Ergeon is a technology-enabled home-improvement company built to make outdoor projects—fences, decks, concrete, and artificial turf—as simple and predictable as shopping online. The traditional experience is messy: phone tag with contractors, hand-drawn sketches, unclear bids, and project timelines that drift. Ergeon flips that script with a digital intake, remote estimating, transparent scopes, coordinated scheduling, and end-to-end project management under a single accountable brand. On its public site, the company foregrounds turnkey categories—Fence Construction, Artificial Grass, Decks, and Concrete—and markets a “made simple” promise that anchors the brand narrative.

The operating problem is large and stubborn. Residential construction is fragmented and trust-deficient; homeowners struggle to compare apples to apples, while small contractors juggle admin work that costs time and money. Ergeon’s platform standardizes scoping and pricing, streamlines permits where required, coordinates vetted crews, and keeps homeowners informed through digital updates and dedicated coordinators. The result is a journey that feels closer to e-commerce than old-school contracting—fast quotes, clear line-items, reliable timelines, and a single point of accountability.

Early traction came from fencing—an outdoor category with repeatable job types and clean unit economics. From there, Ergeon expanded into adjacent services like turf, decks, and concrete, reusing the same customer journey: discovery, remote estimate, on-site verification, installation, and QA. Social proof has reinforced product-market fit; the brand shows strong ratings across review platforms in its active markets, while Better Business Bureau accreditation signals process discipline and consumer trust.

Just as important, Ergeon positioned itself as a modern employer in a legacy industry. Office functions run through a distributed workforce, orchestrated by centralized software and measurable processes. Leadership interviews and third-party recognition highlight the culture’s emphasis on clarity, results, and kindness—an unusual but potent mix for a services-at-scale operator.

Founding Story of Ergeon

Ergeon was founded by Jiayue “Jenny” He and Odysseas Tsatalos. He, an engineer with a Ph.D. and a licensed contractor, saw firsthand how difficult it is for homeowners to scope and manage projects—and how much time contractors lose on non-billable coordination. Tsatalos, a serial entrepreneur known for co-founding oDesk (now Upwork) and Intacct, brought deep marketplace and systems DNA. Together they believed construction services could be radically improved through software, standardized playbooks, and data-driven operations.

Fencing became the starting point because it could be codified. Lineal feet, post spacing, material types, gates, and terrain modifiers fit a structured estimate flow. That allowed Ergeon to deliver fast, remote quotes with consistent pricing and high on-site accuracy—critical for trust in a category where surprise change orders are common. The company’s “startup that builds fences” origin story sharpened its positioning and made the value proposition easy to grasp.

With early validation, the founders invested in an end-to-end operating engine. Performance marketing and local SEO attracted intent; inside sales converted demand using satellite imagery, customer-submitted photos, and standardized SKUs; operations sequenced permits, materials, and crew calendars; field teams executed the install; customer success handled updates, punch lists, and reviews. Each handoff was instrumented, building a learning loop that improved quote accuracy, cycle times, and satisfaction over time.

Founders of Ergeon

Jenny (Jiayue) He — Co-founder & CEO

She is the founder/CEO and a multi-state licensed contractor, a rare combination that pairs deep engineering training with on-the-ground trade credibility. She champions a culture built on “be kind, be lean, invest in people,” which underpins the company’s remote-first structure for office roles and its high-touch homeowner experience.

Odysseas Tsatalos — Co-founder & CTO

Tsatalos previously co-founded oDesk/Upwork and Intacct, bringing decades of experience building two-sided labor marketplaces and finance systems. At Ergeon he focuses on the orchestration layer: remote estimating tools, pipeline management, payments, performance tracking, and the data systems that make a services brand scalable without losing the human touch.

Together the pair is complementary: He anchors construction quality and customer empathy, while Tsatalos builds software and process leverage to deliver that quality at scale.

Business Model of Ergeon

Ergeon is a tech-enabled services platform. It acquires homeowners through digital channels and referrals, converts them through remote quoting, then fulfills projects via a managed network of vetted, insured crews under the Ergeon brand. Revenue is recognized on completed installation work and, where applicable, materials and premium options. Gross margin comes from standardized pricing, centralized procurement, and operational efficiency—fewer reworks, tighter crew utilization, and higher first-time-right rates.

On the supply side, Ergeon offers contractors what amounts to a business-in-a-box: steady pipeline, professional scoping, coordinated scheduling, and prompt payment. Partner crews spend less time on marketing, estimating, and admin—and more time on billable craftsmanship—while Ergeon remains the homeowner’s single accountable counterpart. That positioning is a strategic middle ground between lead-gen marketplaces and traditional independent contracting.

The expansion thesis is concentric. Start with repeatable categories (fencing), expand into adjacent outdoor projects (turf, decks, concrete), and deepen into more complex scopes as software and playbooks mature. Because everything flows through one brand and one journey, cross-sell is natural: a fence frequently leads to a gate, a pad, a turf lawn, or a deck.

Revenue Streams of Ergeon

1) Core Project Revenue. Fixed-scope installations—fencing and gates, turf lawns, decks, and concrete pads/driveways—drive the majority of revenue. Unit-based pricing and a standardized catalog keep bids clear and predictable.

2) Premium Options & Upgrades. Material upgrades (e.g., cedar vs. pine; composite vs. wood), additional gates, stain/seal packages, and decorative elements increase average order value while extending longevity and aesthetics.

3) Permitting & Ancillary Services. Where municipalities or HOAs require documentation, Ergeon coordinates for a fee. The company can also monetize site prep, hauling, and post-install services such as sealing or maintenance.

4) Materials & Logistics Efficiency. Centralized procurement and preferred-supplier relationships deliver margin advantages at scale on lumber, concrete, hardware, and turf. (Operational inference consistent with tech-enabled installation models.)

5) Financing Facilitation. Integrating consumer-finance options at checkout can increase close rates and generate referral economics, while helping customers manage cash flow. (Category-standard approach; specifics vary by market.)

Funding of Ergeon

Ergeon has raised institutional capital to scale technology, operations, and geography. The Series B round, announced June 7, 2022, totaled $40 million led by Prysm Capital, with participation from Basis Set Ventures, DST Global, GGV Capital, and MetaProp. The financing accelerated hiring, market expansion, and investment in the core software stack behind quoting and operations. Earlier seed capital funded product development and the first wave of markets.

Beyond venture funding, the company has pursued validation through strategic partnerships. In August 2024, Sears Home Services announced a collaboration with Ergeon to expand home-improvement offerings—evidence that legacy home-services brands view Ergeon’s tech-enabled operations as a trustworthy fulfillment partner. Moves like this widen Ergeon’s top-of-funnel while reinforcing its credibility with mainstream homeowners.

Funding Rounds (Summary)

| Round | Date | Amount | Lead / Participants | Notes |

|---|---|---|---|---|

| Pre-seed / Seed | 2020–2021 | Undisclosed | Early backers | Product build, first markets |

| Series B | Jun 7, 2022 | $40M | Prysm Capital; Basis Set Ventures, DST Global, GGV Capital, MetaProp | Tech, ops, and geographic scale |

Table 1: Publicly reported funding milestones.

Competitors of Ergeon

Ergeon competes on two fronts. First, local independent contractors who bid directly against Ergeon in each market. Second, platforms that aggregate demand or supply. The latter includes lead-gen marketplaces (Angi/Angi Leads, HomeAdvisor, Thumbtack) that sell homeowner inquiries to pros, and managed service brands that own the customer journey and orchestrate fulfillment under one label.

Big-box retailers with installation programs (e.g., Home Depot and Lowe’s) also play indirectly by bundling product and install for homeowners who prefer a national name. Ergeon’s differentiation is to own the experience end to end while focusing on outdoor categories it can standardize. (Competitive landscape characterized using public category descriptions and Ergeon’s service model.)

Competitive Snapshot

| Competitor | Model Type | Customer Promise | Strengths | Risks vs. Ergeon |

|---|---|---|---|---|

| Angi / HomeAdvisor | Lead-gen marketplace | Multiple bids from local pros | Massive network, breadth | Quality variance; homeowner manages the project |

| Thumbtack | Lead-gen marketplace | Choice + reviews | Broad categories, modern UX | No managed execution; variable outcomes |

| Big-box install programs | Retail + install | One-stop shopping | Brand trust, financing | Limited flexibility; subcontracted execution |

| Local independent contractors | Direct contractor | Relationship & price | Local reputation, bespoke work | Scheduling variability; uneven communication |

| Regional tech-enabled operators | Managed service | Turnkey delivery | Vertical focus | Patchy footprint; less software depth |

Table 2: Where Ergeon plays and wins.

Competitive Advantage of Ergeon

Execution at scale is Ergeon’s moat. It doesn’t just pass leads to a pro; it stands behind scope, schedule, communication, and quality—owning the outcome. That requires software to model scope precisely, operations to eliminate bottlenecks, and a culture designed for distributed collaboration. Over time those elements compound into advantages that are difficult for lead-gen marketplaces or individual contractors to copy.

1) Software-driven scoping and pricing. Remote quoting lowers friction and increases close rates. It also produces cleaner work orders for crews, reducing rework and callbacks. With each job, the system learns—tightening estimates, inventories, and timelines.

2) One accountable brand. Homeowners prefer a single counterpart. Ergeon stands in front of partner crews and warranties the experience. BBB accreditation and strong review-site performance backstop that reputation and help conversion in new markets.

3) Centralized procurement and playbooks. Standard materials, vendor relationships, and repeatable installation methods create unit-economics discipline—the difference between a services business that scales and one that stalls. (Operational principle consistent with tech-enabled installers.)

4) Distributed workforce strength. Remote-first office teams expand recruiting reach and support market coverage across time zones. Leadership interviews and employer recognitions emphasize a culture of clarity and kindness aligned to measurable outcomes.

5) Adjacency flywheel. A fence often leads to gates, pads, turf, or decks. As attach rates rise, customer lifetime value grows, and acquisition costs amortize across multiple projects—fueling profitable expansion.

Products & Services

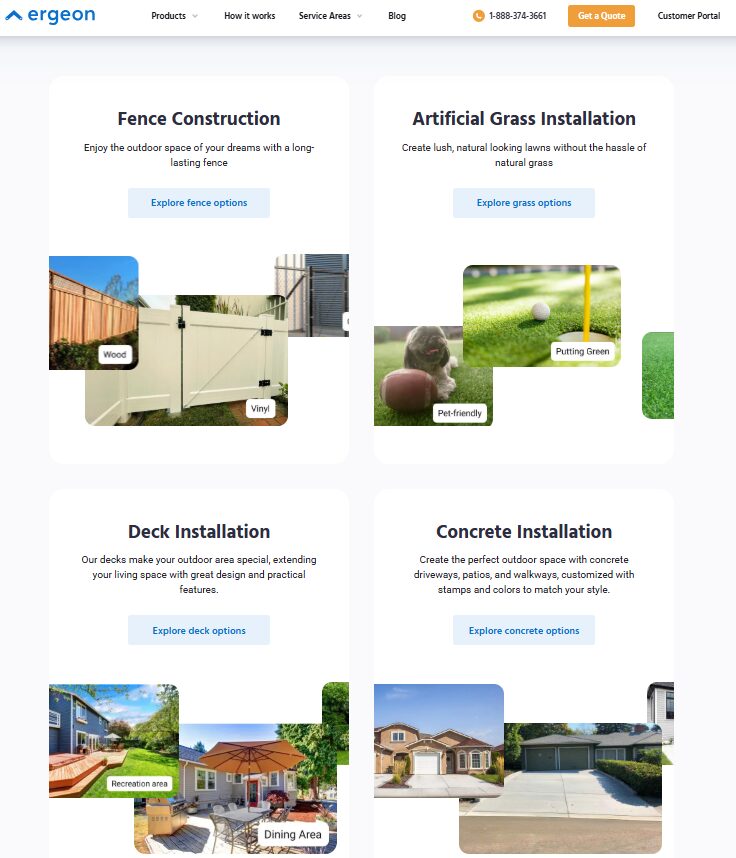

Ergeon’s catalog covers the outdoor envelope of a home, standardized enough for fast quotes yet flexible enough to fit code and design preferences:

-

Fencing & Gates. Wood, chain-link, and other materials; options for height, style, finishes, and hardware; add-ons such as gates and decorative tops; stain/seal packages for longevity.

-

Artificial Grass (Turf). Residential turf lawns with drainage base, infill options, and edging; ideal for low-maintenance yards and water-constrained markets.

-

Decks. Wood and composite systems with railings and stairs; standardized design choices built to local code.

-

Concrete. Driveways, slabs, patios, and walkways; site prep, forming, pour, and finish included.

-

Consulting & Permitting Support. Where required, Ergeon handles permits/HOA packages, inspections, and utility locates.

-

Project Management & Communication. Dedicated coordinators and digital updates that keep homeowners informed at every stage.

Service Matrix

| Category | Typical Use Case | Common Options | Value Hooks |

|---|---|---|---|

| Fencing & Gates | Privacy, security, pet containment | Species, height, gates, finishes | Fast quotes; durable hardware |

| Turf | Low-maintenance lawns | Pile height, infill, edging | Water-saving; year-round green |

| Decks | Outdoor living space | Wood vs. composite; railings | Expands living area; lower upkeep |

| Concrete | Pads, patios, driveways | Thickness, finish, joints | Long life; clean aesthetic |

| Permitting | Compliance | HOA packages; city permits | Speed to build; fewer headaches |

Conclusion

Ergeon’s brand rests on a simple, powerful idea: make outdoor projects feel effortless. By owning the homeowner experience end to end—and arming that experience with software, standardized scopes, and disciplined operations—the company has carved out a differentiated position between pure lead-gen marketplaces and traditional contractors. Its emphasis on remote estimating, transparent pricing, proactive communication, and accountable project management turns a historically opaque, stressful process into a clear, managed journey.

The founders’ complementary strengths—He’s contractor-engineer leadership and Tsatalos’s marketplace-systems expertise—anchor a culture built for scale. With a growing suite of services, strong review-led proof, and partnership channels like Sears Home Services, Ergeon looks positioned to keep expanding share in fencing and adjacent outdoor categories. If it continues to compound data advantages, deepen procurement leverage, and maintain quality across new geographies, the brand can evolve from category specialist to household-name operator for outdoor living—delivering convenience and craftsmanship under one accountable flag.

Also Read: Datavant– Founders, Business Model, Funding & Competitors

To read more content like this, subscribe to our newsletter