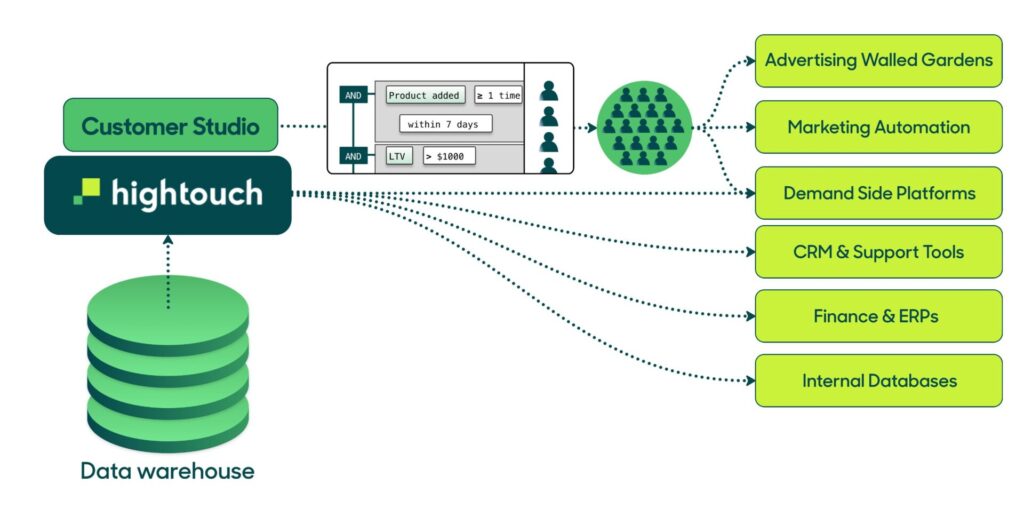

Hightouch is a San Francisco–based data-activation platform that pioneered the reverse ETL approach. Rather than importing data into a warehouse, Hightouch extracts curated data from warehouses (Snowflake, Redshift, BigQuery, etc.) and loads it into operational SaaS tools (CRMs, email platforms, ad networks, customer support, etc.). In practice, Hightouch lets business teams (marketing, sales, finance, support) access real-time customer data in their everyday tools by syncing warehouse SQL queries to 250+ endpoints. The company describes itself as a Composable Customer Data Platform (CDP) and an AI Decisioning solution, enabling one-to-one personalization and automated decision-making on top of warehouse data.

Founding Story of Hightouch

Hightouch was founded in 2019 by three friends who were early engineers on the Segment customer data platform. The founding team initially built a customer-success dashboard (on Slack) but soon discovered that customers already centralized their data in cloud warehouses. As co-founder Kashish Gupta recalled, prospects said, “it doesn’t make sense to give you a dashboard; we should actually get [the data] into our SaaS tool so that we can build our own workflows.” This insight – to “get [data] into your SaaS tool” instead of building another analytics UI – led directly to the launch of Hightouch as a data-activation service. In short, Hightouch was born from a pivot: by 2019 the founders realized that enabling every team to activate warehouse data (rather than merely analyze it) would fill a huge market need.

Founders of Hightouch

Hightouch was co-founded and is led by Tejas Manohar, Josh Curl, and Kashish Gupta. Manohar and Curl were early employees at the Segment CDP (since acquired by Twilio), giving them deep experience with customer data stacks.

Tejas Manohar (co-CEO) was an early engineer on Segment’s core team. Josh Curl (CTO) also helped build Segment’s Personas product and was one of the first engineers at Rancher Labs (a major Kubernetes platform). Their friend Kashish Gupta (co-CEO) had a background in venture capital and machine learning. Together they leveraged this experience to launch Hightouch.

As Ingrid Lunden of TechCrunch notes, “Tejas Manohar — the co-CEO of Hightouch — co-founded [the company] with Kashish Gupta (co-CEO) and Josh Curl (CTO)”. In practice, Manohar and Gupta lead the business strategy (as co-CEOs) while Curl heads engineering.

Each founder brings complementary skills: Manohar focuses on product vision (he coined the “Composable CDP” concept), Curl on building the platform’s engineering and integrations, and Gupta on machine-learning and growth. Their combined tech and startup backgrounds (cloud data, analytics, SaaS) have shaped Hightouch’s focus on leveraging the data warehouse as the source of truth and pushing activation out to every team.

Business Model of Hightouch

Hightouch operates as a cloud-based SaaS platform (hosted on AWS, Google Cloud, etc.) that connects to customers’ data warehouses. Customers deploy Hightouch by granting it read access to their warehouse (Snowflake, Redshift, BigQuery, etc.) and write access to their target SaaS tools.

Under the hood, Hightouch lets data engineers write SQL to define what data to push and where, and also provides no-code UIs for non-technical users. Its “Customer Studio” interface allows marketing teams to build audience segments with point-and-click tools, while data teams can write raw SQL queries if needed.

Technically, Hightouch functions as a reverse-ETL engine: it extracts rows from the warehouse via queries, transforms them as needed, and loads them into systems like Salesforce, Marketo, Braze, HubSpot, Zendesk, and ad networks.

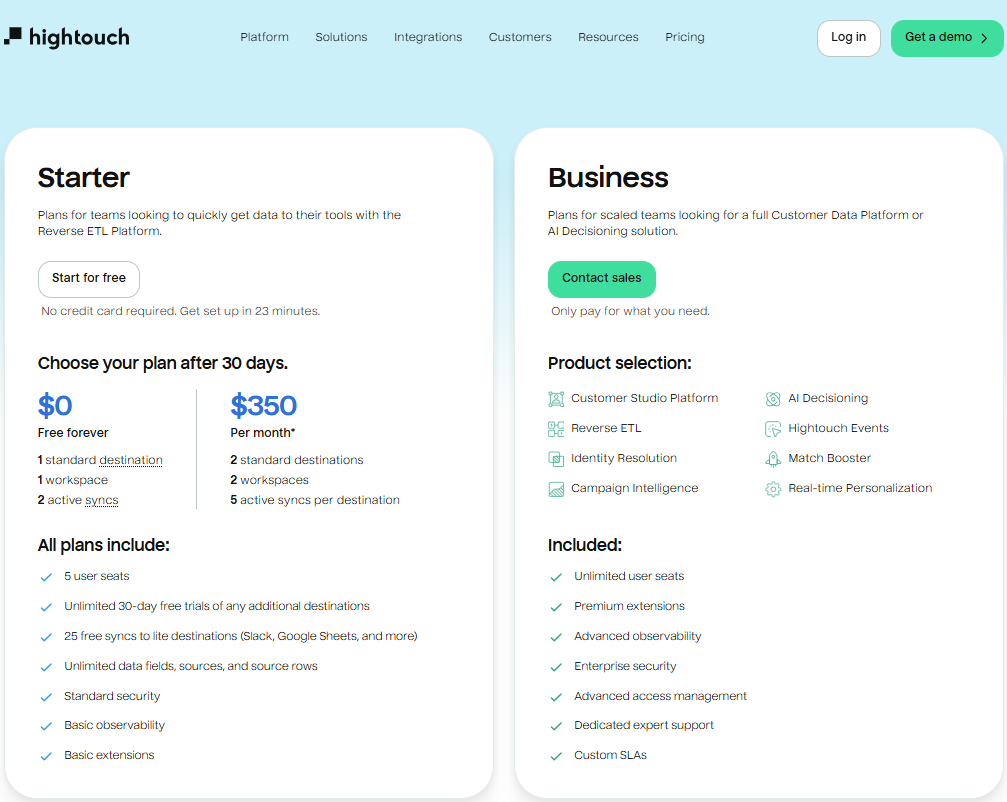

Revenue is generated primarily through subscription licensing: customers pay Hightouch based on usage and feature tiers. According to industry data aggregators, Hightouch’s platform uses a “subscription-based pricing model”. In practice, this likely includes tiered plans or usage metrics (e.g. number of syncs or profiles) common to enterprise data tools. (Some larger customers may also pay for premium support or professional services.)

By delivering the platform as managed SaaS, Hightouch avoids requiring customers to host anything outside their own clouds, reducing friction and security concerns. As one investor put it, Hightouch embraces the new paradigm that “cloud data warehouses are the new customer data platforms,” enabling companies to leverage existing infrastructure rather than building a separate CDP data store.

Revenue Streams of Hightouch

Core Platform Subscriptions:

- Starter Tier ($350/month): 2 destinations, 5 syncs, basic security.

- Business Tier ($150,000+/month): Unlimited destinations, AI Decisioning, and advanced features like Match Booster for ad targeting.

AI Decisioning Add-Ons:

Charges $0.15–$0.32 per GB processed, depending on model complexity. PetSmart’s loyalty program uses this to personalize communications for 70M+ members.

Professional Services:

Implementation fees for complex integrations (e.g., Epic EHR systems) account for 15% of ARR7.

In 2024, Hightouch crossed $200M in ARR, with 65% growth YoY driven by AI adoption

Funding Rounds of Hightouch

-

Seed (2020): Hightouch raised a modest seed round in 2020 from Y Combinator and angels. (exact amount undisclosed).

-

Series A (Jul 2021): $12.1M led by Amplify Partners (with participation from Bain Capital, Y Combinator, Afore Capital, etc.). This round supported the first version of Hightouch’s Reverse ETL platform.

-

Series B (Nov 2021): $40M led by ICONIQ Growth. This influx of capital (announced Nov 17, 2021) helped accelerate product development (adding the visual audience-building “Customer Studio” features) and expand the team.

-

Series C (Jul 2023): $38M led by Bain Capital Ventures (with ICONIQ and Amplify participating). Alongside this round (announced July 19, 2023), Hightouch unveiled its new Customer 360 Toolkit for identity resolution and profile unification.

-

Series D (Feb 2025): $80M led by Sapphire Ventures (joined by NVC, Amplify, ICONIQ, Bain, YC). This latest round catapulted Hightouch to unicorn status at a $1.2B valuation.

Competitors

Hightouch competes in the data activation and reverse ETL space, as well as broader customer data platform (CDP) market. Its most direct competitors include:

One of the original reverse-ETL platforms, syncing warehouse data to business tools. Census (now rebranded as Connective) offers similar functionality and is a well-known Hightouch peer.

An open-source CDP built by ex-Stripe engineers, which provides data pipelines and can support reverse-ETL use cases. RudderStack competes at the CDP/integration layer.

An open-source data integration engine. Primarily focused on forward ETL (loading data into warehouses), but as a major data-connectivity company it indirectly competes on integration flexibility.

Polytomic: (Formerly Census competitor)

A newcomer offering reverse-ELT (bi-directional sync) with a focus on marketing and data warehouse connectivity.

A leading cloud ETL vendor. Although Fivetran focuses on ingesting data into warehouses, its strong market presence in the modern data stack overlaps with Hightouch’s space (some customers choose Hightouch instead of building syncs with Fivetran).

Traditional CDPs: Established platforms like Segment (Twilio), Tealium, mParticle, Adobe Real-Time CDP, Salesforce CDP, etc., compete in the broader “activate customer data” category. Hightouch positions itself as more flexible and warehouse-native compared to these legacy CDPs.

Other smaller competitors may include ELT/Reverse ETL tools like Hevo Data, Singer, and various data orchestration platforms. In summary, Hightouch faces competition from both specialized reverse-ETL providers and larger customer data/integration solutions. (For context, Polytomic and industry surveys also list Segment, Tealium, and Bloomreach as peers in the CDP space.)

Competitive Advantage

Hightouch’s differentiation comes from its warehouse-centric architecture and modular platform approach. Unlike legacy CDPs that force data into their own storage, Hightouch keeps all data in the customer’s cloud warehouse, ensuring enterprise-grade security and governance. This means business teams always act on the “single source of truth” defined by data engineers. As CEO Kashish Gupta puts it, modern data warehouses are the new CDPs. By natively operating on the warehouse, Hightouch avoids the “baggage” of rigid schemas and siloed data that plague traditional CDPs.

Moreover, Hightouch has pursued a flexible, “composable CDP” strategy. It offers multiple sync frameworks (e.g. object sync, event-driven sync, scheduled batches, streaming) and builds additional layers (Customer Studio for segmentation, Customer 360 for identity resolution, AI Decisioning for automated optimization) on the same data backbone. This modular design lets both data teams and marketers use the tools they need without re-platforming. The platform’s no-code interfaces democratize data access, while its SQL foundations satisfy analytics teams. Importantly, Hightouch has been quick to innovate: it coined the term Composable CDP, introduced SQL-powered identity resolution and match-boosting in 2023, and launched an AI-driven “agentic” marketing suite in 2024. These advances – enabled by recent funding and acquisitions – have kept Hightouch at the forefront of data activation.

In short, Hightouch’s competitive edge lies in combining enterprise trust (warehouse-native, SOC 2-compliant) with agility (rapid feature development, API ecosystem). Many customers cite the ability to maintain correct, consistent data definitions (set by their data teams) while empowering non-technical users to run activations – something Hightouch was explicitly built to do.

Global Strategy of Hightouch

Headquartered in San Francisco, Hightouch serves customers globally via cloud platforms and a partner network. Its strategy has been to integrate deeply with major cloud data ecosystems: for example, Hightouch is available through Databricks Partner Connect and similarly in Snowflake’s ecosystem. In 2024–2025 the company emphasized partnerships: it worked with Snowflake, Databricks, Google Cloud and others to co-sell and co-market its Composable CDP. For instance, Hightouch onboarded over a hundred new customers in cooperation with partners like Snowflake, Databricks, and Google Cloud. It also built out a global solutions partner network including consultancies and SIs (Artefact, Deloitte Digital, Tredence, etc.) to implement projects worldwide.

Hightouch’s team is distributed and growing; the company reports hiring talent “across the globe” to support its expansion. Clients span multiple industries (retail, media, fintech, healthcare, B2B SaaS, etc.), and Hightouch markets itself as industry-agnostic. While no public data details its international revenue split, the platform’s reliance on cloud infrastructure means customers in EMEA, APAC and the Americas can onboard it in local regions. In summary, Hightouch’s global strategy is to partner with the major cloud and data vendors, leverage remote sales/marketing teams, and establish regional consultancy alliances – all while keeping the product the same worldwide (since it runs on common cloud warehouses).

Recent Financials and News (as of 2025)

Hightouch’s latest financial highlight was its Series C round in February 2025, raising $80 million at a $1.2 billion valuation. This round (led by Sapphire Ventures) underlines rapid growth: for context, the prior valuation in mid-2023 was about $615M, meaning the company roughly doubled its value in 18 months. In July 2023 (Series C/B2) it raised $38M with Bain as lead, and between then and now it has continued expanding. Although Hightouch is still private, insiders suggest its revenue (ARR) has scaled strongly – company leaders report that they doubled the customer base in 2024, pointing to robust demand. The business remains capital-efficient (“money in the bank” as one founder put it), and management indicates they did not need to raise new funds except to pursue growth in AI and product vision.

On the product side, Hightouch has been very active. In 2024 it launched AI Decisioning, an agent-driven marketing automation feature (August 2024) that uses generative AI to run and optimize campaigns. This feature complements its CDP capabilities. In mid-2023 it rolled out the Customer 360 Toolkit (identity resolution and profile consolidation directly in the warehouse) alongside the Bain-led funding. Earlier, its Customer Studio (audience builder) became generally available after Series B.

Hightouch also made strategic acquisitions to broaden its platform. On April 19, 2022 it acquired Workbase, a workflow-automation startup, to add complex event/trigger capabilities to the platform. On November 16, 2023 it acquired HeadsUp, a customer-data insights startup, to enhance its Customer 360 offering. These deals brought in talent (e.g. HeadsUp co-founder Earl Lee) and technology to speed development of next-gen features.

The company’s leadership team has also evolved. In late 2024 Hightouch hired Josh Kanagy as Head of Revenue to scale its commercial organization (noting at the time that the customer base was doubling). The co-CEO arrangement (Manohar and Gupta) remains in place, and there have been no major departures reported. Hightouch continues to invest in sales, marketing, and support as it grows.

On the partnership front, Hightouch deepened ties with major data vendors. Databricks Ventures took a strategic stake during the 2023 funding round, and Hightouch became a featured partner in the Databricks and Snowflake marketplaces. It also earned industry accolades: for example, Iterable (an email/customer engagement vendor) named Hightouch its Technology Partner of the Year (2024), and G2.com has ranked Hightouch as a Category Leader in the CDP space. (Private rankings like RedPoint’s “InfraRed100” have also recognized Hightouch as a top cloud-data infrastructure company.)

In summary, as of 2025 Hightouch is well-capitalized and expanding rapidly. Its recent Series C made it a unicorn; it has diversified its product line (AI features, identity tools) and grown through acquisitions (Workbase, HeadsUp) and partnerships (Databricks, Snowflake). According to the latest available reports, its customer roster now includes large enterprises like Spotify, PetSmart, and Tripadvisor, and management publicly notes accelerating growth in both revenue and headcount. All told, Hightouch’s financial and product momentum through early 2025 reflects its mission: delivering on the promise of a warehouse-native, AI-enabled customer data platform for global businesses.

Also Read: Flashbots: Founders, Business Model, Funding, Competitors

To read more content like this, subscribe to our newsletter