Accrete AI is a New York-based artificial intelligence startup founded in 2017 with a mission to combat information overload by encoding human expertise into “Knowledge Engine” AI agents.

Serving both government and commercial clients, Accrete has positioned itself as a dual-use enterprise AI provider – meaning its technology is applied in defense as well as Fortune 500 business contexts.

The company’s core products are AI agents that autonomously analyze vast streams of unstructured data to generate predictive insights, helping decision-makers in areas ranging from national security to marketing.

Accrete’s solutions are already trusted by U.S. Department of War units and major enterprises in media, consumer goods, and finance.

This story explores Accrete’s founding journey, its leadership, business model and revenue streams, funding history, competitive landscape, unique advantages, product offerings, and future outlook.

Founding Story of Accrete AI

Accrete’s origin traces back to the insight and hypothesis of its founder, Prashant Bhuyan. In the mid-2010s, Bhuyan had a successful career in high-frequency trading, where he saw firsthand how advanced algorithms could give traders an “unfair advantage” by exploiting tiny market inefficiencies.

However, he also recognized a looming challenge: the digital explosion of data was making it increasingly difficult for humans to parse signals from noise, be it contradictory narratives on social media or rampant misinformation. Bhuyan believed that artificial intelligence, if it could be taught to read, understand, and learn from enormous amounts of unstructured information, would enable organizations to draw critical insights faster than any human analyst.

This vision – using AI to compress tacit knowledge and find “alpha” (unique predictive insights) buried in data – led him to launch Accrete in 2017.

In its early days, Accrete focused on developing AI that could tackle complex, dynamic data in real time. The team achieved a breakthrough by training AI models to detect subtle patterns in open-source information. For example, Accrete’s algorithms were able to extract early rumors of mergers and acquisitions (M&A) from news and social media chatter ahead of the market.

The startup even caught the attention of the entertainment industry when it successfully predicted which pre-release songs would go viral by analyzing social media signals. These early successes across diverse domains validated Bhuyan’s hypothesis that an AI “knowledge engine” could mine unstructured data for predictive insights in any field.

Armed with this confidence, Accrete began broadening its horizon. The founders anticipated that not only corporations but also government agencies would eventually need tools to make sense of unstructured, fast-changing data. In a proactive move, the team subscribed to a Bloomberg Government service to monitor federal project solicitations, looking for problems their AI could solve.

This led Accrete in 2019 to compete for a Defense Innovation Unit (DIU) project addressing supply chain security. Accrete won the contract, beating out dozens of other companies, to develop a prototype system that automatically scans over 30 million open-source records to spot adversarial threats to critical supply chains. The success of this prototype – which an official report noted could identify illicit activities three times faster than human analysts – marked Accrete’s transition from a commercial-first startup to a serious defense technology provider.

By the early 2020s, the company had firmly established itself as a dual-use AI innovator, leveraging lessons from the private sector to tackle some of the U.S. government’s most complex data analysis challenges.

Founders of Accrete AI

Accrete AI was founded by a team of two individuals, each bringing complementary expertise to the venture. The founding duo includes Prashant Bhuyan and Josh Adam who together launched Accrete in 2017.

Prashant Bhuyan (Founder, CEO & Chairman)

The driving force behind Accrete’s vision, Bhuyan is a former Wall Street quantitative trader turned tech entrepreneur. He spent over a decade building high-frequency trading systems before pivoting to artificial intelligence. His background in finance gave him early exposure to algorithmic decision-making, which he now channels into developing AI agents that augment human decision-making rather than replace it. As CEO, Bhuyan steers Accrete’s strategy of encoding human judgment into AI software, and under his leadership the company has secured customers such as the U.S. Department of Defense and multiple Fortune 500 firms.

Josh Adam, CFA (Co-Founder)

Josh Adam brings deep financial and analytical expertise to Accrete. Prior to co-founding the company, he spent nearly 20 years in the hedge fund industry, where he served as a portfolio manager and Director of Research at major funds such as GLG Partners and SAC Capital. He also worked at Goldman Sachs earlier in his career. This strong finance background made Josh Adam adept at analytical problem-solving and risk assessment, skills that have been invaluable in shaping Accrete’s early products (like those predicting market rumors) and in managing the company’s growth. While Josh Adam’s current operational role at Accrete is less public, he was integral in the company’s formative years, ensuring that the AI solutions delivered the rigorous accuracy that enterprise clients expect.

Together, the founding team’s blend of quantitative finance, operations management, and AI expertise formed a strong foundation for Accrete. They were later joined by senior technologists such as Dr. Yurdaer Doganata (a former IBM Research scientist, now Accrete’s CTO) who helped advance the AI platform. This leadership mix has enabled Accrete to navigate both the fast-paced startup world and the stringent demands of government contracting with equal agility.

Business Model of Accrete AI

Accrete operates on a B2B software model, delivering its AI capabilities through licensed platforms and contracts. The company’s business model is characterized by its dual-use approach and focus on AI-as-a-service for high-stakes decision support. In practice, Accrete develops AI “agents” (software solutions) that it licenses to clients as enterprise software or provides via subscription, often cloud-based.

For commercial enterprises, the AI agents integrate into the client’s workflow to continuously analyze data and generate insights, typically under annual or multi-year licensing agreements.

For government customers, Accrete often engages through pilot programs that convert into longer-term contracts, aligning with how defense agencies adopt new tech (e.g. initial prototypes followed by production OTAs – Other Transaction Authority contracts – for deployment).

Crucially, Accrete’s dual-focus means it tailors its go-to-market strategy depending on the sector:

Enterprise Segment:

Accrete earns revenue by providing AI solutions to Fortune 500 and other corporate clients in industries such as consumer goods, media & entertainment, and finance. Solutions are delivered as software licenses or software-as-a-service, often customized to the enterprise’s domain. For example, an entertainment company might license Accrete’s social media narrative analysis agent to predict trends, paying an annual fee per user or per data volume processed.

Accrete bolsters this side of the business via partnerships – it has partnered with firms like Publicis Groupe (a global advertising holding company) to embed AI insights into marketing workflows, and with New Era Technology to deliver digital transformation solutions to enterprise IT operations. Such partnerships extend Accrete’s reach by leveraging established channels to enterprise customers. Additionally, Accrete recently made its technology available on the Snowflake Data Cloud, introducing a Snowflake-native app so that enterprise IT teams can deploy Accrete’s AI agent (for IT service management) directly within their data ecosystem. This innovative distribution channel reflects a scalable aspect of Accrete’s model – providing AI capabilities through marketplace integrations.

Government Segment:

On the defense and government side, Accrete’s business model involves competitive contracting and recurring license fees funded by federal budgets. The company established a subsidiary, Accrete AI Government, LLC, to handle U.S. government engagements.

Initially, Accrete often enters a defense customer relationship via a paid prototype or pilot (for instance, through a DIU contract or a Small Business Innovation Research program). After proving the technology’s value, these pilots can convert into production contracts.

A notable example is Accrete’s Argus threat-detection software: after a successful pilot, Accrete secured a multi-year, multimillion-dollar contract with the Department of Defense in late 2022 to deploy Argus at scale. Government deals like these typically span several years and operate as subscription licenses or service agreements (often termed “OTAs” or eventually becoming Programs of Record). To facilitate sales, Accrete also works with government IT resellers – for instance, Carahsoft Technology Corp. has agreed to serve as a master government aggregator for Accrete, making its AI platform available through federal procurement channels. This indicates that beyond direct contracts, Accrete is investing in the channel sales model for government, which is common in defense tech.

In both segments, Accrete’s revenue model emphasizes recurring revenues from software licensing rather than one-off projects. The company’s agents are delivered as continuously updating systems, which justifies an ongoing subscription or maintenance fee. This approach has the benefit of compounding value for clients over time (as the AI models learn more and get better, clients are likely to renew contracts, seeing increasing ROI). It’s an approach that also provides Accrete with predictable revenue streams. According to the company, the surge in demand for trustworthy AI agents in mission-critical roles has fueled strong growth – Accrete’s revenue grew at a triple-digit rate over a recent three-year period, contributing to its debut on the Inc. 5000 list of fastest-growing companies in 2025.

Revenue Streams of Accrete AI

Accrete generates revenue from two primary streams: enterprise software licensing and government contract income. A breakdown illustrates the balance between these streams:

| Revenue Stream | Description |

|---|---|

| Enterprise AI Licensing | Licensing fees from Fortune 500 and commercial clients for Accrete’s AI platforms. This constituted the bulk of revenue – roughly 86% of 2023 revenue came from enterprise deals. Clients in media, consumer goods, finance, and other sectors pay for software like Nebula (described below) to gain predictive insights from their data. These are often SaaS or on-premise license agreements, sometimes scaled via strategic partners. Rapid growth in enterprise adoption is evidenced by major partnerships (e.g., with Snowflake, Publicis) and Accrete’s inclusion on the Inc. 5000 list due to its swelling commercial client base. |

| Government Contracts | Revenue from U.S. defense and government customers for Accrete’s AI solutions, often delivered through multi-year contracts. In 2023, about 14% of revenue (around $3.2M) was from federal contracts. This includes earnings from prototype R&D contracts (e.g., DIU awards) and production licenses (such as the Department of Defense contract for the Argus threat detection software). Government revenue can also include non-dilutive funding awards; for instance, Accrete’s federal subsidiary received a $15M Air Force STRATFI award in 2025 to enhance its social media analytics platform. These contracts not only provide revenue but also signal strong validation of Accrete’s technology in critical national security applications. |

Diversification: Notably, these two streams reinforce each other. Enterprise contracts yield steady cash flow and product feedback that Accrete uses to refine its offerings, while government contracts often fund cutting-edge capabilities and lend credibility that helps win more enterprise clients. The result is a balanced revenue model. With new defense contracts (like an Army award for social media analytics in 2024) and expanding enterprise deployments, Accrete is poised to continue growing both streams. The company’s own announcements have highlighted “significant government contracts and Fortune 500 deals” as twin engines driving its revenue growth in recent years.

Funding of Accrete AI

Accrete’s growth has been financed through a combination of venture capital, strategic corporate investors, and non-dilutive government funding. Public information indicates that the company maintained a lean, incremental funding strategy over the years. As of late 2024, Accrete had raised approximately $30 million in equity funding over six funding rounds. These rounds range from early seed investments to early-stage venture rounds. In addition to equity, Accrete has leveraged government innovation programs for funding – most prominently, a $15 million Strategic Funding Increase (STRATFI) grant from the U.S. Air Force in 2025. This infusion, while earmarked for product development on a specific defense project, effectively boosted Accrete’s total funding to date when combined with venture capital. By some accounts, including grants and other financings, Accrete’s total funding is on the order of $80–90 million (though the exact figure depends on whether one counts certain government contracts as “funding”).

Accrete’s investor base reflects its dual-use focus. Key investors span both traditional VC and defense-oriented entities. According to PitchBook, investors in Accrete include Pendrell Corporation (an investment firm with interests in advanced tech), Polaris Capital, and OpenDoor Venture Capital, among others. OpenDoor VC, notably, is an early-stage fund founded by Ken Fried – who not only invested in Accrete’s seed round but later joined the company as Head of Enterprise Business Development. On the defense side, Accrete’s collaboration with the Air Force’s AFWERX and SpaceWERX implies those organizations have provided non-equity funding and support, essentially acting as strategic backers. In fact, AFWERX and SpaceWERX are listed among Accrete’s investors, signifying the importance of DoD funding in Accrete’s capital structure. Another named investor is “Capital Research Group,” which suggests involvement from a large asset manager or its affiliate, and Shake and Bake Ventures (an early-stage investor). The diversity of investors – from defense innovation arms to venture funds – underscores Accrete’s bridging of Silicon Valley-style tech and government needs.

Funding Rounds of Accrete AI

The table below summarizes the known funding rounds of Accrete, including dates, amounts, and notable investors where disclosed:

| Date | Round Type | Amount Raised | Investors / Notes |

|---|---|---|---|

| Mar 2017 | Seed Funding (Pre-Seed) | $0.6 Million | OpenDoor Venture Capital (early investor). Provided initial capital to launch Accrete’s prototype development. |

| Jan 2019 | Early Venture Round (Series A) | $9 Million | Venture round to expand R&D and enter new markets. Investors undisclosed in public filings; likely included strategic VCs. This round brought Accrete’s total funding to about $12M at the time. |

| Oct 2020 | Venture Round (Early-Stage) | $5 Million | Early-stage funding to support product enhancements and initial defense market forays. Investors undisclosed. Occurred as Accrete’s DIU pilot was underway, indicating confidence from investors in Accrete’s dual-use prospects. |

| Feb 2021 | Venture Round (Early-Stage) | $3.7 Million | Follow-on funding to fuel hiring and cloud infrastructure for scaling deployments. Likely an extension of the prior round (combined with a small additional $3.75M filing around the same time). |

| Apr 2024 | Bridge Funding (Convertible Note) | $0.6 Million | Convertible Note filing – part of a $15M offering – indicating bridge financing from a sole investor. This infusion was a placeholder as the company sought to raise a larger round. As of April 2024, Accrete had ~$30M total equity funding reported. |

| Mar 2025 | STRATFI Grant (USAF) | $15 Million | U.S. Air Force AFWERX/SpaceWERX STRATFI Award – Non-dilutive funding selected for Accrete’s Argus platform development. This strategic funding increase supports scaling Accrete’s defense solution and is not traditional equity but is included here due to its significance. |

Table: Accrete AI Funding Rounds (2017–2025). Amounts in USD. Equity rounds are cumulative to ~$30M by 2024, with total financing including grants being higher.

Competitors of Accrete AI

Accrete operates at the intersection of AI, big data analytics, and defense technology – a space that is increasingly crowded and competitive. Its competitors range from emerging startups specializing in artificial intelligence for government to established technology companies offering data analytics platforms. Below are some of Accrete’s notable competitors and how Accrete differentiates itself:

Vannevar Labs

A VC-backed defense AI startup specializing in OSINT analytics, foreign-language interpretation, and niche tools like Arabic OCR. Its flagship platform, Decrypt, aggregates hard-to-access data for military users. Vannevar has raised ~$75M (more than Accrete) and has a similar team size. Both firms won major DoD contracts around the same time, competing directly in defense intelligence AI. While Vannevar focuses narrowly on OSINT translation and NLP, Accrete differentiates itself through dual-use AI and “knowledge engines” that encode human expertise.

Primer Technologies

A major NLP-focused competitor known for automated text analysis and summarization for intelligence agencies. Frequently listed as a top competitor to Accrete, Primer excels in polished NLP models for document processing. Accrete overlaps in intelligence analysis but extends further into multimedia analysis (e.g., Nebula Social) and predictive modeling, aiming to build agentic AI systems with memory and collaboration capabilities.

Palantir Technologies

A dominant incumbent in government analytics, with its Gotham platform widely used for integrating and querying intelligence datasets. Palantir offers large-scale data infrastructure, whereas Accrete positions itself as a more automated, AI-agent-driven solution that reduces analyst workload. While Palantir has vast contracts and influence, Accrete competes through agility and specialization—for example, fast threat detection and social-media influence tracking.

Rebellion Defense

Another 2019-founded defense AI startup, backed by large funding rounds (including $150M in 2021). Its products (Iris, Nova) target cybersecurity and battlefield awareness. Rebellion and Accrete share the challenge of government procurement, but Accrete gained an edge by successfully securing a five-year DoD contract in 2022, demonstrating its ability to move beyond pilots into real deployments. Rebellion focuses on mission-specific military systems, while Accrete emphasizes AI-driven intelligence analysis of public data.

Big Tech & System Integrators:

Indirect competitors include Microsoft, Amazon, Google, Booz Allen Hamilton, Raytheon, and Northrop Grumman—all of which build or customize AI systems for government clients. They have deep relationships and resources but lack the specialization and speed of startups like Accrete. Accrete’s strategy is to excel in a focused niche and leverage its agentic AI expertise, reinforced by Gartner’s recognition of it as an innovator, making it attractive even to large integrators as a partner rather than a rival.

Accrete competes with focused AI startups (Primer, Vannevar), major data platforms (Palantir), and large defense contractors. The competitive landscape is crowded, but Accrete’s edge lies in its knowledge-engine AI agents, dual-use flexibility, and proven ability to win and scale defense contracts. As AI adoption accelerates across defense and enterprise intelligence, maintaining this specialization and speed will be key to staying ahead.

Products & Services of Accrete AI

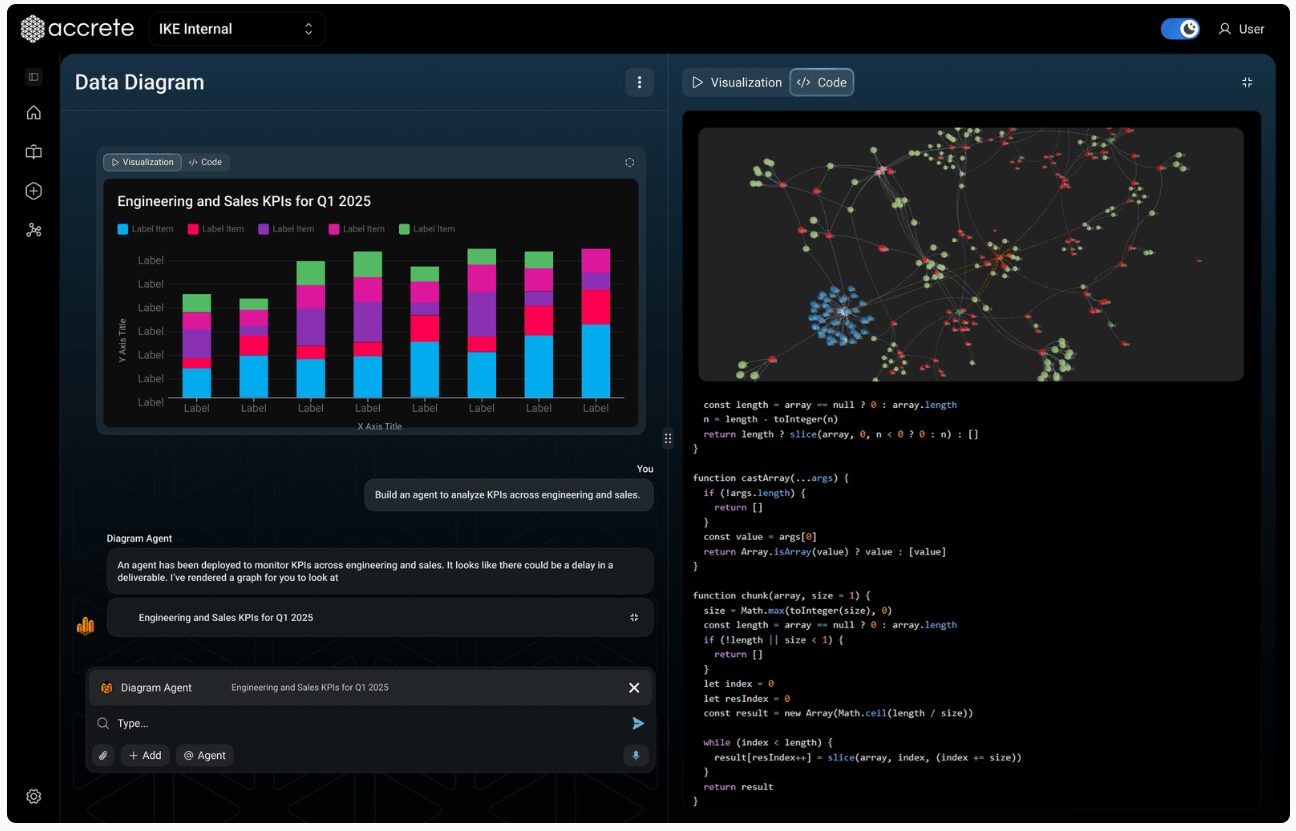

Accrete’s products center on Expert AI Agents built on its Knowledge Engine Platform, designed to autonomously perform complex analytical tasks. As of 2025, its offerings include the Argus and Nebula platforms plus the underlying Knowledge Engine.

Argus

Argus is Accrete’s AI agent for anomaly detection, threat intelligence, and open-source monitoring for government and security customers. It continuously ingests large volumes of multilingual, unstructured data—news, blogs, filings, social media—and uses knowledge graphs to map entities and detect suspicious patterns or influence networks.

Argus for Supply Chain

Built with the U.S. DoD, this version analyzes 30+ million open-source records to identify adversarial influence, shell companies, or foreign ties within defense supply chains. It surfaces behavioral anomalies (e.g., unusual investments, ownership changes) and has enabled analysts to uncover risks in seconds instead of months. In late 2022, it secured a multi-year DoD production contract.

Argus for Social (Information Operations)

Developed under a 2024 U.S. Army contract, this variant detects information warfare, emerging narratives, and disinformation on social platforms. By encoding analyst expertise, Argus flags subtle precursors to viral misinformation, giving information-ops teams early warning. It acts as a persistent watchdog across global social content.

Technical Note

All Argus variants include automated ingestion, real-time updating knowledge graphs, and conversational querying (“Argus Chat”). Argus uses few-shot learning and continuous feedback—requiring minimal manual labeling—making it scalable and low-maintenance.

Nebula

Nebula is Accrete’s enterprise-focused AI platform, trained on a company’s own internal and external data. It behaves like a domain-specific AI analyst for trend prediction, risk detection, and operational intelligence. Key modules include:

Nebula Social

A marketing and consumer-insights agent that analyzes social posts, comments, audio/video trends, and influencer activity. It builds narrative knowledge graphs to reveal what’s driving attention, not just keywords. Its expert agent, Kepler, answers natural-language questions (e.g., trending topics among Gen Z) and learns the user’s preferences. Publicis Groupe uses Nebula Social to power more proactive campaigns.

Nebula IT Service Intelligence (ITSI)

An AIOps agent for predicting IT outages and accelerating incident resolution. It learns from historical logs and service desk data to warn of risky planned changes, correlate monitoring signals, and cut MTTR. ITSI includes a knowledge-graph topology view to visualize dependencies. Launched as a Snowflake Native App in 2025, it allows enterprises to run Nebula directly on their Snowflake data.

Across Nebula modules, the system learns the organization’s unique context, building institutional knowledge that improves recommendations over time.

Knowledge Engine Platform

The foundation powering Argus and Nebula, enabling data ingestion, knowledge-graph construction, and AI agents with memory. It emphasizes security, scalability, and modularity. It has enabled Accrete to rapidly spin up domain-specific agents—e.g., “Project Lifeblood” during COVID-19 to identify plasma donors. The platform’s strength is its ability to unify siloed data with expert knowledge, creating a dynamic, continuously updating “ground truth.”

Services

Accrete provides professional services for deployment, data integration, customization, and training—especially for government use cases. Services support adoption but software licensing remains the primary revenue driver as the company moves toward more configurable, less bespoke solutions.

Accrete’s suite—Argus for external risk intelligence, Nebula for enterprise operations, and the Knowledge Engine beneath them—gives organizations autonomous AI agents capable of understanding, reasoning, and adapting. Because all products share the same platform, improvements in one area strengthen the others. With proven results for the DoD and major enterprises, Accrete is delivering on its promise: AI agents that radically accelerate intelligence and decision-making.

Conclusion

Accrete AI’s brand story is one of convergence – the convergence of human expertise with artificial intelligence, of Wall Street savvy with Pentagon-grade robustness, and of commercial agility with public sector trust. In the span of only a few years, what began as Prashant Bhuyan’s vision in 2017 has matured into a company at the forefront of AI-driven decision intelligence. The journey has been marked by thoughtful evolution: from early prototypes that beat the market to sophisticated agents that shield national security. Investors have been drawn to Accrete’s pragmatic approach of growing through revenue and strategic funding, while customers have been drawn to the tangible value Accrete’s products deliver (be it an 80% reduction in analytical workload or new insights that were previously unattainable)

Accrete’s narrative also reflects broader trends in technology. In an era where organizations struggle under information overload, Accrete stands out by addressing the root of the problem – knowledge loss – with a solution that doesn’t just analyze data, but learns and reasons like an expert over time. Its emphasis on ethical, reliable AI (the company often speaks of advancing “trustworthy artificial general intelligence” within bounded domains) positions it well in a market increasingly concerned about AI’s transparency and accountability.

As of 2025, Accrete finds itself with strong momentum. It has a growing roster of high-profile clients and partners, a solid financial foundation with diversified funding, and recognition as an innovator in its field. The company’s inclusion on the Inc. 5000 list and acknowledgment by Gartner signal that it is not only growing fast but also doing so in the right direction. Looking ahead, Accrete’s strategy is likely to focus on scaling deployments (turning more pilot successes into full deployments), continuing to invest in R&D (to maintain its technological edge in agentic AI), and expanding its product capabilities across sectors. The challenges will include managing competition and the complexities of two very different customer bases, but if its track record is any indication, Accrete will navigate these by leaning on its core strengths – innovation, domain expertise, and a relentless drive to make AI work for people, not the other way around.

In conclusion, Accrete AI’s brand story is a testament to how a bold idea can be executed with discipline to create a new kind of enterprise. It’s a story of a startup that “accreted” knowledge and capital step by step, and in doing so, built an AI platform that turns information overload into strategic insight. For investors, Accrete represents a company marrying revenue with vision; for customers, it offers cutting-edge solutions with proven impact; and for the broader tech community, it provides a compelling example of dual-use innovation in action. As the data age continues to accelerate, Accrete AI appears well-prepared to author the next chapters of its story – ones in which autonomous AI agents become indispensable partners in both boardrooms and command centers around the world.

Also Read: Rudderstack – Founders, Business Model, Funding & Competitors

To read more content like this, subscribe to our newsletter