Wiz is an Israeli-American cloud security startup founded in early 2020. Its founders, all veterans of Israel’s elite Unit 8200, envisioned an all-in-one platform to secure modern, multi-cloud environments. In just a few years Wiz became a market leader: by 2024 it was protecting some 5 million cloud workloads and scanning 230 billion files daily, with roughly 50% of Fortune 100 companies among its customers.

This rapid growth drew huge investor interest, and in March 2025 Google announced a $32 billion all-cash agreement to acquire Wiz. (Notably, Wiz had turned down a reported $23B offer in 2024.) The Google deal, pending regulatory approval, underscores Wiz’s prominence. In the meantime Wiz hit ~$500M ARR in 2024 and aimed for $1B by 2025, marking it as one of the fastest-growing SaaS companies ever.

Founding Story of Wiz

Wiz was born from the founders’ prior success and the explosive demand for cloud security. In 2012 the core team (Assaf Rappaport, Ami Luttwak, Yinon Costica, Roy Reznik) co-founded Adallom, a cloud security company. They led Adallom as CEO, CTO, VP R&D and VP Product respectively, until Microsoft acquired it for roughly $250–$320M in 2015. After the acquisition, the team spent several years at Microsoft’s Israel R&D center, building Azure’s Cloud Security Group. By late 2019 they were ready to try again.

With cloud adoption surging—accelerated by the pandemic—they left Microsoft and founded Wiz in 2020. Their goal was to address the fragmentation of cloud security tools by providing a single, unified platform. At launch the four co-founders pooled their 15+ years of collaboration and deep cloud-security expertise. The timing was fortuitous: as companies raced to migrate to AWS, Azure and GCP, they needed better visibility and risk management, which Wiz aimed to supply in one solution.

Founders (Profiles)

Assaf Rappaport – CEO. An 8200 veteran who later spent two years at McKinsey, Rappaport was CEO of Adallom and led Microsoft’s cloud security team until 2019. He now steers Wiz’s vision.

Ami Luttwak – CTO. Also an 8200 graduate, Luttwak was Adallom’s CTO and then Microsoft’s Cloud Security CTO. He oversees Wiz’s engineering and technical strategy.

Yinon Costica – VP Product. A fellow 8200 alum and Adallom co-founder, Costica led product management at Adallom (later a Microsoft principal manager). He directs Wiz’s product roadmap.

Roy Reznik – VP R&D. The youngest co-founder (8200 vet as well), Reznik was VP of R&D at Adallom and continued as a senior R&D leader at Microsoft. He now leads Wiz’s research and development.

Each founder brings extensive cybersecurity experience; together they had already demonstrated product-market fit with Adallom. (In 2024 Wiz also strengthened its leadership by hiring industry veterans such as Dali Rajic (former Zscaler COO) as President & COO. The founders’ deep trust and history—“four tech musketeers” meeting in the Israeli Army—helped Wiz move quickly from concept to product.

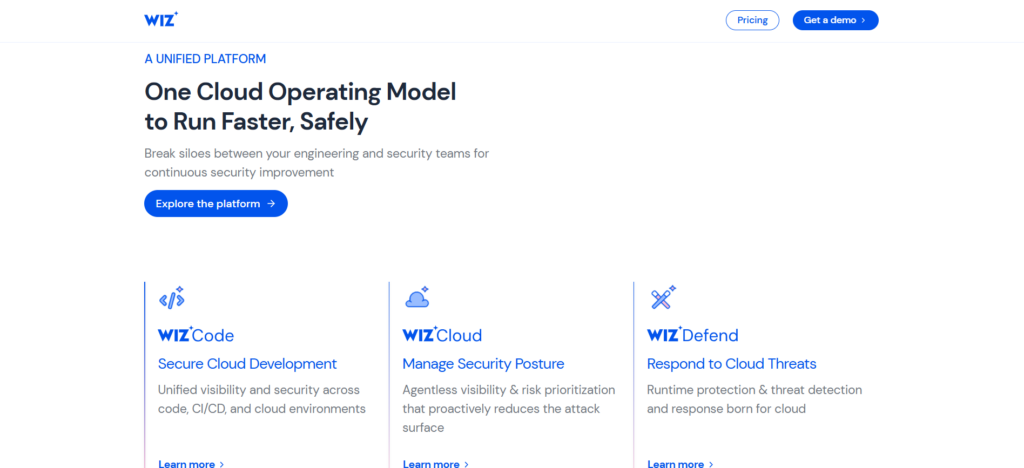

Business Model of Wiz

Wiz’s business model is classic enterprise SaaS for cloud security. It does not sell a free or low-tier product; instead, Wiz targets large organizations with a fully-managed, subscription platform. Sales are primarily handled by a field team: customers book demos and negotiate enterprise agreements rather than self-serve. The product is also offered through cloud marketplaces (notably AWS Marketplace), with predefined package pricing (e.g. plans ranging roughly $24K–$114K per year). This approach simplifies procurement for customers already in those ecosystems.

Wiz’s platform is agentless (it connects via cloud APIs rather than installing software on servers). It provides one-stop coverage across AWS, Azure, Google Cloud, Kubernetes, etc. By bundling CSPM (misconfigurations), CWPP (vulnerability scanning), and CWPP++ (identity & infrastructure posture) into a single console, Wiz pitches itself as a simpler, more consolidated alternative to stitching together multiple point products. Notably, CEO Rappaport has said Wiz’s pricing is usually higher than any other product (e.g. Palo Alto’s Prisma Cloud), reflecting the platform’s broad scope and enterprise value. In practice, Wiz’s deals tend to be sizable multi-year licenses paid annually, yielding predictable recurring revenue.

Revenue Streams of Wiz

Wiz generates revenue almost entirely through recurring subscription fees for its cloud-security platform.

As enterprises commit to the service, Wiz books annual or multi-year contracts that renew. There are no other significant revenue lines (though it likely offers professional services or support as needed).

The financial results attest to this model. Wiz hit $100M ARR within 18 months of founding, then climbed to ~$200M by mid-2023 and ~$350M by early 2024.

By late 2024 Wiz’s ARR reached around $500M, as the company continued doubling every year. (By comparison, legacy vendors like Palo Alto Networks have ARR in the multi-$billions, but Wiz’s growth rate far outpaces them.) In short, subscription license fees from global enterprises drive virtually all of Wiz’s revenue, fueling its hyper-growth trajectory.

Funding and Investment History of Wiz

Wiz has raised an extraordinary amount of capital in a short time. Altogether, it has raised about $1.9 billion over a series of venture rounds. Key milestones include:

-

Series A (Dec 2020) – $100M led by Index Ventures, Sequoia Capital, Insight Partners and Cyberstarts. This was unusual for a Series A but reflected confidence in the team and vision.

-

Series B (Apr–May 2021) – ~$250M (split into two tranches of $130M and $120M), led by Greenoaks Capital and Sequoia (with participation by Index, Insight, Salesforce Ventures, etc.) on a ~$1.7B valuation.

-

Series C (Oct 2021) – $250M led by Insight Partners and Greenoaks (with existing backers Sequoia, Index and new ones like Salesforce Ventures) at a $6B valuation. This made Wiz one of the highest-valued cyber startups globally.

-

Series D (Feb 2023) – $300M co-led by Lightspeed and Greenoaks (with Starbucks owner Howard Schultz and LVMH’s Bernard Arnault among others) at a $10B valuation. After this, Wiz claimed the title of fastest SaaS to reach a $10B valuation.

-

Series E (May 2024) – $1.0B co-led by Andreessen Horowitz, Lightspeed and Thrive (joined by Greylock, Wellington Management and most prior investors) at a $12B. This round set a record as the largest cyber-security financing of 2024.

These rounds reflect huge investor enthusiasm. Wiz’s backers include top-tier VCs (Sequoia, Index, a16z, Salesforce Ventures, Cyberstarts, Greenoaks, Greylock, etc.). By May 2024 Wiz had raised about $1.9B total. (In late 2024 the company continued deploying cash into acquisitions.) The Google deal in 2025 translates to an even higher effective valuation – by late 2024 Wiz’s ARR was ~$500M and a sale at $32B implies ~64× revenue. This funding history underscores the scale of Wiz’s ambition and market.

Funding Rounds of Wiz

| Round | Date | Investors (lead) | Amount (USD) | Post-money Valuation |

|---|---|---|---|---|

| Series A | Dec 2020 | Index, Sequoia, Insight, Cyberstartswiz.io | $100M | (Stealth) |

| Series B | Apr–May 2021 | Greenoaks, Index, Sequoia, Insight, Salesforce | $250M (130+120M) | ~$1.7Ben.wikipedia.org |

| Series C | Oct 2021 | Insight, Greenoaks (w/ Sequoia, Index, Salesforce)wiz.io | $250M | ~$6.0Bwiz.io |

| Series D | Feb 2023 | Lightspeed, Greenoaks (w/ Schultz, Arnault)techcrunch.com | $300M | ~$10Btechcrunch.com |

| Series E | May 2024 | Andreessen Horowitz, Lightspeed, Thrivetechcrunch.com (plus Greylock, Wellington, othersnews.crunchbase.com) | $1,000M | ~$12Btechcrunch.com |

Sources: Wiz’s announcements and press coverage

Competitor Analysis of Wiz

Wiz operates in a crowded cloud-security market. Its major competitors include both legacy security firms and newer cloud-native specialists. Below is a comparison of some of the key competitors:

| Company | Focus / Offering | Comparison to Wiz |

|---|---|---|

| Palo Alto Networks | Prisma Cloud – Modular CNAPP (CSPM/CWPP), firewalls | A market leader in cloud security, Prisma Cloud covers many of the same domains (misconfigurations, vulnerabilities, container security). Palo Alto’s strength is a large, established security portfolio, but it sells modules, whereas Wiz offers a unified platform. Wiz emphasizes an all-in-one agentless approach and a correlated risk graph, while Prisma’s pieces can require more stitching together. Wiz also claims a smoother multi-cloud experience. |

| Microsoft | Defender for Cloud (formerly Azure Security Center) – Native cloud security, especially for Azure | Defender for Cloud provides built-in posture and threat protection for Azure (and to a lesser extent AWS/GCP). It deeply integrates with Microsoft clouds and tools. Wiz, in contrast, focuses on multi-cloud equivalence and customers who value independence from any one vendor. Wiz’s visibility extends across AWS, GCP, OCI etc. and is not tied to a single cloud stack. |

| Orca Security | Cloud security – Agentless CNAPP (CSPM/CWPP) | Orca pioneered agentless multi-cloud security similar to Wiz. Both use cloud APIs to discover assets. Orca’s technology maps workloads and identifies risks without agents. Wiz was founded later but has been aggressive, notably acquiring competitor Gem Security. Orca is now integrated into Palo Alto (via acquisition). Wiz competes by offering similar agentless scanning plus extra modules (like code security) and leveraging its scale and investment. |

| Lacework | Cloud security – Polyglot agentless CNAPP | Lacework (founded 2015) built a large cloud security business (valued >$8B) with agentless tech. Wiz actually attempted to acquire Lacework in 2024 (deal fell through), reflecting overlap. Both scan all cloud layers and emphasize anomaly detection. Wiz argues it can quickly subsume Lacework’s functions (plus others) via acquisitions like Gem and Dazz, whereas Lacework has since been acquired by Sumo Logic. |

| Check Point Software | CloudGuard – Cloud workload and network security | Check Point is a veteran cybersecurity vendor (firewalls, etc.) with cloud offerings under the CloudGuard brand. It focuses more on perimeter and network microsegmentation in cloud, plus posture. Wiz’s approach is platform-oriented across code-to-cloud. Enterprises often consider CloudGuard for traditional policy controls, while Wiz markets to DevSecOps teams. |

| CrowdStrike | Falcon Cloud / Singularity – Cloud workload protection (part of its endpoint platform) | CrowdStrike is known for endpoint protection but has expanded into cloud posture (Cloud Security module). It’s more limited in scope than Wiz. Wiz’s console focuses on infrastructure misconfigurations and identity, whereas CrowdStrike’s cloud tools focus on workload threats. Recent coverage notes CrowdStrike (and Palo Alto) as larger players in the space. |

| Aqua Security | Container and cloud security (CSPM/CWPP) | Aqua specializes in container/Kubernetes security and scanning images. Wiz’s platform also includes container scanning (it covers “13 areas” including container security). Aqua’s strength is in DevOps integration for containers. Wiz competes by embedding container checks into a broader context (network, identity, code) with a unified view. |

Each competitor has some overlapping functionality, but Wiz differentiates by combining everything into one graph-powered platform with minimal agents. Investors have noted Wiz’s unusual breadth (for example, Palo Alto, CrowdStrike and others are cited as part of the competitive set). The table above is a high-level comparison; in practice, many customers evaluate multiple solutions (often piloting Wiz alongside Prisma, Orca, Lacework, etc.) to find the best fit.

Competitive Advantage of Wiz

Wiz’s chief competitive advantage is integration and intelligence. Instead of forcing organizations to stitch together multiple siloed tools, Wiz provides one platform that spans the entire cloud stack. It ingests data via cloud APIs (no agents required) and correlates information across identities, infrastructure, configurations, network and code.

At its core is the Wiz Security Graph – a contextual map that links related risks (e.g. a vulnerable VM exposing a secret key in a storage bucket) and surfaces only the most critical “toxic combinations”. This unified model means security teams see a single prioritized list of cloud attack vectors rather than separate lists from separate tools. In practice, that reduces noise and helps organizations act faster.

This approach has paid off in market traction. Wiz set growth records – becoming the fastest software startup ever to hit $100M ARR in 18 months – and quickly landed large customers (roughly 40% of Fortune 100 by early 2024). Industry observers note that Wiz’s platform is unprecedented in scope: a16z partner Sarah Wang told TechCrunch “there is nothing that competes directly with Wiz in the area of cloud security”. The company’s adoption of AI as a force multiplier further extends its lead; for example, Wiz pioneered AI-Security Posture Management (AI-SPM) in late 2023, the first major CNAPP to embed generative AI for risk analysis.

In short, Wiz’s advantage comes from simplifying cloud security for enterprises. Its single-pane, agentless platform, graph analytics, and rapid innovation mean customers often find one Wiz deployment can replace several legacy products. At $12B valuation (in 2024) it was already the world’s highest-valued private cyber-security firm, a testament to how investors view its differentiation. The founders’ deep expertise and focus on high-end enterprise workloads also play a role: Wiz was built “with the world’s leading enterprises in mind” and its roadmap is driven by customer needs. All these factors – technology, team, and execution – form Wiz’s competitive moat.

Overall, Wiz’s strategy has been to partner where possible and buy when needed. It partners with cloud vendors (Google/Oracle, AWS, etc.) and resellers to extend reach, while bolting on specialized security capabilities via acquisition. Its focus on developer-friendly tools and integrations (e.g. making security data actionable in Jira/Zendesk) aims to capture the trend of shifting security left. In summary, Wiz combines a nimble startup mentality with the backing of deep-pocketed investors and partners, positioning itself as the go-to platform for securing modern cloud (and emerging AI) environments.

Also Read: CodaMetrix – Founders, Business Model, Funding & Competitors

To read more content like this, subscribe to our newsletter