Stoke Space Technologies is an American aerospace startup founded in 2019–2020 by former Blue Origin rocket engineers.

Headquartered in Kent, Washington, Stoke is pursuing a radical vision: fully and rapidly reusable rockets that can launch with aircraft-like frequency.

The company’s mission is “low-cost, on-demand transport to, through, and from space”. From the outset, co-founder Andy Lapsa and his team believed that “the future of space will be defined by fully and rapidly reusable rockets”.

This conviction has attracted heavy investment (including from Breakthrough Energy Ventures, Toyota’s Woven Capital, and the U.S. Space Force) and public support (Space Force, NASA, NSF) to Stoke’s development efforts.

The company is developing Nova, a two-stage medium-lift launch vehicle designed for 100% reuse, along with in-house engines and hardware.

This article reviews Stoke Space’s origins, team, technology, business model and market position, drawing on recent press and filings.

Founding Story of Stoke Space

Stoke Space was conceived in late 2019 by Andy Lapsa and Tom Feldman, who met as propulsion engineers at Blue Origin.

Both had led critical engine programs: Lapsa had been Director of the BE-3 and BE-3U engines and a propulsion engineer on the BE-4, while Feldman worked on the BE-4’s oxidizer pump and thrust chamber.

Frustrated that no company was pursuing full reuse of both rocket stages, they decided to “jump off the cliff” and found their own firm. The pair spent the first six months “heads down, doing the math” in Lapsa’s basement, iterating on designs and exploring funding.

In May 2020, Stoke won a $225,000 NSF SBIR grant to support its propulsion research.

The founders formally launched the company in 2020, attracted seed funding (see below), and set out to build what Lapsa calls “the holy grail of rocketry: fully, rapidly reusable rockets”. Both founders stress that their vision was driven by conviction. Feldman later recalled that reusability is “the inevitable future” of space launch – “somebody’s going to figure out how to not throw these things away in the ocean”.

From day one, their roadmap targeted an aggressively reusable two-stage vehicle, with the ambitious goal of operating like an airline. To achieve this, Stoke’s engineers have pursued novel solutions (described below) – for example, a ring-of-fire engine design for a fully reusable upper stage.

Overall, Stoke’s founding story is one of experienced engineers departing Blue Origin in 2019, working through fundamental rocket design math, and building a venture aimed at solving the last remaining challenge in space reusability.

Founders of Stoke Space

The core founding team combines deep aerospace engineering pedigree with seasoned operations leaders. Andy Lapsa, Ph.D. (CEO) holds a Ph.D. in aerospace engineering (University of Michigan) and a B.S. from Cornell. He spent over a decade at Blue Origin, eventually directing the BE-3 and BE-3U liquid hydrogen engine programs and contributing to BE-4. At Stoke, Lapsa leads technology strategy and investor relations, embodying the company’s mission of “Reusability 2.0.”

Tom Feldman (CTO and Co-founder) holds M.S. and B.S. degrees in aerospace engineering from Purdue University. At Blue Origin he was a senior propulsion design engineer on the BE-4 engine (oxidizer pump and thrust chamber). Feldman’s role focuses on technical development, and he has recounted how he and Lapsa “just jumped off the cliff together” to start Stoke. He emphasizes rapid learning and prototyping, drawing from his experiences and even internships at SpaceX and NASA projects.

Beyond the co-founders, Stoke’s leadership team includes other veteran executives. Kelly Hennig (COO) manages day-to-day operations and engineering execution. She earned an M.S. in electrical engineering (Univ. of Michigan) and previously held senior engineering and executive roles at Raytheon and Northrop Grumman.

Paul Croci (CFO) holds an engineering/economics degree from Harvey Mudd and previously worked on launch vehicle and engine systems at Stratolaunch and Blue Origin.

Devon Papandrew (VP, Business Development) comes from a physics/economics background and has led business strategy at Spaceflight Inc. and other tech startups. Kristen Russell (VP, Marketing) and other leaders bring experience in communications and manufacturing.

Stoke also benefits from high-profile advisors and board members. Notably, SpaceX’s former VP of Build, Hans Koenigsmann, and SpaceX/Firefly alum Robb Kulin serve as advisors. The board includes experienced aerospace investors like Christian Garcia (Partner, Breakthrough Energy) and a former Boeing executive. In short, Stoke’s founders and senior team blend Blue Origin/Soviet-era rocketry expertise with Silicon Valley agility, underpinned by robust technical credentials.

Business Model of Stoke Space

Stoke Space’s business model centers on developing and operating its Nova launch system as a service. Its value proposition is to provide satellite customers and government agencies with frequent, low-cost orbital access by drastically reducing per-launch cost through full reusability.

In broad terms, Stoke plans to manufacture, launch, and reuse Nova rockets much like an airline does planes. The company aims to lower launch costs by amortizing fixed infrastructure and manufacturing costs over many flights, and by enabling very high flight rates.

Stoke’s proprietary technologies – from full-flow staged-combustion engines to a regeneratively cooled second-stage heat shield – are designed to support this model.

Key components of Stoke’s approach include:

-

Fully Reusable Architecture: Both the first and second stages of Nova are designed to return intact for rapid turnaround. This contrasts with most current rockets (SpaceX aside) that are either partly expendable or only partially reusable. By capturing and reusing all hardware, Stoke aims to slash cost per flight.

-

Vertical Integration: Stoke has brought much of the supply chain in-house (engine design, fabrication, software) and spun off capabilities like Boltline, a cloud hardware-engineering platform. This end-to-end control (including an internal ERP-like system) is intended to speed development and scale production efficiently.

-

On-Demand Launch Services: Stoke envisions offering “any orbit, any time” launches. Its design emphasizes quick reusability (aircraft-like cadence) so that customers (commercial or government) can book launches as needed, rather than waiting for expendable schedules. In the near term, scheduled launches will likely focus on satellite deployment and constellation filling; in the longer term, the reusability could support new services like satellite servicing, on-orbit repositioning, and downmass return.

-

Government and Civil Partnerships: From the outset, Stoke has worked closely with U.S. government agencies. Their technology development has been funded by the U.S. Space Force, NASA, and the National Science Foundation. In 2025, Stoke was selected to compete under the Space Force’s $5.6B National Security Space Launch (NSSL) Phase 3 program. These partnerships not only provide R&D funding, but also strengthen Stoke’s credibility as a reliable launch provider for national security payloads.

-

Other Revenue Channels: While launch contracts are core, Stoke is already leveraging its engineering expertise into additional business lines. Notably, Boltline (formerly “Fusion”) is a SaaS platform for hardware design and production management. Boltline is now a separate product, achieving substantial commercial adoption and revenue growth outside the aerospace sector. This software platform serves as an example of how Stoke monetizes internally developed tools.

Revenue Streams of Stoke Space

Stoke’s revenue streams are primarily tied to its launch and aerospace activities, supplemented by its software venture. Major sources include:

-

Commercial Launch Contracts: Stoke plans to sell launch services to commercial satellite operators and small-satellite constellations. As of late 2025 it already has a manifest of contracted launches, indicating paid customers. In practice, this means Stoke will earn revenue each time it launches a Nova vehicle for a customer, similar to a spaceport or “rocket airline.”

-

Government Launch Contracts: The U.S. Space Force selection under NSSL Phase 3 Lane 1 opens the door for lucrative national-security missions. In March 2025, the Department of Defence (now Department of War) awarded Stoke Space an indefinite-delivery/indefinite-quantity (IDIQ) NSSL contract (up to $5.6B). Initially this includes a $10 million task order. Additionally, Stoke could bid on NASA science or technology launch contracts, and has previously received funding from NASA for development. These government contracts provide both revenue and validation.

-

Research & Development Funding: Early-stage grants (NSF SBIR, NASA, DIU, etc.) have subsidized engine development and infrastructure. While not “revenue” in the strict sense, these funds offset R&D costs. For example, Stoke received a $225K NSF SBIR grant in 2020 and contracts from Defense Innovation Unit for tech maturation. Continued agency programs (like NASA launchpad refurbishments, DARPA projects, etc.) may further fund technology milestones.

-

Boltline Software Sales: The Boltline platform — born from Stoke’s internal tools — is now generating outside sales. It streamlines hardware development (parts tracking, BOMs, production workflows) and has been adopted by companies in aerospace, biotech, and advanced manufacturing. Under a 2024 partnership with Toyota’s Woven Capital, Boltline secured dedicated investment to grow its customer base. Management reported that Boltline’s revenue doubled year-over-year (first half 2025), confirming it as a growing revenue line.

-

Future Tech Licensing or Services: In the longer term, Stoke may license its engine technology or thermal protection systems to other aerospace firms. Its unique full-flow staged-combustion engine (Zenith) and cooling heat-shield could have broad applicability. While not yet realized, such licensing or consultancy could be an additional revenue stream, following analogies like SpaceX selling Raptor engines to NASA.

-

Testing Services (Potential): Stoke’s Moses Lake test facility could potentially be offered as a service to third parties needing propulsion test infrastructure. However, there is no public evidence of this, so it remains speculative.

In summary, Stoke expects most of its revenues from launches (commercial and government). However, its early success with Boltline shows the team’s ability to monetize auxiliary innovations. By 2025, Stoke’s diverse funding sources already include investors, grants, and contracts, setting it up for revenue growth as Nova comes online.

Funding and Funding Rounds of Stoke Space

Stoke Space has raised substantial venture capital to date, reflecting confidence in its mission. Table 1 summarizes its funding history:

| Round | Date | Amount | Lead Investors / Notes |

|---|---|---|---|

| NSF SBIR (Phase I) | May 2020 | $0.225M | National Science Foundation (reusable engine research) |

| Seed | Feb 2021 | $9.1M | NFX Guild, MaC Venture Capital |

| Series A | Dec 2021 | $65M | Led by Breakthrough Energy Ventures (Bill Gates) |

| Series B | Oct 2023 | $100M | Led by Industrious Ventures |

| Series C | Jan 2025 | $260M | Investors include BEV, Glade Brook, Industrious Ventures (billions total) |

| Series D (latest) | Sept 2025 | $510M (+ $100M debt) | Led by US Innovative Tech Fund (Thomas Tull); $100M debt arranged with SVB. |

| Total to date | – | ~$990M | – |

-

Early Grants and Seed: In its first year, Stoke secured a $225K NSF SBIR grant (May 2020) for propulsion research. The venture seed round in Feb 2021 brought $9.1M from Y Combinator (Stoke was part of YC’s 2021 cohort) and others. These funds allowed the founders to hire engineers and build prototypes.

-

Series A (Dec 2021, $65M): Led by Breakthrough Energy Ventures (Bill Gates), this round (total $65M) was aimed at developing and testing the Nova second stage. It marked a major endorsement: Gates’s climate fund invested based on Stoke’s promises of low-cost, low-impact launch (presumably using hydrogen fuel).

-

Series B (Oct 2023, $100M): Led by Industrious Ventures (a Silicon Valley defense fund), this round added $100M to accelerate engine development and infrastructure. At this point Stoke had raised about $185M total. This round came after Stoke had demonstrated its second-stage test hops and had moved to larger facilities.

-

Series C (Jan 2025, $260M): In January 2025 Stoke announced it had closed a $260M Series C round (bringing total raised to about $480M). New and existing investors participated, including Breakthrough, Glade Brook, Industrious, Point72, and others. The funds were earmarked for completing Launch Complex 14, finalizing Nova’s design, and ramping up manufacturing. By this time, Stoke had proven key technologies (engine hot-fire, vertical landing of stage2) and was transitioning to full-scale development.

-

Series D (Sept 2025, $510M + $100M debt): The largest round to date, announced October 2025, was led by Thomas Tull’s US Innovative Technology Fund. This $510M equity raise (plus $100M debt) doubled Stoke’s funding to ~$990M. The company stated the capital would scale manufacturing, finalize Nova’s development, and refurbish the Cape Canaveral launch pad. The round’s timing coincided with Stoke’s Space Force contract award, emphasizing the strategic role of its Medium-lift rocket. Major backers now include deep-pocketed industrial and defense investors (Tull, Point72, Toyota’s Woven, etc.), alongside prior venture firms (Breakthrough, etc.).

Competitors of Stoke Space

Stoke Space operates in a highly competitive launch market. Its key competitors fall into two categories: (a) large incumbents/giants, and (b) emerging “new space” launch startups. The landscape is summarized in Table 2.

| Company / Vehicle | Vehicle(s) | LEO Payload (kg) | Reusability | Status | Notes |

|---|---|---|---|---|---|

| SpaceX | Falcon 9 / Heavy | 22,800 kg / 63,800 kg | Reuses first stage (RTLS); Falcon Heavy has 3 boosters; Starship (in development) is intended fully reusable | Operational / Developing | Starship is only other fully reusable rocket in development. Industry market leader. |

| Starship | 150,000 kg | Designed fully reusable (both stages) | Testing | Began test flights in 2023, not fully certified. Recent tests had mixed success (e.g. partial explosion in 2023). | |

| Blue Origin | New Glenn | 45,000 kg | First-stage reusable (barge landing) | Development / Launched | First flight Jan 2025 (upper stage reached orbit, booster lost). Second stage reuse plan (Project Jarvis) shelved. |

| Rocket Lab | Electron | 300 kg | Partial reuse (recovered fairings, partial first-stage refurbishment) | Operational | Small launcher (LEO 300 kg). Leader in smallsat launch. |

| Neutron | ~13,000 kg | Planned first-stage reuse (return-to-launch-site) | In development | Medium-lift. First flight planned ~2026. Competing target class. | |

| Relativity Space | Terran R (Valaris) | ~20,000 kg | Designed fully reusable (both stages) | In development | Terran 1 (small) test failed; Terran R is fully 3D-printed medium-lift. Announced large funding ($650M) and multi-launch contracts. |

| Firefly Aerospace | Eclipse (Beta/MLV) | 16,300 kg | Partially reusable (first stage rockets; collaboration with Northrop) | In development | Derived from Northrop Grumman Antares replacement. First flight NET 2026. |

| United Launch Alliance (ULA) | Vulcan Centaur | 21,200 kg | No reusability planned (expendable) | Development / Operational | Established two-stage heavy rocket (Atlas V / Delta heritage). Competing mainly on reliability; new ACES upper stage planned. |

| Arianespace | Ariane 6 | 21,000 kg | Expendable | In development | Europe’s next heavy launcher. No reusability; competing for geosat/GTO launch market. |

| Others (small) | Various (e.g. Astra, ABL, Virgin Orbit) | < 1,000 kg to LEO | Mostly expendable | Operational/In Development | These focus on micro-launch. Stoke’s primary market (3–7t) is well above these. |

Table 2: Competitor overview – selected launch vehicles with comparable or complementary capabilities.

The competitive environment can be summarized as follows:

1) SpaceX (Falcon and Starship)

SpaceX dominates global launch with its partially reusable Falcon 9 (first stage reuse) and Falcon Heavy vehicles. It is also the only other company pursuing full second-stage reuse (via Starship). According to industry analysts, heavy-lift rockets like Falcon Heavy or Starship inherently achieve lower cost per kilogram than smaller rockets. However, they may not always serve smaller payloads well, leaving room for mid-size vehicles. Stoke’s Nova (3–7 ton to LEO) falls between the payloads of Falcon 9 (~23t) and smaller rockets.

2) Blue Origin (New Glenn)

Blue’s New Glenn heavy rocket had its maiden launch in Jan 2025. It is a partially reusable two-stage launcher: the first stage (seven BE-4 engines) is designed to land on a barge. However, on its first flight the booster was lost during return. New Glenn competes in the heavy-lift segment (45t to LEO) but, like Ariane and ULA, has yet to prove reuse in practice. Blue is also rumored to revive efforts for second-stage reuse (Project Jarvis) in the longer term.

3) Rocket Lab

Currently the leader in small-satellite launch, Rocket Lab’s Electron rocket (~300 kg to LEO) has flown dozens of commercial missions. It has partial reuse of first-stage hardware and fairing segments. Rocket Lab is now developing Neutron, a medium-lift (~13t LEO) partially reusable rocket. Neutron’s design (first-stage landing) overlaps Stoke’s market. Stoke’s founders cite Rocket Lab as a fast-moving competitor in the mid-market.

4) Relativity Space

Known for 3D-printed rockets, Relativity’s Terran 1 (small) had no reusability. Its next rocket, Terran R (now rebranded Valaris), is a fully reusable two-stage medium launcher (payload ~20t) powered by seven large methane engines. Relativity is well-funded (hundreds of millions) and claims dozens of contracts, but it lags in flight testing. If successful, Terran R would be a near-peer to Nova in both payload and reusability strategy. Both companies emphasize 3D printing and modern manufacturing.

5) Firefly Aerospace

Firefly’s medium-lift “Eclipse” rocket (also called MLV) is a joint project with Northrop Grumman. It aims ~16.3t to LEO with partial reuse (future first-stage landings). Eclipse will compete in the upper end of Stoke’s market (Stoke 3–7t). Firefly has also had funding and NASA contracts (e.g. its small Firefly Alpha launcher and lunar cargo contracts), making it a well-supported rival.

6) ULA/Vulcan, Arianespace (Ariane 6)

ULA’s Vulcan (21t, no reuse) and Europe’s Ariane 6 (21t, no reuse) are traditional heavy launchers under development. They compete on reliability and existing government contracts, but without reuse they do not match Stoke’s cost goals. Their presence underscores that fully reusable providers like Stoke face legacy incumbents with entrenched market positions.

Emerging small launchers (Astra, ABL, etc.) –

These focus on very small satellites (sub-500 kg). They offer cheap access for micro payloads, but their vehicles are expendable and payloads far below Nova’s class. Stoke is not directly targeting this sector.

In summary, Stoke’s direct competitors are primarily in the medium-lift reusable launch segment: SpaceX (with Falcon Heavy and upcoming Starship), Rocket Lab (Neutron), Relativity (Terran R), and Firefly (Eclipse). Each competitor has its own approach to reusability, but none besides SpaceX currently operate a fully reusable two-stage vehicle. As Stoke’s CEO observes, the market is “red hot” with many entrants, but also crowded. Industry experts note that heavy-lift vehicles often win on economy-of-scale (cost/kg), whereas medium/smaller rockets must leverage higher frequency and lower absolute costs. Stoke is positioning Nova to fill a niche between small launchers and super-heavy, aiming for sweet spot where high cadence fully reusable flights can outcompete both expendable rockets and be more accessible than space-ships.

Competitive Advantage of Stoke Space

Stoke Space’s main competitive advantages lie in its technology, engineering approach, and support network:

-

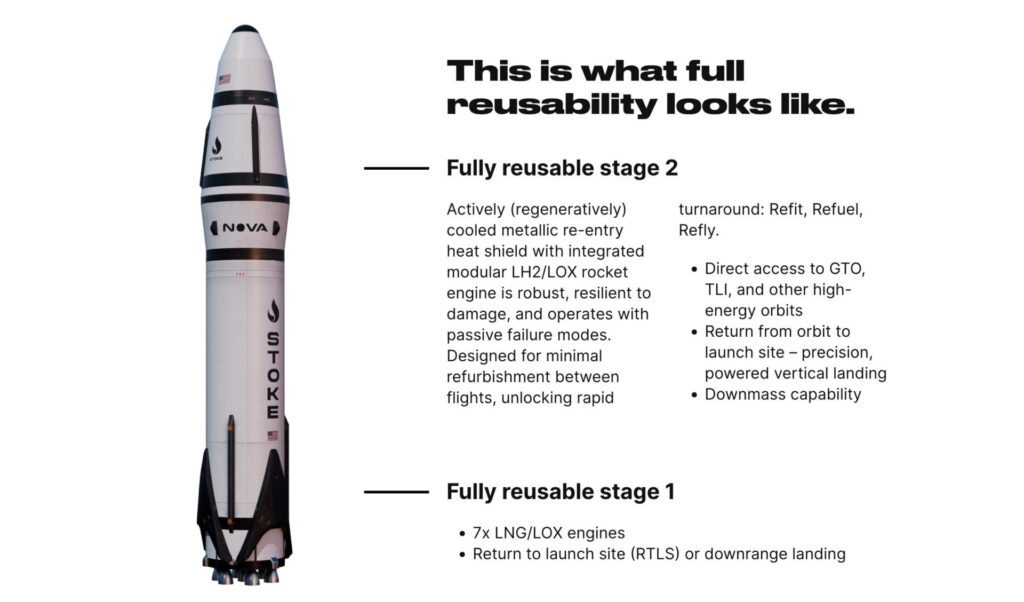

True 100% Reusability: Unlike most competitors, Stoke intends both stages of Nova to be routinely reused. Its second-stage design (the Andromeda stage) employs a novel ring of 24 thrusters built into a regeneratively cooled heat shield. This eliminates thousands of delicate tiles (as on Starship) and supports vertical landing of the upper stage. Demonstrating this capability (with flight-proven heatshield and integrated thrusters) would differentiate Stoke’s rocket from others. The company proudly notes it “pioneered the world’s first actively cooled metallic reentry heat shield” for the upper stage, integrated directly into the engine system.

-

Advanced Engine Technology: Stoke’s Zenith engine (first stage) is a full-flow staged-combustion (FFSC) engine burning methane/oxygen. FFSC rockets have the highest efficiency but are complex; Stoke claims to be only the second company (after Rocket Lab) globally to build and hot-fire such an engine. In June 2024, Stoke achieved the first successful hot-fire of Zenith in just 18 months of development, attesting to its engineering prowess. The combination of high-performance engines and innovative stage designs is a core technical edge.

-

Rapid Development Cycle: Stoke has adopted a “step-by-step development” ethos combining Blue Origin discipline with SpaceX’s trial-and-learn culture. For example, by late 2023 they already built and hopped full-scale second-stage prototypes (Hopper2) to test controls and thermal protection. They also completed first-stage engine hot-fires by mid-2024. This pace – from concept to hardware testing in a few years – is unusually fast for such complex systems. Their culture of rapid iteration and learning from tests is a competitive advantage that shrinks the development risk.

-

Engineering Team and Investors: Stoke has recruited dozens of top rocket engineers (ex-SpaceX, Rocket Lab, Northrop, etc.) into its staff of ~160 (as of 2024). This deep bench means Stoke can iterate quickly and solve problems in-house. Furthermore, its investor base (Breakthrough, USITF, Toyota, Industrious) and advisors (SpaceX veterans) provide not only capital but connections, credibility, and business support. In particular, a Series D lead by Thomas Tull (and co-investment by Space Force interest) underscores national-level confidence in Stoke’s strategy.

-

Vertical Launch Infrastructure: Stoke is aggressively building its flight infrastructure. It operates a 30-hectare test site at Moses Lake (Washington) dedicated to engine and hop testing (complete with a 75-foot test stand). It also secured Space Force Launch Complex 14 at Cape Canaveral for Nova’s orbital flights. By controlling its facilities, Stoke can optimize operations and schedule more flights, similar to SpaceX owning launch pads and factories. The company emphasizes “high-cadence launch operations” in its pitch.

-

Environmental and Cost Focus: Stoke differentiates itself by a stated commitment to low environmental impact (hydrogen-fueled upper stage, full reusability) and low cost to orbit (projecting 20× lower cost than conventional rockets). Breakthrough Energy’s backing suggests Stoke’s sustainability angle is credible. This can appeal to customers and policymakers increasingly sensitive to climate footprint.

Taken together, these advantages (fully reusable architecture, cutting-edge engines, rapid development, and strong support) suggest Stoke could carve out a differentiated niche. However, success still depends on execution. The company must prove ground testing translates to reliable orbital flights, and that its high flight-rate projections can be achieved in practice. But as of 2025, Stoke’s funding, people, and technical achievements put it in a strong position to compete in the “next-generation launch” market.

Products and Services of Stoke Space

Stoke Space’s flagship product is the Nova launch vehicle, a two-stage, medium-lift orbital rocket. Nova is designed from the ground up for full and rapid reuse. Key features:

-

Nova Rocket: As of 2025 Nova is in development, with first flight expected by 2026–27. It stands ~40 m tall (132 ft) and two-stage. The fully reusable first stage is powered by 7 Zenith engines (full-flow methane/LOX engines) generating ~3,110 kN thrust at sea level per engine. The planned payload to LEO with return-to-launch-site (RTLS) recovery is roughly 3,000 kg (about 3–7 tons depending on mission profile). Nova’s first stage is expected to perform powered vertical landings back at Cape Canaveral, similar to a Falcon 9.

Stoke’s first-stage “Zenith” engine under hot-fire testing. In June 2024 the engine ramped to its 350,000-horsepower target (100,000+ lbf thrust) in under one second, demonstrating the power needed for Nova. Stoke built this engine in just 18 months.

-

Upper Stage (Andromeda): The second stage (unofficially called Andromeda) is a regeneratively cooled hydrolox engine with 24 small thrusters arranged in a ring around the heat shield. This “ring-of-fire” architecture allows vertical descent and propulsive landing of the upper stage. The design eliminates fragile thermal tiles by circulating hydrogen propellant through embedded channels in the metallic heat shield. This innovative stage is intended to be fully reusable, carrying satellites to any orbit and returning to drop payloads or even perform on-orbit capture/repair missions. The Nova design is planned for versatile mission profiles, including satellite deployment, logistics to orbital stations, and downmass return of cargo to Earth.

-

Engines: Nova’s engines are all designed and built in-house. The Zenith first-stage engine (full-flow staged combustion) was hot-fired successfully in 2024. Stoke also develops the second-stage thrusters (small hydrogen-oxygen engines) that form the circular cluster. These engines incorporate advanced materials (Inconel, copper) and 3D-printing for high-performance parts. Production of these engines uses large-scale additive manufacturing, enabling rapid iteration.

-

Boltline Platform: Apart from rockets, Stoke offers Boltline, a cloud-based hardware engineering platform. Originally developed for internal use (“we set out to build hardware, and the tools got in our way”), Boltline is now a stand-alone product used by other aerospace and manufacturing companies. It handles bills of material, inventory, manufacturing workflows, and quality control. Stoke’s August 2025 announcement reported Boltline revenue doubling year-over-year. While Boltline is technically a separate business, it stems from Stoke’s integrated model and helps offset development costs.

-

Infrastructure & Testing Services: Stoke operates key facilities that complement its products. Its Moses Lake, WA test site (75 acres) houses a vertical engine test stand and high-altitude simulation rigs. Here Stoke fire-tests engines at full throttle (see image above). Stoke also holds Space Launch Complex 14 at Cape Canaveral, being refurbished for Nova flights. While not a product sold externally, this infrastructure (and associated operations expertise) is part of Stoke’s service offering to launch customers – ensuring fully in-house control of vehicle testing and launch.

-

In-Development Prototypes: Stoke has built prototype test vehicles (“Hopper1” and “Hopper2”) to validate concepts. Hopper2, a short-hop second-stage vehicle, successfully flew (10 m hop) in Sep 2023, proving its differential steering and landing ability. These prototypes are not commercial products, but they demonstrate Stoke’s engineering and de-risk Nova’s design. Stoke may repurpose lessons from these vehicles in future product offerings (for example, technologies for rapid reuse).

In summary, Stoke’s product lineup is anchored by Nova, a fully reusable two-stage rocket. The vehicle incorporates breakthrough technologies (full-flow engines, actively-cooled heat shields) that appear in no other launch system today. Additional products like Boltline diversify Stoke’s portfolio into software, showing the company aims to be both a launch services provider and a broader “space technology” company. As of 2025, Nova is still in development, but Stoke has achieved critical milestones (engine hot-fire, stage hops) setting the stage for the first orbital flights.

Conclusion

Stoke Space Technologies is a deep-tech launch startup aiming to transform space access. Its founding story is rooted in engineering conviction: former Blue Origin veterans determined to build fully reusable rockets. By late 2025, Stoke has amassed almost $1 billion in funding, built significant prototype hardware, and secured government support for its “Nova” vehicle. Its technology roadmap – featuring a full-flow staged-combustion engine and a novel hydrolox second-stage heat shield – could yield a rocket that routinely flies to orbit and back at airline-like cadence.

In the context of the growing space economy, Stoke occupies a promising niche. It sits between smallsat launchers and orbital giants, targeting a medium-class payload segment with a fully reusable approach. With major contracts (Space Force NSSL), advanced engineering achievements, and backing by prominent investors (Breakthrough Energy, Toyota, USITF), Stoke is positioned to enter service in the mid-2020s. If Nova reaches its goals, Stoke could deliver dramatically lower launch costs (orders of magnitude below expendable rockets) and high launch cadence – opening opportunities for rapid satellite deployments, on-demand missions, and more responsive space operations.

However, the challenges are formidable. Launching a new rocket — even more so a 100% reusable one — is historically difficult. Stoke must scale up manufacturing, prove reliability, and compete against both incumbent providers and other well-funded startups. But its advantages (technology, talent, integration) are strong, and its progress to date suggests it can meet these challenges.

In summary, Stoke Space’s brand story is one of ambitious vision backed by engineering execution. It blends “Silicon Valley speed” with blue-chip rocketry pedigree. By pursuing the Holy Grail of rocketry (complete reuse), Stoke aims not just to enter the launch market, but to redefine it. The coming years (2026–2030) will be critical: successful orbital flights and reuse cycles could establish Stoke as a major player, while any failures will be starkly visible. For now, as of 2025, Stoke Space stands out as one of the most promising and well-resourced entrants in the reusable launch race.

Also Read: SpaceX Revolution: Transforming Space Exploration as We Know It

To read more content like this, subscribe to our newsletter