at $135 million in 2023, excluding driver salaries, marketing, and executive pay). This has created a pathway to actual profitability.

Previously, even successful teams burned through $300–500 million annually. The cost cap, combined with growing revenue and TV ratings, means mid-field teams can now break even or turn a profit.

Conclusion

The business of Formula 1 is a finely-tuned machine where every race is an opportunity to win on the track and in the balance sheets. While high costs make it one of the most expensive sports to enter, the combination of prize money, sponsorship, tech spin-offs, and merchandising creates a rich and sustainable ecosystem for top-tier teams.

For teams like Mercedes, Red Bull, and Ferrari, F1 is a marketing juggernaut and a testbed for innovation. For smaller teams, smart sponsorships, cost control, and strategic investments are key to survival and growth.

And with Liberty Media pushing toward a more entertainment-driven global expansion, the financial future of F1 teams looks faster—and more profitable—than ever.

Also Read: From Racing Roots to Luxury Cars: The Story of Mercedes-Benz

To read more content like this, subscribe to our newsletter