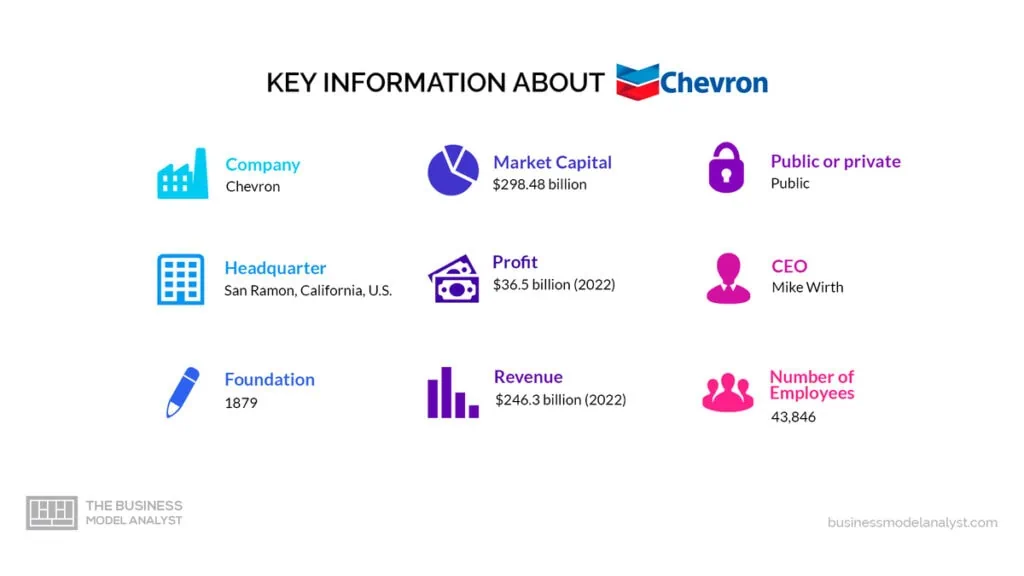

Chevron Corporation stands as a titan in the global energy landscape, boasting a rich history dating back to 1879. Originally established as the Pacific Coast Oil Company, Chevron has evolved through a series of mergers and acquisitions, solidifying its position as the second-largest oil company in the United States and one of the largest integrated energy companies worldwide.

Chevron’s journey began in the emerging oil fields of California. In 1879, the Pacific Coast Oil Company set its sights on harnessing this newfound resource, quickly establishing itself as a key player in the burgeoning industry. Through strategic acquisitions, including the historic 1911 merger with Standard Oil of California (Socal), the company’s reach and influence expanded significantly. This pivotal merger marked the birth of the Chevron brand we know today, named after the chevron symbol adopted by Socal.

Over the past century, Chevron has continued its expansion, venturing beyond its Californian roots to become a truly global energy powerhouse. The company now operates in over 180 countries, actively engaged in every facet of the energy sector, from exploration and production to refining, marketing, and transportation. This vertical integration allows Chevron to exert significant control over its entire value chain, ensuring efficiency and maximizing its impact on the global energy market.

While Chevron remains a dominant force in the oil and gas industry, the company acknowledges the crucial role it must play in the transition towards a lower-carbon future. Recognizing the growing demand for sustainable energy solutions, Chevron has invested heavily in renewable energy sources such as geothermal and biofuels. Additionally, the company is actively researching and developing carbon capture, utilization, and storage (CCUS) technologies to mitigate the environmental impact of its operations.

Chevron’s operations are not without controversy. The environmental impact of the oil and gas industry, including concerns over climate change and potential spills, raises crucial questions about the company’s social and environmental responsibility. Chevron maintains a commitment to operating in a safe and environmentally responsible manner, investing in environmental protection initiatives and upholding strict safety standards. However, the ongoing debate surrounding the industry’s environmental impact compels Chevron to continuously strive for innovative and sustainable solutions that meet the world’s energy needs while minimizing its environmental footprint.

As the global energy landscape continues to evolve, Chevron faces the challenge of balancing its legacy in the oil and gas industry with the pressing need for a more sustainable future. The company’s commitment to innovation and its growing investments in renewable energy suggest a willingness to adapt and embrace the changing energy landscape. Chevron’s future success will likely hinge on its ability to navigate this complex environment, balancing its core business with the growing demand for sustainable and environmentally responsible energy solutions.

Top Chevron Competitors and Alternatives in 2024

Chevron Corporation faces stiff competition in the global energy market, vying for market share and influence with a range of established players. Here’s a breakdown of Chevron’s top competitors, highlighting their strengths and areas of competition:

1. ExxonMobil Corporation

Exxon Mobil Corporation (XOM) stands as Chevron’s fiercest competitor in the global energy market. Both companies are integrated giants, dominating every facet of the oil and gas industry, from exploration and production to refining and marketing. This extensive overlap breeds cutthroat competition across the entire energy value chain.

ExxonMobil holds a significant edge over Chevron in terms of sheer size and financial muscle. They boast higher revenue and earnings, allowing them to invest heavily in new technologies and exploration activities. Additionally, ExxonMobil possesses a vast global network that grants them access to a wider range of resources and markets. However, Chevron might enjoy a slight advantage in investor sentiment, with some analysts perceiving them as a more nimble and adaptable company.

The following table summarizes the key areas of competition between Chevron and ExxonMobil:

| Factor | Chevron | ExxonMobil (XOM) |

|---|---|---|

| Market Position | Second-largest oil company in the US | Largest oil company in the US |

| Financial Strength | Strong financial performance | Potentially higher revenue & earnings |

| Global Reach | Over 180 countries | Extensive global presence |

| Investor Sentiment | Generally positive | Can be volatile due to company size |

| Focus on Innovation | Growing investments in new technologies | Strong emphasis on research & development |

By dissecting these factors, we can gain a deeper understanding of the intense rivalry between Chevron and ExxonMobil. Both companies vie for dominance in the global energy market, and their strategies and areas of strength will continue to shape the industry’s trajectory.

2. Royal Dutch Shell plc

Royal Dutch Shell plc (Shell) emerges as another formidable competitor to Chevron in the global energy arena. Both companies operate as integrated giants, with their fingerprints across the entire oil and gas value chain, from exploration to marketing. This overlap fuels intense competition across various sectors.

Shell stands out for its significant presence in Europe and Asia, giving them a geographical advantage over Chevron. Additionally, Shell boasts a strong foothold in liquefied natural gas (LNG), a critical fuel source for the future. Their focus on cleaner energy solutions through biofuels and hydrogen technology positions them as a potential frontrunner in the transition towards a lower-carbon future. However, Chevron might hold an edge in terms of sheer production volume, owing to its wider resource portfolio and strong presence in North America.

The table below highlights the key areas of competition between Chevron and Shell:

| Factor | Chevron | Royal Dutch Shell (Shell) |

|---|---|---|

| Geographical Strength | Strong presence in North America | Dominant presence in Europe & Asia |

| Focus Area | Upstream & Downstream | Integrated Operations |

| Strength in LNG | Growing presence | Market Leader in LNG |

| Renewable Energy Strategy | Increasing investments | Active investments in biofuels & hydrogen |

| Production Volume | Potentially higher production volume | Focus on efficiency & diversification |

By analyzing these factors, we can appreciate the multifaceted competition between Chevron and Shell. Both companies strive for dominance in the global energy market, with their strategies and strengths shaping the industry landscape.

3. BP plc

BP plc stands as a prominent competitor to Chevron in the global energy landscape. Both companies share a rich history in the oil and gas industry, boasting integrated operations across exploration, production, refining, and marketing. This overlap results in direct competition across various aspects of their businesses.

BP’s downstream operations, particularly refining and marketing through its vast network of BP gas stations, pose a significant challenge to Chevron. Additionally, BP’s strategic investments in renewable energy sources like biofuels and hydrogen position them as a competitor in the future of energy. However, Chevron holds an edge in its upstream exploration and production (E&P) activities, with a wider geographical reach and diverse resource portfolio.

Here’s a table summarizing the key competing factors between Chevron and BP:

| Factor | Chevron | BP |

|---|---|---|

| Dominant Business Segment | Upstream (E&P) | Downstream (Refining & Marketing) |

| Global Presence | Over 180 countries | Over 70 countries |

| Renewable Energy Focus | Growing investments | Active investments |

| Strengths | Diversified E&P portfolio, strong financial performance | Extensive refining & marketing network, brand recognition |

| Weaknesses | Limited downstream presence compared to BP | Dependence on traditional energy sources |

By understanding these competitive factors, we can gain a clearer picture of the dynamic rivalry between Chevron and BP as they navigate the ever-evolving energy market.

4. TotalEnergies SE

TotalEnergies SE emerges as a fierce competitor to Chevron in the global energy landscape. While both companies are integrated energy giants, their strategic approaches differ significantly. Chevron maintains a strong focus on traditional oil and gas exploration and production, with a vast resource portfolio across the globe.

TotalEnergies, on the other hand, emphasizes its commitment to renewable energy sources alongside its integrated operations. They actively invest in solar and wind power, positioning themselves as a frontrunner in the energy transition. This focus on sustainability gives TotalEnergies a distinct edge in attracting environmentally conscious investors and customers. However, Chevron might boast a larger production capacity due to its extensive experience and focus on upstream activities.

The following table highlights the key areas of competition between Chevron and TotalEnergies:

| Factor | Chevron | TotalEnergies (TTE) |

|---|---|---|

| Dominant Business Segment | Upstream (E&P) | Integrated Operations with focus on Renewables |

| Renewable Energy Strategy | Growing investments | Active leader in solar & wind power |

| Global Presence | Over 180 countries | Strong presence in Europe & Africa |

| Production Capacity | Potentially higher production volume | Focus on efficiency & diversification |

| Environmental Focus | Increasing focus on sustainability | Strong commitment to cleaner energy solutions |

This competitive dynamic showcases the evolving nature of the energy market. While Chevron leverages its traditional strengths, TotalEnergies positions itself for the future with its emphasis on renewables. Understanding these factors sheds light on how these companies will navigate the energy landscape in the years to come.

5. ConocoPhillips

ConocoPhillips presents a strong form of competition for Chevron in the global energy market. Both companies operate within the oil and gas industry, but their approaches and areas of focus differ significantly. Chevron, an integrated giant, maintains a presence across all segments of the industry, from exploration and production (E&P) to refining and marketing.

ConocoPhillips, however, takes a more focused approach, specializing primarily in upstream E&P activities. They boast a strong presence in North America, with extensive shale oil and gas reserves. This focus allows them to streamline operations and potentially achieve lower production costs compared to Chevron’s diversified approach. However, Chevron’s wider geographical reach and diverse resource portfolio provide them with greater flexibility and resilience in a volatile market.

The table below summarizes the key areas of competition between Chevron and ConocoPhillips:

| Factor | Chevron | ConocoPhillips |

|---|---|---|

| Business Model | Integrated oil & gas company | Upstream E&P specialist |

| Geographical Focus | Global presence | Strong presence in North America |

| Resource Portfolio | Diversified across regions & resources | Primarily shale oil & gas in North America |

| Strengths | Strong financial performance, global reach | Potentially lower production costs, operational efficiency |

| Weaknesses | Dependence on traditional energy sources | Limited downstream presence and geographical reach |

While not a direct competitor across all aspects of the industry, ConocoPhillips challenges Chevron in the upstream E&P sector through its focused expertise and potentially lower production costs. Understanding this dynamic highlights the diverse competitive landscape within the broader oil and gas industry.

6. Equinor ASA

Equinor ASA emerges as a competitor to Chevron in the global energy market, carving a distinct niche with its focus on the Nordic region and renewable energy solutions. While both companies operate in the oil and gas industry, their strategic approaches and geographical strengths differ significantly.

Chevron boasts a diversified portfolio and extensive presence across various segments, including exploration, production, refining, and marketing. Equinor, on the other hand, concentrates its efforts primarily on the Norwegian Continental Shelf, leveraging its expertise in harsh environment operations. Additionally, Equinor actively invests in renewable energy sources like wind and solar power, showcasing its commitment to a sustainable future. This strategic focus grants them a competitive edge in attracting environmentally conscious investors and customers. However, Chevron’s global reach and experience across the entire oil and gas value chain might provide them with an advantage in terms of resource access and overall production volume.

The table below summarizes the key areas of competition between Chevron and Equinor:

| Factor | Chevron | Equinor ASA |

|---|---|---|

| Business Model | Integrated oil & gas company | Upstream focused, with investments in renewables |

| Geographical Strength | Global presence | Dominant player in the Nordic region |

| Renewable Energy Strategy | Growing investments | Active leader in offshore wind and solar power |

| Production Capacity | Potentially higher production volume | Strong focus on efficiency in harsh environments |

| Environmental Focus | Increasing focus on sustainability | Strong commitment to reducing emissions and developing renewables |

By analyzing these factors, we can appreciate the multifaceted competition between Chevron and Equinor. While Chevron leverages its global presence and diversified operations, Equinor carves a niche through its regional expertise and commitment to renewable energy. Understanding this dynamic sheds light on how these companies will navigate the evolving energy landscape in the years to come.

7. Eni S.p.A.

Eni S.p.A., an Italian multinational oil and gas company, presents a unique form of competition for Chevron in the global energy market. Both companies operate as integrated players, encompassing various segments of the industry, but their geographical strongholds and strategic priorities differ significantly.

Chevron boasts a broader global presence, spanning over 180 countries, while Eni concentrates its efforts in specific regions, with a strong foothold in Africa and the Mediterranean. This allows Eni to develop expertise in these specific areas, potentially achieving greater operational efficiency. Additionally, Eni demonstrates a growing commitment to renewable energy sources like biofuels and geothermal power, positioning itself for the future of energy. However, Chevron’s extensive experience across the entire oil and gas value chain and potentially larger production volume might grant them an edge in terms of overall market influence.

The table below summarizes the key areas of competition between Chevron and Eni S.p.A.:

| Factor | Chevron | Eni S.p.A. |

|---|---|---|

| Geographical Focus | Global presence | Strong presence in Africa & the Mediterranean |

| Renewable Energy Strategy | Growing investments | Active focus on biofuels & geothermal power |

| Operational Scope | Integrated operations across the value chain | Integrated, with emphasis on specific regions |

| Production Capacity | Potentially higher production volume | Focus on efficiency in specific regions |

| Market Influence | Strong global presence | Growing influence in specific regions |

By understanding these factors, we can appreciate the dynamic competition between Chevron and Eni. While Chevron leverages its global reach and diversified portfolio, Eni carves a niche through its regional expertise and focus on renewable energy solutions. This contrasting approach highlights the diverse strategies at play within the global energy landscape.

The competitive landscape surrounding Chevron is complex and ever-evolving. From established giants like ExxonMobil and Shell to regional players like Eni and Equinor, each competitor presents unique challenges and opportunities. As the energy sector navigates the transition towards a lower-carbon future, Chevron’s ability to adapt, innovate, and embrace sustainable practices will be crucial in determining its future success in this dynamic and competitive environment.

Also Read: Marketing Strategy and Marketing Mix of Shell Plc

Also Read: Marketing Strategy and Marketing Mix of Exxonmobil

To read more content like this, subscribe to our newsletter