LinearB is a software delivery intelligence and engineering analytics platform that empowers software development teams to improve their operational efficiency and align engineering work with broader business goals.

Founded in 2018, the company has rapidly emerged as a leader in the nascent field of software delivery management, offering tools that give engineering leaders visibility into their teams’ workflows and productivity, while also providing actionable insights to drive continuous improvement.

With headquarters in both Los Angeles, USA and Tel Aviv, Israel, LinearB serves a global client base and has seen swift adoption – growing from its early customer base to thousands of development teams worldwide within just a few years.

Backed by prominent venture capital investors and armed with a data-driven approach to engineering performance, LinearB’s story is one of identifying a critical gap in software team management and building a solution that addresses the dual mandate of improving the development pipeline and demonstrating engineering’s impact on business outcomes.

Founding Story of LinearB

LinearB’s origin can be traced to the experiences of its co-founders, Ori Keren and Dan Lines, in the early 2010s. The pair first met as engineering leaders at CloudLock, a cloud security startup founded in Israel.

At CloudLock, they helped scale the engineering organization through rapid growth and even saw the company through a successful $293 million acquisition by Cisco in 2016.

However, during that high-growth journey they encountered what they later called the “software engineering leadership paradox” – they were accountable for building high-performance development teams, yet lacked effective tools and data to measure and improve team productivity and effectiveness.

Engineering decisions often relied on gut instinct rather than quantitative insight, an irony not lost on them given that software engineering is one of the most data-focused fields.

By 2018, Ori Keren (based in Tel Aviv) and Dan Lines (in Los Angeles) decided to solve this problem. They envisioned a platform that would give engineering managers the same kind of data-driven visibility into team performance that other business departments (like sales or finance) already enjoyed.

In April 2018, they officially founded LinearB, starting the company as a transatlantic collaboration – with Keren and Lines working 5,000 miles apart from day one.

This unusual remote co-founding setup presented challenges in coordination and communication. The founders later noted that the distance forced them to establish clear divisions of responsibility, well-defined handoff processes, and a culture of independence – habits that not only enabled the company to function across time zones, but also informed the product’s philosophy of improving team workflows and efficiency through structured process and clarity.

LinearB’s initial product prototypes were simple but pointed to a big opportunity. Early on, the team delivered engineering metrics to pilot customers in PDF report form.

These rudimentary reports demonstrated the value of aggregating data from source control and project tools to glean insights on software delivery. The positive reception gave the founders confidence that organizations craved better visibility into development pipelines.

In January 2019, still in private beta, LinearB raised a $1.6 million seed round led by Israeli angel investor Ariel Maislos to build out the vision. With seed funding secured, LinearB evolved from PDF reports to a full SaaS platform that could connect to a team’s code repositories and project trackers in real-time.

The guiding mission remained clear: solve the problem “without data, you can’t manage or improve” in software engineering, by providing objective, actionable metrics that help teams continuously improve.

Founders of LinearB

Ori Keren (CEO) and Dan Lines (COO) are the dynamic duo behind LinearB’s creation. Both co-founders are seasoned engineering leaders with deep firsthand knowledge of the pain points in managing growing dev teams.

Ori Keren

Ori Keren spent his career in the Israeli tech scene, rising from software developer to VP of Engineering roles. Notably, he played leadership roles at companies that achieved significant exits – he helped guide one startup through a $121 million acquisition by AT&T and later, as VP Engineering at CloudLock, through the $293 million acquisition by Cisco.

These experiences gave Keren insight into scaling engineering organizations and the importance of aligning R&D output with business outcomes. At LinearB, Keren serves as CEO, driving the company’s vision of bridging the gap between engineering activities and business value.

Dan Lines

Dan Lines, LinearB’s COO, shares a parallel background. He served as a VP of Engineering alongside Keren at CloudLock and was instrumental in managing engineering operations during the company’s hyper-growth phase. Based in the United States, Lines has a strong product mindset – he has described himself as an engineer who always aspired to “create great products” rather than climb a management ladder for its own sake.

Lines hosts the “Dev Interrupted” podcast (a community initiative by LinearB) and is often the public voice discussing engineering productivity trends.

Together, Keren and Lines exemplify the hacker-hustler founding team: two engineers-turned-executives who identified a gap through personal pain, and leveraged their complementary skills (Keren’s strategic leadership and Lines’s operational acumen) to build a solution. Both founders have emphasized that their time at CloudLock directly inspired LinearB’s mission – at CloudLock they “often found themselves making engineering decisions based on intuition versus data,” an issue they vowed to fix via LinearB.

Business Model of LinearB

B2B software-as-a-service (SaaS)

LinearB operates a B2B software-as-a-service (SaaS) business model focused on enterprise and mid-market software organizations. Its core offering is a cloud-based platform that development teams subscribe to in order to continuously monitor and improve their software delivery process.

The company initially employed a product-led growth strategy: engineering leaders or team managers could self-serve by connecting LinearB to their Git repositories and project management tools, get immediate insights, and later upgrade for more features or seats as needed.

This low-friction onboarding – signing in with GitHub or GitLab and integrating Jira and Slack in minutes – meant small teams could start using the product quickly, demonstrating value without a heavy upfront sales process.

LinearB offered a free tier in its early years, allowing smaller teams to use basic features at no cost, which helped drive adoption and word-of-mouth in the engineering community. As teams grew or desired more advanced capabilities, they would convert to paid plans – a classic freemium-to-subscription conversion funnel.

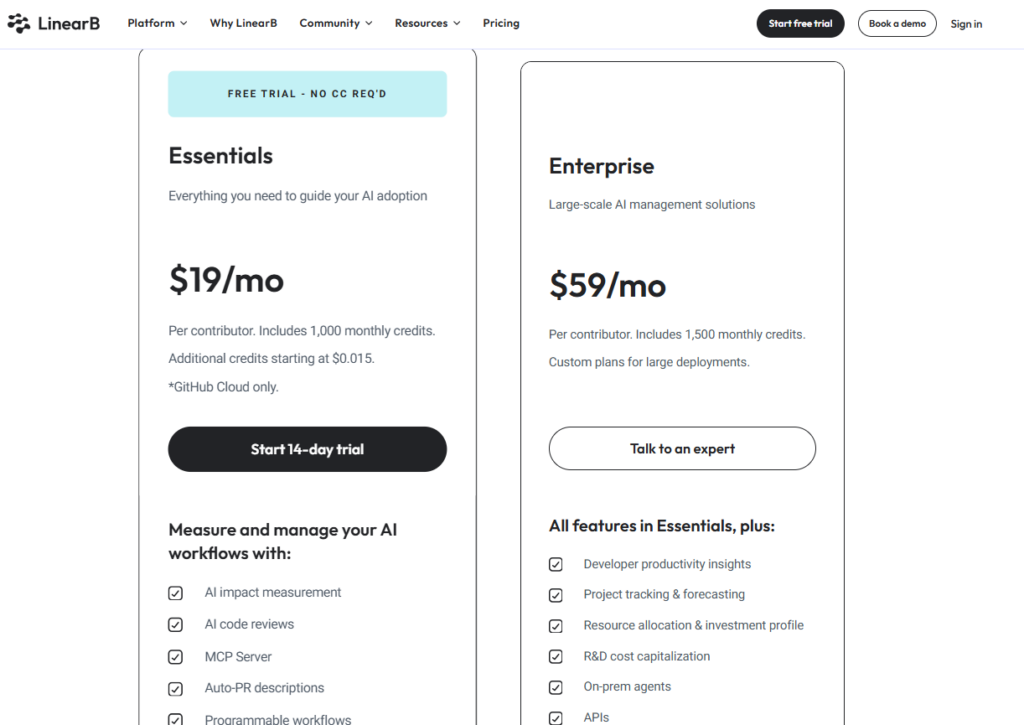

Today, LinearB’s revenue comes primarily from subscription licensing fees for its platform. The company packages its product into tiers that scale by features and team size.

For example, as of 2024 LinearB advertises an “Essentials” plan at around $19 per developer per month and an “Enterprise” plan at about $59 per developer per month, with the higher tier unlocking advanced analytics, integrations, and on-premise deployment options.

Under these subscription plans, customers receive access to the full SaaS platform and support, typically billed annually per user seat. The platform’s usage of AI-driven features (such as AI code review) is metered via a credit system, but each plan includes a generous allotment of credits, ensuring that the primary revenue model remains seat-based licensing.

Enterprise Sales and Customer Success

LinearB’s business model also involves an element of enterprise sales and customer success for larger accounts.

While small teams can start on their own, many larger engineering organizations engage with LinearB through pilots and value assessments, often aided by LinearB’s solution architects.

The goal is to demonstrate measurable improvements in key metrics (like faster cycle times or higher deployment frequency) which justify the subscription cost. Because LinearB’s value proposition ties directly to efficiency gains and business impact, customers often view it as an investment in optimizing R&D spend.

The company further supports its business model with community-building and thought leadership – for instance, the Dev Interrupted community (podcasts, forums) and published Engineering Benchmarks Reports draw engineering leaders into LinearB’s orbit, indirectly feeding the sales pipeline by establishing the brand as a go-to resource for improving dev team performance.

Revenue Streams of LinearB

LinearB’s revenue streams are relatively straightforward, driven almost entirely by its SaaS product subscriptions. Key revenue components include:

Subscription Licenses

This is the primary revenue stream. Organizations pay subscription fees (monthly or annual) per developer or per engineering contributor using the platform. Different tiers (Essentials vs. Enterprise) command different price points, as noted above, with Enterprise subscriptions generating higher Average Revenue per User (ARPU) by offering advanced capabilities and custom support.

In larger enterprises, contracts may be tailored (e.g. volume discounts or enterprise-wide flat fees), but fundamentally the model scales with the number of developers a customer has on LinearB.

Premium Features and Add-Ons

Certain features, especially those introduced more recently involving AI, can drive upsells. For instance, LinearB’s AI-driven code review and automation capabilities consume credits when used heavily.

While the base subscription includes some credit allotment, heavy usage (e.g. very large teams automating thousands of pull requests) might require purchasing additional credits or a higher tier plan.

This effectively ties usage intensity to revenue – if a customer derives a lot of value (through extensive automation), they may pay more. That said, LinearB’s pricing is designed to bundle most functionality into the main subscription; add-on revenue is a smaller piece relative to seat licenses.

Services (Minor Stream)

Unlike some enterprise software companies, LinearB does not focus on professional services as a major revenue driver; however, it does offer training, onboarding assistance, and occasional workshops (for example, free workshops on how to measure GenAI impact in code were offered with the launch of its AI features).

These are largely provided as value-add or marketing, not as separate paid services. In some enterprise deals, a level of custom support or hands-on implementation help might be factored into the contract, but generally the platform is designed for self-service configuration.

Community and Content (Indirect)

LinearB invests in community content (blogs, podcasts, reports) which do not generate revenue by themselves but support the brand and product adoption. For example, the company’s annual Software Engineering Benchmarks Report is free but reinforces the importance of metrics (often using anonymized data aggregated from LinearB’s user base) and thus indirectly promotes the product.

Similarly, the Dev Interrupted podcast boosts brand awareness among engineering leaders. These initiatives strengthen LinearB’s market presence, leading to future revenue rather than immediate income.

In summary, LinearB’s revenue is almost entirely recurring software subscription revenue, reflecting a classic SaaS model. As the customer base has scaled from early adopters to over 5,000 teams by 2022, this recurring revenue model has enabled LinearB to steadily grow its annual recurring revenue (ARR). While exact revenue figures are not publicly disclosed, the combination of a large user base and tiered per-user pricing suggests a healthy growth trajectory, particularly as customers expand usage (many start with one team and later roll out LinearB to multiple teams or departments after seeing initial success).

Funding and Funding Rounds of LinearB

LinearB’s journey has been marked by several successful funding rounds, reflecting investor confidence in the company’s vision and market traction. The table below summarizes LinearB’s funding history:

| Date | Round | Amount Raised | Key Investors |

|---|---|---|---|

| April 2018 (founding) | Pre-seed/Bootstrapping | Undisclosed (Development started) | Ori Keren & Dan Lines (founders) |

| Jan 2019 | Seed | $1.6 million | Ariel Maislos (lead angel) and other Israeli angel investors. |

| Mar 2021 | Series A | $16 million | Battery Ventures (lead), with 83North and others participating. This brought total funding to about $21M to date. |

| May 2022 | Series B | $50 million | Tribe Capital (lead); new investor Salesforce Ventures and existing backers Battery Ventures and 83North joined. Total funding reached ~$71M after this round. |

By the end of the Series B in 2022, LinearB had raised just over $70 million in total funding. The influx of capital in the Series B – a sizable $50M – was a strong endorsement, intended to fuel product development (such as expanding the platform’s automation and AI features), as well as growth in sales and marketing to capture more of the global market. Notably, Battery Ventures was an early champion of LinearB (leading the Series A) and has deep expertise in DevOps and developer tool startups, while Tribe Capital’s lead in Series B and Salesforce Ventures’ participation signaled both financial and strategic backing (Salesforce Ventures often invests in enterprise SaaS with synergies in the business software ecosystem). The presence of 83North (a well-known Israel-based VC) further anchored LinearB’s ties to the Israeli tech scene.

As of 2025, LinearB has not publicly announced a Series C or later round. The company appears to have leveraged its Series B proceeds to reach a growth stage that might set it up for a potential future round or other strategic moves. According to insights shared by Battery Ventures, by late 2023 LinearB’s total funding stood at over $75 million and the company was considered a promising “growth-stage developer tools” venture benefiting from the industry’s focus on productivity and AI tools in software engineering. If LinearB continues on its trajectory, additional fundraising (or even an eventual IPO or acquisition) could be possibilities on the horizon, but for now the $71M+ raised has provided ample runway for expansion.

Competitors of LinearB

LinearB operates in an increasingly active market for engineering productivity and software delivery analytics, and it faces competition from several companies addressing similar needs for development team insights. Some of the notable competitors and alternatives in this space include:

1) Jellyfish

Based in Boston, Jellyfish offers an “engineering management platform” that helps engineering leaders align engineering work with strategic business objectives. Like LinearB, it pulls data from sources like code repositories and project trackers to provide visibility into how teams spend their time.

Jellyfish emphasizes resource allocation and investment alignment – effectively showing where engineering effort is going – and has positioned itself for CIOs/CTOs who want to run engineering with business-level metrics. It raised significant funding (e.g. $31.5M in 2021) as the space gained traction.

2) Code Climate (Velocity)

Code Climate is a developer analytics pioneer that launched “Velocity” as its engineering performance dashboard. It focuses heavily on metrics around code commits, pull request sizes, review times, and individual developer statistics. Code Climate’s approach provides a plethora of charts and reports, but it is seen as providing “surface-level insights” with less workflow automation or business context integration.

For example, it can show which pull requests are large or slow, but it doesn’t automatically suggest or implement improvements. LinearB’s own comparisons note that Code Climate lacks robust resource forecasting and has limited integrations beyond basic GitHub and Jira connections. Still, Code Climate is an established tool and competes for teams that primarily want historical metrics and dashboards.

3) Pluralsight Flow (formerly GitPrime)

GitPrime was one of the first companies in this domain – an analytics dashboard for software teams – and was acquired by Pluralsight in 2019 for $170M, after which it was rebranded as Pluralsight Flow. Flow provides insights into commit frequency, code churn, impact of developers, and other productivity measures by analyzing Git data across the team.

It’s often used by engineering directors to identify patterns at individual and team levels. As part of Pluralsight (which is known for online developer training), Flow has an angle of correlating skills development with output. It is a strong competitor, especially for organizations already using Pluralsight’s suite, though its focus historically has been more on retrospective metrics and less on real-time process intervention.

4) Uplevel

Seattle-based Uplevel brands itself as an “engineering effectiveness” platform. It stands out by incorporating data not just from code repositories but also workplace tools like Slack, calendars, and project trackers to build a holistic picture of developer workload and potential burnout.

Uplevel tracks DORA metrics (Deployment Frequency, Lead Time, etc.) and also measures factors like deep work time vs. meeting time, aiming to improve both productivity and team well-being. This broader scope (including team dynamics and behavioral signals) differentiates Uplevel. In competitive terms, Uplevel and LinearB have some overlapping features around metrics, but LinearB has invested more in automation, whereas Uplevel focuses on analytics and alerts to managers about team health.

5) Waydev

Waydev is another engineering intelligence platform which focuses on tracking engineering performance through Git analytics. It offers insights similar to LinearB’s core metrics (DORA metrics, PR stats, etc.) and pitches itself as a tool to measure team performance and identify bottlenecks in delivery. Waydev gained some early traction with cost-sensitive customers as an alternative to GitPrime/Pluralsight, though it faced challenges (Waydev was involved in a 2020 controversy regarding misrepresentation of some code – an event beyond the scope of this analysis, but it affected its reputation). Despite that, it remains a competitor in the SMB segment for engineering analytics.

Other Alternatives

There are several other players in the ecosystem. Allstacks, for example, focuses on predictive analytics and risk management in software projects (forecasting delivery risks from engineering data). Hatica and Swarmia offer developer productivity dashboards and have gained users in agile startup teams – Swarmia (from Finland) emphasizes healthy team practices and WIP limits, integrating tightly with GitHub and Jira. Propelo (formerly AIops) and Faros are platforms that, like LinearB, integrate across many tools to provide a single pane of glass for engineering operations, with Faros even open-sourcing parts of its platform. Even big players like GitLab and Atlassian (Jira) have started adding analytics features (e.g., Jira’s Accelerators or GitLab’s Value Stream Analytics), although these are not as comprehensive as dedicated platforms like LinearB.

It’s worth noting that the market is relatively young and evolving. LinearB’s main competitors differentiate along lines of depth vs. breadth of insights, degree of automation, and focus on team vs. individual metrics. Despite the competition, LinearB has carved out a strong position, often shortlisted by engineering leadership teams evaluating solutions for improving dev workflow efficiency. The company’s ability to answer both engineering and executive needs (a point of differentiation) has helped it stand out in this competitive landscape.

Competitive Advantage

LinearB’s competitive edge comes from its product philosophy, data-first approach, and focus on real engineering problems. Several factors distinguish it from other engineering productivity platforms:

1. Dual Focus: Improvement + Business Communication

LinearB solves both sides of an engineering leader’s mandate: improving internal development workflows and translating engineering impact into business terms. The platform not only surfaces metrics but also shows how they affect ROI, delivery capacity, and strategic initiatives. While many competitors specialize in either internal metrics or high-level reporting, LinearB combines both in one unified system.

2. Actionable Insights & Automation (Not Just Dashboards)

Unlike tools that stop at visualization, LinearB embeds automation. WorkerB delivers real-time alerts and developer nudges through Slack/Teams, while gitStream automates code-review workflows like routing PRs or merging low-risk changes. These features reduce bottlenecks, speed up cycle time, and remove manual overhead. This “insights + automation” model gives managers ready-made solutions instead of leaving them to interpret charts on their own.

3. Fast Setup & Quick Time-to-Value

LinearB is designed for rapid adoption. Teams can connect Git, Jira, and chat tools within minutes and instantly receive meaningful insights. The system auto-detects inconsistencies — like outdated Jira statuses — and fixes them automatically. This plug-and-play setup shortens time-to-value compared to competitors that require heavy configuration or tuning.

4. Developer-Friendly, Not Surveillance-Based

LinearB avoids individual tracking metrics and focuses on team-level process health. It highlights workflow gaps (e.g., long PR pickup times) instead of measuring lines of code or output per developer. This people-first philosophy builds developer trust and differentiates LinearB from older, surveillance-like tools that were often rejected by engineering teams.

5. Benchmarking Power From Large-Scale Data

With thousands of teams on its platform, LinearB maintains one of the most robust datasets on software delivery performance. This powers its industry benchmarks — enabling teams to compare their metrics against global percentiles. This scale-driven data advantage strengthens the platform’s insights in ways smaller competitors cannot match.

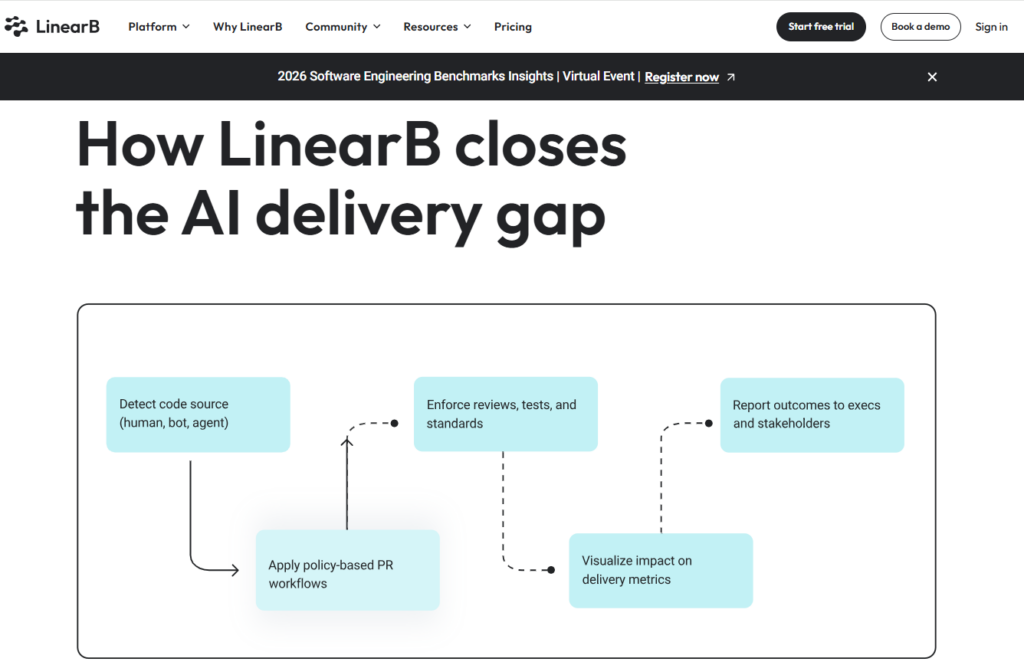

6. Rapid Innovation in AI & Automation

LinearB consistently expands its capabilities with AI-driven features. Recent additions include AI Code Review (which flags risks or quality issues automatically) and analytics that measure the ROI of generative AI coding tools. By positioning itself as an “AI productivity platform,” LinearB stays ahead of emerging engineering needs and trends.

LinearB differentiates itself by combining metrics, automation, AI-driven insights, benchmarking, and business alignment into one cohesive platform. Instead of just highlighting problems, it enables engineering teams to identify, act, and improve in real time — a holistic approach few competitors match.

Products and Services of LinearB

LinearB has grown into a full software delivery management platform that enhances visibility, automation, and alignment across the engineering lifecycle. Delivered as a SaaS application with deep tool integrations, it covers several key areas:

1. Engineering Metrics Dashboard

LinearB offers a unified dashboard with essential engineering and DevOps metrics such as DORA (Lead Time, Deployment Frequency, MTTR, CFR) and workflow insights like PR size, review time, and cycle time.

The dashboards are interactive — managers can drill down into repos, teams, or PRs to pinpoint bottlenecks. Data is correlated across Git, project trackers, and CI/CD tools, helping teams spot issues like long review delays, frequent rework, or stalled sprints.

2. Workflow Automation (gitStream)

GitStream is LinearB’s workflow automation engine that applies rules to every pull request. Teams can automate reviewer assignment, auto-merge safe changes, apply labels, or flag large/idle PRs — all through simple YAML rules.

Offered free and open source, gitStream operationalizes insights: if metrics show large PRs cause delays, automation can enforce policies to improve flow without manual oversight.

3. WorkerB Developer Bot

WorkerB brings insights directly into Slack or Microsoft Teams. It alerts developers when PRs are idle, sends reminders, highlights daily goals, and encourages healthier habits.

Instead of requiring developers to check dashboards, WorkerB surfaces the right information in real time, improving collaboration and reducing context switching.

4. Embedded Automation Insights

LinearB pairs visibility with action by showing how many PRs have been auto-processed and recommending new automation opportunities.

Policies like auto-approving Dependabot updates or flagging large PRs appear with counts, showing users exactly how automation is improving throughput.

5. Project & Portfolio Management

The platform includes project tracking views that combine tasks and repositories into initiative-level progress. Burn-up charts, risk alerts, and forecasts help managers understand delivery timelines.

Resource Allocation dashboards show how engineering time is split across features, maintenance, tech debt, or product lines—helping leaders connect engineering work to business priorities.

6. Executive Reporting & ROI

LinearB supports leadership reporting with audit-ready KPIs, improvement tracking, and ROI calculations.

For example, reductions in cycle time can be translated into engineering hours saved, enabling CTOs to demonstrate measurable value. Security and compliance workflows are also supported for regulated environments.

7. AI-Powered Capabilities

LinearB incorporates AI to enhance code quality and measure productivity:

- AI Code Review scans PRs for bugs, vulnerabilities, and risky patterns.

- AI Impact Measurement tracks how generative coding tools (like Copilot) contribute to code changes and productivity.

These features help teams quantify and improve the impact of AI in their development processes.

8. Benchmarks & Research Content

With data from thousands of teams, LinearB offers in-app benchmarking so organizations can compare their performance to industry peers.

It also provides best-practice guides and research reports, positioning itself as both a tool and a continuous-improvement resource.

9. Deployment Models & Services

LinearB is offered as a cloud-based platform but supports hybrid setups where sensitive code data remains on-premises.

The company provides onboarding support, best-practices guidance, customer success programs, and an active community (Dev Interrupted) to help teams accelerate value.

LinearB delivers an end-to-end engineering efficiency platform — from developer workflow automation and team metrics to executive-level reporting and AI-powered insights. Its focus on visibility + action makes it a central tool for teams aiming to improve software delivery performance.

Conclusion

LinearB’s journey — from two engineers frustrated by the lack of visibility in their teams to the creators of a platform used by thousands — is a modern example of solving a real business problem with data. Founded in 2018, the company evolved from sending simple PDF reports to becoming a leading software delivery management platform. Throughout its growth, LinearB stayed rooted in customer-centricity, data-driven decision-making, and continuous innovation, especially in workflow automation and AI. These values resonated with engineering leaders who must both improve delivery performance and communicate engineering’s business impact.

LinearB used venture funding strategically to capture early momentum in a fast-growing category. Its SaaS subscription model, supported by community-driven and freemium tools like gitStream, accelerated adoption. By embracing automation early and focusing on both engineering workflow improvement and business alignment, LinearB created a strong competitive moat. Its rapid user growth, repeatable product value, and customer base — including companies like Bumble and Drata — highlight its strong market traction.

By 2025, LinearB is positioned at the convergence of major industry shifts:

- Digital transformation, making every company a software company

- Remote and distributed work, increasing the need for async visibility and workflow automation

- AI-driven development, creating both productivity gains and the need to measure them

These macro trends create strong tailwinds for the platform. Investors and industry observers note that growing R&D complexity, fueled by AI and larger teams, makes tools like LinearB essential for maintaining engineering efficiency.

LinearB’s future opportunities lie in doubling down on innovation — from deeper predictive analytics to adjacent areas like AI productivity measurement or developer enablement. Its challenge will be to maintain its edge in an increasingly competitive space while continuing to solve emerging engineering workflow challenges.

Also Read: Accrete AI – Founders, Business Model, Funding & Competitors

To read more content like this, subscribe to our newsletter