LucidLink is a cloud-native file collaboration startup that delivers instant, secure access to cloud-hosted files, enabling remote and hybrid teams to work on large datasets as if they were local.

Founded in 2016 and headquartered in San Francisco, the company pioneered a “storage collaboration” platform purpose-built for modern workflows, eliminating the need to download or sync files by streaming data on-demand from the cloud.

This innovation addresses a critical need in today’s market: as of 2023, three-quarters of creative collaboration now happens remotely, and legacy file-sharing solutions struggle with the massive file sizes and speed requirements involved. LucidLink’s relevance is underscored by its rapid adoption among media, entertainment, design, and other industries that demand real-time collaboration on huge files.

Over the past two years, the company achieved exceptional growth – increasing annual recurring revenue by nearly 5× and its user count by over 4× – despite a challenging environment. This growth reflects how indispensable LucidLink’s service has become for distributed creative professionals.

With a customer base that includes household names like Adobe, A&E Networks, Whirlpool, Shopify, BuzzFeed, and Spotify, as well as major film studios and game developers, LucidLink has proven its market fit across over 40 countries and more than one billion files managed on its platform.

By combining the simplicity of a local drive with the scalability of cloud storage, LucidLink stands at the forefront of the shift toward cloud-first collaboration – a shift expected to drive enterprise cloud infrastructure investment to $1.2 trillion by 2027.

In short, LucidLink has established itself as a trailblazer in remote file access, offering a solution that aligns squarely with the needs of the evolving hybrid workforce.

Founding Story and Origins of LucidLink

LucidLink’s origin story begins with a firsthand struggle in distributed software development.

In 2012, co-founder George Dochev was working remotely from France while his team at DataCore (a storage software company) was split between Florida and Bulgaria. The team produced tens of gigabytes of new build files and crash dumps daily, all of which needed to be shared across continents for testing and debugging.

The existing approach – using VPN tunnels and network file shares – proved painfully slow over long distances, often utilizing only a fraction of available bandwidth and wasting hours waiting for files to copy.

To mitigate this, Dochev’s team tried syncing build files to a local server in the overseas office, which helped that branch but left remote individuals (like himself) struggling with slow, unreliable access. These frustrations planted the seed of an idea: “Wouldn’t it be great if there was something like a distributed file system for the Internet that everyone could access irrespective of location?”.

Dochev envisioned a globally accessible filesystem with one namespace, no need for VPNs, and efficient use of Internet bandwidth – essentially a cloud-based shared drive that streams data on demand instead of requiring full copies.

Such a system could allow instantly opening a multi-GB crash dump for analysis without downloading it entirely, selective folder sync for offices that need local copies, “pinning” frequently used files for offline use, and seamless online/offline transition – all OS-agnostic and easy to use. At the time, no solution on the market delivered this capability, largely due to the formidable technical challenges of building a reliable distributed filesystem spanning devices that come and go on the network.

Undeterred, Dochev began prototyping the concept.

By 2016, George Dochev had developed a working demo of the technology and reunited with Peter Thompson, a former colleague from DataCore, to turn the vision into a company. Thompson, who had spent 14+ years in leadership roles at DataCore and had recently completed an MBA at Stanford, immediately saw the potential: “It seemed like magic…having hundreds of terabytes instantly accessible on a virtual drive without download or sync”, he later remarked.

The two founders complemented each other – Dochev bringing deep low-level storage engineering expertise, and Thompson contributing business acumen and go-to-market experience. They formally co-founded LucidLink in early 2016, incorporating in Delaware, while establishing the engineering team in Sofia, Bulgaria (Dochev’s home country) to leverage strong local tech talent.

An initial seed investment of $1.6 million from Baseline Ventures in December 2016 provided the runway to build out the product.

Dochev’s eureka moment in 2012 thus evolved into LucidLink’s mission: to create a “cloud-native file system” that makes remote storage feel as fast and convenient as local storage, fundamentally transforming how distributed teams collaborate on content.

Founders’ Biographies and Backgrounds

Peter Thompson (Co-Founder & CEO)

Peter Thompson is a technology industry veteran with over 30 years of experience leading business growth and strategic partnerships across global markets. Prior to founding LucidLink, Thompson spent 14 years at DataCore Software, a pioneer in software-defined storage, where he held multiple executive roles.

As VP of Emerging Markets at DataCore, he spearheaded the company’s expansion into Asia (including establishing operations in China) and other regions. Thompson’s background blends deep domain knowledge in storage virtualization with a strong business education – he earned an MBA from Stanford – and a track record of building international teams and channels.

By the time he co-launched LucidLink in his late 40s, Peter Thompson had a rare mix of startup hunger and seasoned leadership. Colleagues describe him as a dynamic leader who built a $390 million-valued company by focusing on team and long-term vision.

At LucidLink, Thompson drives the company’s strategic direction, investor relationships, and enterprise growth, drawing on decades of industry insight.

George Dochev (Co-Founder & CTO)

George Dochev is a renowned storage and file systems expert with over 20 years of experience bringing advanced technologies to market.

Originally from Bulgaria, Dochev was a principal engineer at DataCore Software, where he played a key role in developing complex virtualization and storage infrastructure products. (Notably, Dochev led development for DataCore’s SANsymphony, a flagship storage virtualization platform.) His hands-on technical expertise spans distributed systems, network protocols, and low-level file I/O – precisely the skill set needed to tackle LucidLink’s ambitious engineering challenges.

George Dochev is often credited as the architect of LucidLink’s core technology; in fact, he began coding the first version of LucidLink’s file streaming engine on his own before teaming up with Thompson. Beyond his technical acumen, Dochev has demonstrated strong leadership in growing engineering teams; under his guidance, LucidLink’s development hub in Sofia has become the company’s innovation engine.

As CTO, he remains deeply involved in product strategy and R&D, ensuring that LucidLink’s technology stays ahead of the curve. Together, Thompson and Dochev blend entrepreneurial grit with storage industry pedigree – a combination that has anchored LucidLink’s success from inception to its current scale.

Business Model and Revenue Generation of LucidLink

Software-as-a-Service (SaaS)

LucidLink operates a Software-as-a-Service (SaaS) business model, delivering its file collaboration platform via cloud to organizations on a subscription basis.

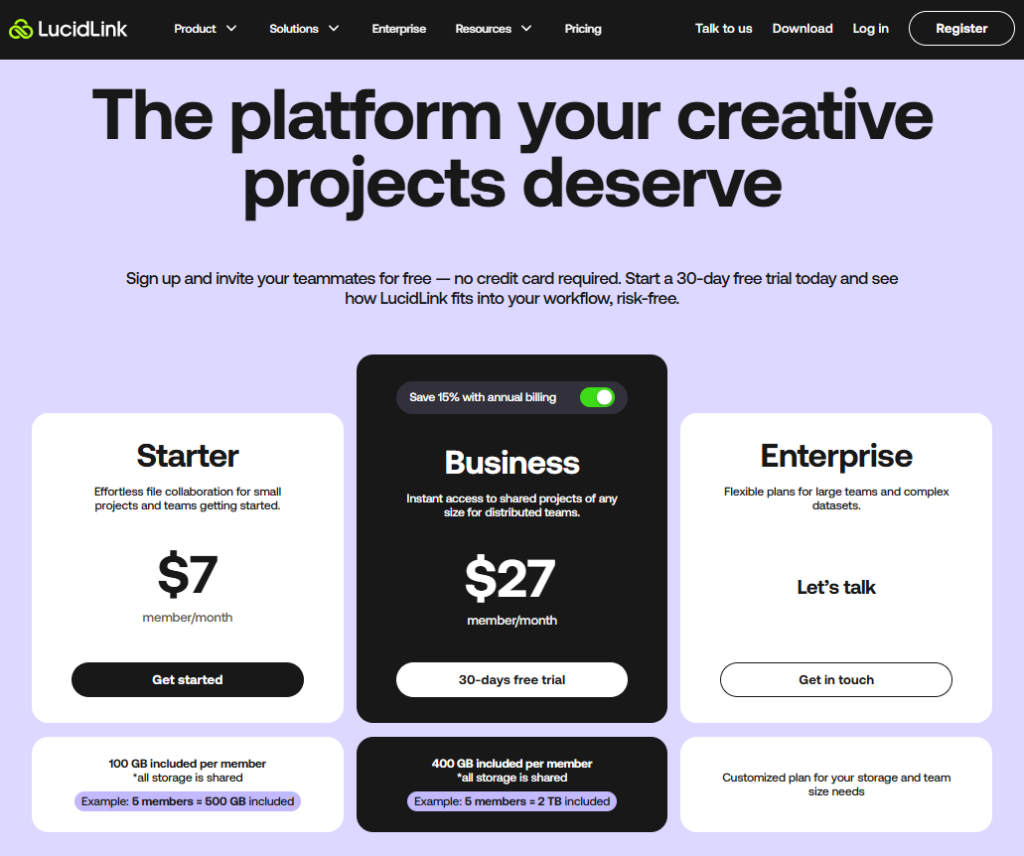

The company generates revenue primarily through recurring subscription fees for access to its LucidLink Filespaces service, with pricing tiered by usage and features. As of 2025, LucidLink offers plans ranging from a Starter tier ($7 per user/month) for small teams to Business and Enterprise tiers for larger deployments.

Each user subscription includes a base storage allotment (e.g. 100 GB per user on Starter, 400 GB on Business) with the ability to consume more storage for an added fee. This model effectively scales revenue with customer adoption: as teams add users or store more data in LucidLink, their monthly spend increases.

Usage-based billing (for storage above plan quotas) ensures revenue grows in proportion to the volume of data under management, a critical factor given that many LucidLink customers work with multi-terabyte media files. According to the company, this pay-as-you-go approach offers clients flexibility while driving LucidLink’s own expansion.

Notably, LucidLink has five-star net retention – existing customers tend to broaden their usage over time – exemplified by a 154% net customer retention rate in 2022 (meaning customers, on average, spend 54% more than the prior year). This reflects successful land-and-expand dynamics in LucidLink’s model, where initial projects often evolve into wider deployments across an enterprise once the productivity benefits are proven.

Self-service Signups

To reach and serve customers, LucidLink employs a combination of self-service signups, direct sales to enterprise accounts, and strategic partnerships. Creative studios and small businesses can start with a free trial and then subscribe online, keeping customer acquisition costs lean for that segment.

Larger organizations frequently engage with LucidLink’s sales team for Enterprise plans, which offer custom storage options (including bring-your-own cloud storage), volume-based pricing, and enhanced support. These enterprise deals contribute significantly to revenue and help LucidLink scale up its ARR (annual recurring revenue).

Indeed, by tailoring solutions for big clients – such as collaborating with Adobe to optimize workflows for Adobe Creative Cloud users – LucidLink not only earns subscription revenue but also secures strategic validation (Adobe became both a customer and investor). Additionally, LucidLink has forged cloud alliances to reduce friction for customers. For example, it negotiated zero egress fees with IBM Cloud for LucidLink users, effectively bundling cloud storage and bandwidth into its service price.

This kind of arrangement enhances the value proposition (predictable costs) and can attract enterprise workloads, indirectly boosting revenue. Overall, 95%+ of LucidLink’s income is recurring software revenue, with minor contributions from professional services (e.g. training or specialized support) when implementing large deployments. The high gross margins typical of SaaS, combined with strong product-market fit, have enabled LucidLink to reinvest in growth – hiring across engineering, sales, and customer success to capture surging demand.

The result is a scalable business model: the more teams rely on LucidLink for daily collaboration, the more the company’s subscription revenue compounds.

Breakdown of Revenue Streams of LucidLink

LucidLink’s revenue streams can be detailed as follows:

Subscription Licenses

Recurring fees from organizations subscribing to LucidLink’s service. This is usage-based, charged per active user (member) per month under a tiered plan. For example, a team of 10 on the Business plan (400 GB included per user) pays about $320/month. Subscriptions can be billed monthly or annually (with discounts for annual commitments). This stream constitutes the core of LucidLink’s revenue, providing predictable ARR (annual recurring revenue).

Storage & Usage Fees

While each user license includes a storage quota pooled for the team, any storage consumption above the included amount incurs overage charges. LucidLink typically charges a rate per additional GB or TB stored (e.g. ~$7–8 per 100 GB/month beyond plan limits). Because many media-heavy customers push into tens of terabytes, these usage-based fees are a meaningful revenue driver. In addition, LucidLink’s pricing bundles data egress costs (which cloud providers normally charge separately) – the company has created a pooled model to offer “all-in” pricing with low or no egress fees passed on to customers. This encourages more data transfer and usage on the platform, indirectly increasing revenue while keeping customer bills predictable.

Enterprise Contracts

For large deployments, LucidLink offers custom enterprise agreements. These often involve enterprise-specific features (such as Single Sign-On integration, private cloud or on-premise storage integration, and priority support) bundled at negotiated rates. An Enterprise customer might opt for a flat annual contract covering a certain number of users or storage capacity. Enterprise revenue may also include paid onboarding services or dedicated customer success engineering to assist with integration into complex workflows. While not broken out publicly, these contracts help LucidLink capture high-value accounts (e.g., major studios or government agencies) and can scale into six or seven-figure annual deals.

Partnership & Channel Sales

LucidLink’s strategic partnerships indirectly contribute to revenue by expanding its reach. For instance, LucidLink is available via the AWS Marketplace, allowing AWS customers to subscribe through that channel, and the company partners with resellers in certain regions. Additionally, co-marketing alliances (like with Adobe) drive adoption in specific verticals, which in turn grows subscription revenue. Though partnership-driven income is not a separate “line item,” it supports the overall sales pipeline. Notably, LucidLink has attracted investment from industry players (Adobe, and early on, Bain Capital Ventures, whose portfolio includes storage firms), aligning incentives to promote LucidLink’s solution in broader ecosystems.

Across these streams, LucidLink’s emphasis on recurring SaaS revenue means that as its customer base and usage expand, its top line scales accordingly. The company’s financial growth thus far reflects this: by late 2023, LucidLink’s ARR had multiplied almost five-fold in two years, indicating strong uptake and deepening usage (i.e., customers adding more users and data over time). With gross margins typical of cloud software, each dollar of revenue is high-margin, which the company can reinvest in R&D and global expansion, fueling a virtuous cycle of growth.

Funding History and Major Investors of LucidLink

Since its inception, LucidLink has attracted significant venture funding to fuel product development and market expansion. The table below summarizes LucidLink’s funding rounds, including amounts raised, key investors, and any known valuations:

| Date | Round | Amount Raised | Lead Investor(s) | Notable Participants |

|---|---|---|---|---|

| Dec 2016 | Seed Round | $1.6 million | Baseline Ventures | Several angel investors |

| June 2018 | Seed Extension | $6 million | BrightCap Ventures (Bulgaria) | Bain Capital Ventures, S28 Capital, Fathom Capital |

| May 2021 | Series A | $12 million | Headline (formerly e.ventures) | Adobe (strategic), Baseline, BrightCap |

| May 2022 | Series B | $20 million | Headline (lead) | Top Tier Capital Partners (new), BrightCap, Baseline |

| Nov 2023 | Series C | $75 million | Brighton Park Capital | Headline, Adobe Ventures, Baseline (includes secondary share purchases) |

Table: LucidLink Funding Timeline (2016–2023)

After an initial $1.6 M seed investment in 2016 led by Baseline Ventures (which helped incorporate the company and build the MVP), LucidLink secured a further $6 M in mid-2018.

This 2018 seed extension notably brought in BrightCap Ventures – a Sofia-based VC that was one of LucidLink’s earliest backers – as well as global investors like Bain Capital Ventures, S28 Capital, and Fathom. By 2020, as the product gained early traction, LucidLink was preparing for a Series A. The timing coincided with the onset of the COVID-19 pandemic, which initially caused some VCs to pull back; however, LucidLink’s remote-work value proposition became only more salient during lockdowns.

In May 2021, LucidLink closed a $12 M Series A led by Headline (a Silicon Valley firm known for scaling tech disruptors). Importantly, Adobe participated as a strategic investor in that round, validating LucidLink’s fit for creative cloud users. The Series A brought LucidLink’s total funding to about $19.6 M at the time.

Exactly one year later, in May 2022, LucidLink raised a $20 M Series B to accelerate growth. Headline doubled down as the lead investor, signaling confidence from the Series A lead. The Series B introduced Top Tier Capital Partners as a new investor, and saw continued support from BrightCap and Baseline. This round occurred amid 12% month-over-month growth, 400% year-over-year revenue increase, and robust customer retention for LucidLink. By then, the company’s total funding was roughly $40 M, and the fresh capital was earmarked for scaling sales, marketing, and engineering to meet rising demand.

LucidLink’s largest raise came in November 2023 with a $75 M Series C led by growth equity firm Brighton Park Capital. Existing major investors – Headline, Baseline, and Adobe’s venture arm – all joined the round, reflecting their continued conviction. The Series C included some secondary transactions (allowing early shareholders to realize gains) and represented the biggest VC investment in a Bulgaria-associated startup to date. While LucidLink did not publicly disclose the post-money valuation, management indicated it was a significant uptick from the Series B amidst an otherwise tight funding environment. Industry observers estimated LucidLink’s valuation in late 2023 to be in the high nine figures (approaching ~$400 M). With this round, the company’s aggregate funding reached approximately $115 M across five rounds. The infusion is being used to accelerate product development and expand into new verticals and geographies.

Competitor Landscape in Cloud File Collaboration

LucidLink operates in a competitive landscape that spans traditional enterprise file-sharing, cloud storage services, and specialized file system solutions. Key players can be grouped into a few categories:

Enterprise File Sync and Share (EFSS)

Platforms like Dropbox, Microsoft OneDrive, and Google Drive dominate general cloud file sharing. These services allow file synchronization across devices and basic collaboration (file sharing, versioning), and they enjoy huge user bases. For example, Dropbox (founded 2007) popularized seamless file syncing for individuals and businesses, while Box (founded 2005) built an enterprise-focused content collaboration suite.

However, EFSS solutions rely on replicating files to each user’s device or a local cache. This model struggles with very large files or real-time multi-user editing – precisely LucidLink’s sweet spot. As LucidLink’s CEO noted, traditional sync-and-share systems create multiple copies and latency: data changes may not propagate to others for minutes or hours, hindering real-time teamwork.

In contrast, LucidLink’s single source-of-truth in the cloud means updates are instantly visible to all clients, eliminating the lag inherent in EFSS approaches. In summary, EFSS competitors offer ease of use and integration but lack LucidLink’s ability to handle massive files with immediate synchronization.

Cloud-Native Storage & Collaboration

A newer cohort of competitors offers cloud file services with global accessibility. Egnyte, for instance, provides a hybrid content collaboration platform that combines cloud storage with local caching and strong governance features. It’s often used in industries like construction and finance for secure file access, but like EFSS, Egnyte typically synchronizes files rather than streaming on demand.

Another emerging player is Hammerspace (founded 2018), which offers a global file data platform allowing data to move between cloud and edge on-demand. While Hammerspace targets similar large-scale file challenges, it is more focused on data management across multiple storage systems.

LucidLink distinguishes itself by its laser focus on real-time access: instead of copying data back-and-forth, it streams file segments directly from object storage, which many of these platforms do not do natively.

Cloud NAS Gateways and Global File Systems

A significant set of LucidLink’s competitors are enterprise infrastructure solutions that create a unified file system across sites using cloud storage as a backend. Panzura, Nasuni, and CTERA are prominent examples in this category. These systems, often termed cloud NAS or cloud gateway caching devices, were designed to connect multiple office locations.

They usually deploy physical or virtual appliances at each site which cache frequently used files and then sync changes through a cloud hub. For instance, Nasuni and Panzura allow organizations to replace traditional NAS by storing files in cloud object stores but keeping active data cached locally for LAN-speed access.

The key difference is architectural: “We classify those as cloud gateway devices tying together branch offices,” Peter Thompson (LucidLink CEO) explains. They excel at multi-site file sharing for moderately sized files, but come with heavy overhead – each branch appliance must stay in sync. “If I make a change to a file [in those systems], that change may not show to all other users for an hour, until it propagates,” Thompson says. Additionally, remote users outside a main office still often need VPN access to reach those systems.

In summary, the competitor landscape is diverse: on one end, ubiquitous sync-and-share services (Google, Dropbox, Box) offer ease of use but falter with large-scale, real-time needs; on the other, enterprise global file systems (Panzura, Nasuni, etc.) tackle multi-site data but with more complexity and less responsiveness.

LucidLink has carved a strong differentiated position by marrying the accessibility of cloud storage with the performance of local storage. Industry analysts list LucidLink alongside Box, Dropbox, Egnyte, Hammerspace and others in the broad “cloud file collaboration” market, but note that LucidLink’s unique streaming architecture sets it apart.

As one review put it, when asked who LucidLink’s competitor is, the founders “would chuckle and say…our true competitor is FedEx,” emphasizing how their service replaces the old paradigm of physically or digitally shuttling big files with something fundamentally more efficient. The company’s challenge moving forward will be continuing to educate the market on this new approach while incumbents race to add similar capabilities.

Products and Services Offered by LucidLink

LucidLink Filespaces

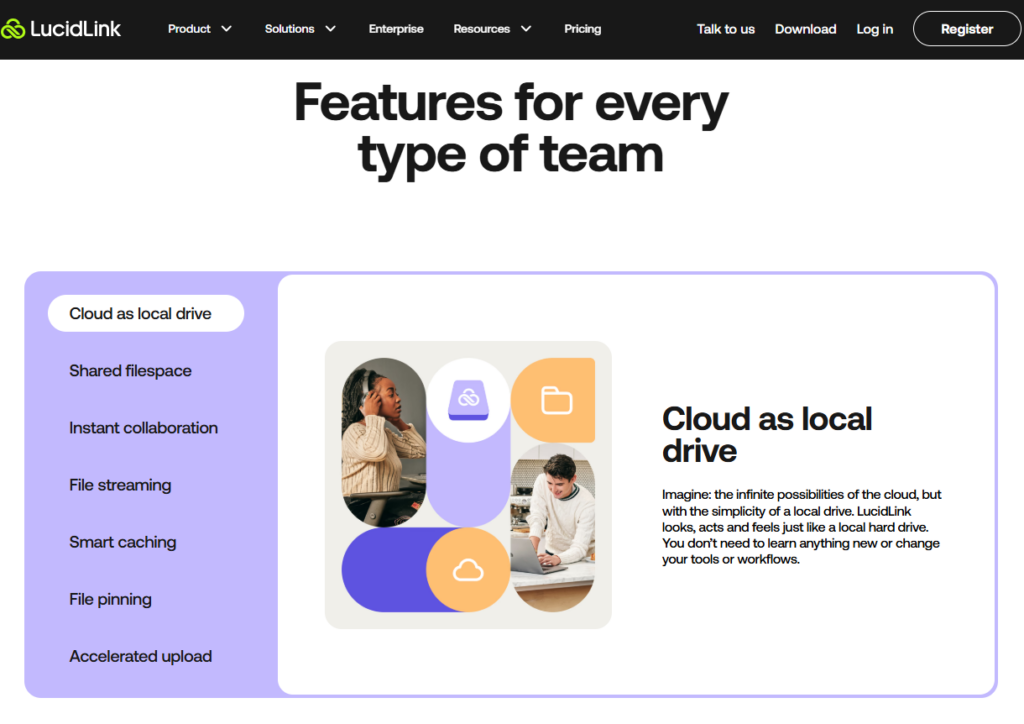

LucidLink offers a single, unified product: the LucidLink Filespaces platform, delivered as a cloud-based service. This platform is composed of client software (available for Windows, macOS, Linux, iOS, and web) and a back-end service that together create a cloud-native file system for users.

In practical terms, a Filespace is a secure, shared cloud drive that team members can mount on their devices. Once mounted, it behaves like an infinitely large external drive or network share – users can add, edit, and organize files within familiar folders, using their standard applications (from Adobe Premiere to AutoCAD) directly on the Filespace. The innovation is that the files actually reside in cloud object storage (such as AWS S3, Azure Blob Storage, Google Cloud Storage, or even on-prem S3-compatible stores), and LucidLink’s service streams data to and from the cloud as needed.

How LucidLink Filespaces work

When a team signs up, LucidLink provisions a Filespace (or multiple) in the cloud. Each Filespace can be thought of as a volume or drive accessible to that team. Users install the LucidLink client and authenticate, upon which the Filespace appears on their system (for example, as drive L: on Windows or a mounted volume on Mac/Linux).

From then on, any file operation – open, save, move, etc. – is intercepted by the client and served via LucidLink’s stream. If a user opens a 10 GB video, the client fetches the initial chunks from the cloud and continuously streams additional data in the background as the user scrubs or jumps to different parts. If the user edits and saves changes, only the modified blocks are sent back (rather than re-uploading the whole 10 GB), and all collaborators immediately see the updated content.

LucidLink ensures consistency with byte-range locking and transactional semantics on writes, so multiple people don’t overwrite each other – essentially, it acts like a cloud NAS with file locking and version control built-in. Furthermore, the platform takes automatic snapshots that let users restore previous versions of individual files or revert the entire Filespace to an earlier state, which is valuable for recovering from mistakes or for audit trails. These snapshots are space-efficient (storing only diffs) and can be scheduled or done on-demand, a feature that resonates with enterprise IT for backup/DR purposes.

Service features and integrations

LucidLink’s product includes a number of features aimed at professional workflows. For example, it has deep integrations with Adobe Creative Cloud tools – through an Adobe panel or extension, editors can work with media in LucidLink without intermediate steps, and Adobe’s team projects can be stored on LucidLink for real-time collaboration. The company also provides a Slack community and in-app chat support, reflecting its focus on user enablement.

On the enterprise side, LucidLink supports integration with identity providers for SSO, and the Enterprise plan allows “bring your own storage” – meaning a customer can connect their own cloud object storage bucket to LucidLink instead of using LucidLink-managed storage.

This is useful for companies that have existing cloud storage contracts or want complete control over data location. In such cases, LucidLink acts as a software layer on top of the customer’s storage. The security framework (zero-knowledge encryption) means even LucidLink’s cloud coordination service never decrypts file contents, which is a compelling feature for compliance-conscious organizations.

Additionally, the product is continually updated; for instance, in 2025 LucidLink released features like custom snapshot schedules (admins can define retention policies), filespace renaming for easier admin, proxy support for corporate networks, and Windows “headless” service mode to run LucidLink on servers without a logged-in user. These enhancements show LucidLink’s progression toward enterprise readiness, allowing it to slot into complex IT environments (e.g., render farms using headless Windows nodes that auto-connect to Filespaces on boot).

In summary, LucidLink’s product can be thought of as a virtual cloud hard drive for teams, combining the collaboration features of a file-sharing service with the performance of a high-end network storage system. Its simplicity (mount and go), power (handle huge files in real-time), and security (client-side encryption, access controls) are all part of the service.

This singular focus means that unlike some competitors, LucidLink doesn’t offer peripheral products like email, content management, or editing software – it relies on integration with best-of-breed tools for those needs. The strategy has been to do one thing extremely well (cloud file service) rather than a suite of mediocre features. As of 2025, the LucidLink Filespaces platform is a mature, robust service that has become the backbone of remote collaboration for many creative and data-intensive organizations.

Its continuous updates (e.g. the “all-new LucidLink” refresh in late 2024 that improved the UI and scalability) and the company’s emphasis on listening to user feedback suggest the product will keep evolving to meet emerging needs (such as even larger 8K/VR media, or integration with AI tools for content search).

Conclusion and Outlook of LucidLink

LucidLink’s momentum in the cloud collaboration space continues to strengthen as it transitions from a niche tool for creatives to an essential infrastructure layer for hybrid enterprises. The company’s $75 million Series C funding in late 2023 is powering aggressive expansion into new verticals such as healthcare, education, and government—sectors hungry for scalable, remote-friendly file access. With a focus on ambitious product updates, global sales expansion, and potential features like dynamic tiering and deeper compliance integrations, LucidLink is positioning itself not just as a utility, but as a category leader. The roadmap signals a shift from a disruptive upstart to a foundational player in enterprise IT, particularly for data-intensive, distributed teams.

LucidLink’s brand story is a case study in solving a deeply technical challenge with user-centered innovation, transforming file access from a bottleneck into a seamless experience. With over $115M in funding, high ARR growth, and a loyal user base, the startup is on a clear trajectory toward profitability and possibly even IPO readiness. Whether it remains independent or becomes an acquisition target for cloud giants or creative software leaders, LucidLink’s real-time, cloud-native collaboration technology sets a new standard. As hybrid work becomes the norm and file sizes grow exponentially, LucidLink’s distributed file system vision is not just relevant—it’s essential to the future of digital collaboration.

Also Read: DevRev– Founders, Business Model, Funding & Competitors

To read more content like this, subscribe to our newsletter