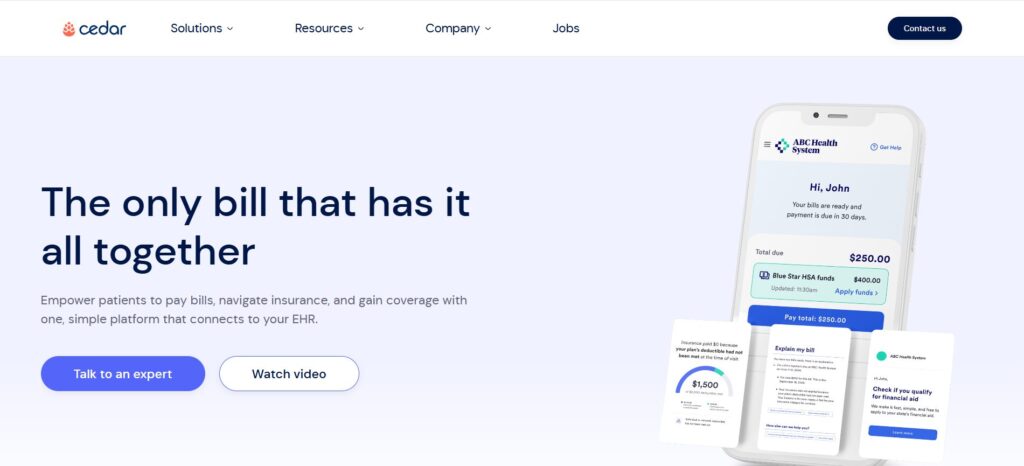

Cedar is a New York–based healthcare financial technology startup founded in 2016. It offers a cloud-based platform that overhauls patient billing and payment processes, aiming to make medical bills clear and easy to pay.

The company leverages data from electronic health records (EHRs), insurance claims (EOBs), and patient accounts (e.g. HSA balances) to personalize the payment experience for each patient. By combining insurance data, payment options, and targeted communications, Cedar’s platform “drives superior patient engagement”.

As of 2025, Cedar reports that it has served over 50 million patients nationwide and processed more than $10 billion in medical payments. Its growth reflects strong demand from hospitals and health systems: Cedar now works with scores of providers (including Novant Health, ChristianaCare, Providence, Allegheny Health Network and others) to digitize billing.

The company has attracted significant venture funding (around $419 million raised by 2022) and a valuation of about $3.2 billion.

Let’s explore Cedar’s origin, leadership, business model, products, financing history, competitive landscape, and strategic positioning in the coming parts of the article.

Founding Story of Cedar

Cedar’s founding emerged from co-founder Florian Otto’s own frustrating billing experience. Otto, a physician by training, found that his mother encountered “a nightmarish personal journey” through fragmented medical bills and opaque insurer .

This motivated Otto and his partner Arel Lidow to launch a patient-centric billing solution in 2016. According to the company, Cedar’s idea took shape as “the system needed to change” to make billing transparent and manageable for patients.

Early investors and the founders themselves framed Cedar’s goal as bringing a “consumer-like” payments experience (similar to Uber or Netflix) to healthcare.

In practical terms, Cedar began by integrating with hospitals’ EHR systems and connecting in real-time to insurance claims and patient accounts.

By 2017 it introduced its first product — a platform unifying all of a patient’s bills, insurer Explanation of Benefits (EOB) data, and payment options into a single interface. This early system also used data-driven algorithms: for example, Cedar would analyze a patient’s bill size, payment history, and demographic factors to optimize communications and payment plans.

Initial trials confirmed the concept: providers using Cedar reported substantial improvements (e.g. in one test, patient collections rose by 22% and bill response times fell by 33%).

Thus the founding story is one of engineers and physicians applying Internet-era design to fix long-standing problems in revenue cycle management.

Founders of Cedar

Cedar was co-founded by Dr. Florian Otto and Arel Lidow.

Dr. Florian Otto, Cedar’s CEO, is a German-trained physician who transitioned into tech entrepreneurship. He served as a vice president at Groupon Brazil and earlier at Zocdoc (a patient scheduling startup) before launching Cedar. Otto also worked as an advisor at McKinsey. His healthcare background and consulting experience shaped Cedar’s vision of merging medical insight with product-driven software.

Arel Lidow, Cedar’s technical co-founder, brings a strong engineering pedigree. He earned a degree in Engineering from Princeton and worked on the founding teams of major adtech companies. Prior to Cedar, Lidow was a project lead at AppNexus and also spent time at Bridgewater Associates (a fintech firm).

Together, Otto and Lidow combined medical domain knowledge and scalable software expertise to build Cedar’s initial platform.

In addition to the co-founders, Cedar’s early leadership included Seth Cohen, who joined as President and later ran patient affordability products (his bio notes a previous tenure as co-founder and CEO of OODA Health, a payer-facing startup). (Note: Cohen joined Cedar during its expansion into the payer space via Cedar’s acquisition of OODA Health in 2021.)

Cedar’s founding team thus blended healthcare, technology, and finance talent. The backgrounds of Otto and Lidow are well documented: for example, one profile notes Otto’s prior roles (physician, Zocdoc, Groupon, McKinsey) and Lidow’s stint at AppNexus.

These founders remain active in company strategy, and their vision continues to drive product development.

Business Model of Cedar

Cedar operates primarily as a business-to-business software provider, selling its “financial experience” platform to healthcare providers (hospitals, health systems, specialty groups). The company positions itself as an enterprise SaaS vendor.

Healthcare organizations typically contract with Cedar to implement the platform across their system. Hospitals integrate Cedar’s software with their EHR or practice management systems, so that Cedar can automatically retrieve patient visits and insurance data. The platform then handles pre-service cost estimates, patient reminders, post-service billing, and payment collection in a unified way. By digitizing the entire payment flow, Cedar’s model reduces manual billing work for providers and offers an improved digital interface for patients.

In terms of pricing and revenue model, Cedar generally follows a mix of subscription and usage-based fees. Clients pay recurring license or service fees to use Cedar’s platform (often structured by hospital system size or transaction volume). In addition, Cedar reports that it takes a percentage of patient payments collected as part of its fees.

In other words, Cedar aligns part of its revenue with improved collection outcomes: if Cedar’s platform helps a hospital collect more self-pay dollars, Cedar earns a cut of that incremental revenue.

Strategic partnerships also play a role in Cedar’s model. For instance, Cedar has partnered with payment processors (Stripe) to facilitate online transactions. It collaborates with banks and HSA/FSA providers to fetch patient account balances for integrated payment options. It also works with insurance navigators (e.g. Advocatia, now Fortuna Health) to offer financial aid tools to patients. These partnerships enhance Cedar’s value proposition but generally do not involve revenue sharing with third parties; they serve to expand the platform’s capabilities.

Overall, Cedar’s business model can be summarized as an enterprise SaaS/subscription model supplemented by outcome-based fees. The company’s success metrics for clients drive its sales pitch. In return for monthly fees and a share of payments, providers gain improved billing efficiency, clearer patient communications, and higher collection rates. Cedar’s alignment of pricing with outcomes (collections) incentivizes the company to continuously optimize the patient financial experience.

Revenue Streams of Cedar

Cedar’s revenue streams derive from its core SaaS offering and related services. While the company does not publicly break out its financials, the following streams are evident:

-

Subscription/License Fees: Hospitals and health systems pay Cedar ongoing service fees to use its platform. These may be structured per provider group or per patient encounter, depending on the customer’s size and usage.

-

Transaction/Collection Fees: As noted, Cedar may charge a percentage of payments collected through its system. This aligns Cedar’s revenue with improved financial performance for the provider.

-

Implementation and Support Services: In many enterprise software models, initial setup, data integration, training, and support generate additional fees. Cedar likely earns one-time implementation fees when new customers go live.

-

Premium Features and Add-Ons: Advanced analytics, AI-driven modules (like Kora), or payer-integration features (Cedar Cover) may be sold as optional add-ons at extra cost.

-

Partnership Revenues: Cedar has strategic investors (e.g. Memorial Hermann Foundation) and partners, but there is no indication of direct revenue from those relationships. It is possible Cedar shares some savings from Medicaid or charity enrollment programs with health systems, but details are not public.

In practice, the dominant streams are enterprise software contracts and transaction fees. One industry report notes that Cedar’s contracts include a fixed seat-based monthly fee plus a variable 1–4% “fee on all collections” for its Pay solution. This fee-based model is common in healthcare billing tech. Cedar’s volume of transactions (it has processed over $10B in payments) suggests transaction fees could be a meaningful portion of revenue, though the exact breakdown remains confidential.

A simplified revenue breakdown might look like:

- Provider Software Fees: ~50–70% (subscription/licensing)

- Transaction/Collection Fees: ~20–40%

- Services and Others: ~0–10%

Table 1: Estimated Breakdown of Cedar’s Revenue Streams (illustrative)

| Revenue Source | Description | Approx. Share |

|---|---|---|

| Subscription / License Fees | Recurring fees from provider clients for platform use (per hospital or per patient) | 50–70% |

| Transaction / Collection Fees | Percentage of patient payments collected (1–4% of collections) | 20–40% |

| Implementation & Services | Upfront setup, integration, training, consulting | 5–15% |

| Premium Features / Add-ons | AI modules (e.g. Kora), affordability tools, analytics | 5–15% |

Note: Exact figures are proprietary. The above estimates are based on industry norms and public reports.

Funding of Cedar

Cedar has raised substantial venture capital to date. According to company and press reports, the startup’s total funding rounds exceeded $419 million by late 2022. Major funders include prominent tech and healthcare investors.

Early backers in 2017–2018 included Founders Fund, Thrive Capital, Kinnevik, Lakestar, Sound Ventures, and angels like Kevin Systrom. Later rounds brought in traditional VC and strategic investors: Andreessen Horowitz led Cedar’s 2020 Series C, Tiger Global led the 2021 Series D, and Memorial Hermann Health System invested in a 2022 round.

Cedar’s use of capital has been to scale its technology and sales organization. Press releases emphasized that funds would build out machine learning capabilities and broaden the product suite. For example, after raising its $102M Series C (June 2020), the company noted plans to “integrate advanced data science” into the platform. The $200M Series D was announced with a valuation of $3.2 billion, indicating investor confidence in Cedar’s market traction. Overall, the funding narrative underscores Cedar’s fast growth and the large addressable market in healthcare payments.

Funding Rounds of Cedar

Cedar’s funding history features multiple venture rounds and an equity extension. The table below summarizes publicly reported rounds as of early 2023:

| Round / Type | Date | Amount (USD) | Lead / Notable Investors |

|---|---|---|---|

| Seed | 2016 | ~$3M (estimate) | (Co-founders, angels) * |

| Series A | Dec 2017 | $13.0M | Founders Fund, Thrive Capital, SV Angel, Martin Ventures |

| Series B | Jun 2018 | $36.0M | Kinnevik; also Thrive, Founders Fund, Lakestar, Sound Ventures, etc. |

| Series C | Jun 2020 | $77.0M | Andreessen Horowitz (a16z) |

| Debt Facility | Jun 2020 | $25.0M | JPMorgan Chase |

| Series D | Mar 2021 | $200.0M | Tiger Global Management |

| Series D (ext.) | Dec 2022 | $68.4M | Memorial Hermann Health System (strategic) |

Sources: Cedar press releases and news reports

After the Dec 2022 extension (sometimes called “Series D-2”), Cedar’s total raised capital is roughly $419.4M. Key investors across rounds include Andreessen Horowitz, Thrive Capital, Founders Fund, Tiger Global, Kinnevik, and strategic health systems (Memorial Hermann). This funding underpins Cedar’s expansion of products and sales outreach.

Competitors of Cedar

Cedar operates in a competitive field of healthcare financial solutions. Its main rivals include both legacy billing vendors and newer fintech entrants. Notable competitors are:

RevSpring (AccuReg)

A long-standing patient billing and engagement firm (recently acquired by Frazier Healthcare in 2024 for $1.3B). RevSpring/AccuReg offers billing statement delivery, payment plans, and analytics across the revenue cycle. In contrast, Cedar emphasizes a unified, digital-first platform with integrated insurer data and predictive personalization.

Experian Health / Patientco

Part of Experian’s healthcare division. Provides patient financing, payment estimation, and modular billing tools. Cedar differs by building a more tightly coupled provider system with in-house AI features.

Paytient

A fintech start-up that gives patients access to employer-sponsored health payment accounts (like an HSA). Paytient focuses on financing options and consumer payment flexibility. Cedar does not offer loans but instead optimizes billing and collections directly.

Inbox Health

A newer company (formerly Daffodil) that consolidates all patient bills (from different providers and insurers) into a single portal or app. Like Cedar, Inbox seeks to simplify the patient’s view of bills, but Cedar’s platform additionally integrates with provider workflows and payer systems at a deeper level.

Flywire

A global payments company that entered healthcare, offering flexible payment options and plans to patients. Flywire’s strength is large-amount cross-border payments, whereas Cedar’s focus is on the domestic US billing flow and adding payer-derived detail (such as HSA balances).

InstaMed (JPMorgan Paymentech)

An older payments network acquired by JPMorgan. InstaMed provides portals and processing for medical payments but traditionally lacked the front-end patient engagement features (it focuses mainly on payment acceptance). InstaMed does not handle pre-visit engagement or interactive billing communications.

Epic Systems (Cheers)

Epic, the largest EHR vendor, has developed its own patient payment platform (“Cheers”). Since Epic dominates many large hospital systems, it is a potential competitor (especially for those already on MyChart). Epic’s solution includes patient estimates and billing, but clients report that Cedar offers a more specialized, AI-powered consumer experience than Epic’s out-of-the-box offering.

Phreesia

Known for patient intake and registration software, Phreesia’s “Pay” module handles pre-visit collections. Phreesia’s revenue in 2024 was ~$356M, making it a significant public peer. Unlike Cedar, Phreesia focuses on intake forms and clinic workflow automation, whereas Cedar’s core strength is post-visit billing and payment optimization. (However, there is some overlap as both offer patient touchpoint solutions.)

Other Niche Players: There are many smaller competitors such as FinPay, PayGround (now part of Zelis), PersonaPay, and ClearGage that offer one-off payment plans or portal solutions. Cedar typically competes by offering a full-suite approach rather than a single feature.

Table 2: Selected Competitors of Cedar and Their Focus

| Competitor | Focus / Description | Cedar’s Differentiation |

|---|---|---|

| RevSpring/AccuReg | Patient billing communications and payments; legacy RCM platform | Cedar emphasizes modern UI, AI-driven personalization, and deep payer integration. |

| Experian Health | Patient cost estimation, payment processing (acquired Patientco) | Cedar offers broader patient engagement and integrated payer data. |

| Paytient | Patient healthcare financing (interest-free payment accounts via employers) | Cedar does not finance care, focusing instead on bill clarity and collections. |

| Inbox Health | Consolidated patient billing portal for patients; aggregates multiple providers’ bills | Cedar’s platform is deeply integrated into provider systems and uses AI to optimize communications. |

| Flywire | Global payment processing with installment plans (used in many industries, expanding in healthcare) | Cedar is U.S.-centric and ties payments to insurance EOB/HSA data. |

| InstaMed (JPM) | Healthcare payments network (patient/payer/provider hub); digital bill pay | Cedar adds front-end patient engagement and messaging, while InstaMed is mainly a payments engine. |

| Epic (Cheers) | Epic’s own patient payment/CRM solution (integrated into MyChart and Epic EHR) | Cedar markets a specialized solution with rapid deployment for midsized systems, rather than relying on incumbent EHR vendor. |

| Phreesia | Patient intake/check-in platform (pre-visit forms, payments); public company | Cedar automates post-visit billing and collections, rather than front-end intake. |

| Other (FinPay, PayGround, etc.) | Various startups offering patient payment portals, budgeting tools, or loan options | Cedar competes by bundling multiple capabilities (payment, affordability, support) in one platform. |

Cedar’s executive team acknowledges that large incumbents like Epic pose a threat; a former Cedar customer noted Epic as “Cedar’s biggest competitive threat,” especially now that Epic is moving into patient engagement with its Cheers product. However, Cedar’s ability to integrate multiple data sources, deploy machine-learning models, and launch new consumer-friendly tools is a core part of its pitch against these competitors.

Competitive Advantage of Cedar

Cedar’s competitive edge lies in its consumer-centric design and data integration. The platform provides a “consumer-grade” billing experience in an industry notorious for confusing statements. Cedar combines payer data (deductibles, EOBs) and patient finances (HSA balances) into a transparent, unified bill, which is uncommon among RCM tools. This approach yields measurable gains for providers. In practice, Cedar clients routinely report double-digit increases in payments collected and high patient satisfaction. For example, by 2023 Cedar claimed that on average its clients saw “up to a 30% lift in patient payments” and achieved about 90% patient satisfaction with the digital billing process.

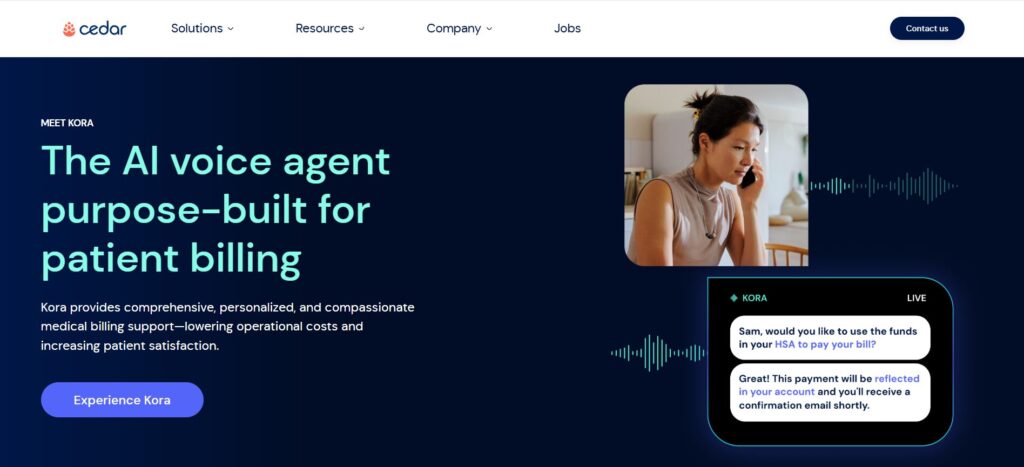

Technologically, Cedar leverages artificial intelligence and machine learning throughout its stack. Its communications engine learns the best time and channel to reach each patient, optimizing message frequency and content. The introduction of Kora, Cedar’s AI voice agent, exemplifies this innovation: Kora “combines AI, proprietary billing data, and empathetic communication to resolve patient inquiries”. By autonomously handling routine billing questions (24/7), Kora reduces call volume and speeds up collections. Cedar reports that Kora can automate about 30% of billing support calls, significantly lowering provider costs (per a May 2025 case with ApolloMD). Many competitors lack such advanced AI features.

Another advantage is the end-to-end integration with healthcare systems. Cedar’s platform covers the full patient journey: pre-service price estimates, patient reminders, post-service billing, payments, and even revenue cycle support. The platform connects directly to EHR and practice management systems (e.g. Epic, Cerner), creating a single source of truth for each patient’s financial picture. By contrast, many competitors address only parts of this flow (e.g. payers like Paytient only offer financing, while legacy RCM companies focus on back-office functionality). Cedar’s unified approach is a strong selling point.

Finally, Cedar’s credibility is reinforced by industry recognition and growth metrics. It has been identified as a leading patient financial experience solution by KLAS Research. Observers note Cedar’s rapid scaling: the company’s patient-engagement volumes grew 14% year-over-year (from 22M in 2022 to 25M in 2023), indicating that health systems trust its platform. Cedar’s combination of venture funding, strategic partnerships, and measurable outcomes creates a compelling narrative of competitive strength. In summary, Cedar’s advantages are its user-friendly interface, its deep use of data and AI (e.g. Kora AI agent), and its end-to-end platform approach. These differentiate it in the crowded healthcare payments field.

Products and Services of Cedar

Cedar offers a suite of integrated products focused on the patient financial journey. All products are part of the Cedar platform but are sometimes branded separately:

-

Cedar Pay: This is Cedar’s core billing and payment solution. It provides an end-to-end patient payment experience by combining providers’ billing data with insurance and benefits information. Cedar Pay sends clear digital invoices, shows real-time EOB and HSA balance information, and offers multiple payment methods (credit card, ACH, digital wallets, payment plans). The platform uses automated outreach (email, SMS, digital statements) to remind patients of bills. In practice, Cedar Pay has proven results: provider clients see a median digital payment rate rise from ~48% (before) to ~73% (with Cedar). It is marketed as a “hardest-working bill in healthcare” that “empowers patients to pay with confidence and clarity”. Cedar Pay is the foundation upon which other modules connect.

-

Cedar Cover (formerly “Affordability Navigator”): Launched in early 2024, Cedar Cover is designed to identify insurance gaps and connect patients to coverage options (Medicaid, ACA plans, pharmaceutical assistance). The platform automates benefits screening and application processes. For example, when a high-balance self-pay patient owes money, Cedar Cover can suggest and even initiate enrollment in an insurance plan or aid program. This lowers write-offs and patient hardship. Cedar Cover was first deployed with community hospitals (e.g. AnMed Health) via a partnership with Advocatia, and later with Fortuna Health for Medicaid eligibility as of 2025. By helping patients secure coverage before paying, Cedar Cover makes care more affordable and recovers third-party revenue for providers.

- Cedar Support: This is Cedar’s customer service and collections support suite, which combines human agents and AI. It includes Kora, the AI voice agent described earlier. Cedar Support provides an outsourced call center and help-desk service: patients can call or chat to resolve billing questions. With AI automation, routine inquiries (e.g. “What is my balance?” or “How can I pay?”) are handled quickly, and complex issues are escalated to live agents. Cedar Support thus “transforms patient billing support” by reducing operational costs and improving patient satisfaction. Among its features are real-time “Agent Copilot” prompts for staff, proactive outbound call lists powered by predictive analytics, and digital collection workflows. Cedar Support effectively closes the loop on collections by engaging patients who have not yet paid, prioritizing those most likely to pay. Clients report higher collection rates when using this combined offering.

- Cedar Pre / Scheduling Integration: Although not always separately branded, Cedar also offers tools to engage patients before their visit. This includes appointment reminders, pre-registration, and upfront payment collection. By surfacing cost estimates and allowing patients to make deposits or copay payments ahead of time, Cedar reduces no-shows and administrative burden. (Some sources refer to this broadly as part of the Cedar Suite’s pre-service capabilities.)

- Cedar Orthodontics: Recognizing that dental and orthodontic practices have unique billing needs, Cedar launched a specialized offering in late 2024. This solution adapts the Cedar Pay platform to orthodontic workflows, including tracking lengthy treatment plans and capitalizing on elective payment opportunities. A partnership with Tand Dental’s 200K members was announced in 2024 to apply Cedar’s tools in the dental market.

Overall, Cedar’s products work together as a suite. The “Cedar Suite” is often described as providing a “consistent, unified experience across the patient journey”. The platform’s modular design means customers can adopt only the pieces they need or the full suite. In sum, Cedar’s services span from pre-service engagement (price estimates, scheduling) to post-service billing (Cedar Pay, Cover), all the way to patient support (Cedar Support, Kora AI). This breadth allows a hospital to rely on Cedar as a one-stop solution for patient financial engagement, rather than using multiple vendors.

Conclusion

Cedar has emerged as a leading innovator in healthcare payments by combining a patient-first design with powerful data analytics. Its founding narrative — improving billing after a personal negative experience — underpins a mission that resonates in today’s market: consumers demand transparency and convenience in paying for care. The company’s academic, evidence-based approach is reflected in its measured outcomes: substantial lifts in provider collections and consistently high patient satisfaction scores. Cedar’s continued product expansions (affordability tools, AI support) and partnerships (with insurance navigators, hospitals, and even tech platforms) illustrate an evolving strategy to cover the entire patient financial journey.

As of 2025, Cedar’s scale and resources are considerable. Serving on the order of 50 million patients and processing over $10 billion in transactions, the company has firmly established its presence in the U.S. healthcare system. It has raised hundreds of millions in capital from top investors, indicating confidence in its business model. Yet the competitive environment remains intense: both legacy giants (Epic) and agile startups (RevSpring, Phreesia, Paytient, etc.) vie for the patient payments market. Cedar’s advantage lies in its integrated, AI-driven platform and its growth into new verticals (dental, behavioral health) and services (pricing transparency, contact center).

Looking ahead, Cedar aims to further solidify its strategic position by continuing to innovate. New product development (for example, advanced AI assistants and expanded affordability programs) and continued integration with provider and payer systems will be key. The company’s high-profile funding and strategic investors (such as health system Memorial Hermann) suggest that Cedar is well-capitalized to pursue this vision. In conclusion, Cedar represents a notable success story in healthcare fintech: it has translated a deep clinical and technical insight into a scalable business that measurably improves both patient experience and provider finances. Its evidence-based approach and sustained growth to 2025 indicate that it will remain a prominent player in reshaping how patients interact with healthcare payments.

Also Read: Ergeon – Founders, Business Model, Funding & Competitors

To read more content like this, subscribe to our newsletter