ArmorCode is a Palo Alto–based cybersecurity startup founded in 2020, offering an AI-powered platform for unified vulnerability and exposure management across software applications, infrastructure, and cloud environments. Its mission is to “democratize and simplify software security,” tackling the challenge that modern DevOps pipelines often release code faster than security teams can vet.

The platform consolidates findings from disparate security scanners into a single dashboard, enabling enterprises to visualize, prioritize and remediate software risks up to 10× faster. In a landscape of accelerating digital transformation and surging cyber threats, ArmorCode positions itself as an independent “control plane” for application and infrastructure security.

By late 2023, the company had raised $65 million, reflecting strong investor confidence in its rapid growth and innovative approach.

Founding Story of ArmorCode

ArmorCode was founded in July 2020 at the height of the COVID-19 pandemic, motivated by two converging trends: the acceleration of digital transformation and the lagging maturity of software security.

Co-founder and CEO Nikhil Gupta observed that organizations were deploying software multiple times a day, often using 80% or more open-source components, yet security tools remained fragmented.

To validate this, Gupta interviewed over 200 security leaders, who unanimously said the industry needed “not yet another scanner” but a unified, vendor-neutral platform that could ingest any security scanner’s output and highlight only the most critical issues.

In response, ArmorCode’s founding team designed a platform that integrates AppSec and infrastructure vulnerability data, correlating findings across cloud, containers, and supply chains to give a holistic view of software risk.

The idea was to break down silos between development, security and operations by automating risk-based prioritization and remediation workflows. This founding vision is encapsulated in the company motto of bringing “application security and infrastructure vulnerability management together” in a single system.

Founders of ArmorCode

ArmorCode was built by a team of seasoned cybersecurity veterans.

The CEO and primary founder is Nikhil Gupta, previously CEO and co-founder of Avid Secure (acquired by Sophos in 2019). Gupta also co-launched The Purple Book Community, a network of software security leaders, signaling his deep ties to the AppSec community.

Other key leaders include Mark Lambert, Chief Product Officer, who leads technology strategy; Karthik Swarnam, Chief Security and Trust Officer; Jon Skoglund, CFO; and Jeff Skeldon, VP of Worldwide Sales.

Together, this core team combines software engineering pedigree (Gupta’s early career included work at Bell Labs) with cybersecurity expertise.

The Board of Directors and advisors features prominent industry figures (e.g. Barmak Meftah of Ballistic Ventures, Corey Mulloy of HighlandX, Mark Fernandes of Sierra Ventures, and ex-AT&T executive John Donovan), reflecting broad support from security investors and thought leaders.

The founders’ background in both product security and venture capital (through their networks) has been instrumental in setting the company’s strategic direction.

Business Model of ArmorCode

ArmorCode operates a subscription-based SaaS business model, selling its platform primarily to large enterprises.

The core offering is its Unified Exposure Management platform (often termed Application Security Posture Management, ASPM) which is delivered via a cloud service or on-premises appliance.

Customers typically pay annual recurring fees based on usage or seat count. A distinctive feature of ArmorCode’s go-to-market strategy is a “channel-first” approach.

Rather than relying solely on direct sales, ArmorCode partners with value-added resellers (VARs), global system integrators (GSIs), advisory firms and managed security providers to reach customers worldwide.

The company explicitly aims to channel 100% of its deals through partners, and plans for 30–40% of leads to originate via the channel by 2025. For example, its partner network includes cybersecurity firms like GuidePoint Security, Optiv, SHI, and WWT, as well as technology alliances with AWS, ServiceNow and CrowdStrike (the platform is available on their marketplaces).

This partner-centric sales model enables ArmorCode to scale globally, addressing both U.S. and international markets (with explicit plans to expand European presence).

In addition to subscription revenue, the business model is complemented by professional services: ArmorCode supports implementation and customization through its partners, and has even created a certification program (ASPM Certified Professional) to train partner engineers.

Overall, ArmorCode’s value proposition is to deliver enterprise-grade security capabilities without forcing customers into additional point tools – instead, it “unifies” the existing security stack under a single dashboard.

Revenue Streams of ArmorCode

ArmorCode’s revenues are driven principally by recurring software subscriptions.

Large enterprises pay annual or multi-year licenses for access to the platform, which includes all integrated modules (ASPM, vulnerability management, compliance, etc.).

According to the company, this subscription model has delivered rapid growth: annual recurring revenue grew ~400% year-over-year, with a net revenue retention rate of 130%. In practical terms, these metrics suggest that not only are customers expanding their usage (adding more assets and modules), but also that churn is low.

In addition to core subscriptions, ArmorCode derives revenue from professional services and training. These include onboarding and customization projects, as well as fees for the ArmorCode Certified Professional (ACP) certification program offered to channel partner engineers and customers.

Finally, because ArmorCode’s product touches compliance, it potentially benefits when customers budget for risk management and regulatory compliance solutions – although specific revenue splits are not public.

The combination of SaaS subscription fees, services engagements, and training/certification fees constitutes ArmorCode’s revenue mix, typical of enterprise cybersecurity platforms. (All financial figures are private; no revenue totals have been disclosed by the company.)

Funding and Funding Rounds of ArmorCode

ArmorCode has completed several funding rounds since its founding, raising a total of $65 million by late 2023. The key rounds are summarized below:

| Date | Round | Amount ($M) | Lead Investors | Notes |

|---|---|---|---|---|

| Jan 2022 | Seed | 8.0 | Ballistic Ventures, Sierra Ventures, Cervin | Early round to launch platform development |

| Nov 16, 2022 | Series A | 14.0 | Ballistic Ventures (lead), Sierra, Cervin | Total raised now $25M; led by Ballistic Ventures |

| Dec 4, 2023 | Series B | 40.0 | HighlandX (lead), Ballistic, NGP, Sierra, Cervin, Nokia GP | Brings total to $65M; pre-emptive round led by Qualcomm spinout |

Each funding round enabled significant growth.

The Series A (Nov 2022) of $14M was led by Ballistic Ventures (a firm founded by cybersecurity luminaries including Kevin Mandia and Barmak Meftah). Including an $8M seed round in January 2022, ArmorCode had raised $25M by that date.

The Series B (December 2023) raised $40M and was led by HighlandX (a venture arm created by Qualcomm veterans) with participation from all existing investors plus Nokia Growth Partners. The Series B was described as “preemptive,” meaning ArmorCode had strong momentum and could choose to raise more than needed to accelerate expansion.

Funds have been earmarked for hiring (targeting ~30% headcount growth), product development (adding AI and software supply chain capabilities), and international go-to-market efforts (especially Europe).

Competitors of ArmorCode

ArmorCode operates in a competitive landscape that includes both traditional vulnerability management vendors and newer AppSec posture platforms. Key competitors and alternatives are summarized below:

| Competitor | Category/Focus | Notes (Key Differentiator) |

|---|---|---|

| Wiz | Cloud Security (CNAPP) | Provides a cloud-native application protection platform (CNAPP) that consolidates CSPM, CWPP, container security, IaC scanning, etc. Strong in cloud infra, where ArmorCode takes a vendor-neutral approach across on-prem and cloud. |

| Tenable (Nessus) | Vulnerability Management | Industry-leading VM/scanning solution for networks, web apps and cloud. Focuses on detecting vulnerabilities; lacks ArmorCode’s integrated AppSec posture management and AI-driven prioritization. |

| Palo Alto Cortex XSIAM | Extended Security (XDR/SIEM) | Next-gen security operations and analytics platform (combining SIEM, SOAR, XDR) that includes scanner integration. Broad security scope, whereas ArmorCode focuses specifically on application and infrastructure vulnerability context. |

| CloudBees | DevSecOps CI/CD Platform | CI/CD and DevOps automation platform (including code security). Competes indirectly by enabling security earlier in the pipeline. ArmorCode instead orchestrates triage and remediation of vulnerabilities. |

| Legit Security | Application Security Posture Mgmt | ASPM-focused startup. Offers a platform to find and prioritize application-layer vulnerabilities. Similar space to ArmorCode’s ASPM module, but with different analytics and workflow. |

| Snyk | Developer Security Platform | Focuses on automated scanning of code, containers and IaC. Strong at developer integration. ArmorCode complements such tools by aggregating outputs and adding AI context, rather than scanning itself. |

| GitLab | DevSecOps Platform | Developer platform with built-in code scanning and compliance tools. While GitLab covers many DevSecOps use cases, ArmorCode’s platform is independent and can ingest findings from GitLab and other scanners for unified analysis. |

These competitors range from broad security suites (e.g. Palo Alto) to point solutions. According to market reviews, ArmorCode’s top alternatives include Wiz, Tenable, CloudBees, Palo Alto Cortex XSIAM and others. TechCrunch notes niche players like Legit Security and ProjectDiscovery in the ASPM space. In general, ArmorCode differentiates itself by providing a vendor-neutral “single pane of glass” for both application and infrastructure security, whereas many competitors focus on one domain or require lock-in to specific tools.

Competitive Advantage of ArmorCode

ArmorCode’s competitive edge stems from its unified, context-driven approach and fast growth traction. Key differentiators include:

-

Unified Exposure Management (UEM): ArmorCode was an early mover in combining Application Security Posture Management with traditional vulnerability management. Its platform correlates data from applications, infrastructure, cloud and supply chain under one roof. As CEO Nikhil Gupta notes, unlike vendors that force teams into a specific scanner, ArmorCode is “vendor-neutral”, working with any security tool to aggregate findings at enterprise scale. This integration-first stance means customers don’t have to rip-and-replace existing security tools, but instead get a meta-layer of analysis.

-

AI-Powered Contextualization: ArmorCode’s investment in AI (its agent named “Anya”) is a core advantage. The AI Code Insights feature (launched June 2025) uses machine learning to analyze code repositories, identify hidden assets, and trace vulnerabilities back to specific developers. This contextual intelligence dramatically improves risk prioritization: security teams can see “what is being built, who is building it, and the impact of code changes”. By enriching vulnerability data with code context, ArmorCode reduces noise and speeds up remediation – an ability that purely signature-based or siloed scanners lack.

-

High Growth and Customer Metrics: ArmorCode’s rapid revenue growth signals strong product-market fit. The company reports ~400% year-over-year ARR growth and an industry-best net retention of 130%, indicating very satisfied customers (mostly large enterprises, including “several Fortune 500”). Dozens of Fortune 1000 companies use the platform (for trillions of dollars in assets) and it has processed over 25 billion findings from more than 285 different security tools. Such scale (“10x faster remediation”, “10 billion findings processed” etc.) underpins customer trust. These performance claims are independently recognized – for example, ArmorCode was named a “Leader” in the 2025 IDC MarketScape for ASPM and appeared twice on Fortune’s Cyber 60 list.

-

Channel Ecosystem and Certification: ArmorCode’s 100%-channel strategy is relatively unique. By deeply engaging VARs, GSIs and technology partners, it gains broader market reach and expert implementation resources. The launch of the ArmorCode Certified Professional (ACP) program also ensures that partners and customers have in-depth expertise. These elements, plus strategic collaborations (e.g. integration with CrowdStrike and Microsoft security feeds), create a “lock-in” effect: once deeply integrated, customers find it hard to switch to point products.

-

Vendor and Platform Independence: As one executive summed up, ArmorCode is “powerfully positioned as the independent governance and risk management platform” that allows customers to choose best-of-breed tools without vendor lock-in. This contrasts with competitors who try to lock customers into their own scanning engines or cloud ecosystems. For enterprises with diverse environments (multi-cloud, mixed on-prem/cloud, DevOps pipelines, etc.), the ability to mix and match scanning tools while having a consistent dashboard is compelling.

Products and Services of ArmorCode

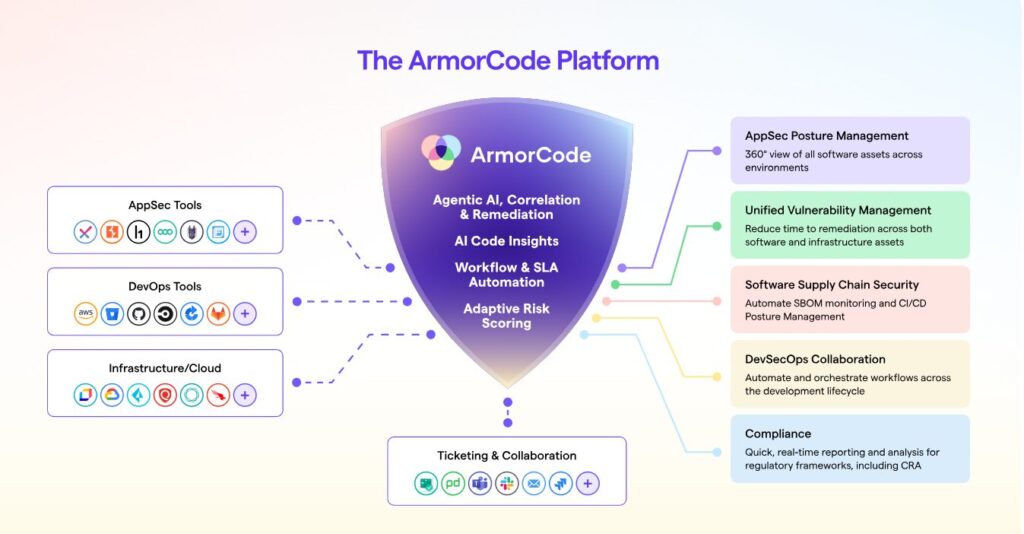

ArmorCode’s product suite revolves around its cloud-native platform, with key modules summarized below:

-

Unified Exposure Management Platform (UEP): The core platform provides Application Security Posture Management (ASPM) and Risk-Based Vulnerability Management (RBVM) in one interface. It ingests vulnerabilities from all scanners (static code analysis, SAST, IAST, SCA, container scanners, cloud posture tools, etc.) and normalizes them. It then correlates these findings with business context (application ownership, business impact, compliance frameworks) and threat intelligence. The outcome is prioritized dashboards tailored to roles (CISO, AppSec lead, InfraSec lead). Under the hood, ArmorCode uses adaptive risk scoring to surface the most critical issues across apps, infrastructure, cloud and supply chain. For example, the platform can highlight an OWASP-critical flaw that exists in a high-revenue app and show exactly who can fix it.

-

AI Code Insights (launched June 2025): This new module leverages ArmorCode’s AI agent “Anya” to analyze code repositories in depth. It provides unprecedented visibility into “what’s in the code”: languages used, cryptography, embedded AI libraries, sensitive data etc., as well as the developers responsible. It automatically discovers hidden assets (e.g. undocumented containers or APIs declared in code) and flags material code changes that could introduce risk (impacting compliance requirements). By linking runtime alerts (from tools like CrowdStrike Falcon and Microsoft Defender) back to source-code changes and owners, the module enables “end-to-end lineage” of findings. In short, AI Code Insights transforms the codebase from a blind spot into an interactive security sensor.

-

Software Supply Chain Security: ArmorCode includes specialized scanning for third-party components and CI/CD pipelines. It ingests data about open-source dependencies, container images, and package registries to find vulnerabilities before they reach production. Coupled with DevSecOps orchestration, it helps teams enforce continuous compliance (SOC2, FedRAMP, OWASP Top 10, etc.) as new code is merged.

-

DevSecOps Orchestration: The platform automates workflow integration with development tools. It syncs with popular issue trackers and ticketing systems, so that high-priority findings are auto-assigned to the right engineer (including via the new ACP-trained partner network). It also provides bi-directional integrations (e.g. to ServiceNow and CI/CD pipelines) to streamline remediation. This emphasis on actionable workflows is a hallmark feature – ArmorCode claims most customers see remediation times accelerate by an order of magnitude once policies are in place.

-

Compliance and Reporting: ArmorCode offers pre-built compliance templates and continuous monitoring for frameworks like PCI, NIST, ISO, GDPR, etc. The system continuously assesses posture against these standards and can auto-generate audit reports. This is increasingly valuable as companies face new regulations (e.g. the U.S. Cybersecurity Maturity Model Certification, CMMC, and the EU’s NIS2 directive). ArmorCode’s “unified compliance” capability means that addressing a vulnerability can simultaneously tick multiple regulatory checkboxes, reducing duplicate effort.

-

Training & Certification (ArmorCode ACP): In March 2025, ArmorCode introduced the industry’s first ASPM Certified Professional program. This service offers partner engineers and customer teams official training and certification on ArmorCode’s platform and best practices. It serves both as a revenue stream and a competitive moat (by ensuring skilled personnel who prefer ArmorCode’s approach).

The table below summarizes key ArmorCode offerings:

| Offering | Description | Introduced |

|---|---|---|

| Unified Exposure Management Platform | Central SaaS platform (ASPM + UVM + RBVM). Consolidates all vulnerability data (apps, infra, cloud) into role-specific dashboards. Vendor-neutral integration with 285+ tools. | 2021 (general launch) |

| AI Code Insights | AI-driven module (agent Anya) for code repository analysis. Provides deep context (“who, what, how”) by correlating code changes with security findings. | June 2025 |

| Software Supply Chain Security | Scans open-source dependencies, container images and pipelines to detect supply-chain risks. Reveals hidden containers/API in code. | 2023 |

| DevSecOps & Compliance Automation | Workflow orchestration for DevOps integration, continuous compliance (SOC2, FedRAMP, NIST, etc.), and reporting. Multi-framework reporting and triage automation. | 2022 |

| ArmorCode Certified Professional | Training and certification program for channel partners and customers. Validates skills in deploying ArmorCode ASPM solutions. | March 2025 |

Competitor Comparison: To place ArmorCode in context, the table below compares it to several notable competitors in key dimensions:

| Competitor | Category | Key Difference from ArmorCode |

|---|---|---|

| Wiz | Cloud Security (CNAPP) | Cloud-native platform (CSPM, CWPP, IaC scanning in one). Strong at cloud posture, container scans. ArmorCode covers cloud plus on-premises and emphasizes multi-vendor integration. |

| Tenable (Nessus) | Vulnerability Management | Leader in vulnerability scanning for networks, apps, cloud. Nessus provides raw scan results; lacks ArmorCode’s unified correlation and AI context for prioritization. |

| Palo Alto Cortex XSIAM | XDR/SOAR (Extended Security) | Security operations platform combining SIEM, XDR and analytics. Focus is broad security telemetry. ArmorCode focuses specifically on software/app exposure and risk scoring across development pipeline. |

| CloudBees | DevSecOps/CI/CD | DevOps automation with code quality and security features. Integrates with Jenkins pipelines. ArmorCode integrates with CI/CD but its core is vulnerability aggregation, not CI orchestration. |

| Legit Security | Application Security Posture Management | ASPM platform (application-layer focus) similar category. Legit offers risk-based prioritization for code vulnerabilities. ArmorCode complements with infrastructure context and a larger ecosystem of scanner integrations. |

| Snyk | Developer Security | Automated scanning of code, containers, dependencies. Very dev-centric. ArmorCode does not scan itself but ingests Snyk findings and adds enterprise reporting and AI context. |

| GitLab | Integrated DevSecOps | Provides SCM, CI/CD, and built-in code scanning. Integrated developer workflow. ArmorCode is standalone and can incorporate GitLab’s scanners into its unified dashboard. |

These comparisons (based on market analyses and reviews) highlight that while overlaps exist, ArmorCode’s USP is the combination of cross-domain integration and AI-driven prioritization in a vendor-agnostic platform. In particular, where many security products target a single layer (e.g. cloud, code or networks), ArmorCode spans all layers for end-to-end visibility.

Conclusion

In summary, ArmorCode has rapidly emerged as an innovative player in enterprise security. Founded to address the pent-up need for cohesive software security, the startup has achieved impressive traction: hundreds of large customers, strong growth metrics, and high-profile industry accolades (e.g. IDC ASPM Leader, Fortune Cyber 60 honoree). Its Unified Exposure Management platform and recent AI Code Insights module exemplify a modern approach to DevSecOps: leveraging AI to reduce noise and guiding teams to fix the most critical software vulnerabilities first. Coupled with a channel-centric global sales strategy, ArmorCode is scaling beyond the U.S. into Europe and other markets. As organizations worldwide grapple with rapidly changing software supply chains and new regulations, ArmorCode’s independent, context-rich solution positions it to continue growing. Going forward, the company’s challenge will be sustaining innovation against deep-pocketed incumbents. However, its strong investor backing, expert team, and clear product vision suggest that ArmorCode is well-equipped to maintain its competitive edge.

Also Read: Accrete AI – Founders, Business Model, Funding & Competitors

To read more content like this, subscribe to our newsletter