Cribl has emerged as one of the fastest-growing infrastructure companies in the data observability space, achieving the remarkable milestone of reaching $100 million in annual recurring revenue in under four years. The company’s journey from a 2018 startup to a $3.5 billion valuation enterprise represents a compelling narrative of technical innovation, strategic vision, and cultural distinctiveness that has fundamentally transformed how organizations manage their IT and security data.

Introduction and Company Overview of Cribl

Cribl operates as “the Data Engine for IT and Security,” providing a comprehensive suite of vendor-agnostic data management solutions designed specifically for IT operations and security teams. The company addresses one of the most pressing challenges facing modern enterprises: the exponential growth of telemetry data, which is expanding at a 28% compound annual growth rate while organizational budgets remain flat. This fundamental tension between data growth, compliance retention requirements, and constrained budgets has created a critical market opportunity that Cribl has successfully capitalized upon.

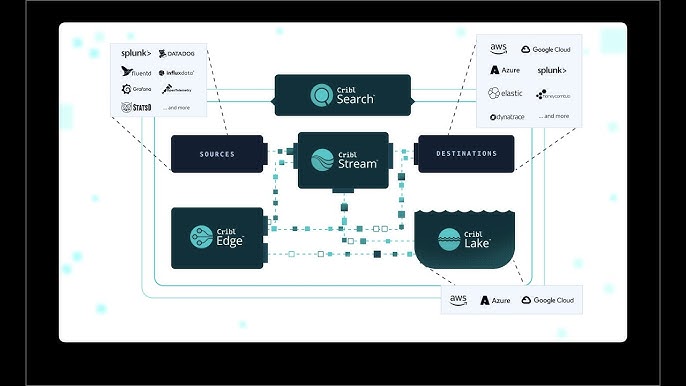

The company’s core value proposition centers on providing organizations with choice, control, and flexibility in managing their observability data streams. Rather than forcing customers into proprietary ecosystems, Cribl’s platform enables seamless integration with over 80 sources and destinations, allowing enterprises to collect, process, route, and analyze logs, metrics, traces, and configuration data across diverse infrastructure environments. This vendor-neutral approach has resonated strongly with enterprise customers seeking to avoid the traditional constraints of single-vendor solutions.

Cribl’s product portfolio encompasses four primary offerings that work synergistically to address different aspects of data management. Cribl Stream serves as the industry’s leading observability pipeline, enabling real-time data collection, reduction, enrichment, and routing. Cribl Edge functions as an intelligent, vendor-neutral agent for edge computing environments. Cribl Search represents the industry’s first search-in-place solution, allowing organizations to analyze data regardless of its location without requiring data movement. Finally, Cribl Lake provides a turnkey data lake solution for cost-effective long-term storage.

Founding Story and Origins of Cribl

The genesis of Cribl traces back to 2018 when three seasoned professionals from Splunk recognized a fundamental gap in the data observability market. The founding team, consisting of Clint Sharp, Ledion Bitincka, and Dritan Bitincka, shared a collective vision of democratizing data access and eliminating the vendor lock-in that had become endemic in the observability space. Their experience at Splunk provided intimate knowledge of customer pain points around data ingestion costs, storage limitations, and the inflexibility of proprietary data formats.

The company was officially established in San Francisco, California, in July 2018, with the mission to “unlock the value of all observability data”. The founders’ shared Albanian heritage and technical expertise created a unique cultural foundation that would later manifest in the company’s distinctive branding and operational philosophy. The decision to position Cribl as a fully distributed company from inception reflected their belief in attracting global talent and building products that could serve organizations worldwide.

The initial product development focused on creating LogStream, an observability pipeline that could sit between data sources and destinations, providing unprecedented control over data flow and transformation. This “Cribl in the Middle” approach represented a paradigm shift from traditional point-to-point data integration, offering customers the ability to optimize their data streams before they reached expensive downstream analytics platforms.

Founders and Leadership of Cribl

Clint Sharp serves as Co-Founder and Chief Executive Officer, bringing extensive experience from his tenure at Splunk and Cricket Communications. Sharp’s leadership philosophy emphasizes customer advocacy and product innovation, positioning him not merely as a business executive but as a passionate product leader who maintains deep engagement with customer pain points and purchasing decisions. His background as a practitioner provides credibility when addressing the technical challenges faced by IT and security teams.

Dritan Bitincka functions as Co-Founder and head of product, where he leads product management, product design, and technical guidance functions. Prior to Cribl, Bitincka served as Principal Architect at Splunk for six years, where he designed and implemented hundreds of deployments of large-scale multi-terabyte distributed systems. His technical expertise has been instrumental in incubating Cribl’s newest products, including Cribl Edge and Cribl Search, while ensuring that customer needs remain central to product development decisions.

Ledion Bitincka serves as Co-Founder and Chief Technology Officer, overseeing the engineering organization with a commitment to continuous innovation and customer problem-solving. His technical leadership has been crucial in developing Cribl’s multi-product suite, bringing a first-principles approach to engineering challenges. Ledion’s experience includes leading the development of several enterprise products at Splunk, including the introduction of Search-Time Schema and the design of Hunk and SmartStore.

The founding team’s collective experience at Splunk provided them with deep insights into the limitations of traditional observability platforms and the specific pain points experienced by enterprise customers. This background has informed Cribl’s product development strategy and go-to-market approach, enabling the company to address real-world challenges with practical, scalable solutions.

Business Model and Revenue Streams of Cribl

Cribl operates on a subscription Software-as-a-Service (SaaS) model with pricing based on the volume of data customers need to ingest and process. This usage-based pricing structure aligns the company’s revenue with customer value realization, ensuring that organizations pay proportionally to their data consumption rather than facing fixed licensing fees regardless of usage patterns.

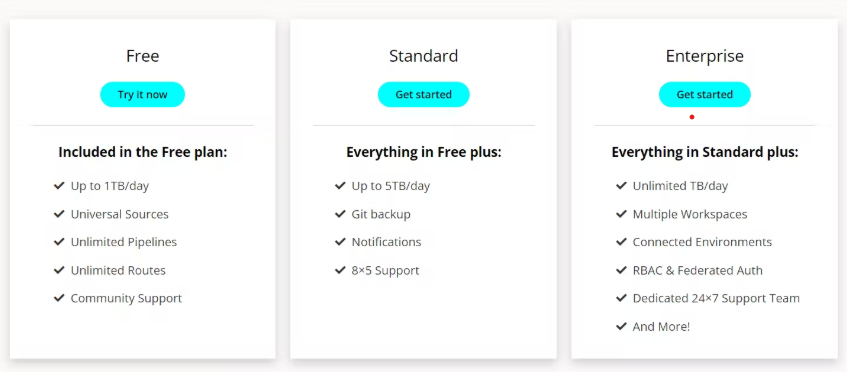

The company offers three primary pricing tiers designed to accommodate different organizational needs and scale requirements. The Free plan allows teams to process up to 1TB per day with unlimited pipelines and routes, providing an accessible entry point for evaluation and small-scale deployments. The Standard plan supports up to 5TB per day and includes additional features such as Git backup, notifications, and business hours support. The Enterprise plan removes data volume limitations entirely while providing unlimited worker groups, multiple workspaces, role-based access control, and 24/7 dedicated support.

Cribl’s credit-based pricing system provides flexibility across its product portfolio, with different rates for various components and deployment models. For Cribl Stream, the company charges $0.32 credits per GB for cloud workers and $0.26 credits per GB for hybrid workers in enterprise deployments. Cribl Edge pricing starts at $0.21 credits per GB per edge node, while Cribl Search offers both subscription-based pricing at $0.15 credits per GB per month and consumption-based pricing at 1 credit per CPU hour. This granular pricing approach enables customers to optimize their spending based on specific usage patterns and requirements.

The business model’s strength lies in its ability to scale with customer growth while providing predictable cost structures. Unlike traditional observability platforms that may impose steep pricing increases as data volumes grow, Cribl’s approach enables customers to optimize their spending through data reduction, intelligent routing, and selective retention strategies. This value proposition has proven particularly attractive to large enterprises seeking to control observability costs while maintaining comprehensive data coverage.

Funding History and Financial Performance of Cribl

Cribl’s funding journey reflects the strong investor confidence in the company’s market opportunity and execution capabilities. The company’s funding progression demonstrates consistent growth in valuation and investor quality, progressing from seed funding to late-stage venture rounds with participation from top-tier venture capital firms.

The funding timeline began in February 2019 with a $4 million seed funding round, providing initial capital for product development and early market validation. The company’s Series A funding round in April 2020 raised $7.4 million, enabling expanded product development and initial go-to-market investments. The Series B round in October 2020 secured $35 million led by Sequoia Capital, marking the entry of a premier venture capital firm and validating the company’s market potential.

The Series C funding of $200 million in August 2021 represented a significant milestone, led by Greylock Partners and Redpoint Ventures with participation from IVP, Sequoia, CRV, and Citi Ventures. This round enabled substantial expansion of the product portfolio and global operations. The Series D funding in May 2022 raised an additional $150 million led by Tiger Global Management, bringing total funding to $400 million.

The most recent Series E funding in August 2024 closed at $319 million, establishing a company valuation of $3.5 billion. This round demonstrates continued investor confidence in Cribl’s growth trajectory and market opportunity. The company achieved significant financial milestones, reaching $100 million in annual recurring revenue in October 2023 and surpassing $200 million in ARR by January 2025, representing more than 70% year-over-year growth.

Competitive Landscape and Market Position

Cribl operates in a complex competitive environment that spans multiple technology categories, including observability platforms, data infrastructure providers, and specialized data pipeline solutions. The company’s vendor-neutral positioning creates both opportunities and challenges as it competes against established incumbents and emerging specialized solutions.

In the log management category, Cribl faces competition from established players including Datadog, which holds 73.20% market share, Splunk with 7.90%, and Loggly with 3.65%. These traditional observability platforms offer end-to-end solutions but often impose usage-based pricing models that become prohibitively expensive as data volumes scale. Datadog and Splunk have responded to Cribl’s emergence by developing their own pipeline capabilities, with Splunk launching Ingest Actions and Datadog introducing Vector.dev.

In the broader big data analytics space, Cribl competes with infrastructure providers including Databricks (15.35% market share), Azure Databricks (15.00%), and Apache Hadoop (12.42%). While these platforms serve general data analytics and warehousing needs, they differ from Cribl’s specialized focus on IT operations and security teams. Traditional data management companies like Commvault and Rubrik concentrate on backup and recovery rather than real-time observability.

Emerging competitors include specialized data pipeline solutions such as Edge Delta and Chronosphere, which focus on specific aspects of telemetry data processing. OpenTelemetry represents an open-source alternative that provides DIY capabilities but lacks the enterprise functionality and support of commercial solutions. Vector and Logstash offer open-source alternatives for data collection and processing, though with more limited enterprise features compared to Cribl’s comprehensive suite.

Cribl’s competitive advantage stems from its vendor-neutral approach and focus on cost optimization through intelligent data reduction and routing. The company’s ability to integrate with over 80 sources and destinations while providing granular control over data flow has resonated strongly with enterprise customers seeking flexibility and cost control. This positioning has enabled Cribl to achieve significant market penetration, particularly among Fortune 1000 companies seeking alternatives to expensive incumbent platforms.

Competitive Advantages and Differentiation

Cribl’s primary competitive advantage lies in its vendor-agnostic architecture that provides customers with unprecedented choice and flexibility in their data infrastructure decisions. Unlike traditional observability platforms that lock customers into proprietary ecosystems, Cribl’s solution integrates seamlessly with existing tools and platforms, enabling organizations to optimize their data strategies without wholesale infrastructure replacement. This approach addresses one of the most significant pain points in enterprise data management: vendor lock-in and the associated costs and limitations.

The company’s focus on cost optimization through intelligent data processing represents another key differentiator. Cribl’s platform enables organizations to reduce data volumes through filtering, transformation, and intelligent routing before data reaches expensive downstream analytics platforms. This capability can result in substantial cost savings, with data format conversions alone achieving 20-40% reductions in storage and network requirements. For large enterprises processing terabytes of data daily, these optimizations can translate to millions of dollars in annual savings.

Cribl’s technical architecture provides significant performance advantages over traditional point-to-point data integration approaches. The platform’s ability to process billions of events per second while maintaining real-time data flow ensures that organizations can scale their observability infrastructure without compromising performance. The company’s support for multiple deployment models, including cloud, on-premises, and hybrid environments, provides additional flexibility for organizations with diverse infrastructure requirements.

The company’s product innovation continues to create competitive differentiation, particularly with solutions like Cribl Search that enable analysis of data in place without requiring data movement. This search-in-place capability addresses the growing challenge of data gravity, where the cost and complexity of moving large datasets for analysis can become prohibitive. By enabling federated search across multiple storage systems and formats, Cribl Search provides organizations with comprehensive data visibility without the associated data movement costs.

Corporate Culture and Brand Identity

Cribl’s corporate culture reflects a unique blend of technical excellence, customer focus, and playful irreverence that has become central to the company’s brand identity. The adoption of a goat as the company mascot represents more than marketing whimsy; it embodies the company’s values of ubiquity, adaptability, and broad perspective. The goat symbolism draws inspiration from both the founders’ Albanian heritage, specifically the legendary figure of Skanderberg whose helmet featured a horned goat, and the practical characteristics that align with Cribl’s mission.

The company’s remote-first culture has been instrumental in attracting global talent and building a diverse, distributed workforce. This approach aligns with Cribl’s vision of ubiquity and global reach, enabling the company to serve customers worldwide while accessing the best talent regardless of geographic location. The emphasis on building a strong remote culture has proven particularly valuable during the company’s rapid growth phase, enabling effective scaling without geographic constraints.

Cribl’s approach to customer engagement emphasizes transparency, education, and community building. The company offers extensive free resources, including training, certifications, and a free tier across all products. This educational approach reflects the founders’ belief in empowering customers with knowledge and tools rather than simply selling software licenses. The company’s community Slack channel provides direct access to Cribl engineers, partners, and customers, fostering a collaborative ecosystem that extends beyond traditional vendor-customer relationships.

The company’s recognition as #1 in Forbes America’s Best Startup Employers 2025 demonstrates the success of its culture-building efforts. This recognition reflects the company’s commitment to creating an environment where employees can do their best work while contributing to meaningful technological innovation. The emphasis on building a “generational company” that can sustain long-term impact guides decision-making across all organizational levels.

Market Impact and Future Outlook

Cribl’s rapid growth and market penetration demonstrate the significant demand for vendor-neutral data management solutions in the enterprise market. The company’s customer base includes 43 members of the Fortune 100 and 130 members of the Fortune 500, indicating broad adoption across major enterprises. Customer satisfaction metrics are strong, with a 92% “willingness to recommend” score in a January 2025 Gartner survey.

The company’s strategic partnerships with major technology providers enhance its market reach and distribution capabilities. Collaborations with CrowdStrike, AWS, Palo Alto Networks, and Deloitte provide integrated solutions that address specific customer use cases while expanding Cribl’s ecosystem presence. These partnerships validate Cribl’s technology while providing customers with pre-integrated solutions that reduce implementation complexity.

Looking forward, Cribl’s multi-product strategy positions the company to address evolving customer needs across the data lifecycle. The expansion from the core Stream product to include Edge, Search, and Lake solutions creates opportunities for increased customer wallet share while providing comprehensive data management capabilities. The company’s continued investment in research and development, supported by substantial funding, enables ongoing innovation in response to changing market requirements.

The broader market trends favor Cribl’s positioning as organizations increasingly recognize the unsustainability of traditional observability cost structures. The combination of exponential data growth, flat budgets, and increasing compliance requirements creates ongoing demand for solutions that can optimize data utilization while maintaining comprehensive coverage. Cribl’s vendor-neutral approach and focus on cost optimization align well with these market dynamics, positioning the company for continued growth in the evolving observability landscape.

Conclusion

Cribl’s brand story represents a compelling narrative of technical innovation, strategic vision, and cultural distinctiveness that has fundamentally transformed the data observability market. From its founding by three Splunk veterans in 2018 to its current position as a $3.5 billion enterprise serving Fortune 100 companies, Cribl has consistently delivered on its mission to provide choice, control, and flexibility in data management. The company’s vendor-neutral approach, combined with its focus on cost optimization and customer empowerment, has created a sustainable competitive advantage that continues to drive rapid growth and market expansion.

The success of Cribl’s business model demonstrates the market’s appetite for alternatives to traditional vendor lock-in approaches, while the company’s strong financial performance and customer satisfaction metrics validate its strategic positioning. As organizations continue to grapple with exponential data growth and constrained budgets, Cribl’s platform provides a proven solution for optimizing data strategies without sacrificing functionality or flexibility. The company’s commitment to innovation, customer success, and cultural excellence positions it well for continued leadership in the evolving data observability landscape.

Also Read: Flashbots: Founders, Business Model, Funding, Competitors

To read more content like this, subscribe to our newsletter