Secureframe is a fast-growing cybersecurity compliance automation platform founded in 2020 to help organizations streamline the onerous process of achieving and maintaining security certifications. In recent years, security compliance has become a critical priority for technology companies, as customers and regulators increasingly demand evidence of rigorous data protections. The startup’s mission from the outset has been to “automate security and compliance” so that businesses can build trust and focus on innovation rather than paperwork. By 2025, Secureframe had secured over $79 million in venture funding, grown to hundreds of employees, and integrated with hundreds of cloud services to serve thousands of customers seeking rapid SOC 2, ISO 27001, HIPAA, PCI DSS, FedRAMP, and other compliance certifications.

Founding Story of Secureframe

Secureframe was conceived when co-founder Shrav Mehta repeatedly encountered painful delays in compliance projects at the startups where he had worked. He saw that traditional audits took months and cost tens of thousands of dollars, often blocking sales because prospective customers insisted on security certifications. As he later recalled: before Secureframe, “getting certificates was difficult and time-consuming”, with companies taking 6–12 months and heavy consultant involvement to finish a SOC 2 audit. To address this gap, Mehta (then 23) teamed up with engineering co-founder Natasja Nielsen to build an integrated platform that could automate evidence collection, continuously monitor controls, and streamline audits.

In early 2020 the founders began by coding core automation for SOC 2 compliance (the most demanded certification) and immediately incorporated connections to many popular business systems (e.g. AWS, GitHub, Jira) to auto-gather proof of controls. As Secureframe’s official narrative describes, the vision was to turn a months-long, resource-intensive process into days of automated work. The name “Secureframe” reflected their goal of providing a security framework for companies – a unified, end-to-end system to maintain compliance. Early beta customers (often startups of only a few engineers) were thrilled to see proof collection and questionnaire automation eliminate weeks of work. Within its first year, Secureframe had already built over 100 integrations and demonstrated that even two- or three-person teams could achieve SOC 2 compliance far faster than before.

Founders of Secureframe

Secureframe was co-founded by Shrav Mehta (CEO) and Natasja Nielsen (CTO).

Mehta, an entrepreneur since his teens (he built popular mobile apps in high school), brought firsthand insight into sales and compliance bottlenecks. As Mehta noted, he had “worked at a handful of startups” and experienced the frustration of a sales pipeline being blocked by slow compliance processes.

Natasja Nielsen, a University of Michigan graduate in computer science and former Amazon and robotics engineer, provided the technical expertise to automate the workflow. She served as Secureframe’s CTO, overseeing product and engineering.

The pair’s complementary skills – Mehta’s product/sales background and Nielsen’s engineering acumen – enabled rapid development of the initial platform.

From the beginning Secureframe positioned itself as an inclusive solution: it aimed to serve “companies of all sizes” in need of certifications. In practice, its early adopters ranged from tiny seed-stage startups to fast-growing mid-market firms, all eager to avoid the traditional audit grind. By democratizing compliance (through automation and partnerships), the founders sought to transform what was once a “resource-intensive distraction” into a streamlined operational task.

As of 2025 Mehta and Nielsen remain at the helm (Mehta as CEO, Nielsen as CTO), and Secureframe has attracted over 2,000 customers under their leadership.

Business Model of Secureframe

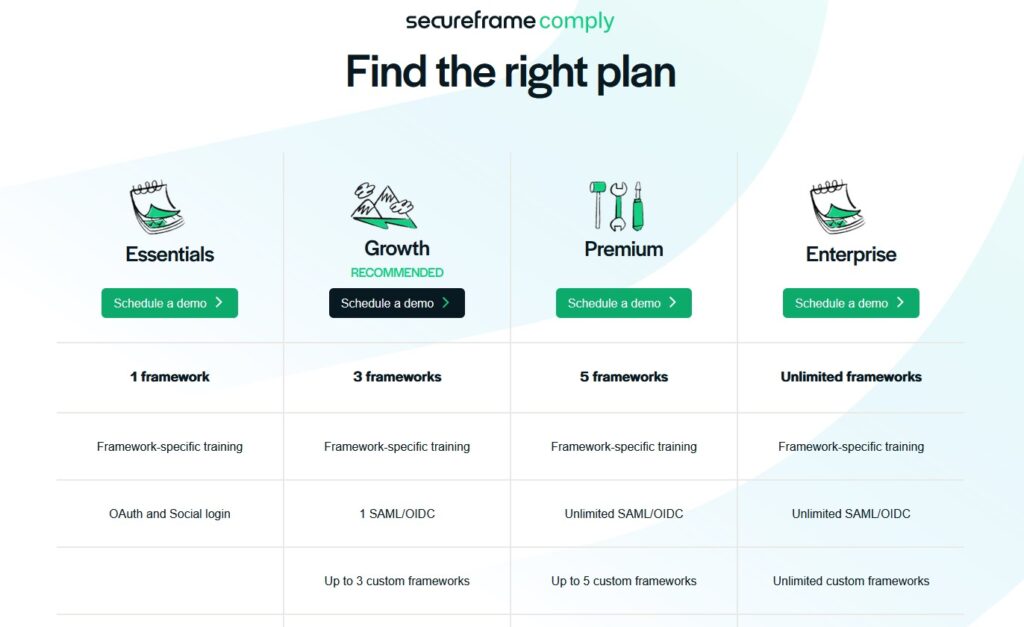

Secureframe operates on a Software-as-a-Service (SaaS) subscription model, selling its platform primarily to technology companies that need to prove compliance to enterprise customers or regulators. Its basic offering is a cloud-based compliance platform (sometimes called Secureframe Comply) that companies license on an annual basis. Customers pay for access to the platform based on their organization size and the scope of compliance frameworks needed. In practice, pricing is per year and often tiered by number of employees; for example, a common package allows up to 100 employees for a set fee (on the order of $7.5K) and includes one compliance framework, with additional frameworks or seat expansions priced additively. This model generates recurring revenue as clients renew subscriptions each year.

In addition to direct sales, Secureframe has cultivated channel and partnership strategies. It markets a “Compliance-as-a-Service” (CaaS) program to managed service providers (MSPs), enabling them to resell Secureframe’s platform under their own brand. The company touts this channel approach as high-margin and scalable: service partners like MSSPs can achieve “high-margin, recurring revenue” by packaging compliance management to their clients. For example, one case study (branded “SecureShield” in Secureframe’s blog) shows an MSP outsourcing a client’s SOC 2 process to Secureframe and, in turn, earning steady subscription fees while accelerating the client’s certification.

Secureframe’s go-to-market also emphasizes inbound demand generation: it offers free tools (gap assessment calculators, policy templates, etc.) and content marketing, and it participates in the AWS Marketplace. Many customers initially engage via the free compliance gap assessment, then convert to paid subscriptions. Over time, Secureframe has expanded from core startups into larger enterprises, now emphasizing an enterprise-ready, scalable compliance solution. The company also has dedicated plans for small businesses versus large enterprises, as its website describes “Small Business” and “Enterprise” solutions, with the latter including advanced controls like SSO/SCIM integration and multiple workspaces.

Revenue Streams of Secureframe

The primary revenue stream for Secureframe is subscription licensing of its compliance platform. Customers pay annual fees covering both the software and ongoing support. As described above, subscription fees typically consist of a platform access charge plus per-framework fees. For example, on the AWS Marketplace one entry-level bundle is $7,500 per year for up to 100 employees plus $7,500 for the first compliance framework (which aligns with third-party pricing guides). Large enterprises with more employees or multiple frameworks pay higher total subscriptions accordingly.

A secondary revenue stream comes from professional services and consulting. While the platform automates much of the process, some customers and partners pay one-time fees for initial compliance gap assessments or onboarding assistance. Secureframe’s own marketing highlights a “Gap Assessment” phase to identify security gaps before starting an audit. Partners may also bundle Secureframe access with managed compliance services, effectively selling compliance consulting and the software together. These recurring managed-service contracts (the CaaS model) are a growing revenue component, as indicated by Secureframe’s emphasis on high-margin recurring streams for partners.

The company’s pricing flexibility and multiple offerings ensure it can serve diverse customer segments. Some smaller clients pay only the basic subscription, while larger accounts often include additional paid modules (e.g. extra workspaces, advanced risk management, dedicated onboarding). Secureframe’s reported growth (10× revenue in 2021) suggests that its mix of subscription renewals and expansion (upselling additional frameworks or seats) has been effective. The platform also generates usage data (e.g. number of controls tested, integrations active) that could potentially form the basis for future usage-based billing or higher-tier packages.

Funding of Secureframe

Secureframe has attracted significant venture capital funding since its inception. The founders initially raised a $4.5 million seed round in October 2020 from investors including Base10 Partners, Gradient Ventures (Google’s AI fund), and others. This was followed by a Series A in March 2021 of $18 million led by Kleiner Perkins, with participation from existing investors. The Series A press release emphasized using the funds to accelerate product development and scale operations as the startup pursued new certification frameworks beyond SOC 2.

In late 2021, Secureframe appears to have closed a modest intermediate funding (some sources list a small undisclosed round in December 2021). The most recent major round was a $56 million Series B in February 2022 led by Accomplice Ventures. This Series B brought Secureframe’s total financing to roughly $79 million to date. Investors in the round included Kleiner Perkins (returning), Optum Ventures (healthcare VC), Kaiser Permanente’s venture arm, and strategic angels from the security industry. Secureframe did not disclose its valuation, but the presence of well-known funds and executives indicates strong investor confidence.

Funding has been used to expand Secureframe’s product scope (adding HIPAA, PCI, CMMC/FedRAMP frameworks) and to grow its team (the company reported roughly 200+ employees by 2025). According to public statements, revenue grew 10× in 2021, suggesting the new capital was fueling rapid customer acquisition. The infusion of capital also enabled geographic and industry expansion – for example, building a specialized “Secureframe Federal” product for government contractors (see below). Overall, Secureframe’s funding history reflects aggressive scaling: within two years of founding it transitioned from seed stage to mid-100s of millions raised, positioning it as one of the better-funded companies in the compliance automation niche.

Funding Rounds of Secureframe

The following table summarizes Secureframe’s publicly reported financing rounds and key investors:

Table: Secureframe’s funding rounds (amounts and dates from company announcements and financial data). Seed rounds may include undisclosed contributions. Kleiner Perkins, Gradient, Base10, Accomplice, and others are repeat backers.

Competitors of Secureframe

Secureframe operates in a competitive market of automated GRC (governance, risk, and compliance) platforms. Several well-funded startups and established vendors offer overlapping services. The two most frequently cited competitors are Drata and Vanta. Drata is a “full-scale trust management platform” that similarly automates evidence collection and provides real-time monitoring for SOC 2, ISO 27001, HIPAA, PCI DSS and other frameworks. Vanta, a popular choice especially for startups, emphasizes very fast setup and out-of-the-box automation for SOC 2 and ISO compliance. Both Drata and Vanta, like Secureframe, integrate with many cloud tools (e.g. AWS, Okta, GitHub) to pull compliance data continuously.

Other players in the space include Sprinto (an India-based compliance platform focused on ease of use and 200+ integrations), Hyperproof (a risk-and-compliance management solution aimed at larger enterprises), and Scrut Automation, Thoropass and Scytale (each offering varying degrees of automation and audit support). Traditional GRC vendors also compete for larger customers; for example, AuditBoard and OneTrust/Tugboat Logic provide broad compliance suites (though typically with more manual processes). Even cloud-native security firms like Lacework and Wiz offer compliance features that overlap in part.

What distinguishes Secureframe from generic audit firms is that it is pure-play automation – unlike hiring an audit shop or consultant, customers interface almost entirely with the software. Some competitors also bundle human audit services, whereas Secureframe’s pitch is self-service automation (augmented by optional partner support). In sum, Secureframe’s direct alternatives are the other SaaS compliance platforms (Drata, Vanta, Sprinto, etc.), with indirect competition from managed auditors, GRC suites, and generalized security toolsets.

Competitive Advantage of Secureframe

Secureframe’s key competitive advantages are automation, integration depth, and breadth of frameworks. From the start, the platform emphasized end-to-end automation of controls and evidence collection. By 2022 it supported continuous monitoring of 100+ security controls and integrations. As Secureframe’s CEO notes, the platform “builds compliance into your daily workflows,” automatically gathering audit evidence so teams spend less time on paperwork. The company also boasts a large and growing integration catalog – its marketing materials mention 300+ native integrations to cloud and identity systems. This allows Secureframe to auto-detect thousands of compliance signals (user logins, firewall configs, service settings, etc.) across platforms that customers already use. Competitors may have fewer integrations or require more manual data entry, so Secureframe can claim faster, more reliable evidence collection.

A second advantage is AI-driven capabilities. In 2024–2025 Secureframe embedded AI into many functions: it launched “Comply AI” modules for automated remediation (auto-fixing cloud misconfigurations), risk scoring, policy drafting, and third-party questionnaire automation. It also introduced an “AI Evidence Validation” feature that uses machine learning to pre-check uploaded audit artifacts for missing or outdated information. Early customer feedback suggests these AI tools significantly accelerate audit preparation. For example, a Secureframe case study claimed its AI features allowed a customer to remediate cloud issues faster and achieve audits more easily. By contrast, many rivals in the space rely on rule-based or partially manual processes; Secureframe’s strong AI emphasis is marketed as a way to reduce human effort and error.

Finally, Secureframe’s framework support and vertical focus broaden its reach. At launch it covered SOC 2 and ISO 27001; by 2022 it added HIPAA and PCI DSS. In 2025 it unveiled a dedicated “Federal Suite” to handle U.S. government requirements (CMMC 2.0 and FedRAMP 20x). This suite includes specialized tools like an automated System Security Plan (SSP) builder, a Plan-of-Action/Milestones tracker, and supplier risk scoring (SPRScore) – features tailored to DOD contractors and federal agencies. Such sector-specific tooling sets Secureframe apart from generic competitors. The company also partners with auditors and consultants (e.g. Plaid) to streamline parts of the audit process, further extending its service.

These advantages are reflected in the market: by early 2025 Secureframe reported over 2,000 customers on its platform and had achieved double-digit expansion in both revenue and headcount. Its aggressive product development (AI features, government compliance, etc.) and broad integration ecosystem aim to keep it ahead of the curve. In short, Secureframe’s strategic differentiators are its deep automation (powered by AI and integrations) and its continuously expanding scope of compliance frameworks and tools, which together help customers save time and cost on certification.

Products and Services of Secureframe

Secureframe’s offerings center around its cloud-based compliance platform. The core product – often just called Secureframe or Secureframe Comply – provides automated evidence collection, continuous control monitoring, and workflow management for multiple security frameworks. Customers can onboard a framework (SOC 2, ISO 27001, HIPAA, PCI DSS, GDPR, etc.) and the system will continuously test related controls, gather logs and policies, and track remediation. Key modules include infrastructure and cloud monitoring, risk management, personnel (on/offboarding) tracking, and policy management. Automated security training is also included to help meet audit training requirements.

A central feature is Automated Evidence Collection: Secureframe connects to a customer’s AWS, GCP, Okta, Azure, GitHub, and other systems to fetch compliance evidence in real time. It maps thousands of data points (e.g. login records, encryption settings, vulnerability scan results) to the required controls. This means much of the audit evidence is compiled without manual uploading. Customers can then use the built-in Trust Center to share their compliance status and reports with clients. (Secureframe Trust, a public-facing portal, lets organizations showcase compliance badges, answer RFP security questions automatically, and support vendor due diligence.) The platform also includes a Questionnaire Automation engine: it auto-fills standard security questionnaires and RFPs by pulling from the company’s control data and previous answers, saving hundreds of hours during sales cycles.

In 2023–2025, Secureframe has layered on advanced components under the Secureframe AI initiative. These AI-powered tools include auto-remediation of cloud misconfigurations (infrastructure-as-code fixes), AI-generated risk assessments, and even AI-assisted policy writing (generating draft policies or refining existing ones). Together, they help accelerate preparation for audits and ongoing compliance upkeep. The platform also offers Third-Party Risk Management: Secureframe can ingest vendor security documentation (such as a supplier’s SOC 2 report) and automatically extract relevant answers to speed up supplier assessments.

Secureframe Federal is a notable specialized suite launched in mid-2025. This add-on targets federal contractors by automating government-specific compliance requirements. It provides a guided SSP (System Security Plan) builder with pre-configured templates for CMMC and FedRAMP controls, a POA&M (Plan of Action & Milestones) manager linked to control implementation, and an SPRS (Supplier Performance Risk System) score calculator that continuously monitors contractor risk for DOD procurement. Early adopter testimonials indicate these tools can save hundreds of hours in preparing CMMC Level 2 or FedRAMP documents.

Besides software, Secureframe offers consulting and audit-prep services. Partner firms may guide clients through Secureframe implementation or perform manual gap analyses. The company also provides policy templates, compliance checklists, and training curricula as part of its platform. All products are delivered via subscription; customers typically choose a package (for example, “Fundamentals” vs. “Complete”) that bundles a set of features and the number of users/organizations supported.

| Product/Offering | Description and Capabilities |

|---|---|

| Secureframe Comply | Core compliance automation platform for SOC 2, ISO 27001, HIPAA, PCI, etc. Continuously collects evidence via 300+ integrations, monitors controls, manages risks, policies, and personnel, and provides automated reporting. Includes features like security training and automated questionnaire response. |

| Secureframe Trust | A public-facing “Trust Center” portal that securely shares compliance status and reports with customers and partners. Automates responses to security questionnaires by leveraging the Comply data. |

| Secureframe Federal | Suite for U.S. government compliance (CMMC 2.0, FedRAMP 20x) introduced 2025. Includes an automated SSP builder, POA&M manager, and SPRS score generator to streamline federal audit processes. |

Table: Summary of Secureframe’s main products and capabilities (sources: company press releases and product pages). Comply and Trust are the primary offerings for most customers; the Federal suite is a specialized 2025 launch.

Conclusion

Secureframe has rapidly become a prominent player in the cybersecurity compliance automation market. Starting from a simple solution to the painful SOC 2 process, it has grown into an end-to-end platform spanning dozens of standards and compliance domains. With nearly $80 million raised and top-tier investors on board, the company has built a robust SaaS business model focused on subscription revenue, extended by managed service partnerships.

Key milestones include 10× revenue growth in 2021 and the addition of hundreds of customers (over 2,000 by 2025). Productwise, Secureframe’s strategy has been to continuously expand automation (e.g. AI features for remediation and policy generation) and to enter new verticals (such as federal contracting compliance in 2025). It now offers one of the broadest compliance portfolios in its space, coupled with advanced analytics and AI.

Secureframe’s competitive advantages are its deep integrations (enabling continuous evidence collection), its end-to-end automation (including machine learning tools), and its focus on customer success (partners and policy guides). Compared to legacy manual processes or more piecemeal solutions, Secureframe promises faster audits and lower costs. That value proposition – “build trust, unlock growth” – seems to be resonating in the market.

Looking ahead, Secureframe will likely invest its new capital in further scaling sales and R&D. The compliance landscape continues to evolve (new frameworks, more regulated industries), which means more opportunity for automation. However, the company also faces strong competition from other well-funded startups and established vendors. To stay ahead, Secureframe will need to keep innovating its product (for example, by leveraging AI) while expanding its customer base globally. As of 2025, though, Secureframe’s trajectory and funding suggest it is well-positioned to lead the next generation of automated compliance solutions.

Also Read: Vanta – Founders, Business Model, Funding & Competitors

To read more content like this, subscribe to our newsletter