Attentive is a leading startup in marketing technology, offering an SMS and email marketing automation platform tailored for e-commerce and retail brands. Founded in 2016 and based in New York, Attentive enables businesses to engage consumers with personalized, mobile-first messaging campaigns.

The company’s platform spans the entire subscriber lifecycle – from growing opt-in lists to sending targeted SMS/email campaigns, providing two-way customer support via text, and delivering analytics to optimize outreach. Attentive’s focus on text messaging (with recent expansion into email) has yielded exceptional engagement: SMS campaigns see ~90% open rates and 30% click-through rates, far outperforming traditional email.

The startup has scaled rapidly into a unicorn, serving thousands of brands and powering over 10 billion messages annually as of 2025. Backed by top venture firms and valued around $7–10 billion at its peak, Attentive is at the forefront of the shift toward mobile, conversational commerce.

Founding Story of Attentive

Attentive’s story begins with the entrepreneurial journey of Brian Long, its co-founder and former CEO. Long and co-founder Andrew Jones had previously launched TapCommerce, a mobile ad-tech startup in 2012 that specialized in retargeting ads based on user activity. TapCommerce experienced rapid growth – reaching about 30 employees and $2 million in monthly revenue within two years – and was acquired by Twitter in 2014 for around $100 million.

After two years at Twitter, Long (TapCommerce’s CEO) and Jones (Chief Product Officer) were eager to build another company, aiming for “something even bigger and more interesting”. In late 2016, Long teamed up with Jones and early TapCommerce engineer Ethan Lo to found a new venture, initially codenamed “Franklin”.

The founders’ first idea was a platform to help businesses communicate with their frontline workers (for example, simplifying messaging to retail staff). However, this concept failed to gain traction – customer feedback was lukewarm and investors gave a “tepid response”.

After about six months of struggling with that model (which Long later called an “abject failure”), the team noticed a different opportunity: businesses were far more interested in better communication with their customers via mobile. In a pivotal pivot, the trio shifted focus to personalized text-message marketing for consumers, giving birth to Attentive in late 2016. This new direction immediately resonated – early pilot customers gave rave reviews (rating 9 or 10 out of 10), validating the concept.

Drawing on lessons from the smartphone boom (smartphone usage had tripled from 2010 to 2017) and the declining effectiveness of email, Long and his team believed SMS could be a disruptive marketing channel.

They developed an innovative “two-tap” mobile opt-in flow that dramatically lowered the friction for consumers subscribing to texts. By simply tapping a link on a brand’s site, a pre-filled text message would pop up on the user’s phone; hitting send then opts them in to that brand’s SMS list.

This elegant solution to the opt-in problem – which Attentive later applied for a patent on – became a cornerstone of its product. With a working prototype and growing demand, Long quickly hired sales reps and scaled up efforts within a year of the pivot.

Founders of Attentive

Attentive’s founding team brought together experienced players from the mobile and ad-tech space:

Brian Long (Co-founder, former CEO) – An entrepreneur at heart, Long studied at the University of Pennsylvania and started his career in sales. He co-founded TapCommerce in 2012, which was acquired by Twitter in 2014, making him a proven founder with a successful exit. At Twitter, Long gained insight into large-scale mobile consumer platforms. He led Attentive as CEO from 2016 until mid-2023, when he transitioned to Executive Chairman to focus on early-stage innovation (as Attentive prepared for a potential IPO).

Andrew Jones (Co-founder, former CPO) – Jones was Long’s close collaborator from the TapCommerce days. He served as Chief Product Officer there and brought deep expertise in product development to Attentive. Jones drove Attentive’s product strategy and user experience, helping craft its marketing automation tools. Like Long, he stepped back from day-to-day operations by 2023 (remaining an advisor) to pursue new ventures.

Ethan Lo (Co-founder, former CTO) – Lo was one of TapCommerce’s first engineers (later a Twitter senior software engineer) and became Attentive’s technical co-founder. As CTO, he built Attentive’s initial platform and patented two-tap signup technology. Lo oversaw the engineering team through the company’s hyper-growth, then departed in 2021 to explore other projects.

This trio’s prior success gave Attentive instant credibility with investors – Bain Capital Ventures, an early TapCommerce backer, noted it “kept close ties to a winning team” and was excited to fund the new venture once the pivot to SMS marketing proved promising. The founders’ experience also shaped Attentive’s culture of rapid innovation, and as the company scaled, they brought in seasoned executives. Notably, in 2023 Attentive hired Amit Jhawar (former Venmo CEO) as President, and by June 2023 Jhawar took over as CEO to lead the company’s next phase while Long moved to the Chairman role. This leadership transition was a proactive step as Attentive eyes an eventual public offering and long-term growth.

Business Model of Attentive

Attentive operates a software-as-a-service (SaaS) model centered on usage-based pricing for messaging. The platform’s core value metric is the number of messages sent (per month). In practice, Attentive sells custom enterprise plans to clients that typically include the software platform plus a volume of SMS messages; customers pay more as their messaging volumes grow.

This usage-based approach contrasts with some competitors that charge a commission or revenue-share on sales generated via texts – Attentive pointedly does not take a cut of its clients’ revenue. Instead, brands are billed for the messaging service itself (usually as a monthly or annual contract scaled to their subscriber count and message counts). For example, instead of paying X% of SMS-driven sales, an Attentive client might pay a platform fee plus a few cents per text sent. This model aligns Attentive’s success with the volume of engagement it drives, while giving marketers cost predictability.

Another pillar of Attentive’s business model is high-touch support and compliance assurance. The company provides each client with a dedicated client strategy team to assist with onboarding, campaign strategy, and technical integration. Given the strict regulations around text messaging (brands must obtain explicit consent and provide opt-outs, per TCPA guidelines), Attentive’s platform includes built-in compliance safeguards and guidance – a major value-add for clients wary of legal risks. This focus on compliance and deliverability (e.g. ensuring messages aren’t filtered as spam) helps differentiate Attentive in the marketplace.

Attentive initially targeted retail and e-commerce brands, but the model has proven applicable across industries. As the company grew, it deliberately branched out beyond e-commerce into verticals like food & beverage, travel/hospitality, entertainment, and fitness. For example, quick-service restaurants use Attentive for promotional texts, media companies for event alerts, and even sports teams (the NBA’s Milwaukee Bucks are a client) to engage fans. The platform is designed to serve both small businesses and large enterprises, scaling from boutique online stores to Fortune 500 retailers. This broad applicability enlarges Attentive’s addressable market while diversifying its revenue base.

Partnerships are another key component of Attentive’s go-to-market model. The company has built integrations with major commerce and marketing platforms – for instance, Attentive teamed up with BigCommerce in 2021 to access 60,000+ merchants through an official extension. It also integrates natively with Shopify, Magento, HubSpot, Zendesk, Salesforce and other tools, allowing clients to sync customer data easily. Attentive has cultivated an ecosystem of agency partners as well, who often recommend the platform to brands and even help manage campaigns on behalf of clients. These partnerships help Attentive efficiently acquire customers and embed into the workflows of businesses that might otherwise use legacy email service providers. By 2025, the majority of Attentive’s customers were small- and mid-sized businesses (<$50M revenue) – many acquired through such integrations and channel partners – even as the company also serves large enterprise accounts.

In terms of value delivered, Attentive’s model has a clear ROI for clients. Its personalized messages drive on average about 18–20% of a brand’s total online revenue when fully utilized. Case studies frequently show Attentive becoming a top-3 revenue channel for its customers, alongside email and paid search. This high impact has allowed Attentive to command significant contracts while maintaining a competitive pricing reputation – reviews indicate Attentive’s fees are often lower than alternatives like Klaviyo or Yotpo’s SMSBump for comparable message volumes. By focusing on usage-based pricing and strong customer support, Attentive’s business model scales with its clients’ success, fostering long-term retention (churn rates are reportedly low, as texting programs tend to become integral to marketing).

Revenue Streams of Attentive

Attentive generates revenue primarily through the services and features of its messaging platform. Major revenue streams include:

| Revenue Stream | Description |

|---|---|

| SMS Messaging Fees | Usage-based fees for text messages sent via Attentive. Clients are typically charged per SMS/MMS message or in tiered bundles (often wrapped into custom monthly/annual plans). This is the core revenue driver – as message volume grows, so do fees. Attentive’s model differs from some competitors that take a % of sales; instead it charges for the messaging service itself. |

| Platform Subscription | SaaS licensing fees for access to Attentive’s marketing automation software. Attentive offers custom enterprise plans rather than one-size pricing. A plan gives the client access to the full platform (campaign builder, automation, analytics, compliance tools, etc.) and dedicated support. In practice, the platform fee is often bundled with a messaging volume package. |

| Email Marketing Service | Since 2022, Attentive has expanded into email – existing clients can run email campaigns through the same platform. The email product is often included as part of the overall subscription (to provide a multi-channel solution), potentially with an add-on fee for higher email volumes. This added channel provides a new, growing source of revenue by capturing budgets that might have gone to separate email providers. |

| Attentive Concierge | Conversational messaging service for two-way customer interactions. Launched in 2022, Attentive Concierge initially used live on-demand agents to reply to customer texts (answering questions, recommending products). It has since been augmented by Attentive AI to automate many responses. Brands pay for Concierge as a premium add-on to handle customer support via SMS at scale. This can be billed per conversation or as an upgraded service tier. By 2023, Concierge’s AI-powered replies enabled instant 1:1 interactions without requiring proportional headcount on the client side. |

| Professional Services | While not broken out as a major revenue stream, Attentive provides extensive client support (strategic guidance, creative assistance, compliance reviews) as part of its offering. These services help ensure customer success and are generally included in the subscription. Attentive does not appear to charge significant separate consulting fees, instead using superior support as a value-add to retain and grow clients (indirectly driving upsells and renewals). |

Attentive’s financial growth has been dramatic. In 2020, the company’s annual revenue was around $78.5 million, which grew to about $125 million in 2021. By 2022, Attentive reached roughly $200 million in ARR (60% year-over-year growth). Despite a cooling tech economy in 2022–2023, Attentive continued to expand its top line – hitting an estimated $308.7 million in 2024 revenue according to one report. This consistent growth reflects both existing clients spending more (as their subscriber lists and messaging frequency increase) and new client acquisition. The company reportedly surpassed 2,000 customers by 2020, grew to 5,000+ customers by end of 2021, and continues to add clients across mid-market and enterprise segments. (Notable customers range from fashion retailers like Kate Spade, to QSR chains like Jack in the Box, to even the Milwaukee Bucks NBA team.) This broad client base and recurring revenue model give Attentive a strong foundation, with high gross margins typical of software businesses – though it also incurs significant messaging costs paid to telecom carriers (an expense that scales with usage).

Funding and Funding Rounds of Attentive

Since its inception, Attentive has attracted substantial venture capital funding, fueling its product development and rapid expansion. The company has raised over $860 million across multiple rounds, joining the ranks of high-valued “unicorn” startups. Below is a summary of Attentive’s key funding rounds and investors:

| Date | Round | Amount Raised | Lead Investor(s) | Post-Money Valuation |

|---|---|---|---|---|

| Oct 2016 | Seed | ~$2M (est.) | Eniac Ventures, FirstMark (unconfirmed) | – (Stealth mode funding) |

| Feb 2018 | Series A | $13 million | Bain Capital Ventures (lead); Eniac, NextView | Not disclosed |

| Aug 2019 | Series B | $40 million | Sequoia Capital (lead); Bain Capital Ventures | Not disclosed |

| Jan 2020 | Series C | $70 million | Sequoia Capital and IVP (co-leads); Bain, others | ~$400M (est.) |

| Apr 2020 | Series C Extension | $40 million | Atomico, Elad Gil (extension investors) | – (extended valuation) |

| Sep 2020 | Series D | $230 million | Coatue Management (lead); Tiger Global, Wellington, D1 Capital, Atomico, etc.attentive.com | ~$2.2 billion |

| Mar 2021 | Series E | $470 million | Coatue (lead); participation from Bain, Sequoia, Tiger Global, Wellington, and others | ~$6.7–7.0 billion |

| Aug 2023 | Late-Stage/Secondary | Undisclosed | – (private investors) | ~$7 billion (internal valuation) |

Sources: Company press releases, news reports, and investor disclosures.

Total funding = approx. $863 million to date. Attentive’s valuation skyrocketed in 2020–21 amid investor enthusiasm for digital commerce enablement – jumping from unicorn status in early 2020 to around $7 billion by 2021. One of its later backers, Coatue, led two consecutive rounds, and Scott Friend of Bain (who invested since Series A) noted the company was valued “at over $10 billion” at its peak in 2021. However, like many late-stage startups, Attentive held off on any IPO during the 2022 downturn; its last known funding in 2023 was a confidential round to bolster the balance sheet (details not publicly disclosed).

Attentive’s investor roster is a who’s-who of top tech VCs: Sequoia Capital, IVP, Index Ventures, Tiger Global, Wellington Management, Bain Capital Ventures, Coatue, Atomico, and others have participated over the rounds. The substantial war chest from these raises has enabled Attentive to invest aggressively in product development (e.g. launching email and AI features), international expansion, and scaling its sales/customer success teams. It also provides a cushion as the company approaches profitability; Attentive has signaled plans to eventually go public when market conditions allow.

Competitors of Attentive

Attentive operates in a highly competitive landscape at the intersection of marketing automation, customer messaging, and e-commerce enablement. As consumer texting has gained popularity, numerous players have emerged or expanded into this space. Attentive faces competition from both focused SMS marketing startups and larger omni-channel marketing platforms. Key competitors include:

Klaviyo

Founded 2012, Klaviyo began as an email marketing platform for e-commerce and later added SMS in 2019. It caters to a similar customer base of online brands. Klaviyo went public in 2023 and, as of 2025, has a market cap around $10.5 billion. It serves over 100,000 businesses (mostly SMBs) and is known for its robust email capabilities. Klaviyo’s move into SMS (and a strategic partnership with Shopify) makes it one of Attentive’s top rivals for mid-market and larger retail clients. Unlike Attentive, Klaviyo started with email-first, but now it competes head-to-head on text messaging features. Klaviyo’s S-1 filing revealed 1.5k large customers (>$50k ARR each) – indicating strong traction upmarket.

Postscript

A venture-backed startup (founded 2018) focused purely on SMS marketing for e-commerce. Postscript originated as a Shopify app for one-way promotional texts, and later introduced “Postscript Plus” with managed services for brands with small teams. It has positioned itself as an easy plug-and-play texting solution for D2C brands. Postscript raised a $65 million Series C in 2022 (notably with Twilio’s fund as an investor). It primarily targets the same niche of online retailers on Shopify/BigCommerce. Attentive and Postscript have a fierce rivalry – in fact, in 2023 Attentive sent a cease-and-desist to Postscript over a case study involving an ex-Attentive client, underscoring the competitive tension. Postscript’s strength is simplicity for small businesses, but it lacks the breadth of Attentive’s product (Postscript only recently added some email and two-way features, and remains smaller in scale).

Emotive

Founded 2018, Emotive set itself apart with a focus on conversational SMS – enabling real 1:1 text conversations between brands and customers, often powered by human agents and AI. This chat-style commerce approach overlaps with Attentive’s Concierge feature. Emotive saw early growth and raised $50 million in 2021 at a $400M valuation, but the company has struggled to scale profitably. In 2022, Emotive laid off 18% of staff amid a push toward profitability. Competitive pressure from larger players like Attentive has squeezed Emotive’s market share. While Emotive offers rich two-way engagement, its challenges indicate how difficult it is for smaller entrants to survive in this crowded space.

Yotpo (SMSBump)

Yotpo is an established e-commerce marketing platform (known for reviews and loyalty programs) which acquired SMSBump – a Shopify-native SMS marketing app – in 2020. Under Yotpo, SMSBump has grown as a direct competitor in the Shopify ecosystem, offering text message marketing integrated with Yotpo’s suite. Many small Shopify stores use SMSBump for its ease of use and lower cost. Attentive competes with SMSBump especially for the long-tail of e-commerce merchants. Reviews suggest Attentive’s pricing can actually be lower at scale than Yotpo’s SMSBump, but Yotpo’s cross-product integrations and Shopify partnership (Yotpo is a Shopify Plus certified app) make it a notable rival in the SMB segment.

Braze

Braze (founded 2011, IPO in 2021) is a customer engagement platform that provides messaging across push notifications, in-app messages, email, and SMS. It typically serves large enterprise clients (media, finance, and big retail) and offers highly sophisticated orchestration across channels. While Braze’s multi-channel breadth goes beyond Attentive’s SMS/email focus, it competes for the digital marketing budgets of big brands. Some enterprises might weigh using Braze (or Salesforce Marketing Cloud, Oracle Responsys, etc.) versus a specialized provider like Attentive. Braze’s strength is in-app and push channels for mobile apps, whereas Attentive’s strength is the text messaging channel and its purpose-built commerce tools. In practice, some large businesses use Braze for app messaging and Attentive for SMS promotions – but as Braze also offers SMS, there is overlap in capabilities. Braze trades at a lower revenue multiple (around 7–13×) compared to valuations that Attentive received, reflecting investor recognition of its diversified approach.

Other competitors and alternatives include Iterable (multi-channel platform blending marketing and product messaging), Mailchimp (primarily email, with some texting add-ons), and DIY solutions using communications APIs like Twilio. It’s a fragmented space – “saturated” with both all-in-one cloud platforms and niche startups fighting for market share. However, consolidation is underway: the basic act of sending an SMS has become somewhat commoditized, putting pressure on smaller players to either specialize or get acquired. Attentive’s early-mover advantage in SMS for commerce, combined with its heavy funding, has enabled it to outpace many rivals. For instance, its leadership claims that at one point the company was able to convert nearly every business it pitched that was already interested in SMS marketing. Nonetheless, competition remains intense. Clients can relatively easily switch providers in this space (the main friction being compliance and integration), so Attentive must continuously differentiate on features, price, and results to maintain its leadership.

Below is a comparison of several notable competitors:

| Competitor | Founded | Focus & Offerings | Notable Stats (2024) |

|---|---|---|---|

| Attentive | 2016 | Personalized SMS & email marketing for commerce; two-way messaging, AI automation. | ~$300M revenue; 5,000+ customers; $7B–$10B valuation. |

| Klaviyo | 2012 | Email marketing automation for commerce; added SMS in 2019. | $585M revenue (2022); 130K+ users (mostly SMB); IPO in 2023 at $9B+ market cap. |

| Postscript | 2018 | SMS marketing for Shopify stores; one-way promos and some managed services. | 8,000+ merchants; $106M total funding; Twilio Ventures investor. Geared to SMB/D2C brands. |

| Emotive | 2018 | Conversational SMS marketing with live agents + AI for 1:1 texting. | $103M raised; faced 2022 layoffs and downsizing as standalone growth slowed. |

| Yotpo SMSBump | 2015 (SMSBump 2017) | SMS marketing integrated into Yotpo’s e-com platform (reviews, loyalty). | 100K+ users (via Shopify App); part of Yotpo’s $2B valuation. Competes on SMB pricing and integration. |

| Braze | 2011 | Cross-channel customer engagement (push, email, SMS, etc.) for enterprises. | $355M revenue (FY2023); ~1,800 customers; public company valued ~$5–6B. Focus on large enterprises and apps. |

(Sources: Company filings, press releases, and industry research.)

As seen above, Klaviyo and Braze represent the bigger platform players encroaching on SMS, while Postscript, Emotive, and others are smaller specialists. Attentive’s ability to compete on both ends – offering ease-of-use and ROI for small merchants, while scaling to serve Fortune 500 retail brands – is a key reason it has maintained an edge. However, the competitive landscape is dynamic: for instance, Shopify’s deep partnership with Klaviyo (Shopify is an investor in Klaviyo) could steer many merchants toward that platform for email/SMS, posing a threat to Attentive’s growth among Shopify stores. Likewise, if large enterprises prefer a single multi-channel hub like Braze or Adobe, Attentive must persuade them that a dedicated best-of-breed texting solution yields superior results.

Competitive Advantage of Attentive

Despite the competition, Attentive has established a strong competitive moat through a combination of product innovation, demonstrated performance, and strategic focus. Its key competitive advantages include:

Mobile-First & Proprietary Technology

From the outset, Attentive built its platform mobile-first with SMS in mind, rather than bolting texting onto an email system. Its signature “two-tap signup” flow is a proprietary innovation that dramatically increases subscriber opt-in rates for clients. This reduced friction in acquiring SMS subscribers gave Attentive customers a head start in building large text marketing lists. Attentive has also invested heavily in SMS deliverability infrastructure – partnering with 80+ carriers and aggregators to ensure messages get through even during peak periods like Black Friday. Features like built-in link shorteners (to avoid carrier spam filters) and automatic compliance tools further set it apart. These mobile-specific capabilities are not trivial for competitors to replicate quickly, especially those originally focused on email or other channels.

Superior Engagement & ROI

Attentive has consistently proven that it drives higher engagement and revenue for brands, which is perhaps the ultimate competitive advantage in a results-driven marketing world. The company often cites that its clients see click-through rates over 30% and ROI of 25x or more on campaigns. Internal metrics show Attentive’s texts contribute around 18–20% of total online revenue for the average client. These outcomes (significantly better than email marketing benchmarks) make a compelling case for choosing or staying with Attentive. For example, some Attentive clients reported that on major shopping days like Black Friday/Cyber Monday, SMS campaigns through Attentive outperformed every other marketing channel in driving sales. This level of impact isn’t easily matched by newer entrants. By publicizing case studies and statistics, Attentive has built a reputation as the platform that delivers mobile commerce revenue, giving it an edge in sales cycles.

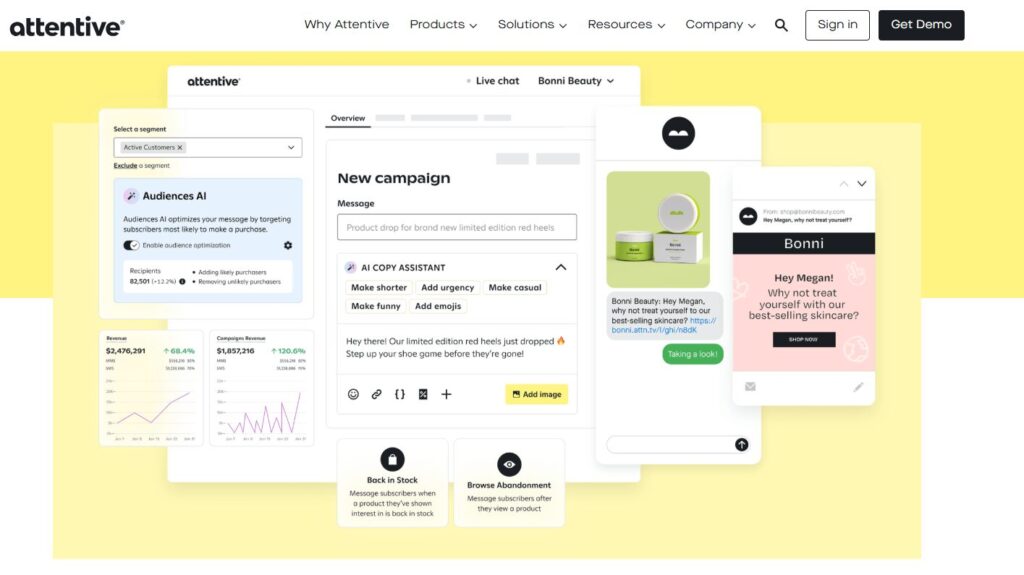

Holistic Platform (SMS + Email + AI)

Attentive’s product has evolved into a broader marketing hub, which is now a competitive strength. While initially focused solely on SMS, Attentive added email marketing capabilities in 2022 to become a multi-channel platform. This means clients can manage both email and texting in one place, leveraging unified data. The platform’s analytics and segmentation span across channels, providing a 360° view of customer messaging. Attentive also rolled out Attentive AI in 2023 – a suite of AI features that automate campaign content creation and optimization. For instance, the AI can suggest message copy, A/B test variants, or even automatically respond to common customer texts through the Concierge service. These enhancements improve productivity for marketers and keep Attentive at the cutting edge. Smaller competitors often lack the resources to develop such AI-driven capabilities, and bigger competitors can be slower to incorporate new tech. By continuously expanding its feature set (e.g. supporting MMS and even RCS for richer messages, and launching tools like Attentive Signal for identifying website visitors), Attentive stays ahead of the curve, making it a one-stop solution for text-message-centric marketing.

Deep E-commerce Focus and Integrations

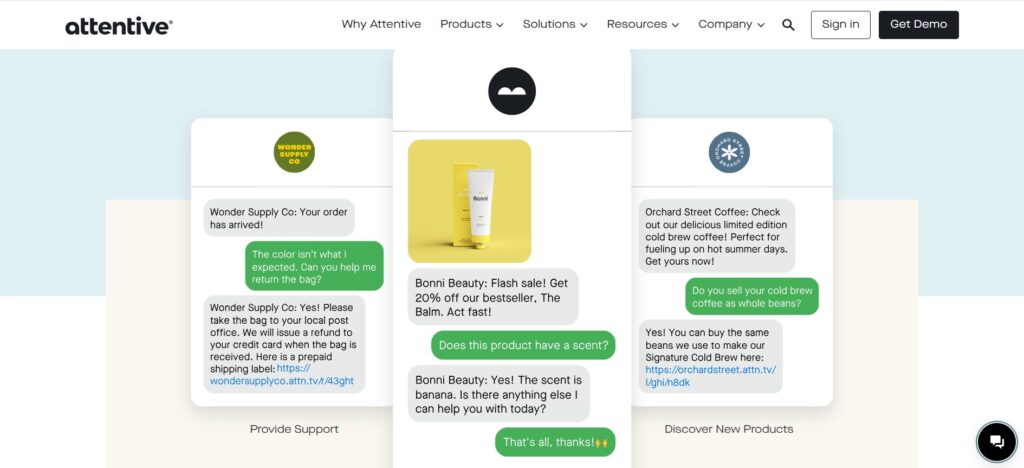

Attentive has entrenched itself in the e-commerce ecosystem. Its numerous direct integrations (with Shopify, Magento, BigCommerce, WooCommerce, etc., and with marketing tools like Salesforce, HubSpot, Zendesk) make deployment easier for brands. In addition, Attentive has built playbooks and templates tailored to retail scenarios – cart abandonment reminders, product drop alerts, back-in-stock notifications, loyalty and sale announcements, etc. – based on best practices from thousands of brands. This domain expertise means Attentive speaks the language of retail CMOs in a way general marketing platforms often do not. Attentive also forged partnerships with e-commerce agencies and consultants who specialize in driving online sales, further embedding the platform in the community. This ecosystem advantage creates a network effect: the more e-com brands that succeed with Attentive and share their wins (some openly tout that Attentive drove millions in incremental sales), the more new customers are drawn to the platform. It also makes switching less attractive; for example, an online boutique using Attentive integrated with its Shopify store and CRM sees tangible revenue coming in – switching to a less specialized tool could jeopardize those gains.

Scale and Funding (Execution Advantage)

Having raised over $800M, Attentive can out-invest many rivals in product development, customer success, and marketing. The company grew to ~1,000 employees by 2023 (and ~1,533 by early 2025), including one of the largest dedicated SMS-focused engineering teams in the industry. This scale allows Attentive to serve enterprise clients with complex needs (with “white-glove” support), while also improving its platform at a rapid clip. For example, Attentive’s sizable data science team can continuously optimize send-time algorithms or train AI models on billions of message interactions – capabilities a smaller startup like Postscript or Emotive would struggle to match. Additionally, Attentive has shown willingness to compete on pricing when needed; being well-capitalized meant it could offer flexible deals (or volume discounts) to win marquee clients without imperiling its business. Smaller competitors feeling that squeeze have had to downsize or seek acquisition. Attentive’s momentum and resources thus reinforce a virtuous cycle: it’s seen as a “safe bet” in SMS marketing, which helps it win more of the biggest customers, further strengthening its market position.

In summary, Attentive’s competitive edge comes from being early and excellent in a fast-growing niche. It pioneered the methods that others now try to copy (easy opt-in, personalized behavioral targeting via text), maintains a laser focus on texting as a channel, and complements that with broader capabilities like email and AI to stay ahead. While competitors abound, Attentive’s blend of innovative tech, proven ROI, and industry focus has positioned it as the leader in text-message marketing for brands. As long as it continues executing on product innovation and client success, Attentive is well placed to defend its turf against both upstart challengers and larger marketing clouds.

Product Evolution of Attentive

Attentive’s product has rapidly evolved from a single-channel SMS tool to a robust multi-channel marketing suite. In its early days (2017–2018), the core product was the SMS campaign manager with two-tap signup and basic automation (like welcome messages and cart abandonment reminders). By 2019, Attentive had introduced more advanced “Journeys” – automated drip campaigns triggered by user behavior (e.g. browse abandonment, post-purchase follow-ups) – essentially bringing marketing automation flows to SMS. It also added support for rich media in texts (images, GIFs via MMS) and segmentation tools to personalize messages based on customer attributes. In 2020, Attentive launched features like Quiet Hours and Smart Sending to prevent over-messaging and manage send frequency caps, addressing a pain point for brands worried about spamming users.

A major evolution came in 2021–2022 when Attentive expanded beyond SMS. Recognizing that many brands wanted an integrated solution, Attentive debuted an email marketing product in 2022, allowing clients to create email campaigns and capture email signups through Attentive’s forms. While email was a crowded field, Attentive leveraged its existing customer relationships – many clients were happy to consolidate email and SMS with one vendor. By mid-2025, Attentive reported over 1,000 brands using its email product and even launched an AI-powered email content generator (“AI Pro for Email”) to enhance it. The addition of email put Attentive in more direct competition with platforms like Klaviyo, but also increased its share of marketing wallet from clients.

Attentive also heavily invested in two-way messaging capabilities. In 2022 it rolled out Attentive Concierge, a service enabling brands to handle inbound text replies and customer service via SMS. At launch, this involved live agents (either the brand’s team or Attentive’s on-demand agents) responding to consumer texts – for example, answering product questions or helping with orders. This was essentially Attentive entering the customer support arena. However, scaling human agents is costly, so in 2023 Attentive infused this service with AI chatbots. The updated Concierge with Attentive AI could instantly answer common queries or draft responses for agent approval. This dramatically improved response times and reduced the need for large support staffs on the client side. The company reported that AI-driven replies yielded impressive results – some customers saw a 160%+ increase in conversions and significantly higher sales from two-way interactions. This move toward “conversational commerce” via AI is a logical extension of Attentive’s vision to make brand-consumer communication more interactive and immediate.

Another new product area is “Attentive Signal”, introduced around 2023, which is an identity resolution and website audience tool. It helps brands identify website visitors (even before they subscribe) and target them with pop-ups or tailored messages to convert them into subscribers. Attentive Signal uses first-party data and browsing behavior to personalize the sign-up prompts (for example, recognizing a repeat visitor and offering a special SMS discount). This feature reflects Attentive’s broader strategy to help clients grow their subscriber lists aggressively – a necessary precursor to effective messaging campaigns. By offering growth tools, messaging, and analytics all in one, Attentive is positioning itself as a comprehensive customer engagement platform for commerce.

Finally, Attentive has kept pace with emerging messaging channels. In 2023 it announced support for RCS (Rich Communication Services), which is essentially the next generation of SMS on Android phones, enabling richer interactive messages (with carousels, buttons, etc.). While RCS usage is still nascent (and not supported on iPhones), Attentive’s early support for it indicates readiness to adopt new channels when they gain traction. Similarly, Attentive has explored integration with WhatsApp and other messaging apps in markets where those are prevalent, though SMS remains the primary channel for now. This flexibility ensures Attentive can serve global clients who may want to reach customers on different messaging platforms.

Also Read: Solifi – Founders, Business Model, Funding, Competitors & Others

Global Expansion of Attentive

While the bulk of Attentive’s business has been in North America, the company began international expansion in earnest in 2022. It opened a London headquarters (its first office outside the U.S.) in April 2022 to serve the UK and Europe, hiring a GM of International to lead the growth in EMEA and APAC. The UK was seen as an attractive first step due to its high smartphone usage and openness to mobile commerce, and many UK brands looking for personalized SMS solutions. Attentive had already been supporting some global programs (for instance, U.S. clients using it to text customers in Canada, UK, Australia, etc., with compliance to each region’s regulations). The London office allowed Attentive to directly sign local European brands and provide in-time-zone support. By late 2022, Attentive also established a presence in Canada and Australia, reflecting where initial client demand pulled them.

Adapting to new markets meant handling different carrier systems, languages, and data privacy laws (like GDPR in Europe). Attentive built features for localized opt-in compliance and messaging in 10+ languages. Its international team tailored best practices for each region – for example, emphasizing WhatsApp in some APAC countries if SMS was less dominant. The global push opens a vast new opportunity: the worldwide SMS marketing software market is projected to grow at ~20% CAGR, reaching $24.7B by 2028. Being an early mover globally could let Attentive replicate its U.S. leadership abroad. As of 2025, the company has clients in Europe, Latin America, and Asia-Pacific and continues to invest in international sales. This expansion also helps serve U.S.-based multinational brands who want a consistent texting solution across countries.

Also Read: Contentstack – Founders, Business Model, Funding & Competitors

Future Outlook of Attentive

Looking ahead, Attentive’s trajectory will likely involve preparing for the public markets and continuing to innovate. The company has indicated it is aiming for an IPO when conditions are favorable, and with revenues in the few-hundred-million range and a durable SaaS model, it has the profile of a strong IPO candidate. To bolster its story for Wall Street, Attentive is working on improving profitability (as many late-stage startups did post-2022) and showcasing its expansion into new areas like AI. The broader trends favor Attentive: consumer receptiveness to brand texts is high and rising (more than 90% of customers express interest in texting with brands, and SMS opt-in rates are growing). As email inboxes get more crowded and open rates decline, brands are reallocating budget to SMS – over 60% of marketers planned to boost SMS spend in 2024. Attentive is well-positioned to capture that spending.

However, it will need to navigate challenges, such as evolving privacy regulations (e.g. ensuring compliant messaging in each region, handling consumer data responsibly) and keeping ahead of competitors’ feature sets. The company’s emphasis on AI suggests a future where a lot of campaign optimization and even creative work is handled by algorithms, allowing marketers to focus on strategy. Attentive’s recent product updates – like AI Journey optimization and predictive analytics to improve customer purchase frequency – indicate it sees intelligence and insights as key differentiators going forward. Additionally, we may see Attentive extend into adjacent channels or services: for instance, could it incorporate push notifications or app messaging to complement SMS? Or offer more commerce capabilities (maybe shoppable text experiences)? The total addressable market (TAM) could broaden as Attentive moves from being “the text marketing company” to a more holistic customer communication platform for commerce.

In conclusion, Attentive’s brand story – from a scrappy pivot in 2016 to an industry leader by 2025 – showcases how identifying an unmet need (personalized texting in a mobile-first era) and executing relentlessly can create tremendous enterprise value. The company’s founding DNA of innovation, its strategic expansions (email, AI, global markets), and its focus on delivering measurable revenue for clients have all been integral to its success. Attentive today stands as a vital partner for brands seeking to build direct, loyal customer relationships via the most immediate channel there is: the mobile phone. With solid fundamentals and continuing growth, Attentive is poised to remain a dominant player in the next chapter of digital marketing, as the line between marketing and personalized conversation continues to blur.

Also Read: Vanta – Founders, Business Model, Funding & Competitors

Also Read: Pacaso – Founders, Business Model, Funding & Competitors

Also Read: Wiz – Founders, Business Model, Funding & Competitors

To read more content like this, subscribe to our newsletter