Coal India is the largest coal-producing company in the world, based on the company’s raw coal production of 606 million tons in 2019. As of March 31, 2010, the company operated 471 mines

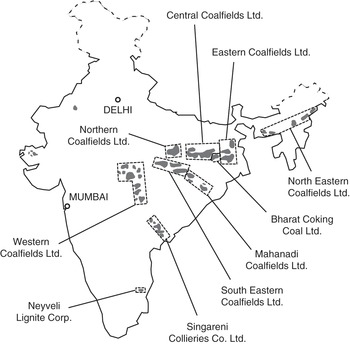

in 21 major coalfields across eight states in India, including 163 open cast mines, 273 underground mines, and 35 mixed mines, which include both open-cast and underground mines. The company also produces non–coking coal and coking coal of various grades for diverse applications. The 11 coalfields in which it conducts its most significant mining operations are the Korba, Singrauli, Talcher, IB Valley, Wardha Valley, Jharia, North Karanpura, Central India Coalfields, Raniganj, Rajmahal/Deogarh, and East Bokaro coalfields. CIL accounts for about 85% of India’s total coal production and over 70% of the utility sector’s total thermal power generating capacity.

Its customers include large thermal power generation companies, steel and cement producers, and other industrial companies in the public and private sector with many of whom the company has long-standing relationships. Most of the company’s coal is used in the thermal power sector in India. NTPC, a public sector power generation company and utility, has historically been its most significant customer, and the company’s five largest customers are all public sector power utilities.

Its subsidiaries

The company has nine direct subsidiaries and two indirect subsidiaries.

Direct Subsidiaries

Indian Subsidiaries

Bharat Coking Coal Limited (BCCL)

Central Coalfields Limited (CCL)

Central Mine Planning & Design Institute Limited

Eastern Coalfields Limited (ECL)

Mahanadi Coalfields Limited (MCL)

Northern Coalfields Limited (NCL)

South Eastern Coalfields Limited (SECL)

Western Coalfields Limited (WCL)

Foreign Subsidiary

Coal India Africana Limited (CIAL)

Indirect Subsidiaries, which are held through its Subsidiary, Mahanadi Coalfields Limited

MJSJ Coal Limited; and

MNH Shakti Limited

History of CI

Coal India originally incorporated as a private limited company with the name of ‘Coal Mines Authority

Limited’, under the Companies Act, 1956, as amended (“Companies Act”) on June 14, 1973, pursuant to a shareholders’ resolution dated October 15, 1975, and approval of the Ministry of Law, Justice, and Company Affairs dated October 21, 1975, got its name changed to ‘Coal India Limited.’

The company is established in 1973, is wholly owned by the Government of India. Its coal production operations are primarily carried out through seven of its wholly-owned subsidiaries in India. In addition, another wholly-owned subsidiary, CMPDIL, carries out exploration activities for its subsidiaries and provides technical and consultancy services for its operations as well as to third–party clients for coal exploration, mining, processing, and related activities.

The company has established a joint venture, ICVL, with SAIL, NTPC, NMDC, and RINL for the acquisition of coal assets outside India. SAIL and Coal India each hold a 28.7% equity interest in ICVL and NTPC, RINL and NMDC each hold a 14.3% equity interest. In addition, it has also entered into a joint venture with NTPC to establish CIL NTPC Urja Private Limited (‘CIL NTPC Urja’), a company formed primarily to jointly undertake the development, operation, and maintenance of certain coal mine blocks in Jharkhand, and integrated coal-based power plants. NTPC and the Company each hold 50.0% equity interest in CIL NTPC -Urja.

It has also entered into a memorandum of understanding with GAIL (India) Limited (“GAIL”) in January 2008 (‘GAIL MoU’) for the joint development of a surface coal gasification project for the production of synthesis gas to be used as a feedstock for fertilizer production. Further to the GAIL MoU, it entered into a memorandum of intent in December 2009 with GAIL and Rashtriya Chemicals and Fertilizers Limited (“RCF”) to jointly set–up coal gasification based ammonia urea and ammonium nitrate complex.

Details about coal product

Coking Coal: These coals, when heated in the absence of air form coherent beads, free from volatiles, with strong and porous mass, called coke.

· These have coking properties

· Mainly used in steelmaking and metallurgical industries

· Also used for hard coke manufacturing

Semi Coking Coal: These coals, when heated in the absence of air, form coherent beads not strong

enough to be directly fed into the blast furnace. Such coals are blended with coking coal in adequate

proportion to make coke.

· These have comparatively less coking properties than coking coal

· Mainly used as blendable coal in steel making, merchant coke manufacturing, and other metallurgical industries

NLW Coking Coal: This coal is not used in metallurgical industries. Because of its higher ash content, this coal is not acceptable for washing in washeries. This coal is used for power utilities and non-core sector consumers.

Non-Coking Coal: These are coals without coking properties.

· Mainly used as thermal grade coal for power generation

· Also used for cement, fertilizer, glass, ceramic, paper, chemical and brick manufacturing, and for

other heating purposes

Washed and Beneficial Coal: These coals have undergone the process of coal washing or coal beneficiation, resulting in the value addition of coal due to a reduction in ash percentage.

· Used in manufacturing of hard coke for steel making

· Beneficiated and washed non-coking coal is used mainly for power generation

· Beneficiated non-coking coal is used by cement, sponge iron, and other industrial plants

Middlings: Middling’s are by-products of the three-stage coal washing/beneficiation process, as a fraction of feed raw coal.

· Used for power generation

· Also used by domestic fuel plants, brick manufacturing units, cement plants, industrial plants, etc.

Rejects: Rejects are the products of the coal beneficiation process after separation of cleans and/or middling’s, as a fraction of feed raw coal.

· Used for Fluidized Bed Combustion (FBC) Boilers for power generation, road repairs, briquette

(domestic fuel) making, landfilling, etc.

CIL Coke/LTC Coke: CIL Coke / LTC Coke is a smokeless, environment-friendly product of the Dankuni Coal Complex, obtained through low-temperature carbonization.

· Used in furnaces and kilns of industrial units

· Also used as domestic fuel by hallways, hotels, etc.

Coal Fines/Coke Fines: These are the screened fractions of feed raw coal and LTC coke / CIL Coke respectively, obtained from the Dankuni Coal Complex and other coke oven plants.

· Used in industrial furnaces as well as for domestic purposes

Tar/Heavy Oil/Light Oil/Soft Pitch: These are products from Dankuni Coal Complex using low-temperature carbonization of non-coking coal in vertical retorts.

· Used in furnaces and boilers of industrial plants as well as powerhouses, oil, dye, pharmaceutical

industries, etc.

Also Read: ONGC – The Crown Jewel Of India’s Energy Success Story

Challenges facing Coal India

CIL is taking a new path to improve its position on the market after having faced a variety of difficulties in previous years.

Despite being India’s major coal-producer, CIL faces many challenges that need to be paid heed to. It has been unable to produce top-quality coal due to the unavailability of the latest technology – machinery available with the company is not advanced enough to extract good quality coal.

Another problem is the rampant erosion caused by mining, which is hindering the climate in areas surrounding the coal reserves. There are also many people engaged in illicit coal mining. On the one hand, the country is bleeding for gas, while on the other, people are engaging in malpractice, such as the illicit selling of coal for personal gain.

The Government is making new efforts to diversify the coal mining industry. To this end, they are seeking to build harmony between the private and public sectors. This policy is being applied to reduce the pressure on CIL as India’s leading producer of coal.

It is expected that in the coming years, India will need millions of tons of coal, so instead of collecting all the burden to meet the demand of one company, it will be easier to divide the responsibility for the supply. India also imports vast amounts of coal from other countries, which raises prices. Diversifying the industry would limit this to a fair degree.

Diversification would also bring about changes in the economy. It would generate more competition on the industry, which could favor the final customer. India is also far from reaching the largest coal mining market. When this occurs, potential competitors will have to compete with CIL in order to enter into long-term distribution contracts.

It is expected that this latest trend of diversification of the sector will help to resolve these difficulties and give the sector a fresh face. For this reason, the technology department of CIL has been expanded. The Ministry of Coal has aided CIL in securing forest and environmental approval for a number of coal mines. The challenge of the unavailability of coal supplies should also be ratified.

Why CIL is still going strong?

Strategic importance in meeting India’s energy requirement: Given India’s ample coal reserves and the lack of availability of other renewable sources of power, coal will continue to play a dominant role in meeting the country’s energy requirements. CIL accounted for an estimated 85 percent of the domestic coal supply in the fiscal year 2020. Total production by the company and output during the fiscal year was 602 and 582 million tonnes, respectively (607 and 608 million tonnes, respectively, in the previous fiscal). About 80 percent of its supplies went to the power market.

Continued near-monopoly status: CIL controls 48 percent of India’s proven reserves in its command area and accounts for the bulk of domestic coal supply. Although the government has recently initiated auctions for 41 commercial mining coal mines through private sector companies, execution would take time. CIL will also continue to enjoy its monopoly over the medium term.

Strong financial risk profile: The financial risk profile is supported by low debt and high net value. Gearing stayed high at 0.20 times as of 31 March 2020 (0.08 a year earlier) amid a rise in working capital debt.

Liquidity remains robust with net cash and cash equivalents of about Rs 16,000 crore as at September 30, 2020 (around Rs 22,000 crore as on March 31, 2020). CIL has authorized the use of letters of credit (LCs) as a medium of payment for coal supplies, which has resulted in a rise of about Rs 6,000 crore in receivables during the first half of the fiscal year 2021 and has had an effect on the net cash balance to that degree. Net currency and cash equivalents are forecast to stay above Rs. 15,000 crore by the end of the current fiscal year.

In fiscal years 2021 and 2022, CIL will conduct a CAPEX of Rs 20,000-23,000 crore, mainly to increase mining and coal-mining capacity and boost rail infrastructure. The business plans to set up solar and thermal power plants and re-engineer plants. However, these proposals are at the early stage, with no substantial investment anticipated over the medium term.

Despite the expected CAPEX, equity buy-back, and substantial dividend distributions, the financial risk profile and liquidity will remain high over the medium term, backed by a stable balance base, a large liquid surplus, and reasonable cash accrual. Any large-than-expected Capex that adversely affects the cash situation will remain a key control.

To read more content like this, subscribe to our newsletter.