Placer.ai is a leading location analytics startup that provides insights into consumer foot traffic and physical location trends for businesses in retail, real estate, hospitality, and other sectors.

Founded in 2018 and headquartered in Los Altos, California (with R&D offices in Tel Aviv, Israel), Placer.ai has developed a platform that uses anonymized location data from tens of millions of mobile devices to show where, when, and how people move in the physical world.

These insights help companies make data-driven decisions on site selection, marketing, and operations by revealing patterns in visits, trade areas, and customer demographics. It counts a wide array of organizations among its clients – from commercial property firms like JLL and Regency Centers to retail brands like Planet Fitness and BJ’s Wholesale Club – all leveraging Placer’s data for strategic planning.

By 2024, Placer.ai has grown rapidly – reaching over 4,300 customers and a $100 million annual recurring revenue (ARR). Backed by substantial venture funding and valued at $1.5 billion as of 2024, Placer.ai has emerged as a prominent player in the proptech and retail analytics space globally, translating offline consumer behavior into actionable digital intelligence.

Founding Story of Placer.ai

Placer.ai’s origin story begins with a team of tech entrepreneurs in 2016 who recognized a major information gap in the offline world. Co-founder and CEO Noam Ben-Zvi recalls that the founding team “lived in the digital world” but saw an opportunity to apply big data to physical spaces.

Fascinated by emerging sources of mobility data from smartphones, they envisioned a company that could make sense of the physical world by tracking and analyzing real-world movement patterns.

Early validation came from a few forward-thinking partners – such as a California boardwalk, a Las Vegas casino operator, and a broker at CBRE – who agreed to pilot the concept.

With this initial support, the founders raised seed funding in 2017 and spent over a year in stealth mode refining their technology. They iterated on the accuracy of their location analytics platform by incorporating feedback from these early adopters.

By late 2018, the product had matured enough to launch publicly. Market timing was on their side: commercial real estate and retail firms were becoming “hungry for more up-to-date data” as traditional tools proved inadequate.

Placer.ai’s launch met this need, and adoption picked up quickly as word spread about its ability to illuminate foot traffic trends for virtually any location.

Founders of Placer.ai

Placer.ai was founded by four Israeli entrepreneurs – Noam Ben-Zvi (CEO), Oded Fossfeld (CTO), Ofir Lemel (CPO), and Zohar Bar-Yehuda (Data Scientist).

Together they brought expertise in big data, enterprise software, and analytics. Ben-Zvi is a serial entrepreneur guiding the company’s vision, Fossfeld oversees technology development, Lemel leads product strategy, and Bar-Yehuda heads data science.

This blend of skills proved critical for transforming massive location datasets into a simple, actionable product for end users. From the outset, the team also emphasized privacy compliance and anonymization in the platform’s design, which helped build early trust with enterprise clients.

Business Model of Placer.ai

Placer.ai operates on a Software-as-a-Service (SaaS) model centered on recurring subscriptions to its analytics platform. Clients pay annual or multi-year license fees for access to a cloud-based dashboard that delivers real-time and historical foot traffic data for millions of points of interest.

The company offers customized subscription packages tailored to client size and needs, but most plans provide unlimited location queries and user seats so that entire teams can leverage the insights without usage friction. This fixed-fee, all-you-can-analyze approach encourages broad adoption within client organizations.

Notably, Placer.ai does not monetize by selling ads or personal data – all revenue comes from providing analytical access to aggregated, anonymized data.

The platform ingests raw location signals (e.g. GPS pings) and applies proprietary algorithms to estimate visits, dwell times, and visitor profiles, but customers only see the insights rather than any individual device data. By selling intelligence rather than data itself, Placer.ai positions itself as a value-added analytics provider.

Subscriptions also include a dedicated Customer Success manager for support and training, ensuring that users can extract full value from the platform. This combination of rich data, user-friendly software, and included support has helped drive strong customer retention and referrals, fueling the company’s growth flywheel.

Revenue Streams of Placer.ai

Placer.ai’s revenues are generated primarily from its subscription services. The core revenue stream is enterprise SaaS subscriptions: large retailers, commercial real estate firms, municipalities, and financial services clients pay recurring fees (often annual contracts) to access the platform. This stream has grown rapidly, as reflected by the company’s ARR surpassing $100 million in 2024. The predictable, recurring nature of these subscriptions provides a stable foundation for the business.

Additionally, Placer.ai generates revenue from API/data feed licenses and data marketplace add-ons. For clients who need to integrate Placer.ai’s data into their own systems or analyses, the company offers API access and bulk data feeds for an extra charge. These allow programmatic retrieval of foot traffic metrics and are popular with hedge funds, real estate analysts, and other data-centric customers.

The Placer Data Marketplace offers optional datasets (for example, local vehicle traffic counts, neighborhood demographics, or weather impacts) that enterprise users can purchase to enrich the core foot traffic analytics. Selling these premium data add-ons increases the average contract value and deepens the insights available on the platform.

Placer.ai has deliberately avoided one-time report sales or short-term consulting projects, favoring the scalability of subscription income. By focusing on recurring revenue and upselling additional data capabilities to its installed base, the company roughly tripled its annual revenue within a two-year span (growing from about $30M to $100M+ ARR between 2022 and 2024).

Funding and Funding Rounds of Placer.ai

Since its inception, Placer.ai has attracted significant venture capital investment to fuel product development and expansion. Table 1 summarizes the company’s funding history.

Early seed rounds between 2016 and 2018 provided a few million dollars to build the initial product. The formal Series A in January 2020 raised $12 million, enabling expansion of sales and data capabilities.

This was followed by a $50 million Series B in April 2021, and a $100 million Series C in January 2022 that valued Placer.ai at about $1.0 billion (making it a “unicorn”).

Most recently, in August 2024 Placer.ai secured an additional $75 million (Series D), increasing its valuation to approximately $1.5 billion. Across all rounds, the company has raised over $240 million to date.

Table 1: Placer.ai Funding History

| Round | Date | Amount Raised | Post-Money Valuation | Lead Investors |

|---|---|---|---|---|

| Seed (Pre-Series A) | 2016–2018 | ~$4 million | N/A (seed stage) | Array Ventures, IrishAngels, Stage VP |

| Series A | Jan 2020 | $12 million | Not disclosed | JBV Capital, Aleph VC |

| Series B | Apr 2021 | $50 million | Not disclosed | Josh Buckley, Fifth Wall |

| Series C | Jan 2022 | $100 million | ~$1.0 billion | Josh Buckley, WndrCo |

| Series D | Aug 2024 | $75 million | ~$1.5 billion | Josh Buckley (existing investors) |

| Total | 2016–2024 | $240+ million | — | — |

This investor backing has included both tech-focused funds and real estate industry players. Notable backers such as Josh Buckley, WndrCo (Jeffrey Katzenberg’s fund), Fifth Wall, and MMC Ventures have not only provided capital but also strategic connections. The rapid escalation in valuation from 2020 to 2024 underscores the market’s confidence in Placer.ai’s trajectory. By late 2024, the company was well-capitalized to pursue product enhancements and international expansion.

Competitors of Placer.ai

In the location analytics arena, Placer.ai faces competition from several other players, each with a different focus. Notable competitors include SafeGraph, Foursquare, GroundTruth, and Near, among others. SafeGraph specializes in providing raw point-of-interest datasets and foot traffic counts for data science use; Foursquare (leveraging its check-in heritage) offers location intelligence and developer tools; GroundTruth integrates foot traffic analysis with a location-based advertising platform; and Near provides global mobile location data blended with other consumer datasets for audience insights.

Table 2 outlines how some of Placer.ai’s rivals compare in focus and features:

Table 2: Selected Placer.ai Competitors and Their Focus

| Competitor | Founded (HQ) | Core Focus | Notable Features |

|---|---|---|---|

| SafeGraph | 2016 (San Francisco) | POI & foot traffic data (raw datasets) | Extensive database of physical locations and visit counts for custom analysis. |

| Foursquare | 2009 (New York) | Location intelligence & APIs | Large first-party check-in data; visitor demographics and loyalty insights for brands. |

| GroundTruth | 2009 (New York) | Location-based ad tech + analytics | Ties foot traffic measurement to digital ad targeting and attribution. |

| Near | 2012 (Singapore) | Global consumer mobility data | Aggregates mobile location with transaction & social data; strong presence in APAC. |

Notably, there are also point solutions like in-store people counters (e.g. RetailNext sensors) and general BI platforms, but these lack either the market-wide scope or the location-specific intelligence that Placer.ai’s specialized platform provides. While each competitor brings unique strengths, Placer.ai’s key differentiator is its all-in-one platform that is purpose-built for business end-users.

Unlike some rivals that only provide data or require technical integration, Placer.ai offers a turnkey solution with an easy interface, nationwide coverage, and ready-made insights. This comprehensive approach, combined with strong customer support, gives Placer.ai an edge in winning clients who prefer a one-stop shop for location analytics.

Competitive Advantage of Placer.ai

Placer.ai has established a strong competitive advantage through several factors:

Comprehensive Data & Accuracy: The company aggregates dozens of data sources to offer unmatched coverage of foot traffic trends. Its models are continually calibrated with real-world feedback, resulting in highly accurate visit estimates for virtually any property. Competitors often lack either the breadth (e.g. limited to certain regions) or depth (limited metrics or validation) of data that Placer.ai provides.

Integrated Platform & Service: Placer.ai delivers a full-stack solution – not just data, but a user-friendly analytics platform and dedicated support. Clients get instant, self-serve insights via the dashboard, and a customer success team ensures they can interpret and act on the data. This reduces friction in adoption. By packaging data + software + service, Placer.ai creates more value for non-technical users compared to competitors that might require in-house analysts or multiple tools to derive insights.

Real-Time & Actionable Insights: The platform offers close to real-time analytics (with only a few days’ lag) and is increasingly adding predictive capabilities. This timeliness means businesses can respond quickly to emerging trends (e.g. a sudden drop in visits or a surge from a promotion). Investor Jeffrey Katzenberg noted that Placer.ai provides “instant, simple and actionable insights to questions we’ve been asking for over 30 years” – underlining how the product turns raw data into readily usable answers. In contrast, some competitors supply data that requires further analysis before yielding decisions.

Market Traction & Trust: As an early mover focused on retail and real estate needs, Placer.ai has built a large client base and strong brand recognition in those sectors. Thousands of professionals now rely on its metrics, creating a network effect where its foot-traffic benchmarks are becoming industry standards. The company’s strict adherence to privacy (only aggregated, anonymous data) also engenders trust. Clients and data partners see Placer.ai as a neutral, privacy-conscious provider, which gives it an advantage in an era of rising data regulations.

Products and Services of Placer.ai

Placer.ai’s offerings revolve around its location intelligence platform and related data services:

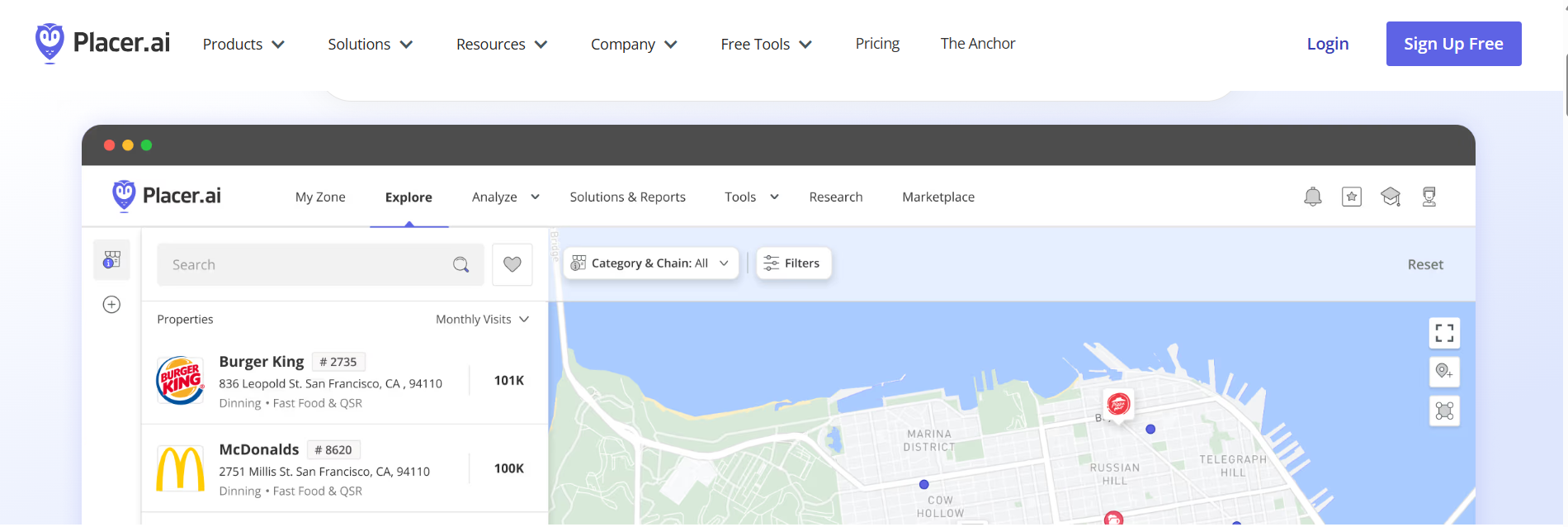

Analytics Dashboard: The flagship product is a cloud-based web platform where users can explore foot traffic analytics. It provides a rich set of metrics for any given place or retail chain – including visit counts over time, peak hours, repeat vs. new visitors, trade areas (where visitors come from), and comparisons to competitors or industry benchmarks. Results are displayed in interactive charts and maps, and users can easily generate reports to share. Over time, Placer.ai has expanded the dashboard to incorporate new layers of insight; by 2024, users could see not just foot traffic but also co-tenancy (which adjacent stores draw similar visitors), consumer demographics, and even external factors like nearby development projects that might impact a location. The emphasis is on making complex geospatial data accessible and actionable for business users without specialized expertise.

API and Data Integrations: For clients with advanced needs, Placer.ai offers a robust API and data integration options. The API allows developers to programmatically query Placer.ai’s database – for example, retrieving weekly visit totals for a list of store locations, or pulling the demographic profile of visitors to a particular mall. This is useful for companies that want to incorporate foot traffic data into their own analytical models or dashboards. Placer also provides bulk data exports for large-scale analysis (e.g. a hedge fund ingesting foot traffic trends for dozens of retail stocks into a predictive model). These technical offerings make Placer’s data more flexible and ensure that more data-driven clients can integrate location insights into their workflows.

Data Marketplace and Add-Ons: Within the platform, Placer.ai has a marketplace where users can access additional datasets to enrich their analysis. These include both Placer.ai’s own expanded data and third-party partner data. For instance, a user might overlay local crime statistics, weather events, or nearby vehicle traffic counts on top of foot traffic trends to get more context about a site’s performance. By 2023, the company was adding data like planned construction projects and purchase transactions to this marketplace. Customers can choose which add-ons to include, making the platform a customizable one-stop shop for location-based intelligence. This not only enhances the value of the insights but also provides an upsell channel for Placer.ai as clients seek deeper analysis.

Free Tools and Content: To broaden its reach, Placer.ai also offers a range of free tools and educational content. These include public dashboards (for example, nationwide retail recovery trackers), weekly newsletters and reports analyzing industry trends, and the Placer Academy learning center with how-to guides and case studies. For example, a Pizza Hut promotion drove a 63% year-over-year jump in Tuesday visits, and the launch of Starbucks’ Pumpkin Spice Latte corresponded with a 27% spike in foot traffic on its release day. Such case studies demonstrate the platform’s insights and often inspire prospective clients to explore what location analytics could reveal for their own business. While not direct revenue drivers, these free resources establish Placer.ai’s thought leadership and educate the market on the power of location analytics.

Conclusion

Placer.ai’s journey from a stealthy startup in 2018 to a market leader by 2025 showcases how a strong vision and execution can unlock a new category of data-driven decision-making. The company has empowered organizations to measure and understand offline consumer behavior with the kind of rigor that was once limited to e-commerce analytics. Having achieved unicorn status and over $100M in recurring revenue, Placer.ai has begun focusing on sustainable growth – even streamlining operations in early 2025 to prioritize profitability (an 18% reduction in headcount, bringing total staff to around 700) as it positions itself for future growth.

Looking ahead, Placer.ai is positioned to extend its footprint globally. Thus far, its coverage has focused on the United States, but leadership has indicated plans to expand into markets like Canada, Europe, and Asia. International expansion will bring new challenges – from sourcing data in different regions to competing with local players – but the fundamental demand for physical-world analytics is global. With a strong product, loyal customer base, and significant capital reserves, Placer.ai aims to replicate its success abroad. As of 2025, Placer.ai remains privately held, and many in the industry anticipate an eventual IPO or strategic exit as the company continues to mature. Bridging the physical and digital worlds is increasingly important, and Placer.ai is poised to remain at the forefront of this ongoing evolution in coming years

Also Read: People.ai – Founders, Business Model, Funding & Competitors

To read more content like this, subscribe to our newsletter