Ethena is a Brooklyn-based startup that has reimagined corporate compliance and ethics training through a modern, engaging platform. Founded in 2019, Ethena set out to tackle a ubiquitous workplace problem: traditional compliance training is often ineffective, forgettable, and seen as a mere box-checking exercise.

The company’s solution combines research-backed microlearning with humorous, relatable content to transform mandatory training into a driver of positive workplace culture.

In just a few years, Ethena’s approach has attracted thousands of organizational customers, from high-growth tech firms to large enterprises, and earned the company over $50 million in venture funding.

This article analyze Ethena’s brand story and strategy, with sections covering its founding narrative, the founders’ backgrounds, business model, revenue streams, funding history, competition, competitive advantages, products and services, and a concluding outlook. Each section presents evidence-based insights into how Ethena grew from an idea born of personal experience into a leading innovator in compliance training as of 2025.

Founding Story of Ethena

Ethena’s origin story is rooted in the lived experiences of its founders, who witnessed first-hand the shortcomings of conventional compliance training. Co-founder and CEO Roxanne Petraeus conceived the idea for Ethena after years spent in environments where harassment and exclusion were pervasive despite mandatory training requirements.

Petraeus, a former U.S. Army officer, recalls egregious incidents during her military service – from openly sexist remarks to serious misconduct – as well as subtler “microaggressions” and biases that traditional training never addressed.

In one formative episode after her military career, Petraeus received an email from a senior colleague telling her to “smile more” during a meeting, a comment that underscored the gendered expectations women often face in the workplace. Discussing her frustration with a male teammate, she realized that despite him having sat through 20+ hours of standard harassment training, he lacked awareness of these everyday biases.

The “aha” moment was that traditional compliance training taught only “the floor” of behavior – the legal minimum to avoid liability – but not “the ceiling” of how to actively foster an inclusive culture. Petraeus wanted a training solution that ventured into the gray areas and truly changed behavior, rather than one that just checked a legal box.

With this vision, Roxanne Petraeus teamed up with co-founder Anne Solmssen in 2019 to build Ethena. The two were introduced through a mutual friend and quickly discovered a shared determination to fix compliance training. They brainstormed a novel approach: instead of annual hour-long lectures or outdated videos, Ethena would send brief “nudges” – five-minute interactive lessons delivered monthly via email or Slack – making training a continuous learning process rather than a one-time event.

In early 2020, Ethena launched its first pilot focusing on sexual harassment prevention, offering what Petraeus called an “effective versus check-the-box” training experience. The timing coincided with a growing corporate emphasis on #MeToo and building ethical workplaces, which helped spark interest in Ethena’s fresh approach.

Initially, the founders assumed their early adopters would be fellow tech startups seeking innovation in HR practices. However, demand quickly came from larger companies as well, as even established enterprises were “willing to be innovative in a space historically dominated by lawyers and legacy e-learning providers”.

By February 2020, Ethena had live pilots, and by June 2020 it secured seed funding to expand.

The founding story – from Petraeus’s personal catalyst to the early product launch – set the tone for Ethena’s brand: grounded in real-world insight, challenging the status quo of compliance training, and committed to making workplaces better through education rather than mere compliance formalities.

Founders of Ethena

Ethena was co-founded by two Harvard-educated women whose complementary backgrounds shaped the company’s product and culture.

Roxanne Petraeus

Ethena’s CEO, graduated from Harvard in 2009 with an Economics degree and completed the Army ROTC program. Upon commissioning, she served as an officer in the U.S. Army, including a combat deployment to Afghanistan and training missions in Asia.

Petraeus’s military service, in a male-dominated institution, exposed her to leadership under pressure and gave her a first-hand view of how standard-issue training often failed to prevent misconduct. After the Army, she worked as a management consultant at McKinsey & Company, where she again encountered workplace cultural challenges (such as the “smile more” incident) that reinforced the need for a new approach to compliance education. Petraeus brings to Ethena a mission-driven leadership style influenced by her military and consulting experiences, as well as a data-informed perspective – she often cites research on how adults learn and the importance of continuous training for genuine behavior change. Notably, Petraeus is one of relatively few female veteran tech CEOs, and under her leadership Ethena fosters a culture that values discipline, inclusivity, and evidence-based practices.

Anne Solmssen

Ethena’s Chief Technology Officer and co-founder, provides the technical and product design expertise behind the platform.

Solmssen earned a Computer Science degree from Harvard in 2015, where she gained a strong foundation in software engineering. Early in her career, she interned at Palantir Technologies, a company known for its rigorous engineering culture and work on data-driven platforms. She also worked at startups prior to Ethena (the Ethena press release notes her background in “consulting and startups”), giving her first-hand experience with the fast-paced product development cycles of tech companies. As a woman in tech, Solmssen had her own exposure to the often suboptimal compliance training at startups, lending her a personal understanding of the user experience that Ethena needed to improve.

When Petraeus and Solmssen met in 2019, they bonded over having spent their careers in environments where they were often the only women in the room. This shared experience informed Ethena’s content: they knew “the problem” they were trying to solve on a very personal level. Colleagues describe the co-founders as an “impressive duo” who balance each other well. Petraeus has a high risk tolerance and bias for action, while Solmssen is more deliberative – a combination that Solmssen herself noted was crucial in deciding to embark on the startup journey together. Together, they cultivated a company ethos that values thoughtful innovation: they didn’t just bring tech skills and business acumen, but also a passion for making compliance training more human-centered.

The fact that Ethena’s founding team consists of two women (still a rarity in tech startups) is also a notable part of the brand’s story – it underscores Ethena’s commitment to inclusion and may have helped the company approach compliance challenges with fresh eyes. As Petraeus has pointed out, female-founded teams historically receive only a tiny fraction of venture funding, yet Ethena was able to break through that barrier with a compelling vision and measurable early traction.

Business Model of Ethena

Ethena operates on a business-to-business SaaS (Software-as-a-Service) model, providing an online platform that companies subscribe to in order to train their employees on compliance and ethics topics. At its core, Ethena’s business model centers on delivering engaging microlearning content at scale and providing tools for organizations to manage compliance training effortlessly. Unlike traditional compliance training vendors that might sell one-off training modules or in-person workshops, Ethena’s approach is to embed training into the fabric of employees’ routine work life.

The platform sends bite-sized training “nudges” to employees on a monthly basis, typically taking about 5 minutes to complete each time. This continuous delivery model keeps important topics “top of mind” for employees year-round, in contrast to the conventional annual seminar that employees often quickly forget. By making training more frequent, digestible, and relevant, Ethena aims to actually educate and influence behavior rather than just fulfill a legal requirement.

On the administrative side, Ethena’s platform functions as an all-in-one compliance training management system for HR and compliance teams. Through a web-based dashboard, administrators can assign training courses to employees (with targeting by department, role, or location), automate reminder emails, and track completion rates and metrics in real time.

Ethena also integrates with common HRIS (Human Resource Information System) software like Workday, BambooHR, Rippling and others. This integration capability means new hires can be automatically enrolled and the correct trainings can be assigned based on location-specific laws (for example, ensuring California employees get state-mandated harassment training). The convenience and time-saving aspect for administrators is a key part of the value proposition – one HR manager noted that Ethena “is administratively less burdensome than our previous platform,” highlighting features like one-click reminders for overdue trainees that replaced manual follow-ups. In effect, Ethena’s product doubles as a compliance content provider and a learning management system tailored for compliance needs.

Another pillar of the business model is content development. Ethena invests in creating high-quality, engaging training content across a broad range of topics – from sexual harassment prevention and diversity & inclusion to cybersecurity and data privacy. The content is designed to be “delightfully cringe-free,” often using humor and storytelling (e.g. unique videos, podcast-style audio lessons, or even comic-strip graphics) to hold employees’ interest. Each course is crafted in consultation with subject-matter experts and legal counsel to ensure accuracy and compliance with regulations.

By keeping the content fresh and relevant, Ethena encourages employees to actually learn and participate; the company even boasts that over 90% of learners rate its training positively – a stark contrast to the eye-rolls typically associated with corporate training. This focus on user experience supports the business model by driving customer retention: if employees find value in the training (and perhaps even enjoy it), their employers are more likely to renew Ethena’s service annually rather than seeking alternatives.

Ethena’s initial go-to-market strategy focused on high-growth tech companies and startups, which often needed to implement compliance training quickly as they scaled. By mid-2021, Ethena had over 150 companies on board including well-known tech firms like Netflix, Zoom, and Figma. Serving these tech-savvy clients helped Ethena refine its product (for example, adding a Slack integration so that training notifications can appear where employees already communicate). At the same time, Ethena proved its model could scale to larger enterprises: within its first year, the company saw a 29× increase in annual recurring revenue (ARR) as clients enthusiastically adopted the platform. Ethena’s ability to land major clients (Netflix, for instance, signed on early) lent credibility to its model and demonstrated a market appetite beyond just small startups.

Today, Ethena’s business model includes serving “thousands of organizations” globally, indicating that it has expanded into diverse industries and mid-to-large enterprises, not just Silicon Valley firms. The platform’s design – cloud-based, multi-language, and modular – allows Ethena to cater to clients ranging from a 50-person startup to a multinational corporation with thousands of employees. Each customer typically pays an annual subscription fee (priced per employee user) in exchange for access to Ethena’s full library of courses and the management platform, which ensures a recurring revenue stream for the company.

This scalable SaaS model, combined with an innovative product approach, forms the foundation of Ethena’s strategic business model: deliver effective training in a user-centric way, leverage data and tech to automate administration, and grow through subscription-based enterprise relationships.

Revenue Streams of Ethena

Ethena generates revenue primarily through subscription fees for its software platform and content, leveraging a classic SaaS subscription model with tiered plans.

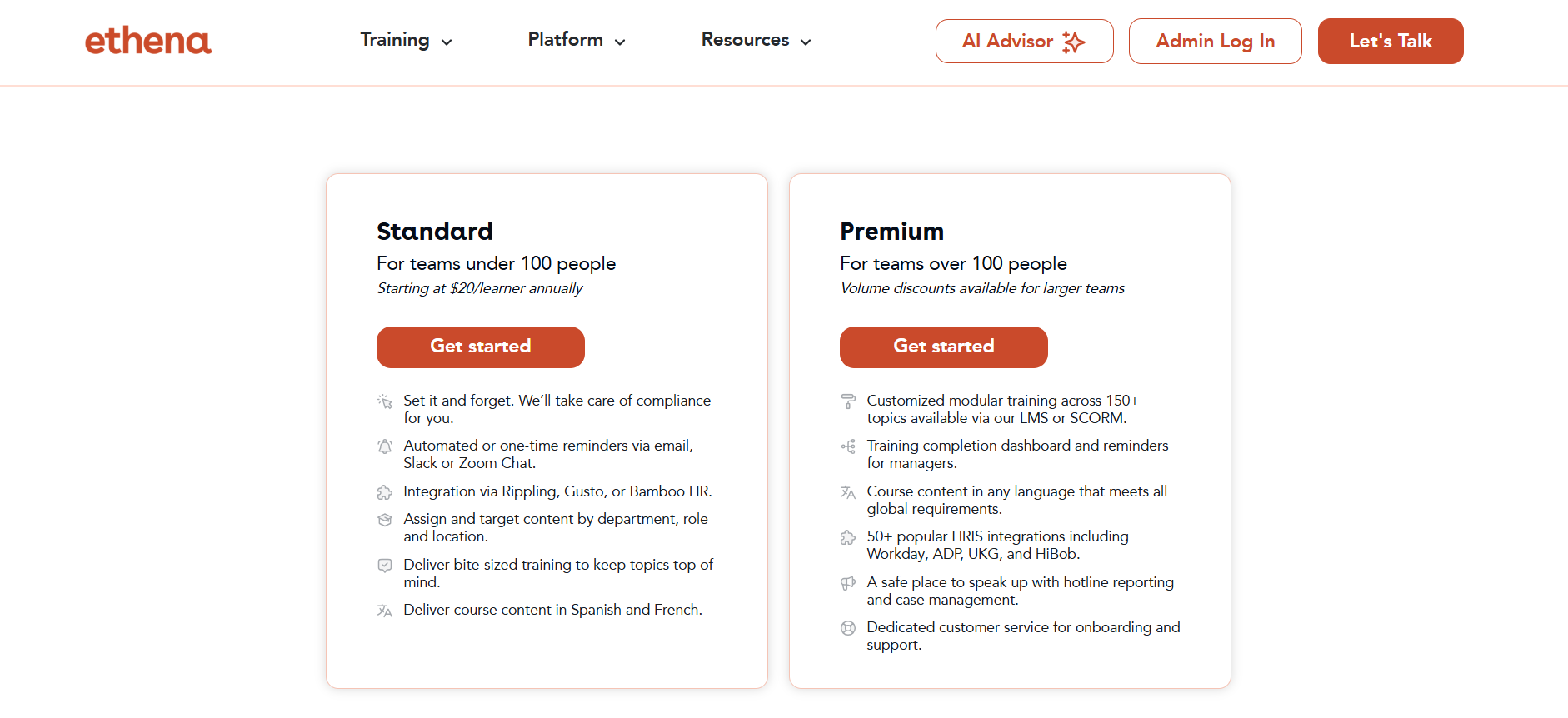

The primary revenue stream is the annual per-user license that organizations pay to enroll their employees in Ethena’s training. As of 2025, Ethena’s pricing structure offers a Standard plan for small teams and a Premium plan for larger enterprises. The Standard plan, designed for organizations under 100 people, starts at $20 per learner annually. This base plan provides access to Ethena’s core training library and basic admin features – essentially a “set it and forget it” solution where Ethena automates compliance training delivery and reminders for the client.

For larger companies (100+ employees), Ethena offers volume pricing under the Premium plan, which includes enhanced features and services. In the Premium tier, customers get customization options, such as modular course selection from over 150 topics and the ability to deploy Ethena’s content via SCORM into their own LMS if desired. Premium subscribers also enjoy advanced analytics dashboards (including training completion reports for managers), support for additional languages to meet global requirements, integration with a wider range of HR systems (50+ HRIS integrations are supported, including enterprise platforms like Workday and ADP), and access to Ethena’s Ethics Hotline and case management tool for employee reporting. Premium customers are furthermore provided with dedicated customer success support during onboarding and beyond. These added services effectively bundle more value into the higher-tier subscription, encouraging larger clients to opt for Premium plans which carry higher per-user (or bulk) pricing.

While subscription licensing is Ethena’s bread and butter, the company has a couple of ancillary revenue considerations. One is content licensing flexibility: Ethena’s platform allows enterprise clients to use its compliance content in external systems via SCORM, which implies some clients might pay specifically for content packages if they prefer to host training on an internal LMS. In practice, however, Ethena likely rolls this into the Premium subscription rather than selling content à la carte. Another potential revenue stream is the introduction of new compliance tools that could be monetized separately or as add-ons. For instance, Ethena’s phishing email simulator and its AI-driven “Policy Bot” (which answers employees’ questions about company policies) add tangible value to the platform.

Currently, these appear to be included as part of the overall platform offering, especially for Premium customers, rather than separate charges – but they enhance Ethena’s ability to justify higher subscription prices and upsell existing clients to more comprehensive plans. Ethena does not rely on one-off training fees or advertising; its model is recurring revenue, which aligns incentives to keep customers satisfied year after year.

Funding of Ethena

To fuel its growth and product development, Ethena has raised multiple rounds of venture capital financing, securing backing from prominent investors in the tech and SaaS space. The funding journey began with seed funding in 2020. In June 2020, as Ethena’s early pilots showed promise, the startup raised approximately $2 million in seed capital. This round was driven by venture firms who saw potential in Ethena’s novel approach; participants included Homebrew, Neo, and Village Global, among others.

That initial seed infusion enabled Ethena to formally launch its platform (which it did in February 2020) and start acquiring customers during its first year. Demonstrating early traction – including signing contracts with major companies and reaching 20,000 active users by early 2021 – Ethena attracted additional investor interest. In early 2021, the company raised a seed extension (sometimes characterized as a “Seed 2” or pre-Series A round) of another $2 million led by GSV (Global Silicon Valley) Capital. By the start of 2021, Ethena’s total venture funding reached about $5 million, which the company used to expand its content library (moving beyond harassment training into code of conduct, financial compliance, etc. per customer demand) and to scale up its team.

On the back of robust growth, Ethena proceeded to raise a Series A round in mid-2021. Announced in July 2021, the Series A brought in $15.5 million in fresh capital. The round was led by Felicis Ventures, a top-tier VC firm known for investing in SaaS and enterprise startups. This investor syndicate included notable names: Lachy Groom (a former Stripe executive-turned-investor who had participated as an angel and would later lead Series B), GSV (follow-on from seed), Homebrew and Neo (existing investors), and even prominent individuals like Henry Kravis (the co-founder of KKR) who joined as an investor. Such an array of backers underscored strong confidence in Ethena’s trajectory.

The Series A funding was earmarked for scaling the business – expanding the team, accelerating product development, and increasing sales efforts. Indeed, around this time Ethena was growing its customer count rapidly; Felicis noted that over 150 companies were using Ethena by mid-2021 and that the company had achieved remarkable ARR growth in its first year. The infusion of $15.5 M allowed Ethena to invest in platform features (such as more robust analytics and integrations) and to broaden its course offerings to stay ahead of market needs.

Less than a year later, Ethena secured its Series B round amid continued momentum. In June 2022, Ethena announced a $30 million Series B funding. This round was led by Lachy Groom, who, having been an early investor, doubled down with a leadership stake at Series B. Existing investors Felicis, Neo, Homebrew and others also participated, signaling their continued support of Ethena’s mission and growth. Additionally, a cadre of angel investors with expertise in scaling SaaS companies joined the round – including Jack Altman (CEO of Lattice, an HR tech company), Mathilde Collin (CEO of Front), William Hockey (co-founder of Plaid), Gretchen Howard (Google/CapitalG executive), and Claire Johnson (a Stripe and Google alumna). Their involvement brought not just capital but strategic guidance on building enterprise software and expanding in the HR/compliance tech market. The Series B valued Ethena at a substantially higher level (though exact valuation was not disclosed, a $30 M raise for a series B implies a healthy mid-to-high eight-figure valuation).

Importantly, Ethena’s fundraising success came during a period when investors were seeking more than just growth at all costs; they wanted efficient growth and clear product-market fit. Ethena was able to demonstrate both. By 2022, the company had a solid roster of paying clients and strong renewal rates, indicating the business model’s sustainability. The fact that Ethena’s Series B was oversubscribed by high-caliber investors suggests that the company could potentially raise additional growth capital if needed. As of 2025, no Series C has been publicized, implying that Ethena may be either sufficiently funded from the last round or possibly approaching profitability such that immediate new funding isn’t necessary. The venture backing to date has provided Ethena with the resources to innovate aggressively ahead of competitors and to expand its team (which in turn drives sales and product development).

Funding Rounds

To summarize Ethena’s fundraising trajectory, the table below outlines the major funding rounds, including dates, amounts raised, and key investors for each round:

| Round | Date | Amount Raised | Lead Investor(s) | Notable Participants |

|---|---|---|---|---|

| Seed | Jun 2020 | $2 Million | Homebrew (participant) | Neo, Village Global (seed VC firms) |

| Seed Extension | Feb 2021 | $2 Million | GSV Capital | Homebrew, Neo (follow-on); others |

| Series A | Jul 2021 | $15.5 Million | Felicis Ventures | Lachy Groom, GSV, Homebrew, Neo, Henry Kravis |

| Series B | Jun 2022 | $30 Million | Lachy Groom | Felicis, Homebrew, Neo (existing); Angels (Jack Altman, Mathilde Collin, etc.) |

Table: Ethena’s funding rounds from seed through Series B. The startup raised a total of roughly $50 M in venture funding by mid-2022 across these rounds.

Each round built on Ethena’s growing credibility and business traction. The seed rounds were about proving the concept and building an initial client base. By Series A, Ethena had demonstrated product-market fit (with dozens of enterprise customers and rapid ARR growth), which attracted a leading SaaS investor (Felicis) to lead the round. The Series B, led by an individual super-angel (Lachy Groom) with deep fintech and SaaS experience, aimed to turn Ethena into a platform player in the compliance space, beyond just training. It’s also worth noting the mix of investors: from traditional VC firms to strategic angels and even an industry veteran like Henry Kravis.

This diversity suggests Ethena’s value proposition resonated widely, not just with typical enterprise software investors but also with business leaders who saw the practical importance of what Ethena was offering. Ethena’s funding rounds have thus both provided capital and brought valuable networks and expertise into the company, aiding its strategic development.

Competitors of Ethena

Ethena operates in the broader market of compliance and workplace training, where it faces competition from both legacy providers and newer entrants aiming to modernize the experience. Key competitors can be grouped into a few categories:

Modern Compliance Training Startups:

These are peers to Ethena that also emphasize engaging, tech-driven solutions.

A notable example is EasyLlama, a startup offering online compliance training with a focus on microlearning and an extensive course library. EasyLlama positions itself as a user-friendly platform with competitive pricing (around $20 per employee per year, similar to Ethena’s standard pricing) and touts features like a large selection of ready-made courses and robust analytics. EasyLlama is reportedly bootstrapped and reached around $4.5 M in revenue with a lean team, indicating it has found a niche particularly among small to mid-sized businesses seeking an affordable solution.

Ethena and EasyLlama have broadly similar value propositions (mobile-friendly content, short interactive modules, etc.), and indeed Ethena acknowledges EasyLlama as a direct competitor in its marketing comparisons. Ethena often differentiates itself by highlighting superior content quality and automation: for example, Ethena claims to offer better admin workflow integration and higher learner engagement, whereas EasyLlama might boast a greater quantity of course offerings and a “price match guarantee” for budget-conscious buyers.

Another new competitor is Traliant (founded in 2016), which gained traction with scenario-based video training modules. Traliant is somewhat a bridge between old and new – it offers modern video micro-learning and customization options. In recent years, Traliant has been aggressively expanding through acquisitions: it received a majority investment from PSG (a private equity firm) in 2021 and subsequently acquired Kantola Training Solutions (a long-standing harassment training video provider) and Clear Law Institute (another e-learning compliance company) in 2023.

These moves have made Traliant a larger competitor, with a broad content catalog (by integrating Kantola’s high-quality video content and Clear Law’s courses) and increased market reach. Traliant’s consolidation strategy indicates that the compliance training market is heating up, with players aiming to offer one-stop shops. Ethena competes with Traliant by focusing on even more interactive and up-to-date content (e.g. Ethena’s courses are updated continuously and delivered via a modern platform versus Traliant’s more episodic video courses). However, Traliant’s growing size and resources mean it often targets the same customer segment of mid-sized and large organizations seeking off-the-shelf compliance training.

Traditional Compliance Training Providers:

These include established companies that have long provided compliance content or learning management systems, albeit with a more conventional approach.

NAVEX Global is one such competitor – known for governance, risk, and compliance (GRC) software, NAVEX also offers a library of compliance e-learning courses (it previously acquired a company called GlobalCompliance/LawRoom). Many corporations have used NAVEX or similar vendors for years, meaning Ethena often has to displace an incumbent provider. Traditional providers typically offer comprehensive content to cover legal requirements, but their content has a reputation for being stale or “click-through” PowerPoint-style modules.

Skillsoft and SAP Litmos (LMS platforms with compliance course libraries) also fall in this category; they provide the infrastructure and generic content but may not engage learners. Ethena’s strategy against these incumbents is to emphasize engagement and efficacy – where legacy courses might meet the letter of the law, Ethena promises to actually change employee behavior and knowledge. This claim is supported by data Ethena shares (such as the Gallup poll it often cites that only 10% of employees strongly agree they learned something from typical training, vs. Ethena’s own internal stats of improved confidence and 90% positive feedback).

Moreover, Ethena’s interface and ease of use often surpass older systems: for instance, HR leaders from companies like Snap Inc. have publicly praised Ethena as a “contemporary, culture-fitting training platform” in contrast to the “outdated systems” they replaced. Nonetheless, large competitors have entrenched relationships and very extensive content catalogs. Ethena must continuously expand its offerings (for example, adding niche courses on topics like PCI compliance, HIPAA, or global anti-bribery laws) to compete head-on with those full-service vendors when courting big enterprise contracts.

Learning Management Systems (LMS) and HR Platforms:

Some organizations fulfill their compliance training needs via general LMS software (such as Cornerstone OnDemand, TalentLMS, or Udemy Business) where they either create their own content or purchase content libraries. These are indirect competitors: Ethena could be seen as both a content provider and an LMS combined. If a company already has an LMS and only needs content, they might compare Ethena’s integrated solution with buying a set of courses from a content library provider.

Ethena anticipated this by enabling content export via SCORM and by integrating with other systems, effectively playing nice with existing LMS infrastructure. The risk from pure LMS solutions is that some clients may favor one system for all training (compliance, skills, etc.) and be reluctant to add a separate specialized platform. Ethena’s counter is to position itself as the expert in compliance training effectiveness, not just another LMS. Its competitive advantage here is the depth of its compliance focus – including features like the policy Q&A bot, automated regulatory updates, and reporting tailored to legal needs – which generic training platforms lack.

In-House or Ad-Hoc Training Approaches:

Prior to companies like Ethena, many organizations managed compliance training by either hiring external trainers (e.g. law firms giving annual seminars) or using static slide decks and quizzes developed in-house. While not competitors in a commercial sense, these old approaches are what Ethena often replaces. The inertia of “how we’ve always done it” can be a competitor. Ethena competes by proving that its modern solution not only reduces administrative burden but also yields better compliance outcomes (fewer incidents, more reporting of issues, improved culture). The cost of non-compliance or a toxic culture is high, and Ethena’s selling point is that investing in good training can mitigate those costs.

In summary, Ethena’s competitive landscape includes agile startups like EasyLlama chasing a similar vision, scaled-up players like Traliant merging content libraries under PE sponsorship, and long-established firms offering compliance training as part of larger compliance or HR suites. Despite this crowded field, Ethena has carved out a leading position in the “next generation” of compliance training by outperforming competitors on content engagement and platform intelligence. Its early start and strong backing give it a notable advantage, but it will need to keep innovating as competitors mimic its microlearning model or attempt to undercut on price or breadth. Ethena’s strategy seems to be focusing on quality and effectiveness over sheer quantity of courses – an approach validated by many clients’ feedback that legacy solutions, while comprehensive, simply did not resonate with employees. As the market evolves, Ethena’s main rivals will likely be those who can combine rich content with tech-savvy delivery; to that end, continuous improvement (like adding AI features and maintaining a humorous, relevant tone) will be key for Ethena to stay ahead of the competition.

Products and Services of Ethena

Ethena began with a singular product focus (harassment prevention training) but by 2025 it has developed a comprehensive suite of products and services that collectively form a compliance training platform. The core of Ethena’s offering is its online training curriculum, which now spans dozens of topics across multiple compliance domains. Ethena’s Course Library includes, for example: Preventing Harassment and Discrimination, Diversity, Equity, Inclusion & Belonging, Compliance and Code of Conduct, Cybersecurity and Data Privacy, Workplace Health and Safety, Anti-Bribery and Corruption, Anti-Money Laundering, Insider Trading, and even soft-skill areas like Management Essentials and Hiring Practices.

In total, Ethena offers 150+ bite-sized training modules, each of which can be assigned standalone or as part of a larger course, allowing organizations to customize their training programs. Notably, Ethena adds new courses each year to address emerging needs – for instance, it launched modules on Generative AI in the Workplace as AI tools proliferated, and it keeps content up-to-date with new laws (like a course on California’s SB 553 workplace violence prevention requirements). All content is available in multiple languages (English, Spanish, French by default, with additional languages for global requirements) to support multinational clients.

Complementing the content, Ethena provides the Platform (LMS) capabilities under what it calls an “AI-Powered LMS”. Key platform features include: Assignment Automation (automatically enrolling employees in the correct trainings based on role/region and sending reminders on a set schedule); an AI Training Builder (this suggests organizations can leverage AI to generate custom training content or policies, a feature Ethena likely introduced to let clients create tailored micro-courses easily); AI Translations (machine-assisted translation of content for international offices); and Kiosk & Classroom Mode (catering to frontline or non-desk workers who might take training in a group setting or on shared devices). The platform also includes robust Reporting and Analytics dashboards. Admins can track completion rates, aggregate quiz scores, and identify patterns (for example, if certain departments consistently lag in compliance, or if certain quiz questions are often missed indicating a knowledge gap). Ethena’s analytics help organizations spot issues proactively – aligning with its mission to be a preventative “operating system” for compliance, not just a reactive training supplier.

Beyond training delivery, Ethena’s platform now encompasses Anonymous Reporting tools. The Ethics Hotline allows employees to anonymously report misconduct or ethical concerns via the Ethena platform. This is integrated with a Case Management system for the employer’s compliance officers or HR to track and respond to these reports. By bundling a hotline, Ethena taps into a service traditionally provided by dedicated ethics hotline vendors, thereby adding value for clients who can manage reports in the same dashboard as training. Such integration can encourage a culture where training and reporting reinforce each other (employees learn what’s unacceptable in training and have a clear, accessible channel to report issues when they arise).

Ethena also offers Compliance Tools like the Phishing Simulator. This tool sends simulated phishing emails to employees to test their cybersecurity awareness, and then automatically enrolls those who click on fake links into a quick remedial training. By doing so, Ethena’s platform closes the loop between assessment and training intervention in the cybersecurity realm. This is a practical service, given the rise in social engineering threats, and it’s a feature that not all compliance training providers include. Another notable tool is the AI Policy Bot – essentially a chat interface (likely powered by an AI model) where employees can ask questions about company policies or hypothetical situations and get instant answers. For example, an employee could ask, “Is it a conflict of interest if I start a side business?” and the bot would reference the company’s code of conduct to provide guidance. This tool helps reinforce training by providing on-demand clarity, and it positions Ethena as a daily resource, not just a periodic training vendor.

Service-wise, Ethena provides strong customer support and advisory services to help organizations implement their compliance training programs. On the Premium plan, Ethena assigns a customer success manager to assist with onboarding, course rollout planning, and ongoing support. They also help companies map out what trainings are needed to meet various regulatory requirements (for instance, many U.S. states have specific harassment training mandates – Ethena’s team ensures the client’s employees in California get the California-compliant course version, those in Illinois get the Illinois version, etc., all of which Ethena has built into its library). Ethena’s website provides supplemental resources as well: guides, templates, checklists, and webinars on compliance topics. These free resources further establish Ethena as a thought leader and support tool for compliance professionals, even outside the direct training modules.

In summary, Ethena’s products and services by 2025 can be viewed as a three-layer offering:

-

Engaging Compliance Content: Covering a wide array of topics (legal and cultural) with microlearning design, regularly updated and customizable to the organization’s needs.

-

Training Delivery & Management Platform: A full-featured LMS specialized for compliance – automating assignment, integrating with other HR systems, providing analytics, and ensuring delivery via multiple channels (email, Slack, in-person modes).

-

Auxiliary Compliance Tools: Additional features that complement training – anonymous hotline reporting, case management, phishing simulations, AI-powered Q&A – making Ethena a one-stop platform for promoting and monitoring compliance and ethics in an organization.

Ethena’s expansion of services reflects a strategic broadening from “just training” to “compliance enablement” more generally. This not only opens up additional revenue opportunities (selling to the compliance department budget, not only HR’s training budget), but also increases the platform’s stickiness. A client using Ethena for training, reporting, and policy management will be deeply integrated and less likely to switch to a competitor. It also aligns with Ethena’s brand promise: helping companies build better workplaces. By offering the tools to both educate employees and to act on issues (reporting, analytics), Ethena covers the full lifecycle of compliance management. Few competitors can match this integrated suite. For clients, the benefit is an efficient, unified approach – for example, data from the training side (like which topics employees struggle with) could inform what issues to watch for on the hotline side, and vice versa, all within Ethena’s ecosystem. This synergy of products and services is a distinctive strength of Ethena’s offering in the market.

Conclusion

Ethena’s journey from a 2019 startup to a leading compliance training platform by 2025 illustrates how a clear mission combined with innovation can disrupt a staid industry. Founded on the insight that compliance education should strive for culture change rather than mere legal compliance, Ethena crafted a brand story that deeply resonates with modern organizations. The founders’ personal experiences with ineffective training became the company’s driving ethos: training that actually works. This ethos is evident in everything Ethena does – from its engaging microlearning content to its data-rich platform and responsive customer support. The company’s strategic analysis reveals several factors behind its success. Ethena identified a gap in the market (widespread dissatisfaction with “boring” training) and filled it with a product that employees find refreshingly approachable and even enjoyable. By leveraging technology (automation, AI, integrations) Ethena also tackled the administrative pain points, turning compliance training from a headache into a manageable routine for HR departments.

As of 2025, Ethena stands at a juncture where it is well-positioned to dominate the modern compliance training market and possibly expand into adjacent areas of corporate learning and compliance tech. The company’s focus on evidence-based results and customer-centric design will remain critical as it grows. Future opportunities may include international expansion (leveraging its multi-language content to win non-US clients), deeper analytics and benchmarking (using industry-wide training data to offer insights back to clients), and partnerships or integrations with broader HR and compliance software ecosystems. Ethena will also need to stay vigilant of competition – both from upstarts and large enterprise software firms that might develop similar offerings. However, the strong foundation Ethena has built in product quality, brand trust, and subject-matter expertise gives it a durable platform for the future.

In conclusion, Ethena’s brand story and strategic journey exemplify how a startup can transform a critical aspect of workplace culture. By marrying technology with a clear ethical vision, Ethena has not only achieved business success but also contributed to a higher standard for compliance and ethics training – one that promises to make workplaces safer, more inclusive, and more accountable. This alignment of commercial success with positive social impact is perhaps Ethena’s most noteworthy achievement, and it bodes well for the company’s continued growth as a leader in compliance and ethics innovation.

Also Read: Solifi – Founders, Business Model, Funding, Competitors & Others

Also Read: Glean – Founders, Business Model, Funding & Competitors

To read more content like this, subscribe to our newsletter