HDFC (Housing Development Finance Corporation) Bank was among the first to receive ‘in-principle’ approval from the RBI to set up a bank in the private sector in 1994 during India’s banking sector’s liberalization. HDFC India commenced its operations as a Scheduled Commercial Bank in January 1995. It’s India’s most valuable brand with a brand value of over $20 billion, according to Kantar-BrandZ rankings.

Its headquarters is in Mumbai and has 5000+ branches across India. The initial expansion plan was to have a presence in all major industrial and commercial centers across India, where its corporate customers are located, and understand the need to build a strong retail customer base for both loans and deposits products.

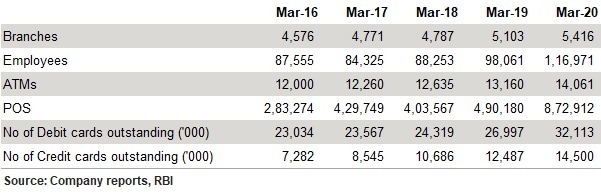

Being a clearing and settlement service provider to various leading stock exchanges, they have branches in centers where the stock exchanges have a strong and active member base. The Bank also has a network of 14,061 ATMs across India. Their ATM network can be accessed by all international and domestic Visa /or MasterCard, Visa Electron /and Maestro, Plus / Cirrus and American Express Credit / Charge cardholders.

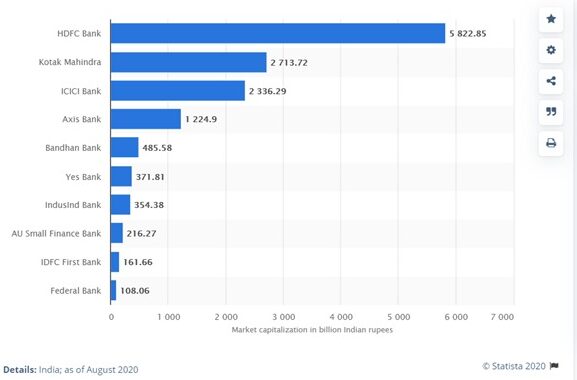

It is now the largest private sector bank by assets (US$220 billion). Also, in terms of Market Capitalisation with Rs. 5.8(approximately) trillion, it is the most valued bank of India, followed by Kotak Mahindra and ICICI Bank.

History

HDFC Bank is a subsidiary of the Housing development finance corporation. It is one of India’s premier housing finance companies and enjoys an unblemished track record in domestic and international markets. Having been established in the year 1977 by Hasmukhbhai Parekh, the corporation had maintained healthy growth in operations to remain the market leader in housing loans and mortgages.

They have great expertise in retail mortgage loans and have a significant corporate client base for their housing credit facilities. Owing to its strong market reputation and large shareholder base, HDFC was in a great position to promote a bank in India. HDFC Bank was incorporated after getting approval from the Reserve Bank of India in the year 1994. Mr. Deepak Parekh was appointed as the chairman of the bank.

HDFC had 19.38 %, and HDFC investment had a 6.72 % stake in the bank. Later on, the chairman has appointed Mr. Aditya Puri as the Managing Director (MD) of the bank who was working as CEO of Citibank in Malaysia at that time. In the year1995, HDFC Bank launched Rs 50-crore initial public offer (IPO) (5 crore equity shares at Rs 10 each at par), attracting a record 55 times oversubscription. In the same year, the bank got listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

In the year 1998, they launched the first retail lending product ‘Loans against Shares’, and in the year 1999, they launched online real-time Net Banking.

HDFC Bank was the first Bank to launch an International Debit Card in association with VISA. Later on, they started the credit card business, and currently, they are the market leader in this field with 27 percent of share followed by SBI with an 18 percent share. HDFC Bank is among the few banks of national importance that have zero debt exposure to Kingfisher Airlines.

HDFC Bank’s enormous success can be attributed to its strategy and proper planning. During the year 2000-2008, our economy was increasing at a rapid pace. The business was flourishing, so many business houses needed loans to develop appropriate infrastructure, power, etc.

These corporate loans sum is quite large in numbers, so the return is also large, but when the company cannot pay the amount, it accumulates in NPA(Non-Performing Assets). HDFC Bank decided not to provide loans to these budding business and refrain from investing in corporate loans when all the other banks provided loans to these firms. They provided corporate loans to Blue-chip companies only.

Blue-chip are large companies and financially very strong and have a low default rate. Because of that, HDFC Bank was able to withstand the Great Recession of 2009. On the other hand, other banks faced NPA issues during that period as the companies could not return the loans.

Below is the NPA data of the banks that provided loans heavily at that time:-

Currently, HDFC Bank has a base of 116,971 permanent employees as of March 2020. It has a network of 11,000 banking correspondents and to expand its ATM rural reach, HDFC is planning to increase the strength to 25 thousand by the end of this year. Recently, HDFC Bank was awarded the ‘Great Place to Work’ certification by Great Place, which shows overall high trust by employees and performance at workplaces.

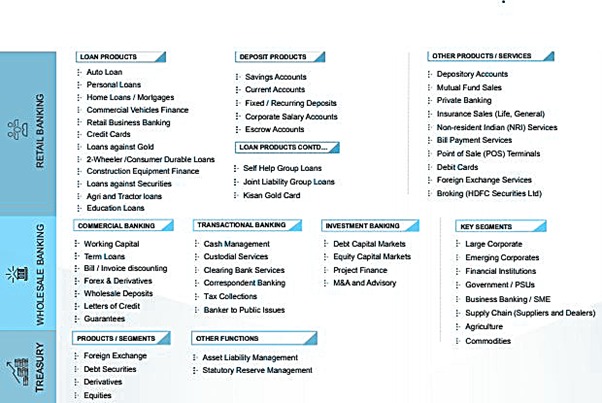

Product and services

Key Highlights

- ATMs + cash deposit and withdrawal machines- 14,901

- Total Customers- More than 5.6 crores

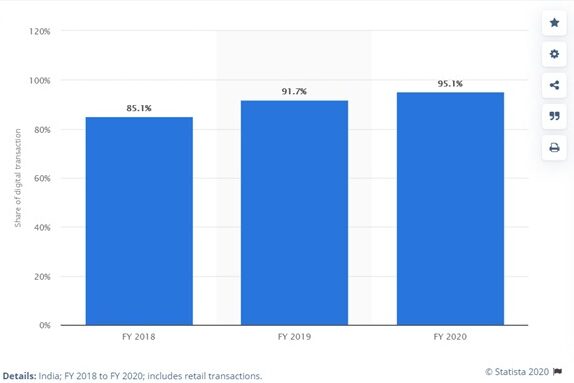

- Digital Transactions- 95.1%

- Merchant Acceptance Points- 17.97 lakhs

- Total Debit and Credit cards- 3.21 crores and 1.45 crores, respectively

- Market Capitalization- 5822.85 billion rupees

- Balance Sheet Size- Rs 1,530,511 crores

- Net Revenue- Rs 79,447.07 crores

- Net Profit- Rs 26,257.3 crores

- Return on Capital- 16.8%

- Earnings per Share- 48

Also Read: Zerodha – From A Crazy Idea To Biggest Retail Broker Of India

Go Digital

HDFC Bank had understood the importance of digital technology, and they launched Chillr and PayZapp, as part of its ‘Go Digital’ campaign in the year 2015. Chillr allows customers to send and receive instant money on their mobiles. Payzapp makes every form of shopping and payment convenient. It is the first bank to introduce a DigiPOS machine on 22nd August 2017. It offers the complete suite of digital payment options on the Point of Sale machine through Unified Payment Interface (UPI), Bharat QR, SMS Pay, and PayZapp, and the facility to pay by debit and credit cards.

According to Razorpay’s report on ‘The Era of Rising Fintech’ digital transactions grew by 338% from 2018 to 2019 with UPI and card transactions seeing the highest growth and HDFC Bank had leveraged its robust technology to emerge as a leader in this field.

Digital payment volumes across different channels in India recorded 45.72 billion transactions for FY20, which was higher than the target of 40.19 billion transactions set by the Ministry of Electronics and Information Technology (MeitY). HDFC bank scored an overall score of 80 out of 100 and is ranked 2nd after ICICI Bank with a score of 83. More than 95 percent of all transactions made through HDFC Bank were digital transactions during the financial year 2019-20.

Mergers and Acquisitions

In 1999, Times Bank was merged with HDFC Bank, and it was the first friendly merger in the banking industry and done through a share swap deal. Later in the year 2008, HDFC Bank approved the acquisition of Centurion Bank of Punjab for INR 9,510 crores ($2.4 billion) in one of the largest mergers in India’s financial sector at that time.

Mission and Values of HDFC Bank

HDFC Bank’s mission is to become a world-class Indian bank, and they have a two-fold objective for the same. The first objective is being the preferred provider of banking services for target retail and wholesale customer segments. The second objective is to achieve healthy growth in profitability, consistent with the bank’s risk appetite.

Core Values of HDFC Bank:

i)Consistent Growth and Nationwide footprint

ii)Responsible leadership and Good governance

iii)Customer-centricity

iv)Empowering households

v)Climate change initiative

Corporate Social Responsibility (CSR)

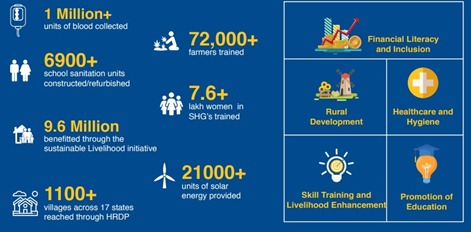

Much before CSR contributions were made mandatory for Companies, HDFC Bank was following board-approved targets and contributing to social causes. The Bank implements its CSR works under the aegis of ‘Parivartan’ and aims to transform society through initiatives in the sectors like education, skill training, health care, environmental sustainability, and rural development, etc.

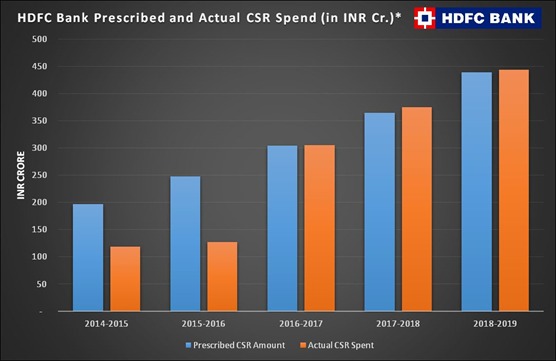

They also extended their hand to fight the ongoing deadly Coronavirus and provided INR 150 crores to the PM-CARES Fund. During the year ending 31st March 2019, HDFC Bank CSR spend was INR 443.8 crores that were 20% more than the previous year.

The progress of any country starts when the communities are empowered to attain sustainable means of livelihood. As a step towards progress, Parivartan is reaching out to organizations to help them shift from a cycle of poverty to achieve a pattern of growth and empowerment.

Through this initiative, HDFC bank has collected over 1 million blood units, constructed or refurbished more than 6900 toilets in school, and trained more than 7.6 lakh women in self-help groups (SHG) and provided approx 21,000 renewable energy units, and trained 72,000 farmers. HDFC Bank is among the top spenders on CSR in India, and it is among the few corporates to adopt an integrated reporting approach.

Social Media Marketing

Along with HDFC Bank’s success in the banking world, its social media presence is also quite popular. They live up to their tagline of ‘We Understand Your World’ and carefully evaluate their target audience and curate their content as per them.

Their Instagram content is usually fun-filled with funny quirks. They came up with the trend #SpendItWell on Instagram. They placed their newly launched Millenia cards targeted at youngsters during the Navratri and Diwali festivals. They successfully create a FOMO for their product while positioning themselves as a relaxed and fun brand for the youths.

HDFC Bank has leveraged other social media like Facebook and Youtube. Through their #StartDoing campaign, they were able to create a buzz among youngsters. They encouraged them to take loans to live up to their dreams rather than procrastinating their goals.