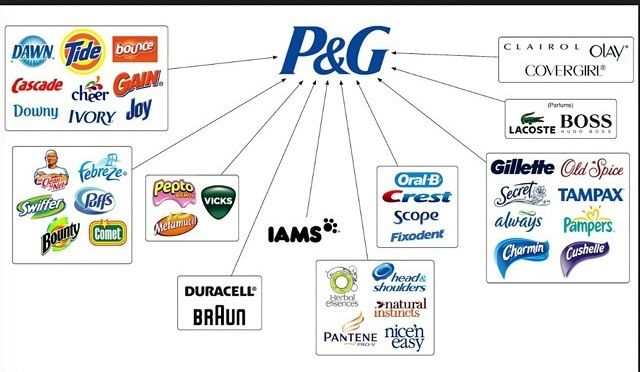

Head & Shoulders (H&S) is an American anti-dandruff shampoo brand founded by Procter & Gamble in 1961. It quickly established itself as a premium medicated shampoo – even using the slogan “America and World’s No. 1 Shampoo” at its launch. Over time, H&S expanded globally, entering markets across Asia, Europe, and the Americas (debuting in India in 1997) and leveraging P&G’s vast distribution network. Today it is the “world’s #1 shampoo and #1 dermatologist-recommended brand”, a claim backed by P&G’s own data (H&S along with Pantene account for roughly 20% of global retail hair-care market share). This leadership position is reinforced by extensive R&D and marketing: P&G has long cited Head & Shoulders’ high ad spend and sales, noting that “no other brand matches its sales” in the anti-dandruff category.

From the outset, Head & Shoulders built its identity around confidence and first impressions. Early ads introduced slogans like “You Never Get a Second Chance to Make a First Impression,” reflecting a classic anxiety-marketing approach that linked dandruff control to social confidence. Over time, the brand evolved its messaging (for example, its 1990s “I don’t have dandruff” campaign as described below), but always emphasized that H&S not only treats dandruff, it also makes hair look healthy – countering the stigma that medicated shampoos hurt hair. Combined with consistent branding (the blue-and-white logo, the distinct bottle shape) and P&G’s global scale, this positioning has underpinned H&S’s rise from a 1960s start-up shampoo to a household name worldwide.

Head & Shoulders today offers a diversified product portfolio of shampoos, conditioners, and treatments targeting various scalp needs. Beyond the classic Original formula, modern lines include Clinical Solutions for severe dandruff and 2-in-1 shampoo-conditioners (often co-branded, e.g., with Old Spice scents). It has variants for men and women, children’s formulas, and specialty treatments (e.g., “Royal Oils” scalp treatments) to address different hair types.

This broad product mix – including trial/travel sizes to premium large bottles – reflects a segmentation strategy where H&S offers value tiers (standard, premium, specialty) and penetration pricing to remain affordable while investing in new variants. In short, H&S’s introduction as a leading medicated shampoo, combined with decades of innovation, has cemented its global reach and leadership in anti-dandruff haircare.

Marketing Strategies of Head & Shoulders

1. Global Brand Positioning and Heritage

Head & Shoulders has built a globally consistent brand identity focused on dandruff control and hair confidence. From its 1961 launch in New York, P&G positioned H&S as “the world’s No. 1 Anti-Dandruff Shampoo”, a claim rooted in market leadership. This heritage positioning is reinforced by the company’s heavy marketing investment; analysts noted that in the 1980s “no other brand matches its sales” despite it being a medicated shampoo.

P&G emphasizes H&S’s pharmaceutical-grade efficacy (with active ingredients like zinc pyrithione) while assuring users that hair will still look great – a critical trust-building message. For example, early ads assured consumers with “I don’t have dandruff” messaging to showcase visible results without embarrassment.

Today, H&S continues to leverage its legacy. The tagline “You never get a second chance to make a first impression” (which P&G classifies as an “anxiety marketing” approach) remains part of its brand lore. Global consistency comes through the iconic blue-and-white brand colors, the distinctive bottle shape, and the persistent emphasis on scalp health.

According to internal Nielsen data, H&S’s consistency has paid off – it is often cited as “the world’s #1 shampoo” in sales and dermatological endorsement. This global positioning allows H&S to enter new markets with instant credibility. For instance, when H&S launched in India (1997) or Africa, it entered not as an unknown startup but as a proven P&G flagship brand. The brand’s “penetration policy” (aggressive entry pricing and wide distribution) helped it become ubiquitous on shelves from Europe to Southeast Asia.

This heritage-driven strategy yields clear marketing advantages. In new countries, H&S often shares the messaging of its global campaign (e.g. the “Great Hair, Don’t Care” theme in the 2010s) to maintain a unified image. Yet even at its core H&S highlights local leadership: it is #1 globally, and it pushes that point in marketing to reinforce authority.

For example, packaging and ads frequently note that “P&G’s #1 Brand” or “dermatologist recommended” globally, establishing trust. This makes many marketing tactics simply affirmations of its leadership – whether it’s sponsoring a community health event or running an awareness campaign, H&S’s premium heritage gives it weight.

In sum, H&S’s global brand positioning—rooted in its 1961 launch and sustained by continuous investment—serves as a foundation for all its marketing strategies.

2. Iconic Advertising Campaigns

One of H&S’s most enduring marketing strategies is its consistent core advertising campaign, famously known as the “Don’t” campaign. Originating in the early 1990s, these ads feature a simple scenario: someone asks “I didn’t know you had dandruff!” The confident H&S user replies “I don’t.”

This visual-pun concept (often showing the asker brushing dandruff off their own shoulder) became a cultural touchstone. As The Brandgym notes, the campaign’s six key elements (bottle spotting, the question, the “I don’t” reply, flakes brushing, a demo of dandruff vs. no-dandruff, and the tagline) were identified and retained for decades. By focusing on these core elements, P&G ensured instant recognizability: even as the visuals change, audiences always understood the “don’t have dandruff” premise.

Crucially, H&S has kept the campaign fresh while preserving its essence. The brandgym analysis explains that in 2024 H&S launched a new high-production ad series (movie-parody vignettes) that still follow the original plot beats: a bottle is spotted, the challenge is asked, and the user answers “I don’t.” Only the tagline was updated from “Don’t have dandruff. Have great hair” to “Don’t have dandruff. Prevent it.”. This change reflects H&S’s modern focus on prevention through routine use.

By contrast, older ads emphasized “great-looking hair” because early H&S users worried the shampoo would make hair dull. Maintaining the brand message (dandruff prevention) while tweaking the second line demonstrates the strategy of creative evolution: core message unchanged, execution continuously renewed. As Brandgym concludes, this “fresh consistency” approach has kept H&S top-of-mind for over 30 years.

The longevity of this campaign exemplifies H&S’s broader marketing principle: stick with what works, but update it. Whenever a new market or demographic is targeted, H&S often reuses this format. For example, the brand produced a Greek-language version of the “Don’t” commercial in a local village setting.

Even with different actors or settings, the ad always opens with “I didn’t know you had dandruff!” and closes with “I don’t (because I use Head & Shoulders)”. This means that global viewers—even if they’ve never seen the American ads—quickly get the joke and the brand promise. Such iconic campaign branding ensures that every H&S ad feels part of a unified story. P&G’s commitment to this strategy (rather than reinventing the wheel) contrasts with many brands that frequently change slogans. The result is a coherent long-term brand narrative: safe from fad changes, H&S’s “I don’t have dandruff” creative has become inseparable from the brand identity.

3. Localization and Cultural Adaptation

While maintaining a consistent global message, H&S also tailors campaigns to local cultures and languages. A striking example is Japan’s animated campaign (2021) created by P&G and Forsman & Bodenfors Singapore. Recognizing that Japanese men rarely openly discuss dandruff (seen as “sensitive hygiene issue”),

H&S launched “The Chase”, an action-comedy anime film. This series of animated spots features a character (Ando the spy) who is pursued by a detective and realizes his dandruff is giving him away – until he uses Head & Shoulders Scalp and escapes “without a trace”. By using humor and the popular anime format, H&S directly addressed a stigmatized issue in a culturally resonant way. The campaign explicitly aimed to “help men break free from the stigma that surrounds dandruff”.

Behind the scenes, P&G research found over 40% of Japanese men have dandruff and half feel ashamed by it; the anime approach confronted that stigma head-on. This local adaptation – storytelling in anime – is unique to Japan, showing how H&S customizes creative execution for regional media tastes.

Similarly, in Southeast Asia H&S has turned language quirks into campaigns. In Vietnam, consumers struggled to pronounce “Head & Shoulders,” resulting in hundreds of funny nicknames. Rather than shy away, P&G Vietnam embraced this in the “1 Brand, 100 Names, 1 Solution to Dandruff” campaign. The campaign celebrated various mispronunciations (e.g. “breath soda”) with humor, producing regional videos and even song-and-dance numbers based on the nicknames. It incorporated local pop singer Isaac and online minigames to encourage people to share their own names for H&S. The result was a record-breaking boost in brand awareness and share in Vietnam, turning a “disadvantage” (difficult English name) into local pride.

In Indonesia, H&S ran a related campaign called “Say it Proud.” There, too, mispronunciation was an issue: Indonesian consumers often heard of Head & Shoulders but couldn’t say it easily in local languages. The “Say it Proud” campaign invited people to call H&S by any name confidently, turning the problem into pride. This TV/digital/radio effort led to increased sales and share in the market.

Overall, these examples show H&S’s local adaptation strategy: the same core product promise (dandruff-free confidence) is expressed through culturally tailored hooks. Whether it’s anime adventure in Japan or a social-media festival of nicknames in Vietnam/Indonesia, H&S ensures its advertising resonates locally while keeping the brand promise front and center.

4. Celebrity Endorsements and Sponsorships

Head & Shoulders frequently enlists celebrities, influencers and sports partnerships to amplify its message.

Globally, H&S has featured well-known faces to build trust and appeal. For example, many markets have seen H&S ads with athletes or stars. In the U.S., NFL Hall-of-Famer Troy Polamalu has appeared in spots (promoting the tagline “Make Every Wash Count” against dandruff microbes). Around the world, Bollywood actors Saif Ali Khan and Kareena Kapoor appeared in Indian campaigns. Latin American markets have seen singers like Thalía endorse H&S.

The idea is to link H&S to people with healthy, attractive hair who are widely admired. Marketing literature notes that H&S “invests heavily in advertising campaigns featuring well-known personalities” to highlight efficacy.

H&S also invests in sports sponsorships and co-branding.

A notable example is its collaboration with FC Barcelona football club. In 2015 P&G ran an integrated promotion in China offering a free FC Barcelona towel with H&S purchase. The soccer team’s massive fan base gave H&S access to millions of potential buyers, and the gift-with-purchase (GWP) was a strong purchase incentive. The campaign was “a huge success, with sales of H&S products increasing significantly in China”.

Similarly, H&S has aligned with Olympic athletes and teams (P&G is an Olympic sponsor and H&S has produced ads around games), capitalizing on the message of peak performance and confidence. For instance, Team USA skier Gus Kenworthy starred in an H&S “Shoulders of Greatness” Olympics commercial (2018), and the brand is marketed as an official shampoo of Team USA athletes. These sports partnerships tie H&S to global athleticism and broad fan communities.

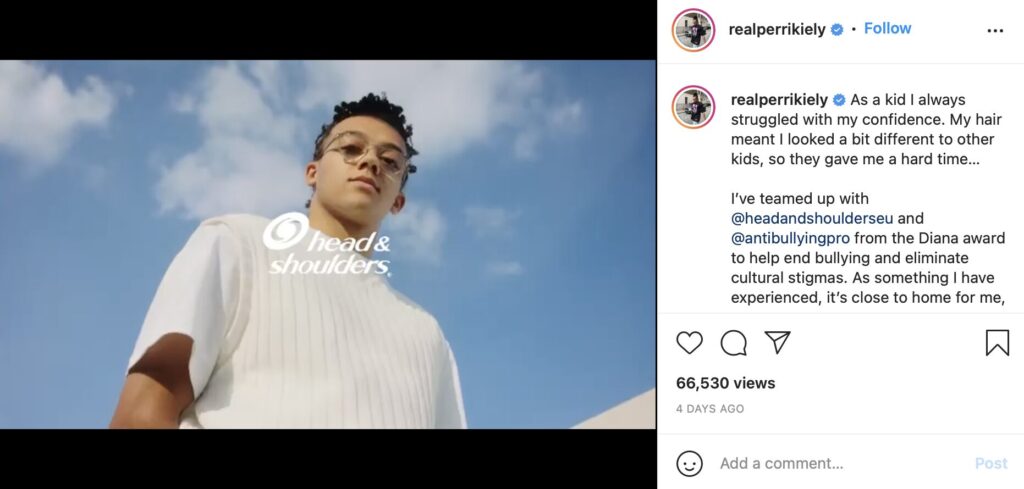

On digital platforms, H&S also works with social influencers and campaign-specific ambassadors.

In Vietnam’s mispronunciation campaign, the brand partnered with singer Isaac and local KOLs (Key Opinion Leaders) from each region. In its recent anti-bullying campaign (see below), H&S collaborated with the Diana Award charity in the UK, leveraging that credibility to reach schools and youth.

These collaborations amplify H&S’s reach: whether it’s a pop star promoting a new bottle on Instagram or a football legend in a TV spot, celebrity associations lend authority. In short, H&S’s endorsement strategy is multifaceted – it taps mainstream celebrities, athletes, and niche influencers depending on the market – all to reinforce the brand message of confidence through a healthy scalp.

5. Digital and Social Media Engagement

Head & Shoulders maintains a strong digital presence to engage consumers online. It uses social media, content marketing, and interactive digital campaigns to reach younger audiences and stay culturally relevant. For example, H&S’s official websites and social channels offer scalp care tips and interactive quizzes (“Find your perfect H&S product”) to educate users.

The brand actively posts on platforms like Facebook, Instagram and YouTube with advice articles and product demos. Marketing analysts note that H&S “maintains a robust online presence through social media platforms, engaging consumers with informative content, product demonstrations, and promotions”. This includes video content on YouTube that both showcases ads and provides haircare tutorials.

The Vietnam mispronunciation campaign (above) also leaned heavily on digital: it geo-targeted YouTube ads to Northern/Central/Southern audiences, seeded videos on popular KOL channels, and used social communities to create buzz. These tactics highlight H&S’s use of geo-targeting, influencer networks and platform partnerships (e.g. embedding campaign videos in new music video releases) to maximize online reach.

On social media, H&S frequently runs hashtag campaigns and interactive challenges.

A recent example is the #FreeTheShoulders anti-bullying campaign (2019-2020), which combined digital storytelling with user engagement (see next section). The brand also uses seasonal hashtags (e.g. #HSDandruffAwarenessMonth) and user-generated content contests to keep audiences involved.

Additionally, H&S invests in online advertising and search marketing to ensure it appears in hair-care conversations. According to WARC, a dedicated campaign in Indonesia combined TV, radio and even voice assistants to encourage people to “say it proud” and search for H&S – showing how H&S integrates digital voice/search activation into media strategy.

Overall, H&S leverages digital channels to make its marketing interactive and data-driven. Campaigns often include mini-games, quizzes, and social challenges to directly involve consumers. For example, the Vietnamese campaign created online quizzes asking users to share local H&S nicknames. This not only boosted engagement but generated user data and content. In short, digital marketing for H&S isn’t just about broadcasting; it’s about conversation and community-building around scalp health.

By meeting consumers on social platforms with engaging content and interactive features, H&S keeps the brand relevant, especially to younger demographics.

6. Product Innovation and Diversification

Innovating the product line is a key strategy to maintain relevance. H&S has expanded far beyond its original medicated shampoo. Its product portfolio now spans dozens of variants: from the Classic Clean formula to specialized lines like Clinical Solutions (for stubborn dandruff), Moisture Care, Royal Oils, and Itchy Scalp products.

The brand also introduced 2-in-1 shampoos that combine conditioner (branded in collaboration with P&G’s Old Spice), as well as co-wash and leave-on treatments for deep scalp health. In recent years, Head & Shoulders has focused on natural and gentle ingredients too, launching ranges like Bare (minimal ingredients) to appeal to health-conscious consumers. This broad range allows H&S to segment its offerings by usage occasion, gender, hair type and price. For example, it offers economy-value sizes for price-sensitive markets and premium formats (e.g. botanically enriched formulas) at higher price points.

Product innovation is not just about line extension but also efficacy. P&G regularly updates H&S’s formula with new active ingredients or combinations (zinc pyrithione, selenium disulfide, piroctone olamine, etc.) and skin-health additives. They also introduce new delivery formats (like scalp serum masks) to claim technological leadership. When launching these, H&S’s marketing highlights “clinically proven” benefits, reinforcing the science behind the brand.

For instance, new products have been introduced with dermatologist endorsements or with marketing claims like “#1 anti-dandruff ingredient” on-pack. The brand also reformulates to follow broader trends: an example is developing sensitive scalp and hypoallergenic versions for markets with strict cosmetic regulations. Each innovation is accompanied by targeted promotion (e.g. a marketing blitz when clinical-strength lines debut).

Geographically, H&S adapts its product innovation to local hair needs. For example, markets with harder water or different climates got specialized formulations (like Extra Strength formulations in some Latin American markets). In India and Southeast Asia, H&S introduced coconut or herbal extracts to cater to local preferences. This product localization ensures that H&S is not just a one-size-fits-all brand. Through such diversification and steady product development, Head & Shoulders keeps refreshing its image and entering new segments (e.g. men’s styling gels in some regions), thus maintaining growth even as dandruff treatment becomes a mature category/

7. Promotional and Distribution Strategies

Head & Shoulders employs aggressive promotion tactics and broad distribution to boost sales. For one, the brand often uses gift-with-purchase (GWP) and bundling offers. The 2015 FC Barcelona campaign in China is a prime example: any consumer who bought H&S received a free FCB-branded towel. These kinds of promotions encourage trial and high-volume purchase (as customers often buy multiple bottles to get the gift).

Outside sports tie-ins, H&S regularly runs seasonal promotions (e.g. summer discounts) and in-store deals. Marketing analysis shows H&S uses “promotional pricing strategy during the summer” offering extra discounts and incentives, which boosts sales volume at peak time. Retailers often run H&S bundle packs or point-of-purchase displays to highlight multi-bottle deals. According to industry commentary, H&S “frequently runs promotions, discounts, and bundling deals” in collaboration with retailers to attract price-sensitive buyers.

Pricing is another strategic lever. H&S typically adopts value-based and competitive pricing. It keeps prices on par with rivals (Sunsilk, Clear, etc.) to defend market share. However, it also has a range of sizes (small trial bottles to large family-size bottles) so that consumers of different budgets can buy the brand. In essence, H&S is positioned as an affordable premium: it is often priced slightly above local basic shampoos (leveraging the medicated claim) but below luxury salon brands. This middle-tier pricing ensures broad appeal. In some markets, H&S even used penetration pricing when entering (e.g. low launch price in India) to quickly gain trial.

On distribution, H&S boasts a vast global network. It is sold in over 100 countries, and on every continent. The brand is stocked in all major retail channels: supermarkets, drugstores, hypermarkets, and e-commerce platforms. In emerging markets, H&S expands beyond urban chains into local mom-and-pop stores (where, for example, language campaigns like “Say it Proud” target). P&G ensures consistent availability through sophisticated supply-chain management. Partnerships with retailers are deep: H&S runs co-branded promotions (e.g., buy X bottles get a free travel pack) and secures prominent shelf space. Additionally, online sales are growing – H&S has official brand stores on platforms like Amazon, Lazada, and Flipkart.

In summary, H&S’s promotion strategy combines on-pack offers and seasonal deals with wide availability. By making the shampoo easy to find and offering periodic incentives, H&S keeps purchase barriers low. These tactics – from celebratory gifts in sports promotions to digital coupon campaigns – complement the brand’s image-building efforts, ensuring Head & Shoulders dominates both mindshare and shelf space in the anti-dandruff category.

8. Social Causes and Emotional Branding

In recent years, Head & Shoulders has embraced purpose-driven marketing to connect emotionally with consumers, particularly youth. A major initiative was the “#FreeTheShoulders” campaign (launched ~2019) which addressed the stigma and bullying faced by teens with dandruf. Insight research showed “one in three teenagers are bullied, and those with dandruff are twice as likely to experience bullying”. Traditionally, H&S ads had focused on dandruff as a vanity issue. In contrast, #FreeTheShoulders reframed it as a social issue – bullying. The brand produced a haunting film (narrated by a bullied teen) and used real stories to highlight how dandruff can hurt confidence. Crucially, H&S partnered with The Diana Award (UK’s leading anti-bullying charity) to lend authenticity and deliver anti-bullying education in schools.

This emotional campaign expanded H&S’s brand purpose from “treat flakes” to “free hearts.” By aligning with a cause, H&S humanized the brand and gave youth a reason to care beyond product features. The results validated the strategy: over 1,000 bullying stories were shared during the campaign, and H&S reached a quarter-million students through the program. Independent awards even recognized it as “Best marketing to Youth” in Eastern Europe. Social media played a part too: the film and related content went viral among teens, generating praise and discussion. In essence, this strategy built brand empathy – H&S showed it “understands the audience,” not just the scalp condition.

Head & Shoulders has used similar approaches elsewhere. In Indonesia, the #SayItProud campaign (celebrating local nicknames) was pitched not just for humor, but to boost local confidence in the brand. Elsewhere, H&S has tied into broader campaigns (e.g. “Scalp Awareness Month” educates women on hair-health issues). These initiatives turn the brand into an ally for consumers. By addressing the emotional side-effects of dandruff – embarrassment, teasing, self-esteem – H&S marketing creates a deeper connection. This is a deliberate strategy to stay relevant as health and wellness trends grow. Rather than remaining a purely clinical brand, H&S positions itself as caring for people’s lives, a tactic that modern consumers (especially young ones) appreciate.

Conclusion

Head & Shoulders has masterfully positioned itself as a global leader in the anti-dandruff segment, not merely through product efficacy but by weaving a powerful brand narrative built on confidence, trust, and cultural relevance. From its iconic “I don’t have dandruff” campaign to localized storytelling in anime, sports tie-ins, and purpose-driven initiatives like #FreeTheShoulders, the brand has demonstrated an exceptional ability to evolve without losing its core identity. Its success lies in a consistent yet flexible marketing strategy—anchored in dermatological credibility and adapted through cutting-edge digital engagement, strategic partnerships, and product innovation tailored to diverse audiences.

In an increasingly fragmented marketplace, Head & Shoulders continues to stand out by combining science-backed solutions with emotional resonance. Whether reaching rural consumers in Southeast Asia or Gen Z on social media, the brand remains attuned to shifting cultural norms and personal care values. Ultimately, its decades-long dominance in the haircare industry proves that true brand leadership is not just about being first—it’s about staying relevant, trusted, and irreplaceable.

Also Read: Marketing Strategies and Marketing Mix of P&G

Also Read: Understanding the Brand Architecture of Proctor & Gamble (P&G)

To read more content like this, subscribe to our newsletter